Answered step by step

Verified Expert Solution

Question

1 Approved Answer

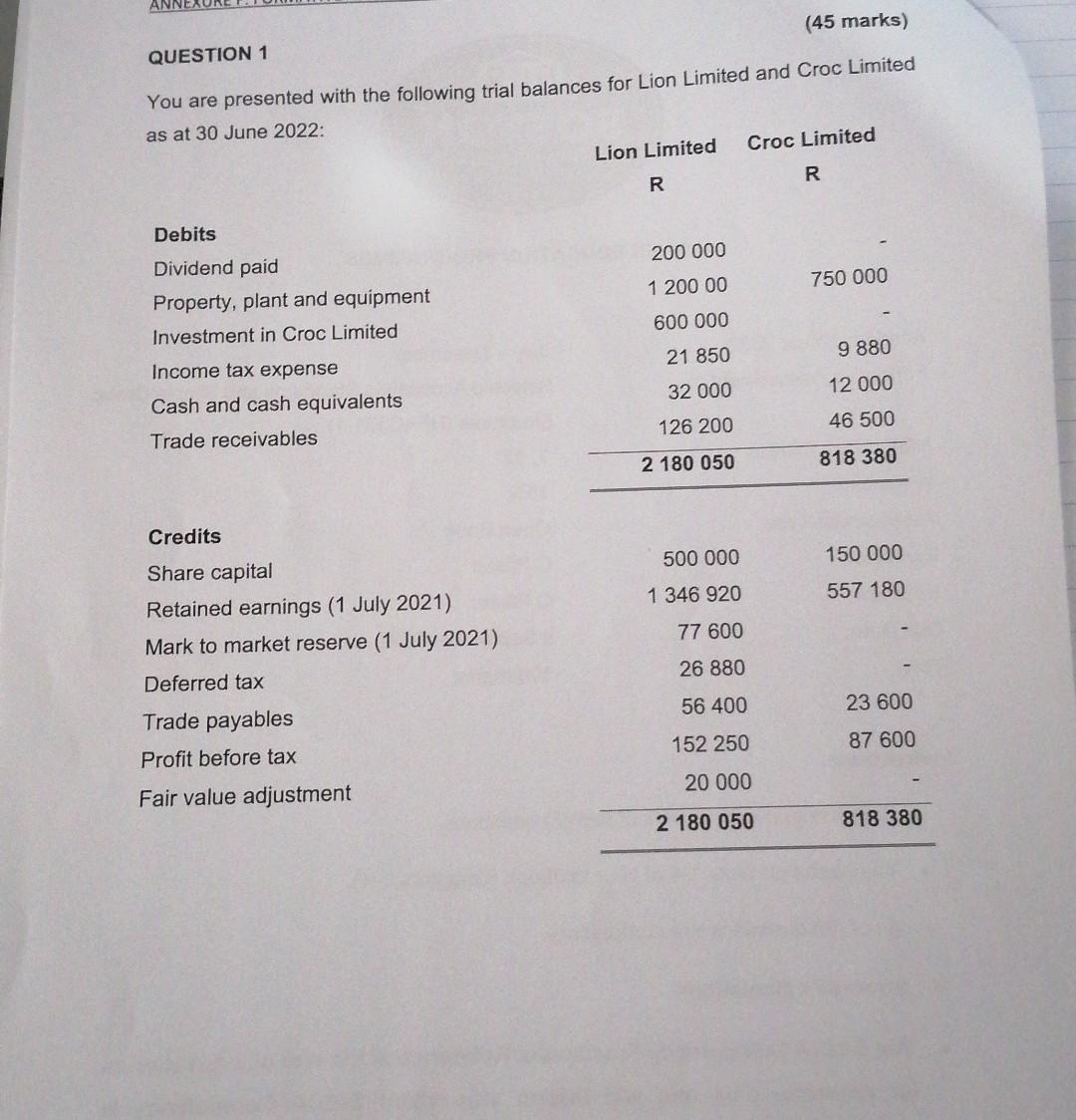

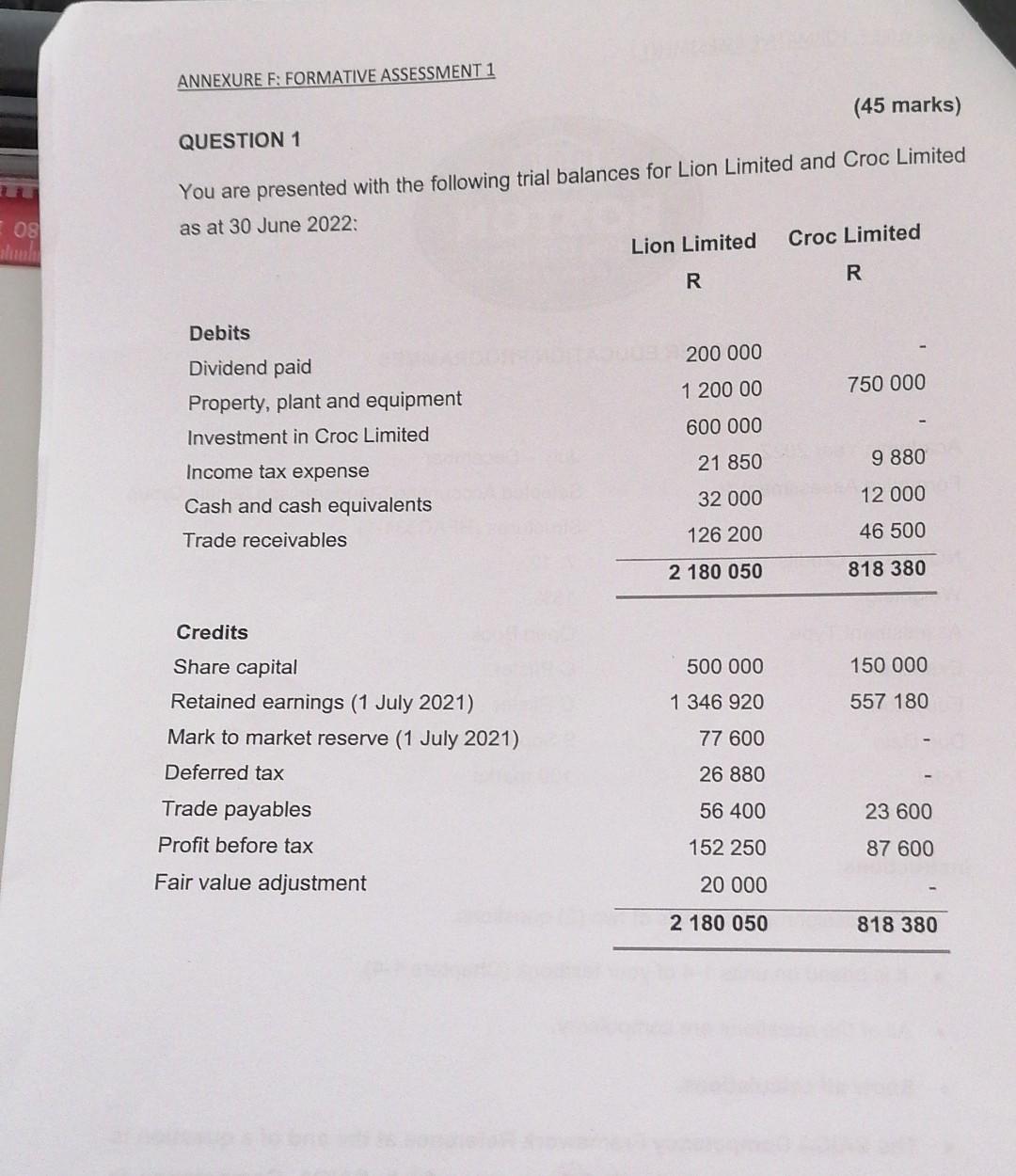

This is all the information they provided us. QUESTION 1 You are presented with the following trial balances for Lion Limited and Croc Limited Additional

This is all the information they provided us.

