Question

This is an example of a tax return , I need help with this one I did just half but I get stuck Taxpayer Information

This is an example of a tax return , I need help with this one I did just half but I get stuck

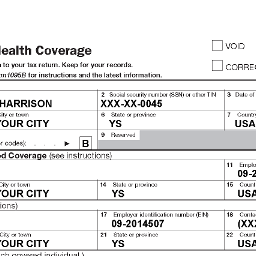

Taxpayer Information

Taxpayer name:

Bruce H. Harrison

Taxpayer SSN:

201-00-0045

Taxpayer DOB:

April 1, 1977

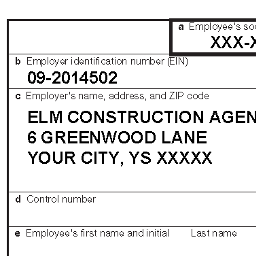

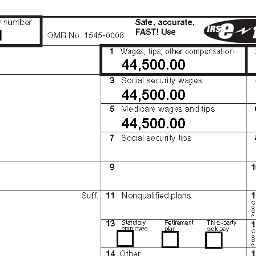

Taxpayer occupation:

Contractor

Spouse name:Lois A. HarrisonSpouse SSN:201-00-1451Spouse DOB:March 28, 1982Spouse occupation:

Newscaster

Address:

1312 Locust Street

Your City, YS XXXXX

Cell phone (T):

(XXX) 555-6336; Preferred: Anytime;

FCC: Yes; OK to call

Cell phone (S):(XXX) 555-6363; Anytime; FCC: Yes; OK to callTaxpayer

Spouse

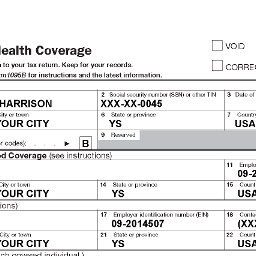

Health Insurance Information

Did everyone in the household have health insurance in 2019?YesTotal months covered through a state exchange or federal marketplace:0Total months covered through an employer-sponsored plan:12Was a Form 1095-A issued?No

Bruce and Lois Harrison are new clients. Last year, they prepared their own return using online software, but this year, they would like professional assistance. They are married and wish to file a joint tax return. Both of their SSNs are valid for work in the U.S. and were received before the original filing due date of their return (including extensions). Both are U.S. citizens. No one may claim them as dependents. Neither is astudent. They both wish to designate $3 to the Presidential Election Campaign Fund. Neither is blind or disabled.

Bruce and Lois did not suffer any casualty losses during the current tax year. They did not receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency. Neither Bruce nor Lois have a financial interest in or signature authority over a foreign account. They did not receive a distribution from, nor were they the grantors of or transferor to, a foreign trust.The IRS has not issued any Identity Protection ID Numbers for their return.

They did not receive a notice from the IRS or any state or local taxing authority within the last year. Neither Bruce nor Lois provide a driver's license or state identification.

Household Information

Bruce and Lois own their home. They have two children.

Dependent name:

Lyla B. Harrison

Dependent SSN:

201-00-2451

Dependent DOB:

July 12, 2014

Dependent relationship:DaughterTime in household:12 monthsGross income:$0Support:Does not provide over half of her own support

Dependent name:Kevin E. HarrisonDependent SSN:201-00-2452Dependent DOB:October 15, 2016Dependent relationship:SonTime in household:12 monthsGross income:$0Support:Does not provide over half of his own support

Lyla and Kevin lived with Bruce and Lois all year, and they did not have any income. Neither is married or disabled. They are both U.S. citizens. Lyla and Kevin have SSNs that are valid for work in the United States and were received before the due date for the return (including extensions). Bruce and Lois brought in copies of medical records for both children.

Adjustments

Lois contributed $2,500 to a traditional IRA during the year. She only has one IRA account, and the value of this account on December 31, 2019, was $13,097.85. All of her previous contributions were deductible. Lois has never taken a distribution from this or any other retirement account. Bruce is covered by an employer-sponsored retirement plan, but Lois is not.

Credits

Bruce and Lois paid Little Ones Learning Center $7,200 ($3,600 for each child) to care for Kevin and Lyla while they worked. The center's EIN is 09-2014501. It is located at 1521 West Plain Road, Your City, YS XXXXX. The phone number for the Center is (XXX) 555-0034. Bruce and Lois have documentation substantiating this expense.

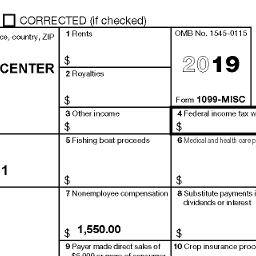

Self-Employment Income

Lois has always been an avid reader, and during the year, she had an opportunity to lead a book club at a nearby community center. The community center paid Lois for this work. At the end of the year, they sent Lois a Form 1099-MISC reporting an amount for nonemployee compensation in box 7 of the form. This form is shown in the Information Documents section. The community center is within walking distance of the couple's home, so Lois did not have any vehicle or travel expenses. Her only business-related expense was for $225 in supplies.

For purposes of the qualified business income deduction (QBID), this isnota specified service trade or business (SSTB). Lois did not pay any qualified wages, nor does she have any qualified business property, or any losses or short-term gains from asset disposition.

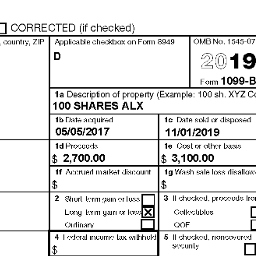

Capital Assets

Bruce was unhappy with the performance of an investment he had made in 2017. He sold the shares of stock on November 7, 2019, for fear the stock would continue its downward trend. Information relating to this sale was reported on a Form 1099-B. This form is shown in the Information Documents section.

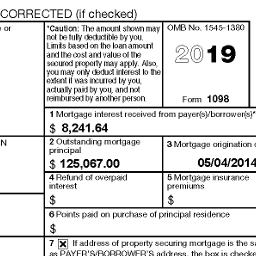

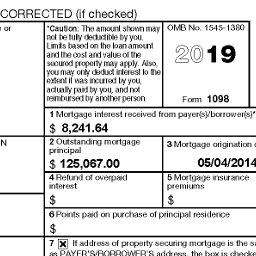

Itemized Deductions

Bruce and Lois want to itemize deductions if it will be more beneficial than taking the standard deduction. They bring a Form 1098 reporting mortgage interest and real estate taxes paid on their personal residence. This is shown in the Information Documents section. Bruce and Lois would prefer to take the state income tax deduction rather than the sales tax deduction. They also had the following potentially deductible items for 2019:

ItemAmountNotes2018 State balance due$582Made this payment on April 10, 2019Cash donation to Cancer Research Foundation$475Paid March 4, 2019

Information Documents

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started