Answered step by step

Verified Expert Solution

Question

1 Approved Answer

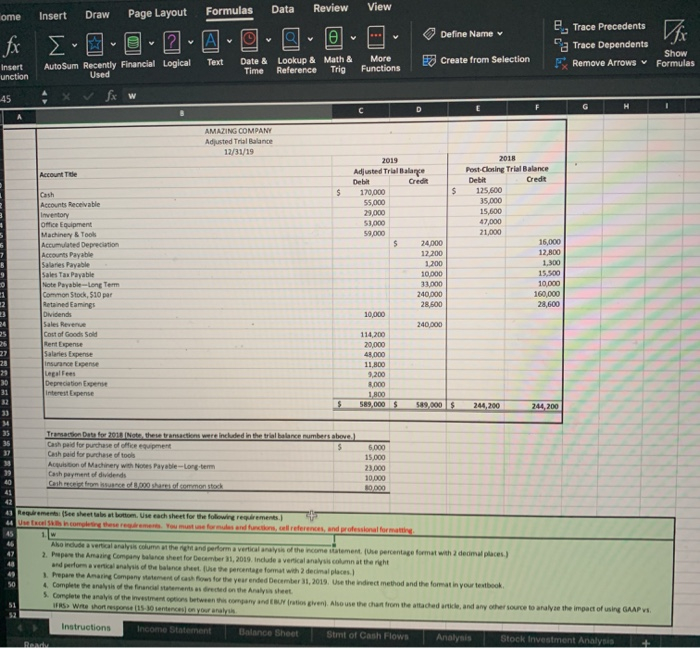

This is done on excel. The requirements are the instructions in green box. The information they give you is the transaction data for 2018 and

