Answered step by step

Verified Expert Solution

Question

1 Approved Answer

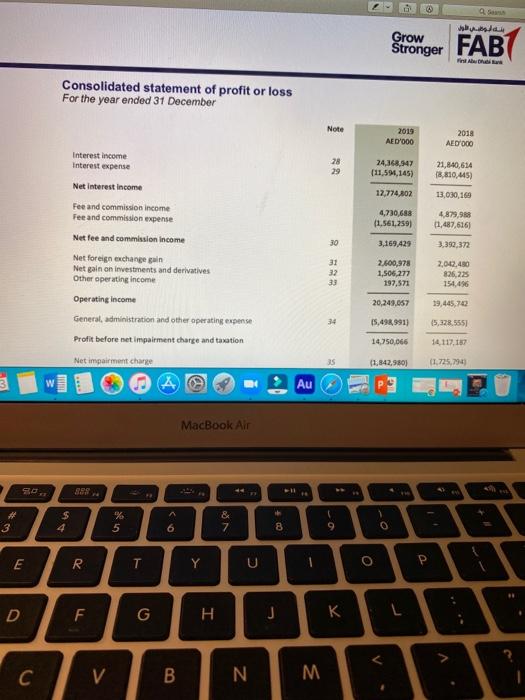

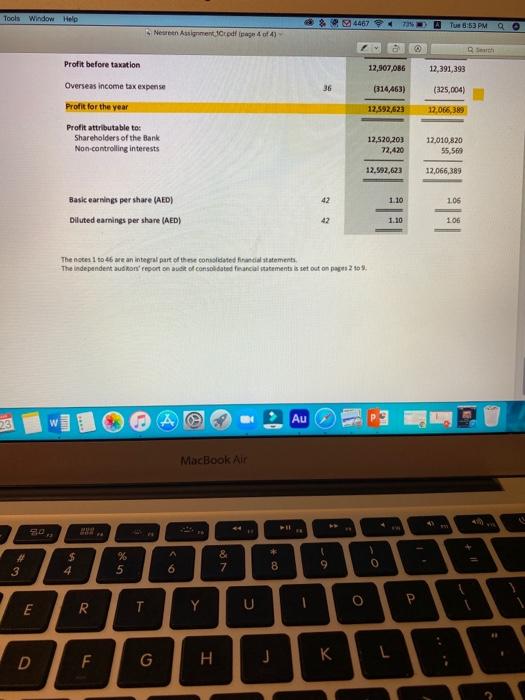

this is example of how to answer QUESTION 1. (1) Followings are the balance sheet and income statement of FAB for the year 2019 and

