Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is an old test we took and I would just like some clarification on what the answers were and why. thanks! (Also to eliminate

This is an old test we took and I would just like some clarification on what the answers were and why. thanks! (Also to eliminate comfusion its a study abroad course so questions are asking in euros)

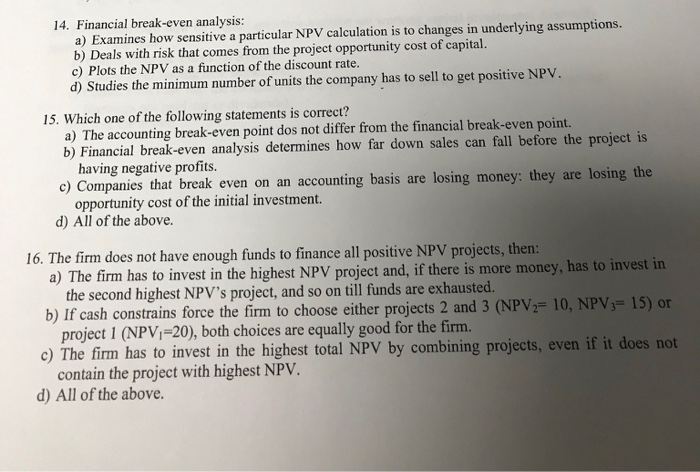

14. Financial break-even analysis: a) Examines how sensitive a particular NPV calculation is to changes in underlying assumptions. b) Deals with risk that comes from the project opportunity cost of capital. c) Plots the NPV as a function of the discount rate. d) Studies the minimum number of units the company has to sell to get positive NPV. 15. Which one of the following statements is correct? a) The accounting break-even point dos not differ from the financial break-even point. b) Financial break-even analysis determines how far down sales can fall before the project is having negative profits. c) Companies that break even on an accounting basis are losing money: they are losing the opportunity cost of the initial investment d) All of the above 16. The firm does not have enough funds to finance all positive NPV projects, then: a) The firm has to invest in the highest NPV project and, if there is more the second highest NPV's project, and so on till funds are exhausted. b) If cash constrains force the firm to choose either projects 2 and 3 (NPV2= 10, NPV15) or project 1 (NPV,-20), both choices are equally good for the firm. c) The firm has to invest in the highest total NPV by combining projects, even if it does not contain the project with highest NPV. d) All of the above. money, has to invest in 17. Increasing firm's leverage: a) Results in higher financial risk. b) Results in higher required return from the company's owners. c) Results in higher cost of equity d) All of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started