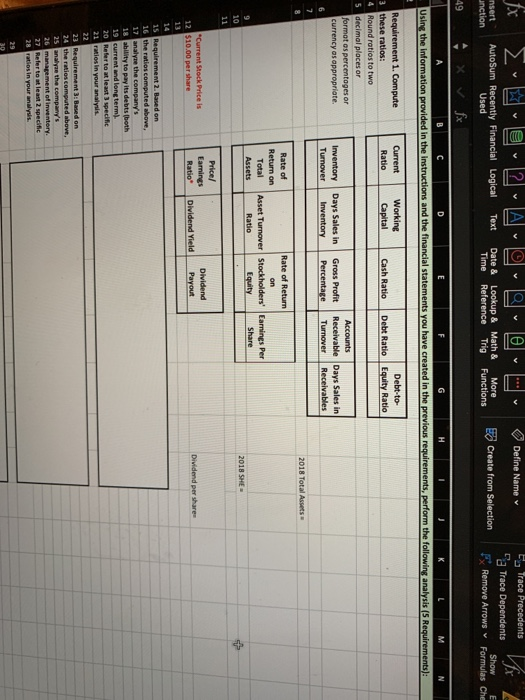

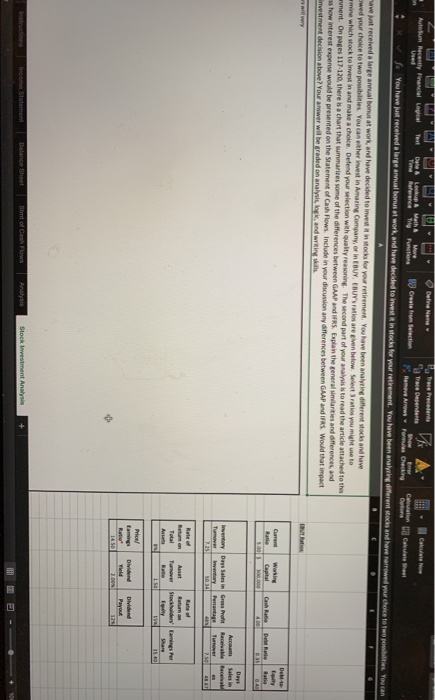

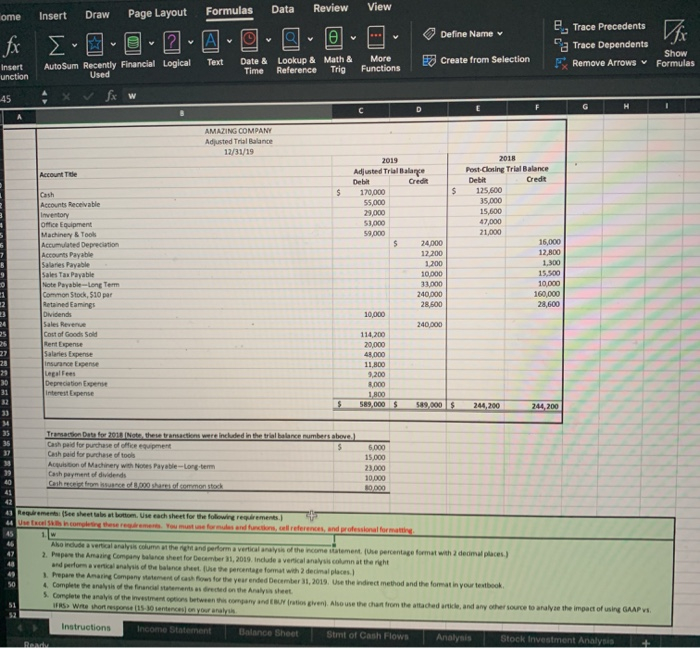

This is done on excel. The requirements are the instructions in green box. The information they give you is the transaction data for 2018 and the Trial balance. The instructions want you to use the information given to contruct a income statment, balance sheet, statment of cash flow, analysis, and stock investment analysis. The pictures are not in order.

