This is all the information! There isn't any additional information.

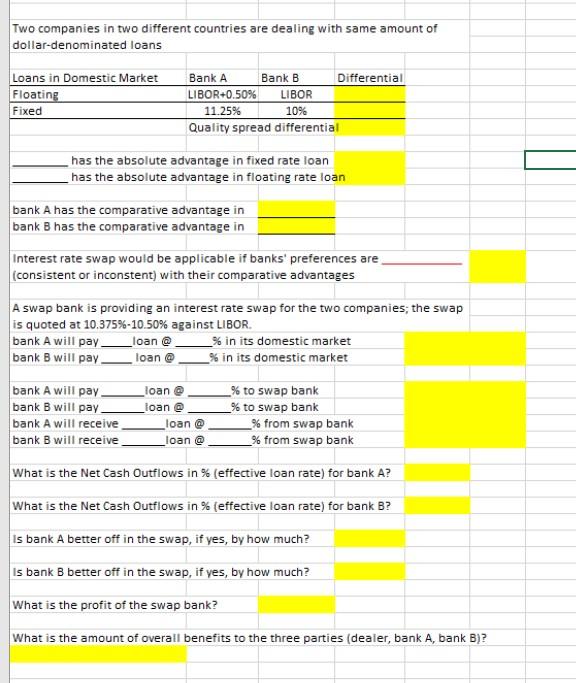

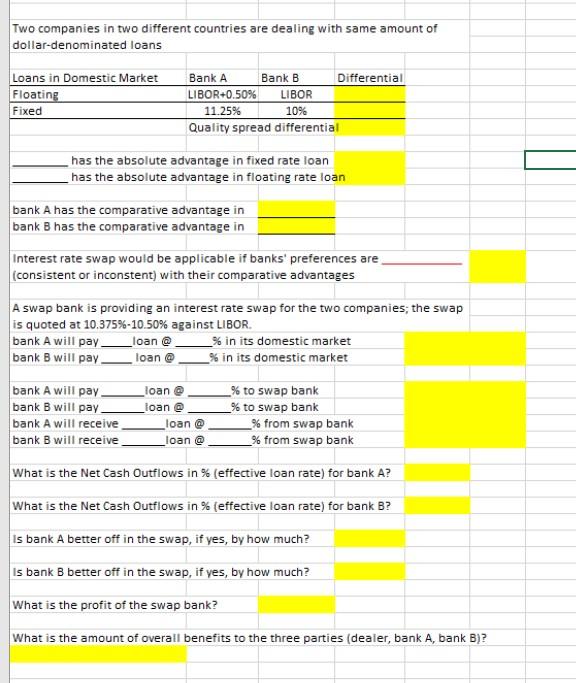

Two companies in two different countries are dealing with same amount of dollar-denominated loans Loans in Domestic Market Floating Fixed Bank A Bank B Differential LIBOR+0.50% LIBOR 11.25% 10% Quality spread differential has the absolute advantage in fixed rate loan has the absolute advantage in floating rate loan bank A has the comparative advantage in bank Bhas the comparative advantage in Interest rate swap would be applicable if banks' preferences are (consistent or inconstent) with their comparative advantages A swap bank is providing an interest rate swap for the two companies; the swap is quoted at 10.375%-10.50% against LIBOR. bank A will pay loan @ _% in its domestic market bank B will pay. loan _% in its domestic market bank A will pay. loan _% to swap bank bank B will pay loan @ _% to swap bank bank A will receive loan @ _% from swap bank bank B will receive loan _% from swap bank What is the Net Cash Outflows in % (effective loan rate) for bank A? What is the Net Cash Outflows in % (effective loan rate) for bank B? is bank A better off in the swap, if yes, by how much? is bank B better off in the swap, if yes, by how much? What is the profit of the swap bank? What is the amount of overall benefits to the three parties (dealer, bank A, bank B)? Two companies in two different countries are dealing with same amount of dollar-denominated loans Loans in Domestic Market Floating Fixed Bank A Bank B Differential LIBOR+0.50% LIBOR 11.25% 10% Quality spread differential has the absolute advantage in fixed rate loan has the absolute advantage in floating rate loan bank A has the comparative advantage in bank Bhas the comparative advantage in Interest rate swap would be applicable if banks' preferences are (consistent or inconstent) with their comparative advantages A swap bank is providing an interest rate swap for the two companies; the swap is quoted at 10.375%-10.50% against LIBOR. bank A will pay loan @ _% in its domestic market bank B will pay. loan _% in its domestic market bank A will pay. loan _% to swap bank bank B will pay loan @ _% to swap bank bank A will receive loan @ _% from swap bank bank B will receive loan _% from swap bank What is the Net Cash Outflows in % (effective loan rate) for bank A? What is the Net Cash Outflows in % (effective loan rate) for bank B? is bank A better off in the swap, if yes, by how much? is bank B better off in the swap, if yes, by how much? What is the profit of the swap bank? What is the amount of overall benefits to the three parties (dealer, bank A, bank B)