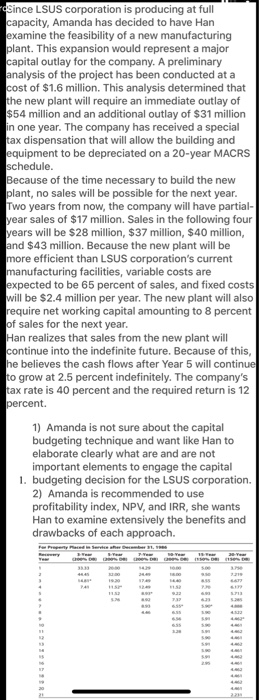

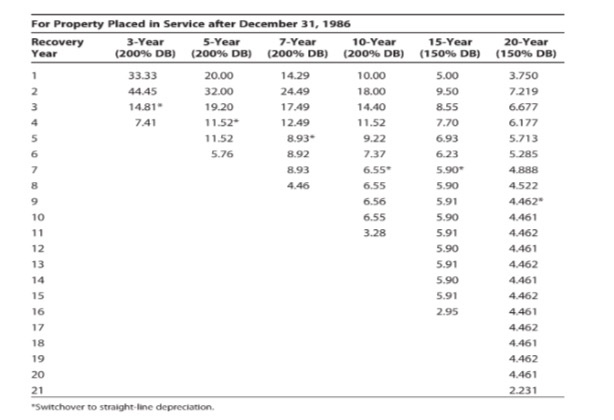

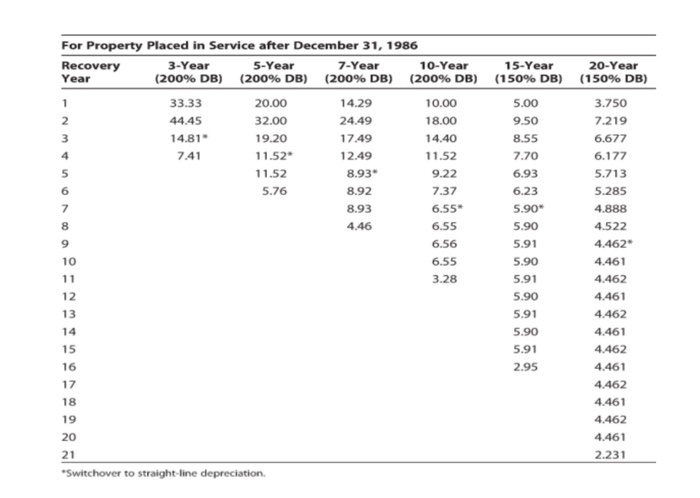

Since LSUS corporation is producing at full capacity, Amanda has decided to have Han examine the feasibility of a new manufacturing plant. This expansion would represent a major capital outlay for the company. A preliminary analysis of the project has been conducted at a cost of $1.6 million. This analysis determined that the new plant will require an immediate outlay of $54 million and an additional outlay of $31 million in one year. The company has received a special tax dispensation that will allow the building and equipment to be depreciated on a 20-year MACRS schedule. Because of the time necessary to build the new plant, no sales will be possible for the next year. Two years from now, the company will have partial- year sales of $17 million. Sales in the following four years will be $28 million, $37 million, $40 million, and $43 million. Because the new plant will be more efficient than LSUS corporation's current manufacturing facilities, variable costs are expected to be 65 percent of sales, and fixed costs will be $2.4 million per year. The new plant will also require net working capital amounting to 8 percent of sales for the next year. Han realizes that sales from the new plant will continue into the indefinite future. Because of this, he believes the cash flows after Year 5 will continue to grow at 2.5 percent indefinitely. The company's tax rate is 40 percent and the required return is 12 percent. 1) Amanda is not sure about the capital budgeting technique and want like Han to elaborate clearly what are and are not important elements to engage the capital 1. budgeting decision for the LSUS corporation. 2) Amanda is recommended to use profitability index, NPV, and IRR, she wants Han to examine extensively the benefits and drawbacks of each approach. For Property Placed in Service after December 31, 1986 Recovery 3-Year 5-Year 7-Year 10-Year Year (200% DB) (200% DB) (200% DB) (200% DB) 15-Year (150% DB) 20-Year (150% DB) 5.00 9.50 33.33 44.45 14.81" 741 20.00 32.00 19.20 11.52 11.52 5.76 14.29 24.49 17.49 12.49 8.93 8.92 10.00 18.00 14.40 11.52 9.22 7.37 893 6.55 4.46 5.90 5.91 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 20 "Switchover to straight-line depreciation For Property Placed in Service after December 31, 1986 Recovery 3-Year 5-Year 7-Year 10-Year Year (200% DB) (200% DB) (200% DB) (200% DB) 15-Year 20-Year (150% DB) (150% DB) 33.33 44.45 14.81" 7.41 20.00 32.00 19.20 11.52" 11.52 5.76 14.29 24.49 17.49 12.49 8.93" 8.92 8.93 4.46 10.00 18.00 14.40 11.52 9.22 5.00 9.50 8.55 7.70 6.93 6.23 5.90* 5.90 5.91 5.90 7.37 6.55* 6.55 6.56 6.55 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462" 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 5.90 5.91 2.95 *Switchover to straight-line depreciation