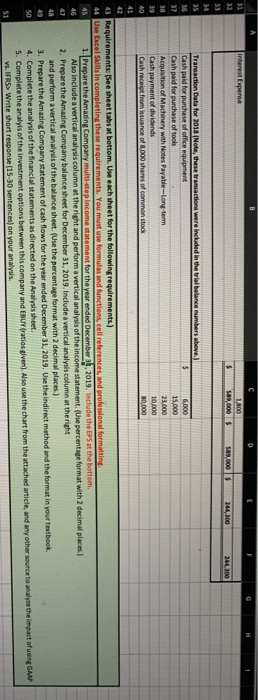

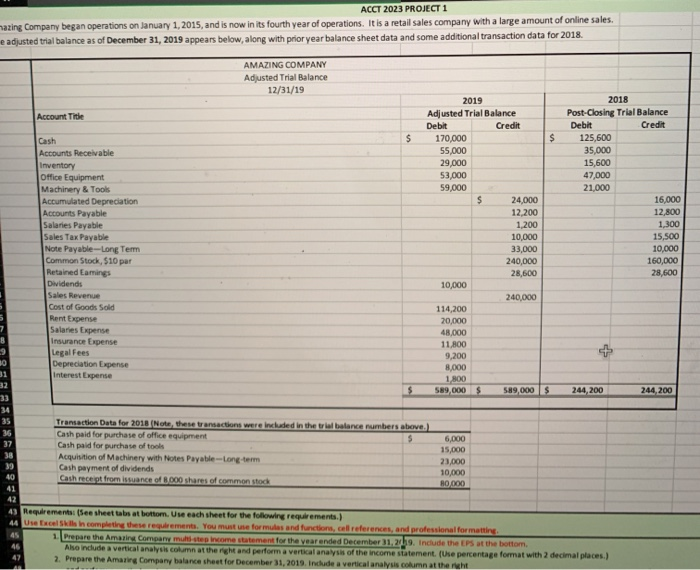

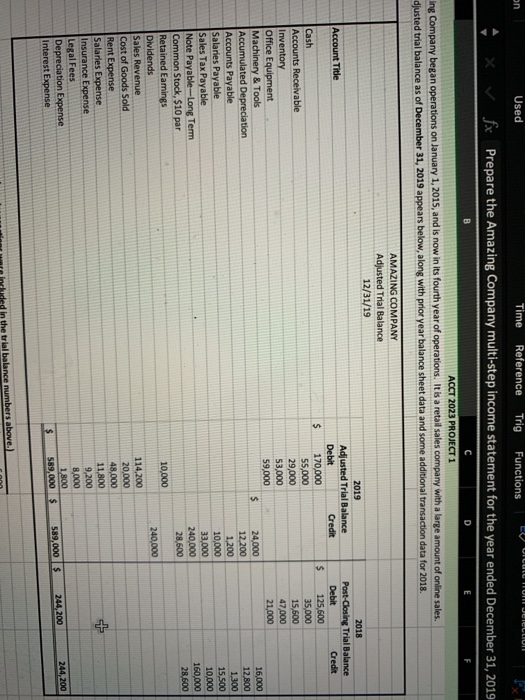

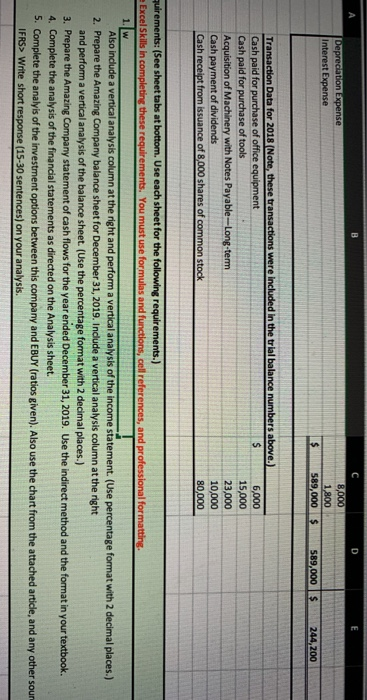

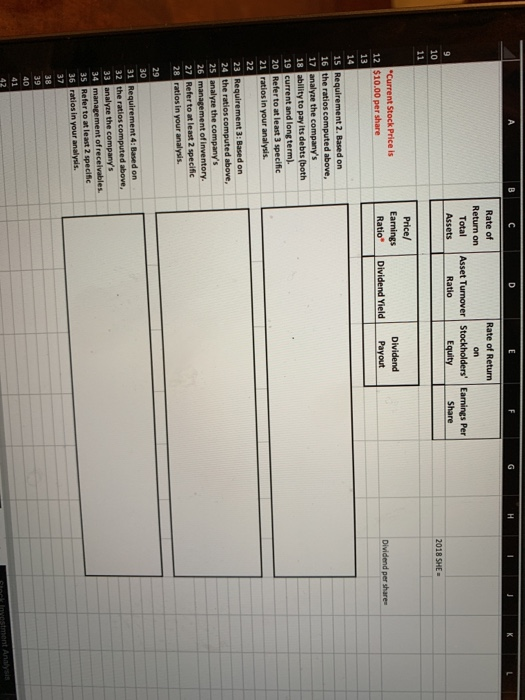

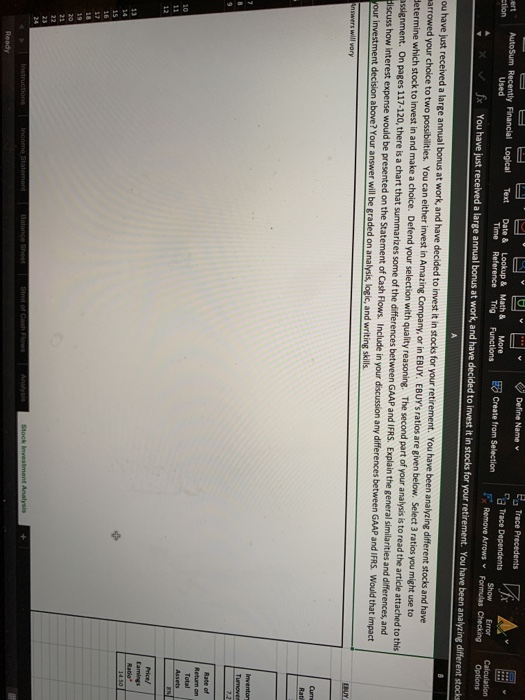

Interest Expense $ 9.000 .000 $ 244, 200 2 44.200 Transaction Data for 2011 Note, these transactions were included in the trial balance numbe Cash paid for purchase of office equipment Cash paid for purchase of tools Acquisition of Machinery with Notes Payable-long-term Cash payment of dividends Cash receipt from suance of 8.000 shares of common 43 Requirements: See sheet tabs at bottom. Use eh heet for the following requirements.) 44 Use Excel Silsin completing these requirements. You must use formules and functions, cell references, and professional formatting 1. Prepare the Amating Company multi-stepincome statement for the year ended December 2019. Include the EPS at the bottom. Also include a vertical analysis column at the right and perform a vertical analysis of the income statement (Use percentage format with 2 decimal places.) 2. Prepare the Amazing Company balance sheet for December 31, 2019. Include a vertical analysis.column at the right and perform a vertical analysis of the balance sheet. Use the percentage format with 2 decimal places.) 3. Prepare the Amazing Company statement of cash flows for the year ended December 31, 2019. Use the indirect method and the format in your textbook. 4. Complete the analysis of the financial statements as directed on the Analysis sheet. S. Complete the analys of the investment options between this company and EBUT ratios glven)Also use the chart from the attached article, and any other source to analyse the impact of using GMP vs IFRS) Write short response (15-30 sentences) on your analysis. ACCT 2023 PROJECT 1 mazing Company began operations on January 1, 2015, and is now in its fourth year of operations. It is a retail sales company with a large amount of online sales. e adjusted trial balance as of December 31, 2019 appears below, along with prior year balance sheet data and some additional transaction data for 2018. AMAZING COMPANY Adjusted Trial Balance 12/31/19 Account Title Cash Accounts Receivable Inventor Office Equipment Machinery & Tools Accumulated Depreciation Accounts Payable Salaries Payable Sales Tax Payable Note Payable-Long Term Common Stock, $10 par Retained Camings Dividends Sales Revenue Cost of Goods Sold Rent Expense Salaries Expense Insurance Expense Legal Fees Depreciation Expense Interest Expense 2019 Adjusted Trial Balance Debit Credit 170,000 55,000 29,000 53,000 59,000 24,000 12,200 1,200 10.000 33,000 240,000 28,600 10,000 240,000 114,200 20,000 48.000 11,800 9,200 8,000 1 800 589,000 $ 589,000 2018 Post-Closing Trial Balance Debit Credit 125,600 35,000 15,600 47,000 21,000 16,000 12,800 1,300 15,500 10,000 160,000 28,600 $ 244,200 Transaction Data for 2018 (Note, these transactions were included in the trial balance numbers above.) Cash paid for purchase of office equipment Cash paid for purchase of tools Acquisition of Machinery with Notes Payable-long-term Cash payment of dividends Cash receipt from issuance of 6.000 shares of common stock 6,000 15,000 23,000 10,000 80,000 43 Requirements: (See sheet tabs at bottom. Use each sheet for the following requirements.) 