Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is class assignment. I would like to know how you get the letter i only. I don't know how to figure it out and

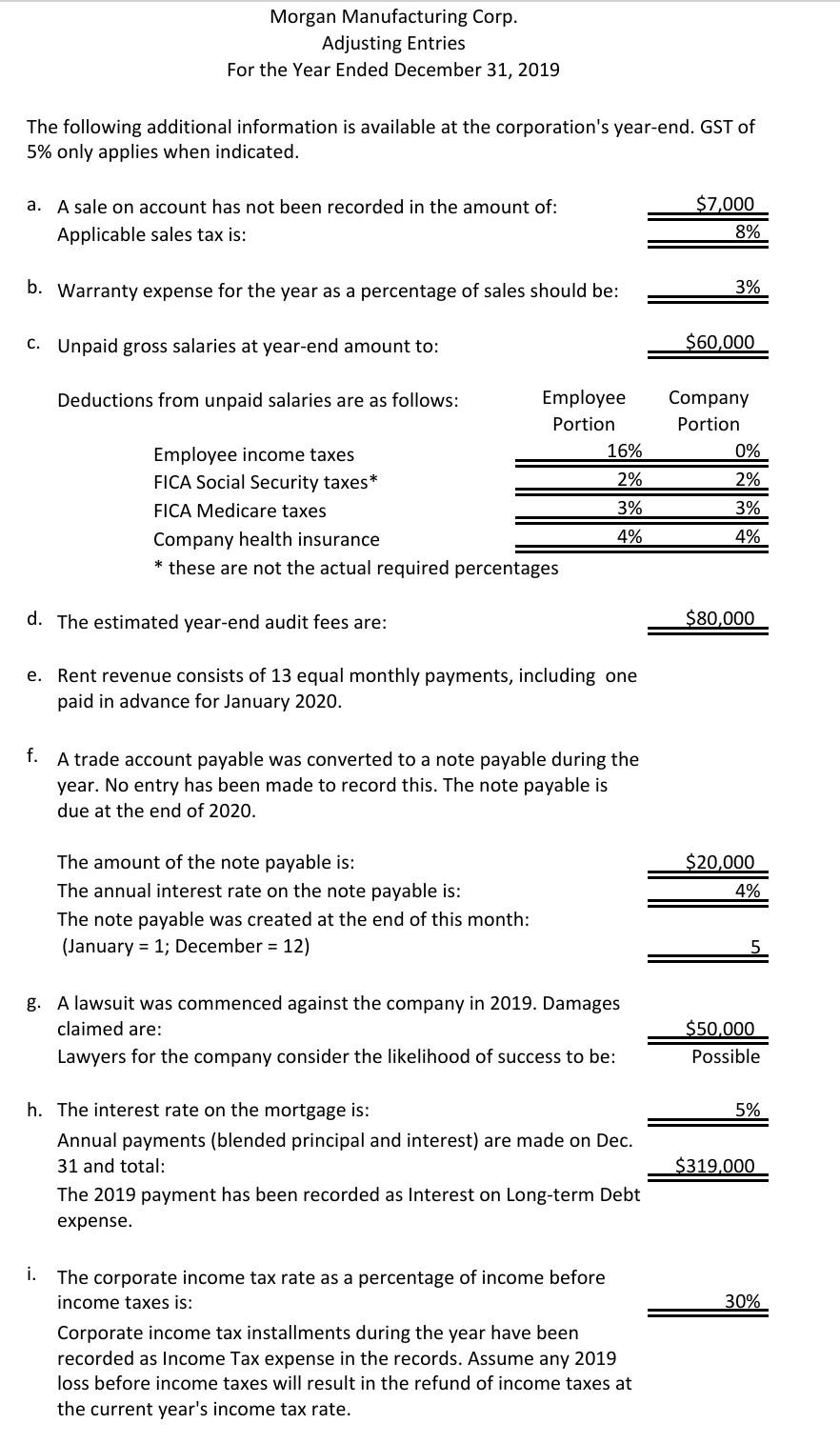

This is class assignment. I would like to know how you get the letter i only. I don't know how to figure it out and where they get the numbers from.

