Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is Company and Accounting, please show step by step with all calculations and consolidated statement financial position with balanced amount. I will give you

This is Company and Accounting, please show step by step with all calculations and consolidated statement financial position with balanced amount.

I will give you upvote. Thank you.

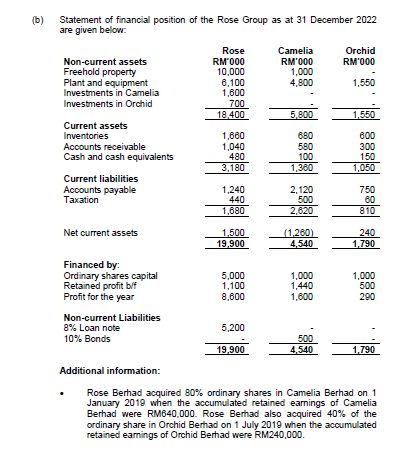

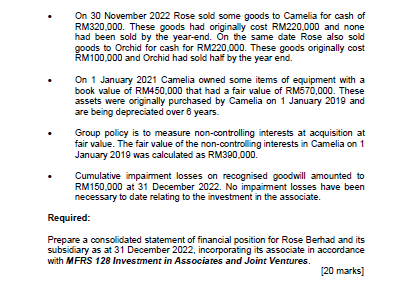

Statement of financial position of the Rose Group as at 31 December 2022 are given below: Additional intormation: - Rose Berhad acquired 80% ordinary shares in Camelia Berhad on 1 January 2019 when the accumulated retained earnings of Camelia Berhad were RM640,000. Rose Berhad also acquired 40% of the ordinary share in Orchid Berhad on 1 July 2019 when the accumulated retained eamings of Orchid Berhad were RM240,000. - On 30 November 2022 Rose sold some goods to Camelia for cash of RM320,000. These goods had originally cost RM220,000 and none had been sold by the year-end. On the same date Rose also sold goods to Orchid for cash for RM220,000. These goods originally cost RM100,000 and Orchid had sold haf" by the year end. - On 1 January 2021 Camelia owned some items of equipment with a book value of RM450,000 that had a fair value of RM570,000. These assets were originally purchased by Camelia on 1 January 2019 and are being depreciated over 6 years. - Group policy is to measure non-controlling interests at acquisition at fair value. The fair value of the non-controlling interests in Camelia on 1 January 2019 was calculated as RM390,000. - Cumulative impaiment losses on recognised goodwill amounted to RM150,000 at 31 December 2022 . No impairment losses have been necessary to date relating to the investment in the associate. Required: Prepare a consolidated statement of financial position for Rose Berhad and its subsidiary as at 31 December 2022, incorporating its associate in accordance with MFRS 128 Investment in Associates and Joint Ventures. [20 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started