44 Use Excel skills in completing these requirements. You must une formules and function cell references, and professional formatting 1. Prepare the Amazing Company mult step income statement for the year anded December 31, 2019. Include the EPS at the bottom. Also include a vertical analysis column at the right and perform a vertical analysis of the income statement (Use percentage format with 2 decimal places.) 2. Prepare the Amazing Company balance sheet for December 31, 2019. Include a vertical analysis column at the cht Used Time Reference Trig Functions fx Prepare the Amazing Company multi-step income statement for the year ended December 31, 2019 X V ACCT 2023 PROJECT 1 ing Company began operations on January 1, 2015, and is now in its fourth year of operations. It is a retail sales company with a large amount of online sales. djusted trial balance as of December 31, 2019 appears below, along with prior year balance sheet data and some additional transaction data for 2018. AMAZING COMPANY Adjusted Trial Balance 12/31/19 2019 Account Title Credit Debit 2018 Post-Closing Trial Balance Credit 125,600 35,000 15,600 47,000 21,000 16,000 12,800 Adjusted Trial Balance Debit 170,000 55,000 29,000 53,000 59,000 24,000 12,200 1,200 10,000 33,000 240,000 28,600 10,000 240,000 114.200 20,000 1.300 Son 10,000 Cash Accounts Receivable Inventory Office Equipment Machinery & Tools Accumulated Depreciation Accounts Payable Salaries Payable Sales Tax Payable Note Payable--Long Term Common Stock, $10 par Retained Eamings Dividends Sales Revenue Cost of Goods Sold Rent Expense Salaries Expense Insurance Expense Legal Fees Depreciation Expense Interest Expense 160,000 26 11.800 9,200 8,000 1 800 589,000 244,200 244, 200 589,000 $ aded in the trial balance numbers above. D Depreciation Expense Interest Expense C 8,000 1.800 589,000 $ 589,000 $ 244,200 Transaction Data for 2018 (Note, these transactions were included in the trial balance numbers above.) Cash paid for purchase of office equipment Cash paid for purchase of tools Acquisition of Machinery with Notes Payable-Long-term Cash payment of dividends Cash receipt from issuance of 8,000 shares of common stock 6,000 15,000 23,000 10,000 80,000 quirements: (See sheet tabs at bottom. Use each sheet for the following requirements.) Excel Skills in completing these requirements. You must use formulas and functions, el references, and professional formatting 1. W Also include a vertical analysis column at the right and perform a vertical analysis of the income statement. (Use percentage format with 2 decimal places.) 2. Prepare the Amazing Company balance sheet for December 31, 2019. Include a vertical analysis column at the right and perform a vertical analysis of the balance sheet. (Use the percentage format with 2 decimal places.) 3. Prepare the Amazing Company statement of cash flows for the year ended December 31, 2019. Use the indirect method and the format in your textbook. 4. Complete the analysis of the financial statements as directed on the Analysis sheet. 5. Complete the analyis of the investment options between this company and EBUY (ratios given). Also use the chart from the attached article, and any other sour IFRS> Write short response (15-30 sentences) on your analysis. AMAZING COMPANY Income Statement Year Ended December 31, 2019 Vert. Analysis AMAZING COMPANY Balance Sheet December 31, 2019 Vert. Analysis Balance sheet AMAZING COMPANY Statement of Cash Flows Year Ended December 31, 2019 Read Stm Cash Flows fx 2 2 A ge Define Name v Ed Create from Selection ETrace Precedents a Trace Dependents EX Remove Arrows insert unction Autosum Recently Financial Logical Text Used Date & Lookup & Math & Time Reference Trig More Functions Show E