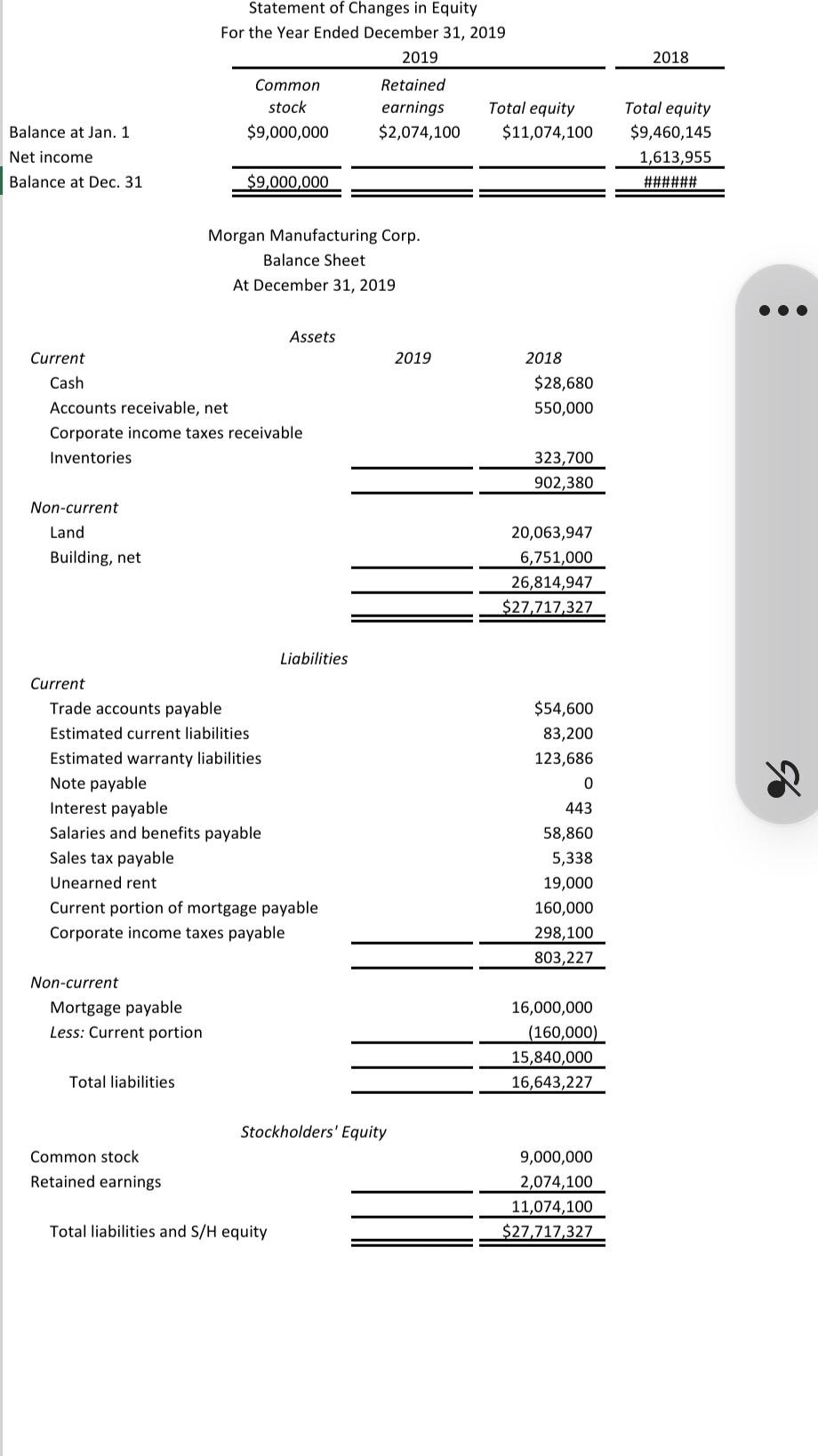

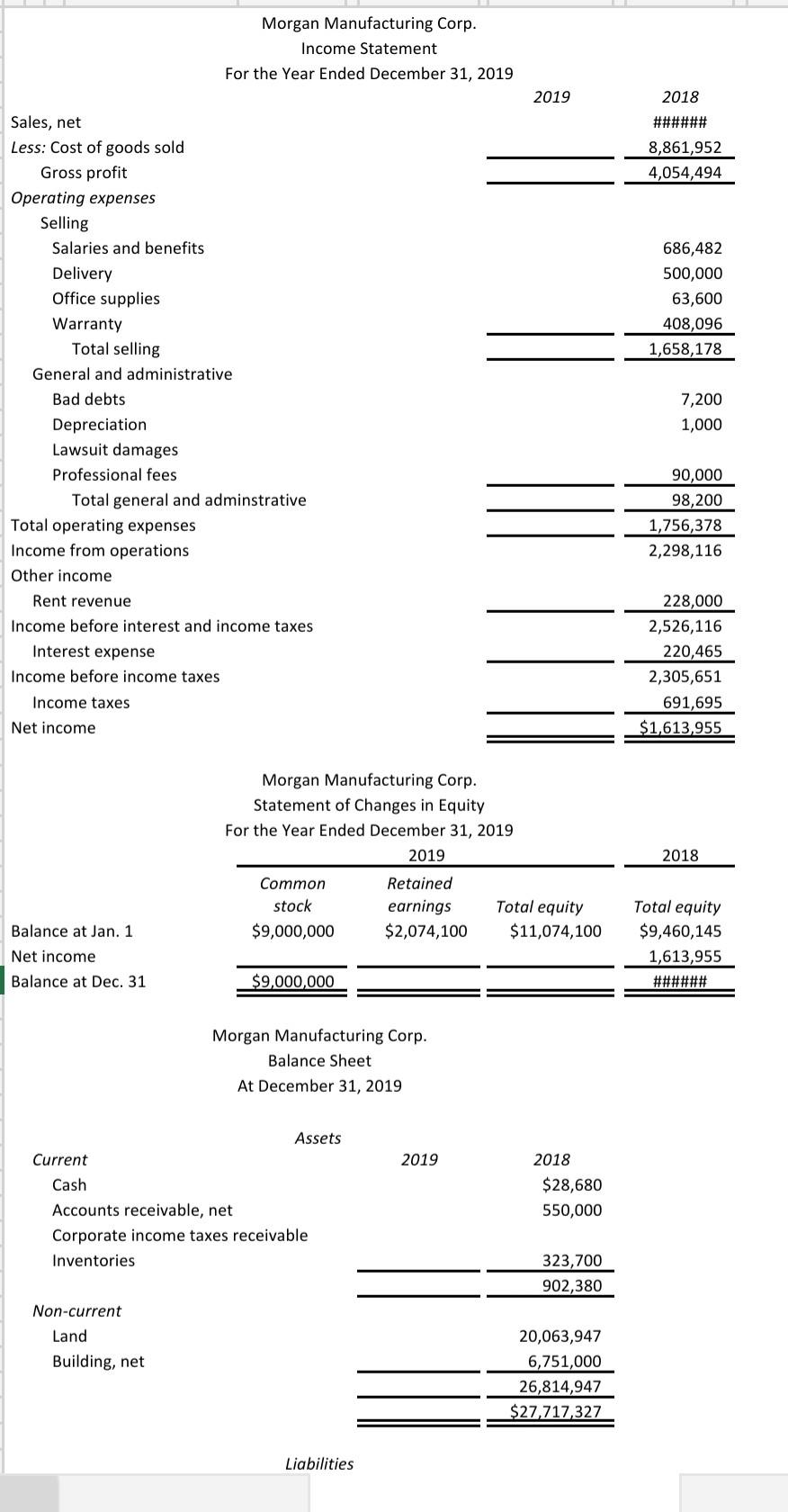

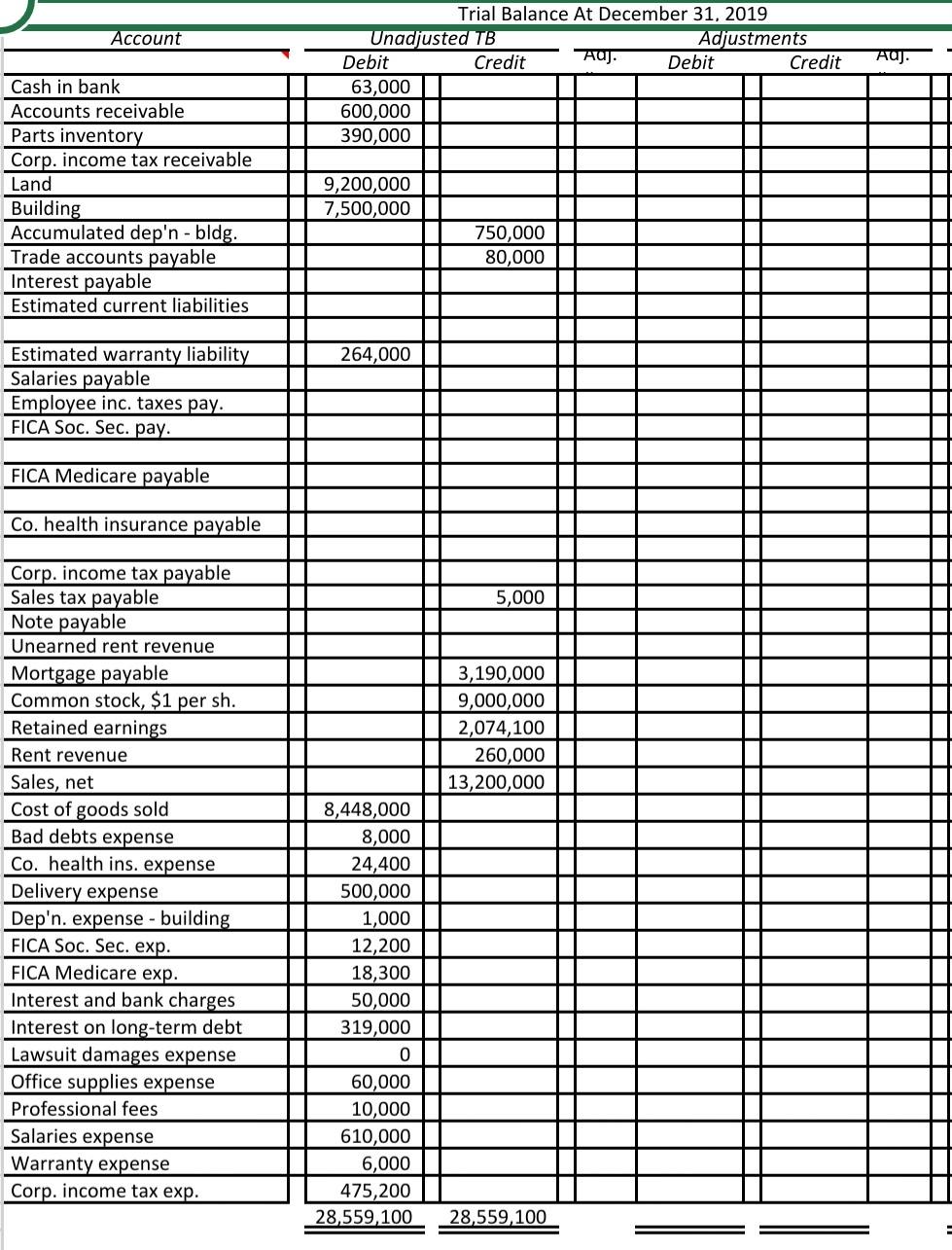

2018 Statement of Changes in Equity For the Year Ended December 31, 2019 2019 Common Retained stock earnings Total equity $9,000,000 $2,074,100 $11,074,100 Balance at Jan. 1 Net income Balance at Dec. 31 Total equity $9,460,145 1,613,955 ###### $9,000,000 Morgan Manufacturing Corp. Balance Sheet At December 31, 2019 2019 2018 Assets Current Cash Accounts receivable, net Corporate income taxes receivable Inventories $28,680 550,000 323,700 902,380 Non-current Land Building, net 20,063,947 6,751,000 26,814,947 $27,717,327 Liabilities Current Trade accounts payable Estimated current liabilities Estimated warranty liabilities Note payable Interest payable Salaries and benefits payable Sales tax payable Unearned rent Current portion of mortgage payable Corporate income taxes payable de $54,600 83,200 123,686 0 443 58,860 5,338 19,000 160,000 298,100 803,227 Non-current Mortgage payable Less: Current portion 16,000,000 (160,000) 15,840,000 16,643,227 Total liabilities Stockholders' Equity Common stock Retained earnings 9,000,000 2,074,100 11,074,100 $27,717,327 Total liabilities and S/H equity Morgan Manufacturing Corp. Income Statement For the Year Ended December 31, 2019 2019 2018 ###### 8,861,952 4,054,494 686,482 500,000 63,600 408,096 1,658,178 