Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is all the information, they are indepnedent porblems. QUESTION 17 The Kolasinski and Li study of earnings surprises showed that prices tend to overreact

this is all the information, they are indepnedent porblems.

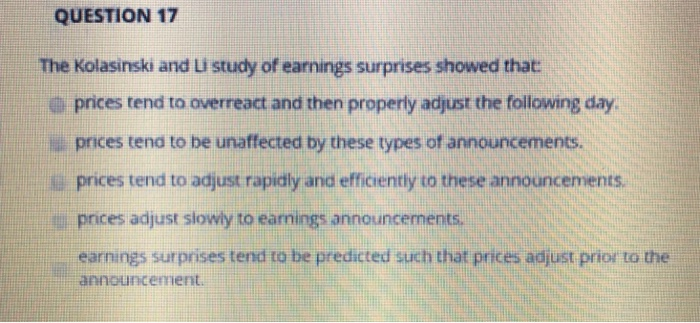

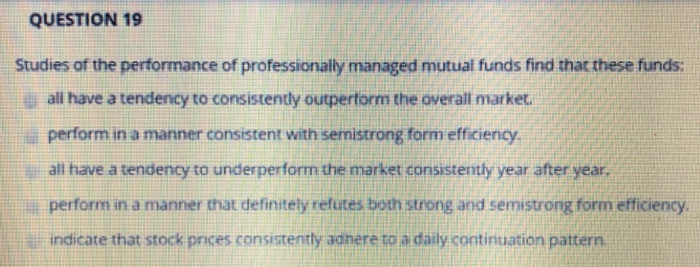

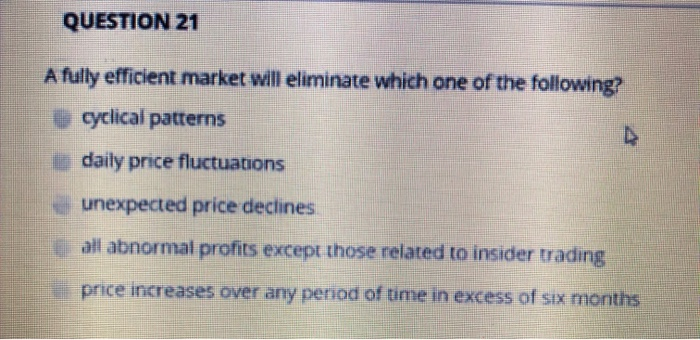

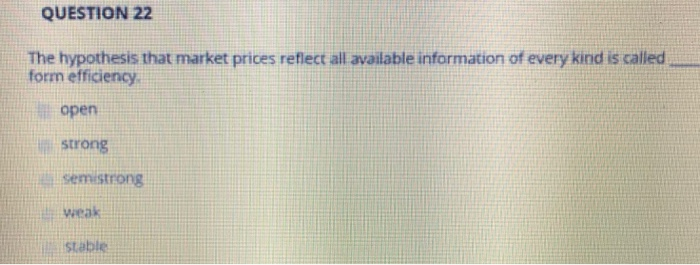

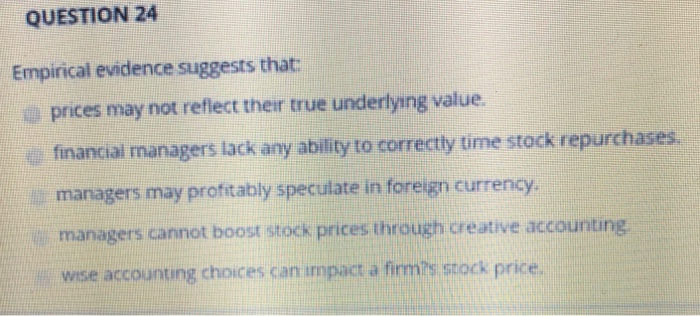

QUESTION 17 The Kolasinski and Li study of earnings surprises showed that prices tend to overreact and then properly adjust the following day. prices tend to be unaffected by these types of announcements. prices tend to adjust rapidly and efficiently to these announcements. prices adjust slowly to earnings announcements. earnings surprises tend to be predicted such that prices adjust prior to the announcement. QUESTION 19 Studies of the performance of professionally managed mutual funds find that these funds: all have a tendency to consistently outperform the overall market. perform in a manner consistent with semistrong form efficiency. all have a tendency to underperform the market consistently year after year. perform in a manner that definitely refutes both strong and semistrong form efficiency indicate that stock prices consistently adhere to a daily continuation pattern QUESTION 21 A fully efficient market will eliminate which one of the following? cyclical patterns daily price fluctuations unexpected price declines all abnormal profits except those related to insider trading price increases over any period of time in excess of six months QUESTION 22 The hypothesis that market prices reflect all available information of every kind is called form efficiency open strong sem strong weak stable QUESTION 24 Empirical evidence suggests that: prices may not reflect their true underlying value. financial managers lack any ability to correctly time stock repurchases. managers may profitably speculate in foreign currency managers cannot boost stock prices through creative accounting. wise accounting choices can impact a firm's stock price Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started