Formulas Che 49 K L M N Using the information provided in the instructions and the financial statements you have created in the previous requirements, perform the following analysis (5 Requirements): Current Ratio Working Capital Debt-to- Equity Ratio Cash Ratio Debt Ratio Requirement 1. Compute 3 these ratios: 4 Round ratios to two 5 decimal places or formatos percentages or currency as appropriate. Inventory Turnover Days Sales in Inventory Gross Profit Percentage Accounts Receivable Days Sales in Turnover Receivables 2018 Total Assets Rate of Return Rate of Return on Total Assets Asset Turnover Stockholders' Earnings Per Ratio Equity Share 2018 SHE Pricel Earnings Ratio Current Stock Price is 12 510.00 per share Dividend Dividend Yield Dividend per share 15 Requirement 2. Based on 16 the ratios computed above 17 analyre the company's 18 ability to pay its debts both 19 current and long term. 20 Refer to at least specific 21 ratios in your analysis 23 Requirement: Based on 24 the ratios computed above, 25 analyze the company's 26 management of inventory 27 Refer to at least 2 specific 28 ratios in your analysis Rate of Return on Total Assets Rate of Return on Asset Turnover Stockholders' Earnings Per Ratio Equity Share 2018 SHE Price/ Earnings *Current Stock Price is 12 $10.00 per share Dividend Payout Dividend Yield Dividend per share 15 Requirement 2. Based on 16 the ratios computed above, 17 analyze the company's 18 ability to pay its debts (both 19 current and long term). 20 Refer to at least 3 specific 21 ratios in your analysis. 22 23 Requirement 3: Based on 24 the ratios computed above, 25 analyze the company's 26 management of inventory. 27 Refer to at least 2 specific 28 ratios in your analysis. 31 Requirement 4: Based on 32 the ratios computed above, 33 analyze the company's 34 management of receivables. 35 Refer to at least 2 specific 36 ratios in your analysis. Flyestment Analysis ert etion Define Name e, Trace Precedents AutoSum Recently Financial Logical a Trace Dependents Text Date & Lookup & Math & More E Create from Selection Error Show Calculation Used Time Reference Trig Functions Remove Arrows Formulas Checking Options X I x You have just received a large annual bonus at work and have decided to invest in stocks for your retirement. You have been analyzing different stock ou have just received a large annual bonus at work, and have decided to invest it in stocks for your retirement. You have been analyzing different stocks and have arrowed your choice to two possibilities. You can either invest in Amazing Company, or in EBUY. EBUY's ratios are given below. Select 3 ratios you might use to Hetermine which stock to invest in and make a choice. Defend your selection with quality reasoning. The second part of your analysis is to read the article attached to this assignment. On pages 117-120, there is a chart that summarizes some of the differences between GAAP and IFRS. Explain the general similarities and differences, and Hiscuss how interest expense would be presented on the Statement of Cash Flows. Include in your discussion any differences between GAAP and IFRS. Would that impact your investment decision above? Your answer will be graded on analysis, logic, and writing skills. Write short response (15-30 sentences) on your analysis. AMAZING COMPANY Income Statement Year Ended December 31, 2019 Vert. Analysis AMAZING COMPANY Balance Sheet December 31, 2019 Vert. Analysis Balance sheet AMAZING COMPANY Statement of Cash Flows Year Ended December 31, 2019 Read Stm Cash