Sales, net Less: Cost of goods sold Gross profit Operating expenses Selling Salaries and benefits Delivery Office supplies Warranty Total selling General and administrative Bad debts Depreciation Lawsuit damages Professional fees Total general and adminstrative Total operating expenses Income from operations Other income Rent revenue Income before interest and income taxes Interest expense Income before income taxes Income taxes Net income 7,200 1,000 90,000 98,200 1,756,378 2,298,116 228,000 2,526,116 220,465 2,305,651 691,695 $1,613,955 Morgan Manufacturing Corp. Statement of Changes in Equity For the Year Ended December 31, 2019 2019 Common Retained stock earnings Total equity $9,000,000 $2,074,100 $11,074,100 2018 Balance at Jan. 1 Net income Balance at Dec. 31 Total equity $9,460,145 1,613,955 ###### $9,000,000 Morgan Manufacturing Corp. Balance Sheet At December 31, 2019 2019 Assets Current Cash Accounts receivable, net Corporate income taxes receivable Inventories 2018 $28,680 550,000 323,700 902,380 Non-current Land Building, net 20,063,947 6,751,000 26,814,947 $27,717,327 Liabilities Account . Trial Balance At December 31, 2019 Unadjusted TB Adjustments Debit Credit Auj. Debit Credit 63,000 600,000 390,000 Cash in bank Accounts receivable Parts inventory Corp. income tax receivable Land Building Accumulated dep'n - bldg. Trade accounts payable Interest payable