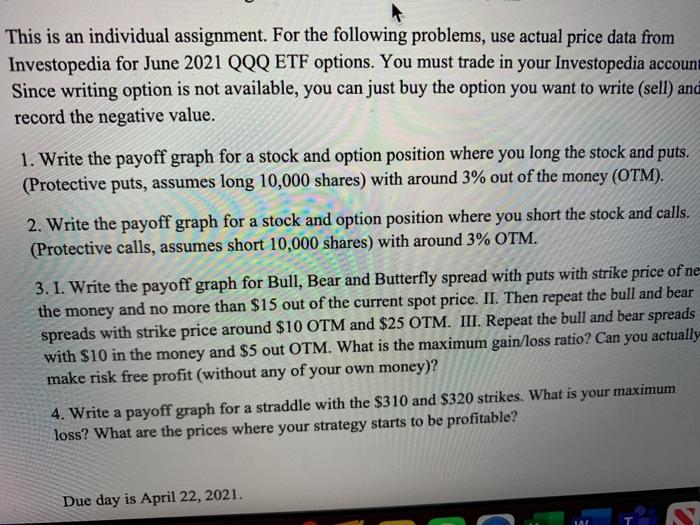

This is an individual assignment. For the following problems, use actual price data from Investopedia for June 2021 QQQ ETF options. You must trade in your Investopedia account Since writing option is not available, you can just buy the option you want to write (sell) and record the negative value. 1. Write the payoff graph for a stock and option position where you long the stock and puts. (Protective puts, assumes long 10,000 shares) with around 3% out of the money (OTM). 2. Write the payoff graph for a stock and option position where you short the stock and calls. (Protective calls, assumes short 10,000 shares) with around 3% OTM. 3. I. Write the payoff graph for Bull, Bear and Butterfly spread with puts with strike price of ne the money and no more than $15 out of the current spot price. II. Then repeat the bull and bear spreads with strike price around $10 OTM and $25 OTM. III. Repeat the bull and bear spreads with $10 in the money and $5 out OTM. What is the maximum gain/loss ratio? Can you actually make risk free profit (without any of your own money)? 4. Write a payoff graph for a straddle with the $310 and $320 strikes. What is your maximum loss? What are the prices where your strategy starts to be profitable? Due day is April 22, 2021. 1A This is an individual assignment. For the following problems, use actual price data from Investopedia for June 2021 QQQ ETF options. You must trade in your Investopedia account Since writing option is not available, you can just buy the option you want to write (sell) and record the negative value. 1. Write the payoff graph for a stock and option position where you long the stock and puts. (Protective puts, assumes long 10,000 shares) with around 3% out of the money (OTM). 2. Write the payoff graph for a stock and option position where you short the stock and calls. (Protective calls, assumes short 10,000 shares) with around 3% OTM. 3. I. Write the payoff graph for Bull, Bear and Butterfly spread with puts with strike price of ne the money and no more than $15 out of the current spot price. II. Then repeat the bull and bear spreads with strike price around $10 OTM and $25 OTM. III. Repeat the bull and bear spreads with $10 in the money and $5 out OTM. What is the maximum gain/loss ratio? Can you actually make risk free profit (without any of your own money)? 4. Write a payoff graph for a straddle with the $310 and $320 strikes. What is your maximum loss? What are the prices where your strategy starts to be profitable? Due day is April 22, 2021. 1A