Question

This is an excerpt from Maxi's Grocery Mart case study. Reset your sales percentages and salaries back to their original values and then make the

This is an excerpt from Maxi's Grocery Mart case study.

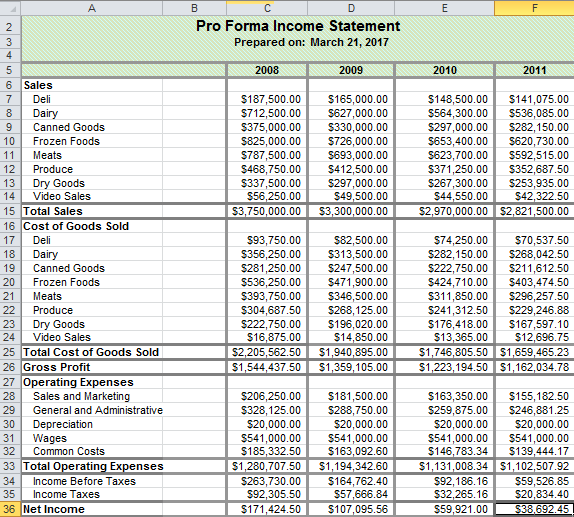

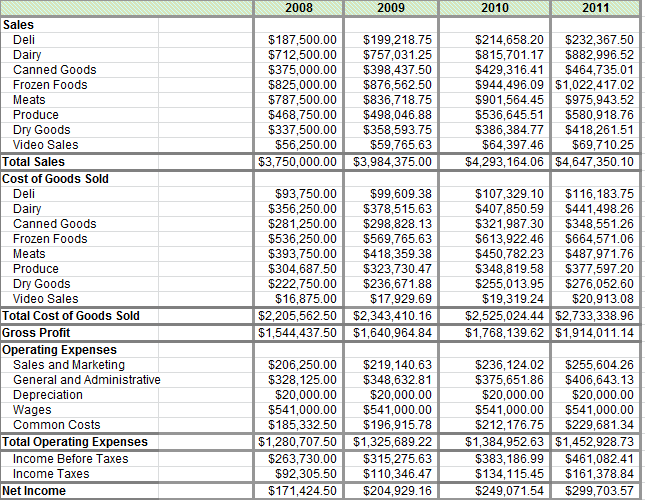

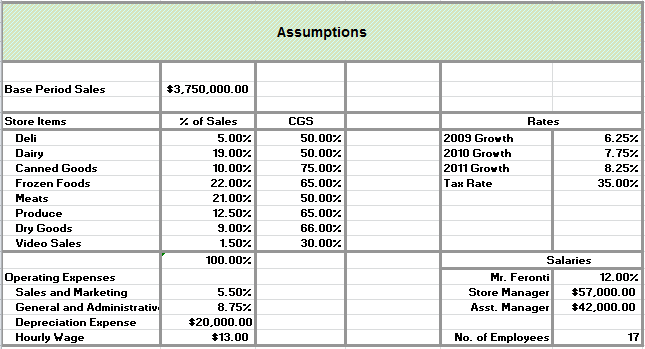

Reset your sales percentages and salaries back to their original values and then make the following changes. Assume a discount chain is opening a grocery store in a neighboring town. Mr. Feronti thinks this may cause his sales to decrease. He thinks his growth may decrease in 2009 by 12 percent, 2010 by 10 percent and 2011 by 5 percent. Would you still recommend renovating the grocery mart? Why or why not? Below is the table with lower net income due to decreased rate growth:

Below is the oriinal table:

A B C D E F Pro Forma Income Statement Prepared on: March 21, 2017 2008 RNS2009 2010 2011 Sales Deli $187, 500.00 165,000.00 148, 500.00 $141,075.00 Dairy $712, 500.00 $627,000.00 $564, 300.00 $536,085.00 canned Goods $375,000.00 s 330,000.00 S297,000.00 S282,150.00 Frozen Foods $825,000.00 S726,000.00 $653,400.00 s620,730.00 Meats $787,500.00 $693,000.00 $623,700.00 $592,515.00 11 Produce $468, 750.00 $412, 500.00 12 S371,250.00 S352,687.50 13 S297,000.00 S267,300.00 S253,935.00 S3750,000.00 IS3,300,000.00 15 Total Sales S2,970,000.00 $2,821,500.00 Cost of Goods Sold 16 Deli S93,750.00 $82.500.00 $74, 250.00 $70,537.50 17 S282, 150.00 S268,042.50 Frozen Foods $536,250.00 $471,900.00 $424,710.00 $403,474.50 20 Meats $393, 750.00 $346, 500.00 21 S311,850.00 S296,257.50 Produce S304,687.50 S268,125.00 S241,312.50 S229,246.88 24 25 Gross Profit S1,544,437.50 $1,359,105.00 S1,223,194.50 $1,162,034.78 operating Expenses 27 sales and Marketing S206, 250.00 $181, 500.00 28 S163,350.00 S155,182.50 General and Administrative S328,125.00 $288,750.00 S259,875.00 S246,881.25 Depreciation s20,000.00 s 20,000.00 s 20,000.00 s20,000.00 30 31 S541,000.00 $541,000.00 S541,000.00 S541,000.00 $163,092.60 S146,783.34 S139,444.17 Total Operating Expenses S1 280,707.50 S1194.342.60 S1 131.008.34 102507.92 33 S263,730.00 S164,762.40 35 S92,305.50 36 Net Income S171 424.50 S107,095.56 S59,921.00 S335g24H

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started