Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is chapter 10 Investing in Risk-Free Projects. 10.5 (I am also curious about what is the title of this book) Small Corp. is investigating

This is chapter 10 Investing in Risk-Free Projects. 10.5

(I am also curious about what is the title of this book)

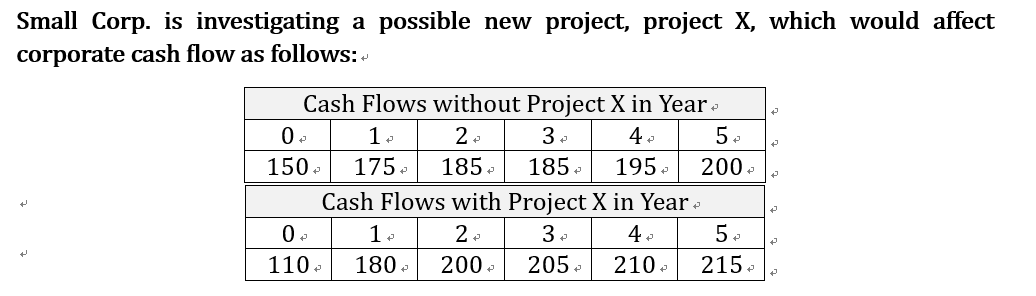

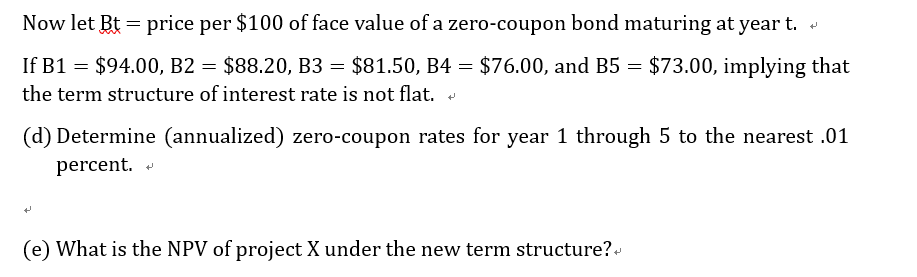

Small Corp. is investigating a possible new project, project X, which would affect corporate cash flow as follows: tt Cash Flows without Project X in Year | 0 1 2 3 4 5 150 175 185 185 195 200 Cash Flows with Project X in Year 0 1 | 2 3 4 5 . 110 180 200 205 210 215. l. Now let Bt = price per $100 of face value of a zero-coupon bond maturing at year t. If B1 = $94.00, B2 = $88.20, B3 = $81.50, B4 = $76.00, and B5 = $73.00, implying that the term structure of interest rate is not flat. (d) Determine (annualized) zero-coupon rates for year 1 through 5 to the nearest .01 percent. + (e) What is the NPV of project X under the new term structure

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started