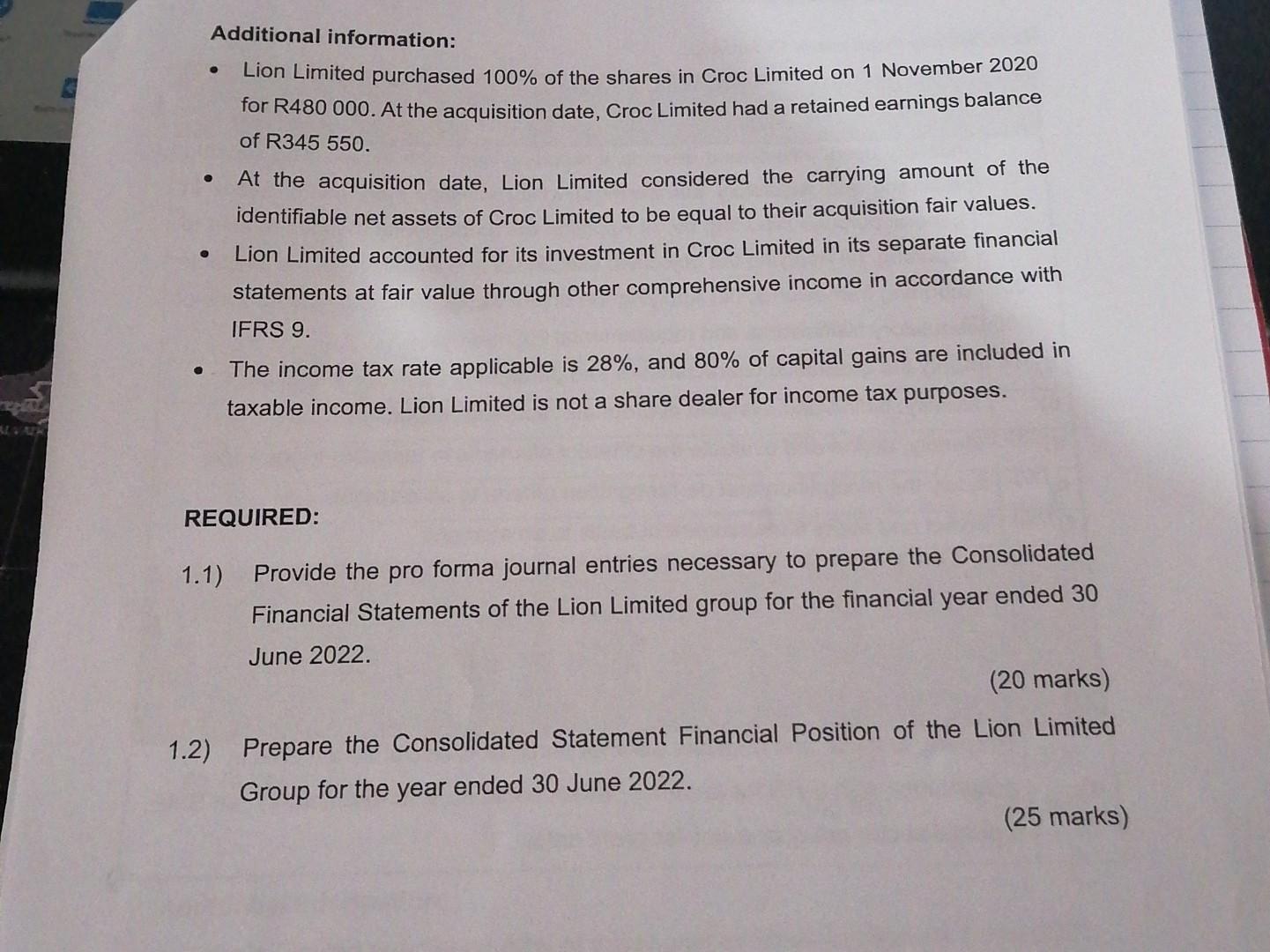

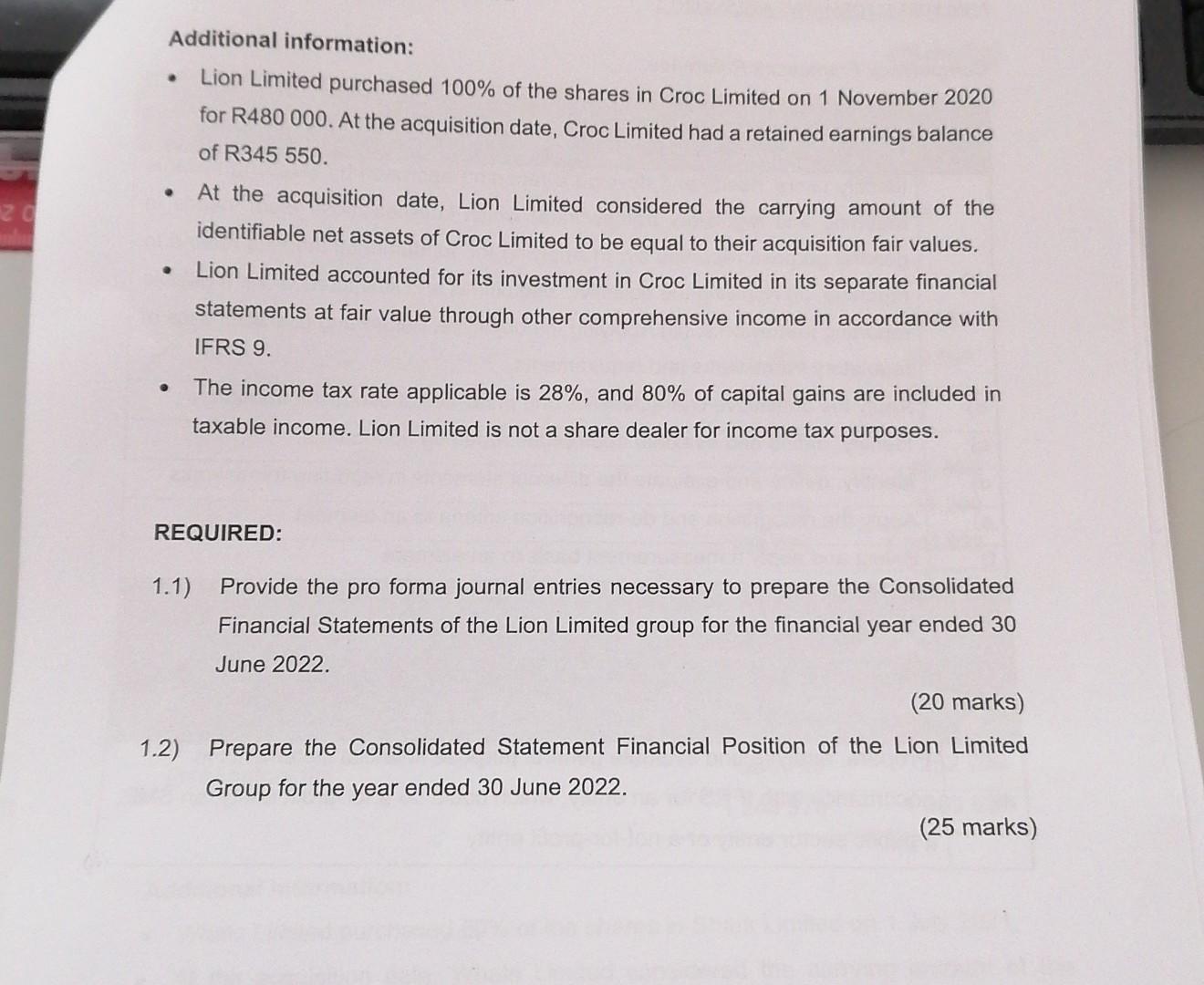

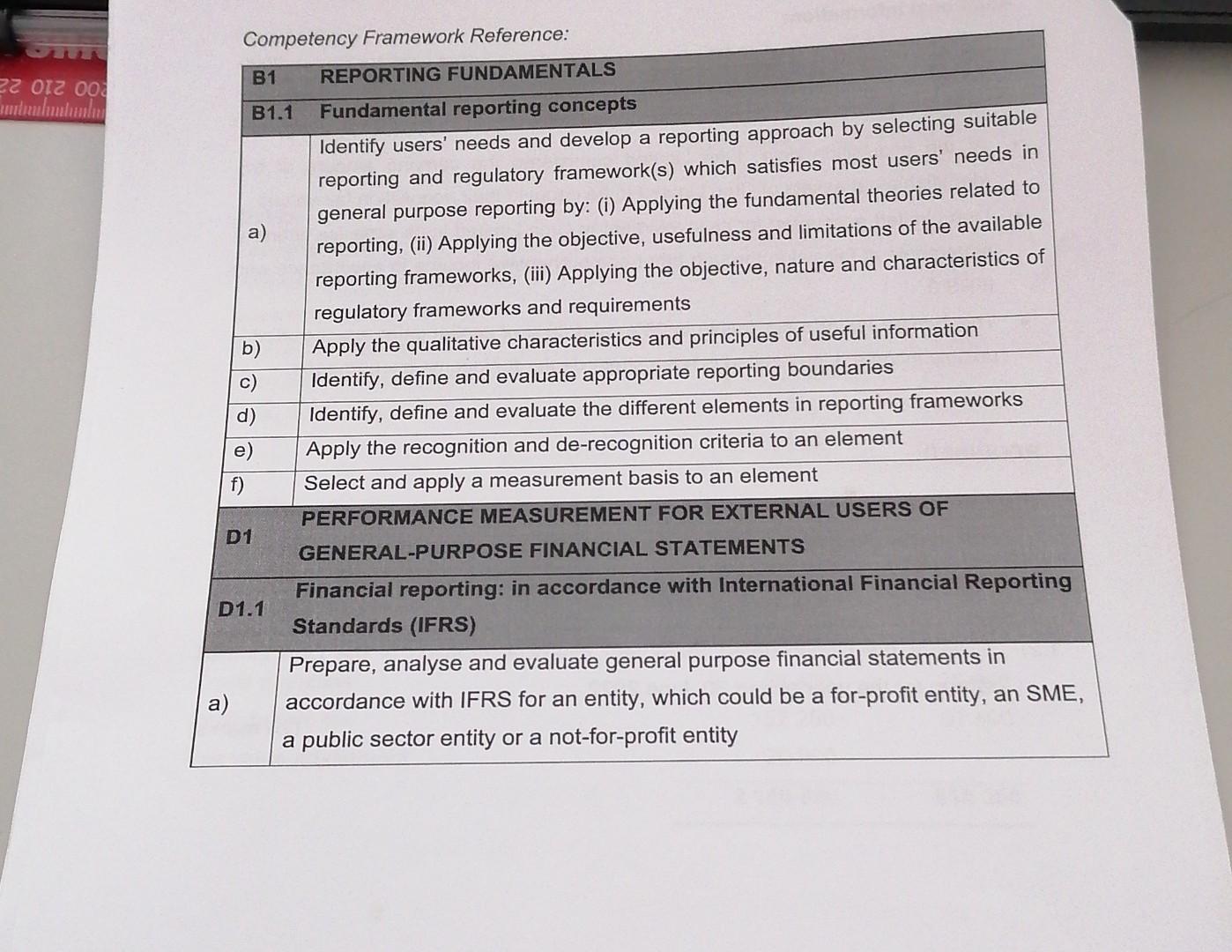

QUESTION 1 You are presented with the following trial balances for Lion Limited and Croc Limited Additional information: - Lion Limited purchased 100\% of the shares in Croc Limited on 1 November 2020 for R480 000. At the acquisition date, Croc Limited had a retained earnings balance of R345 550 . - At the acquisition date, Lion Limited considered the carrying amount of the identifiable net assets of Croc Limited to be equal to their acquisition fair values. - Lion Limited accounted for its investment in Croc Limited in its separate financial statements at fair value through other comprehensive income in accordance with IFRS 9. - The income tax rate applicable is 28%, and 80% of capital gains are included in taxable income. Lion Limited is not a share dealer for income tax purposes. REQUIRED: 1.1) Provide the pro forma journal entries necessary to prepare the Consolidated Financial Statements of the Lion Limited group for the financial year ended 30 June 2022. (20 marks) 1.2) Prepare the Consolidated Statement Financial Position of the