Flows fx 2 2 A ge Define Name v Ed Create from Selection ETrace Precedents a Trace Dependents EX Remove Arrows insert unction Autosum Recently Financial Logical Text Used Date & Lookup & Math & Time Reference Trig More Functions Show E Formulas Che 49 K L M N Using the information provided in the instructions and the financial statements you have created in the previous requirements, perform the following analysis (5 Requirements): Current Ratio Working Capital Debt-to- Equity Ratio Cash Ratio Debt Ratio Requirement 1. Compute 3 these ratios: 4 Round ratios to two 5 decimal places or formatos percentages or currency as appropriate. Inventory Turnover Days Sales in Inventory Gross Profit Percentage Accounts Receivable Days Sales in Turnover Receivables 2018 Total Assets Rate of Return Rate of Return on Total Assets Asset Turnover Stockholders' Earnings Per Ratio Equity Share 2018 SHE Pricel Earnings Ratio Current Stock Price is 12 510.00 per share Dividend Dividend Yield Dividend per share 15 Requirement 2. Based on 16 the ratios computed above 17 analyre the company's 18 ability to pay its debts both 19 current and long term. 20 Refer to at least specific 21 ratios in your analysis 23 Requirement: Based on 24 the ratios computed above, 25 analyze the company's 26 management of inventory 27 Refer to at least 2 specific 28 ratios in your analysis Rate of Return on Total Assets Rate of Return on Asset Turnover Stockholders' Earnings Per Ratio Equity Share 2018 SHE Price/ Earnings *Current Stock Price is 12 $10.00 per share Dividend Payout Dividend Yield Dividend per share 15 Requirement 2. Based on 16 the ratios computed above, 17 analyze the company's 18 ability to pay its debts (both 19 current and long term). 20 Refer to at least 3 specific 21 ratios in your analysis. 22 23 Requirement 3: Based on 24 the ratios computed above, 25 analyze the company's 26 management of inventory. 27 Refer to at least 2 specific 28 ratios in your analysis. 31 Requirement 4: Based on 32 the ratios computed above, 33 analyze the company's 34 management of receivables. 35 Refer to at least 2 specific 36 ratios in your analysis. Flyestment Analysis ert etion Define Name e, Trace Precedents AutoSum Recently Financial Logical a Trace Dependents Text Date & Lookup & Math & More E Create from Selection Error Show Calculation Used Time Reference Trig Functions Remove Arrows Formulas Checking Options X I x You have just received a large annual bonus at work and have decided to invest in stocks for your retirement. You have been analyzing different stock ou have just received a large annual bonus at work, and have decided to invest it in stocks for your retirement. You have been analyzing different stocks and have arrowed your choice to two possibilities. You can either invest in Amazing Company, or in EBUY. EBUY's ratios are given below. Select 3 ratios you might use to Hetermine which stock to invest in and make a choice. Defend your selection with quality reasoning. The second part of your analysis is to read the article attached to this assignment. On pages 117-120, there is a chart that summarizes some of the differences between GAAP and IFRS. Explain the general similarities and differences, and Hiscuss how interest expense would be presented on the Statement of Cash Flows. Include in your discussion any differences between GAAP and IFRS. Would that impact your investment decision above? Your answer will be graded on analysis, logic, and writing skills.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started