Estimated current liabilities 9,200,000 7,500,000 750,000 80,000 264,000 Estimated warranty liability Salaries payable Employee inc. taxes pay. FICA Soc. Sec. pay. FICA Medicare payable Co. health insurance payable 5,000 3,190,000 9,000,000 2,074,100 260,000 13,200,000 Corp. income tax payable Sales tax payable Note payable Unearned rent revenue Mortgage payable Common stock, $1 per sh. Retained earnings Rent revenue Sales, net Cost of goods sold Bad debts expense Co. health ins. expense Delivery expense Dep'n. expense - building FICA Soc. Sec. exp. FICA Medicare exp. Interest and bank charges Interest on long-term debt Lawsuit damages expense Office supplies expense Professional fees Salaries expense Warranty expense Corp. income tax exp. 8,448,000 8,000 24,400 500,000 1,000 12,200 18,300 50,000 319,000 0 60,000 10,000 610,000 6,000 475,200 28,559,100 28,559 100 Morgan Manufacturing Corp. Adjusting Entries For the Year Ended December 31, 2019 The following additional information is available at the corporation's year-end. GST of 5% only applies when indicated. a. A sale on account has not been recorded in the amount of: Applicable sales tax is: $7,000 8% b. Warranty expense for the year as a percentage of sales should be: 3% C. Unpaid gross salaries at year-end amount to: $60,000 Company Portion 0% Deductions from unpaid salaries are as follows: Employee Portion Employee income taxes 16% FICA Social Security taxes* 2% FICA Medicare taxes 3% Company health insurance 4% * these are not the actual required percentages 2% 3% 4% d. The estimated year-end audit fees are: $80,000 e. Rent revenue consists of 13 equal monthly payments, including one paid in advance for January 2020. f. A trade account payable was converted to a note payable during the year. No entry has been made to record this. The note payable is due at the end of 2020. $20,000 4% The amount of the note payable is: The annual interest rate on the note payable is: The note payable was created at the end of this month: (January = 1; December = 12) g. A lawsuit was commenced against the company in 2019. Damages claimed are: Lawyers for the company consider the likelihood of success to be: $50,000 Possible 5% h. The interest rate on the mortgage is: Annual payments (blended principal and interest) are made on Dec. 31 and total: The 2019 payment has been recorded as Interest on Long-term Debt expense. $319,000 30% i. The corporate income tax rate as a percentage of income before income taxes is: Corporate income tax installments during the year have been recorded as Income Tax expense in the records. Assume any 2019 loss before income taxes will result in the refund of income taxes at the current year's income tax rateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started