Lion Limited Group for the year ended 30 June 2022. (25 marks) QUESTION 1 You are presented with the following trial balances for Lion Limited and Croc Limited Additional information: - Lion Limited purchased 100\% of the shares in Croc Limited on 1 November 2020 for R480 000. At the acquisition date, Croc Limited had a retained earnings balance of R345 550 . - At the acquisition date, Lion Limited considered the carrying amount of the identifiable net assets of Croc Limited to be equal to their acquisition fair values. - Lion Limited accounted for its investment in Croc Limited in its separate financial statements at fair value through other comprehensive income in accordance with IFRS 9. - The income tax rate applicable is 28%, and 80% of capital gains are included in taxable income. Lion Limited is not a share dealer for income tax purposes. REQUIRED: 1.1) Provide the pro forma journal entries necessary to prepare the Consolidated Financial Statements of the Lion Limited group for the financial year ended 30 June 2022. (20 marks) 1.2) Prepare the Consolidated Statement Financial Position of the Lion Limited Group for the year ended 30 June 2022. (25 marks) Competency Framework Reference: QUESTION 1 You are presented with the following trial balances for Lion Limited and Croc Limited Additional information: - Lion Limited purchased 100\% of the shares in Croc Limited on 1 November 2020 for R480 000. At the acquisition date, Croc Limited had a retained earnings balance of R345 550 . - At the acquisition date, Lion Limited considered the carrying amount of the identifiable net assets of Croc Limited to be equal to their acquisition fair values. - Lion Limited accounted for its investment in Croc Limited in its separate financial statements at fair value through other comprehensive income in accordance with IFRS 9. - The income tax rate applicable is 28%, and 80% of capital gains are included in taxable income. Lion Limited is not a share dealer for income tax purposes. REQUIRED: 1.1) Provide the pro forma journal entries necessary to prepare the Consolidated Financial Statements of the Lion Limited group for the financial year ended 30 June 2022. (20 marks) 1.2) Prepare the Consolidated Statement Financial Position of the Lion Limited Group for the year ended 30 June 2022. (25 marks) QUESTION 1 You are presented with the following trial balances for Lion Limited and Croc Limited Additional information: - Lion Limited purchased 100\% of the shares in Croc Limited on 1 November 2020 for R480 000. At the acquisition date, Croc Limited had a retained earnings balance of R345 550 . - At the acquisition date, Lion Limited considered the carrying amount of the identifiable net assets of Croc Limited to be equal to their acquisition fair values. - Lion Limited accounted for its investment in Croc Limited in its separate financial statements at fair value through other comprehensive income in accordance with IFRS 9. - The income tax rate applicable is 28%, and 80% of capital gains are included in taxable income. Lion Limited is not a share dealer for income tax purposes. REQUIRED: 1.1) Provide the pro forma journal entries necessary to prepare the Consolidated Financial Statements of the Lion Limited group for the financial year ended 30 June 2022. (20 marks) 1.2) Prepare the Consolidated Statement Financial Position of the Lion Limited Group for the year ended 30 June 2022. (25 marks) Competency Framework ReferenceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started