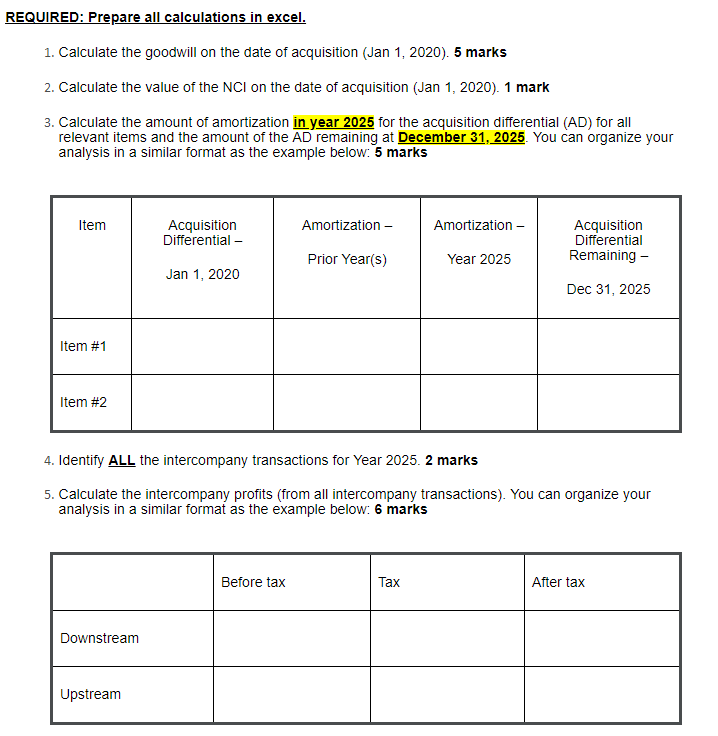

This is consolidation question and if you could help with any part of it, I can mark your answer as helpful:

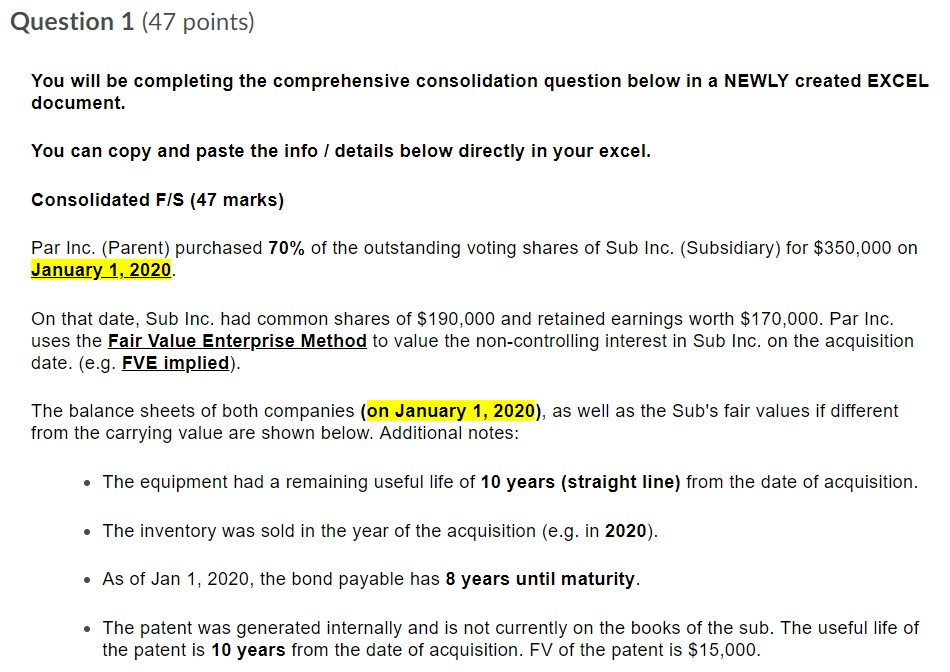

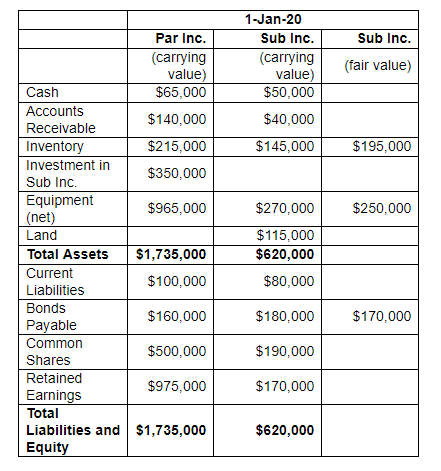

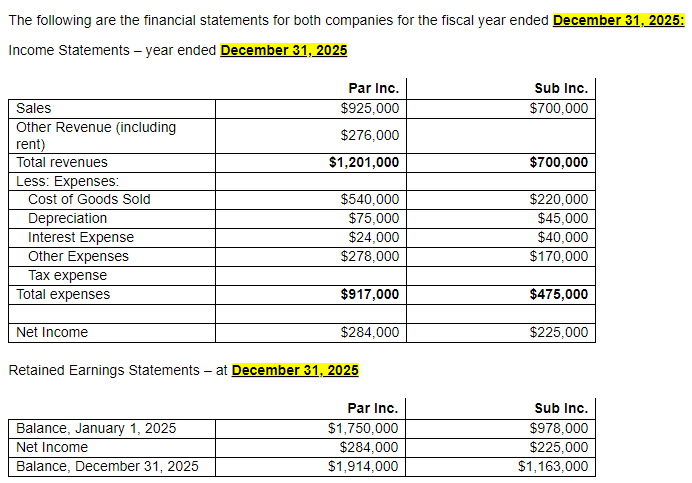

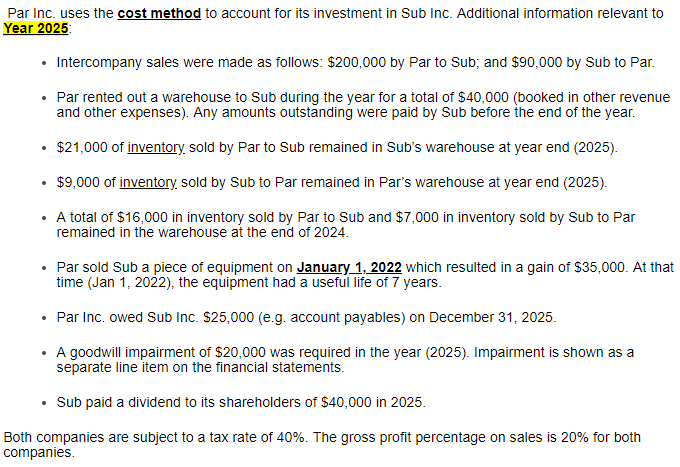

Question 1 (47 points] You will be completing the comprehensive consolidation question below in a NEWLY created EXCEL document. You can copy and paste the info I details below directly in your excel. Consolidated FIS (47 marks} Par Inc. (Parent) purchased 70% of the outstanding voting shares of Sub Inc. (Subsidiary) for $350,000 on January_1, 2020. On that date, Sub Inc. had common shares of $190,000 and retained earnings worth $1?0,000. Par Inc. uses the Fair Value Enterprise Method to value the non-controlling interest in Sub Inc. on the acquisition date. (e.g. FVE implied). The balance sheets of both companies (on January 1, 2020), as well as the Sub's fair values if different from the carrying value are shown below. Additional notes: . The equipment had a remaining useful life of 10 years (straight line) from the date of acquisition. - The inventory was sold in the year of the acquisition (e.g. in 2020). - As of Jan 1, 2020, the bond payable has 8 years until maturity. - The patent was generated internally and is not currently on the books of the sub. The useful life of the patent is 10 years from the date of acquisition. FV of the patent is $15,000. 1-Jan-20 Par Inc. Sub Inc. Sub Inc. (carrying (carrying value) value) (fair value) Cash $65,000 $50,000 Accounts Receivable $140,000 $40,000 Inventory $215,000 $145,000 $195,000 Investment in Sub Inc. $350,000 Equipment (net) $965,000 $270,000 $250,000 Land $115,000 Total Assets $1,735,000 $620,000 Current Liabilities $100,000 $80,000 Bonds Payable $160,000 $180,000 $170,000 Common Shares $500,000 $190,000 Retained Earnings $975,000 $170,000 Total Liabilities and $1,735,000 $620,000 EquityThe following are the nancial statements for both companies for the fiscal year ended December 31, 2025: Income Statements year ended December 31, 2025 Par Inc. Sub Inc. Sales $925,000 $?00,000 Other Revenue (including $2306 000 rent) ' Total revenues $1,201,000 $700,000 Less: Expenses: Cost of Goods Sold $540,000 $220,000 Depreciation $15,000 $45,000 Interest Expense $24,000 $40,000 Other Expenses $2?8,000 $1 T0,000 Tax expense Total expenses $917,000 $475,000 Net Income $234,000 $225,000 Retained Earnings Statements at December 31, 2025 Par Inc. Sub Inc. Balance, Januaryr 1, 2025 $1,?50,000 $508,000 Net Income $234,000 $225,000 Balance, December 31, 2025 $1,914,000 $1,153,000 Par Inc. uses the cost method to account for its investment in Sub Inc. Additional information relevant to Year 2025 . Intercompany sales were made as follows: $200,000 by Par to Sub; and $90,000 by Sub to Par. Par rented out a warehouse to Sub during the year for a total of $40,000 (booked in other revenue and other expenses). Any amounts outstanding were paid by Sub before the end of the year. . $21,000 of inventory sold by Par to Sub remained in Sub's warehouse at year end (2025). . $9,000 of inventory sold by Sub to Par remained in Par's warehouse at year end (2025). . A total of $16,000 in inventory sold by Par to Sub and $7,000 in inventory sold by Sub to Par remained in the warehouse at the end of 2024. . Par sold Sub a piece of equipment on January 1, 2022 which resulted in a gain of $35,000. At that time (Jan 1, 2022), the equipment had a useful life of 7 years. . Par Inc. owed Sub Inc. $25,000 (e.g. account payables) on December 31, 2025. . A goodwill impairment of $20,000 was required in the year (2025). Impairment is shown as a separate line item on the financial statements. . Sub paid a dividend to its shareholders of $40,000 in 2025. Both companies are subject to a tax rate of 40%. The gross profit percentage on sales is 20% for both companies.REQUIRED: Prepare all calculations in excel. 1. Calculate the goodwill on the date of acquisition (Jan 1, 2020). 5 marks 2. Calculate the value of the NCI on the date of acquisition (Jan 1, 2020). 1 mark 3. Calculate the amount of amortization in year 2025 for the acquisition differential (AD) for all relevant items and the amount of the AD remaining at December 31, 2025. You can organize your analysis in a similar format as the example below: 5 marks Item Acquisition Amortization - Amortization - Acquisition Differential - Differential Prior Year(S) Year 2025 Remaining - Jan 1, 2020 Dec 31, 2025 Item #1 Item #2 4. Identify ALL the intercompany transactions for Year 2025. 2 marks 5. Calculate the intercompany profits (from all intercompany transactions). You can organize your analysis in a similar format as the example below: 6 marks Before tax Tax After tax Downstream Upstream