this is example of how to answer

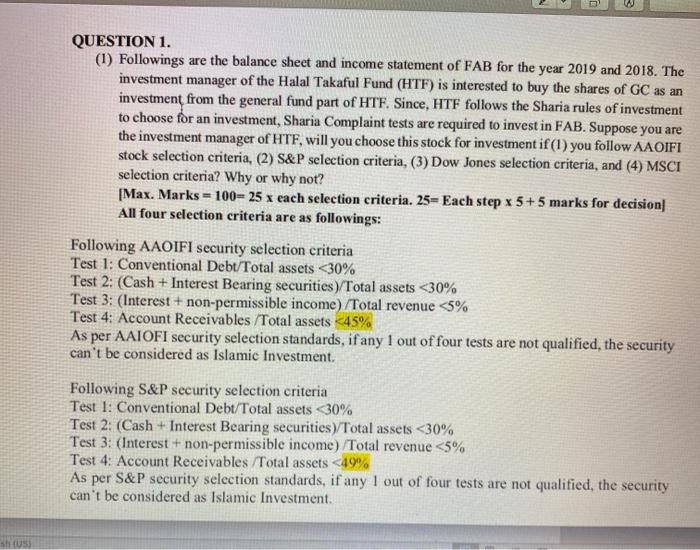

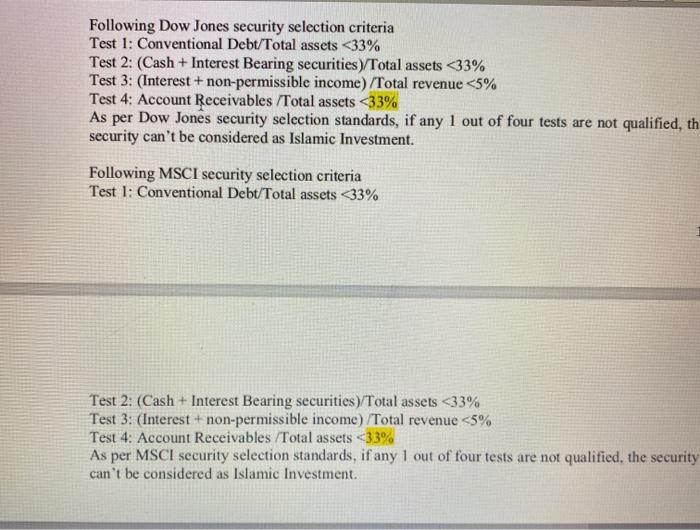

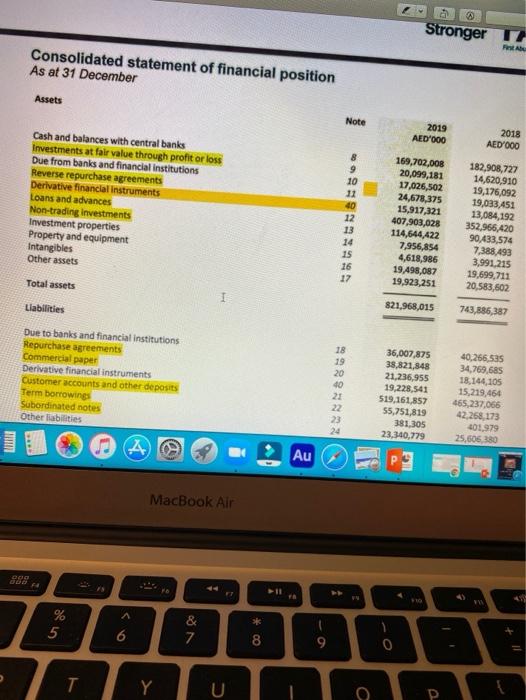

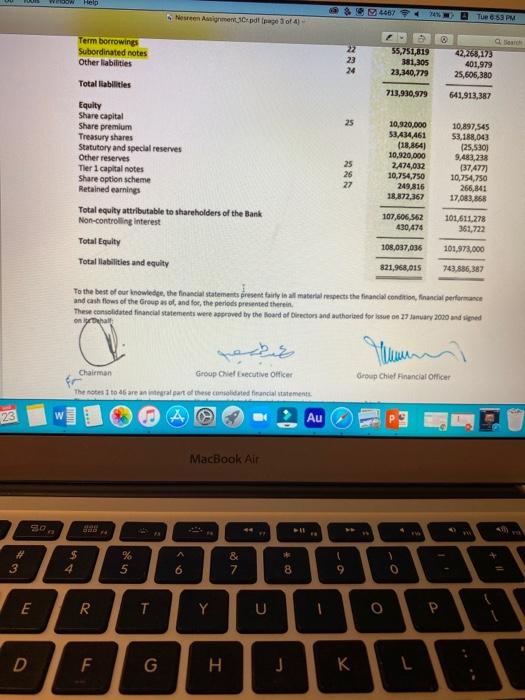

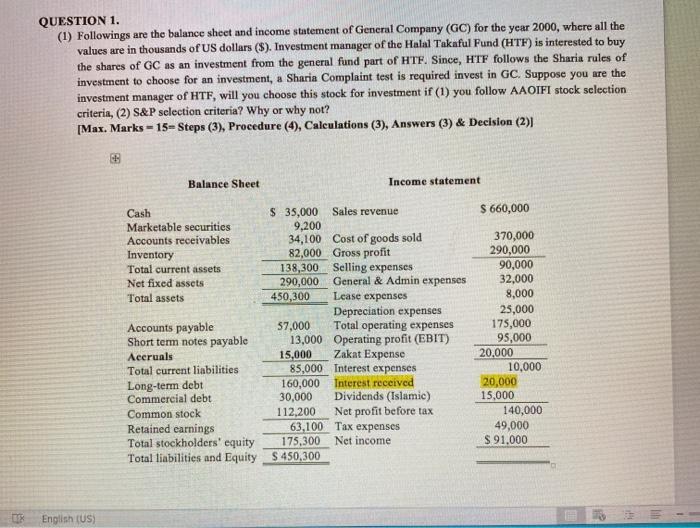

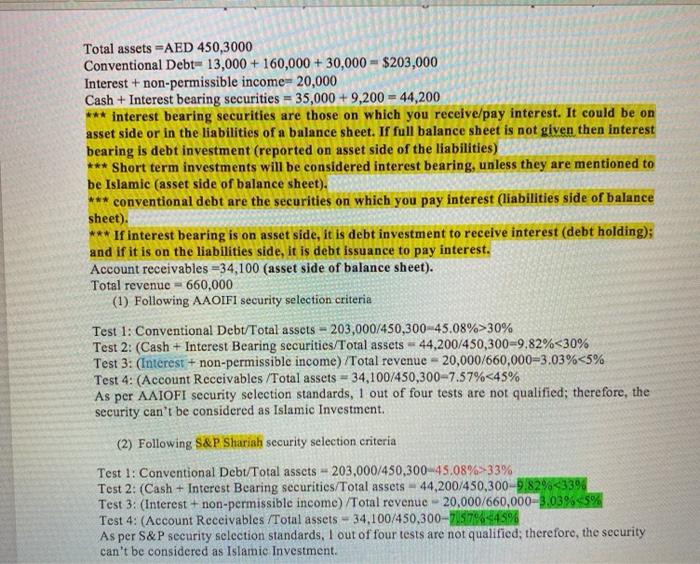

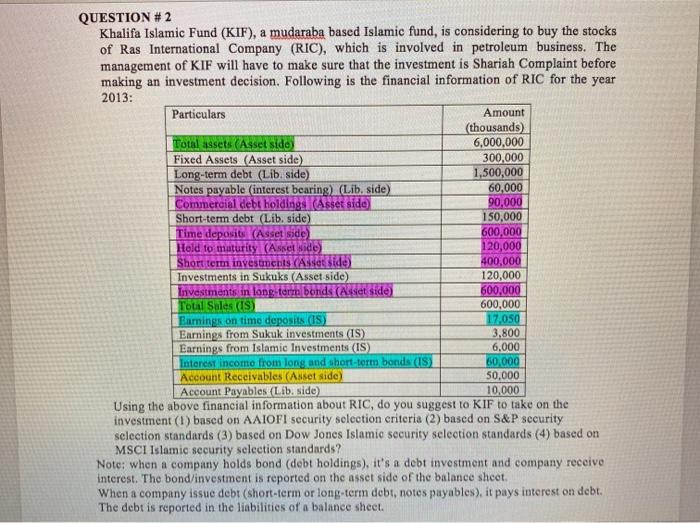

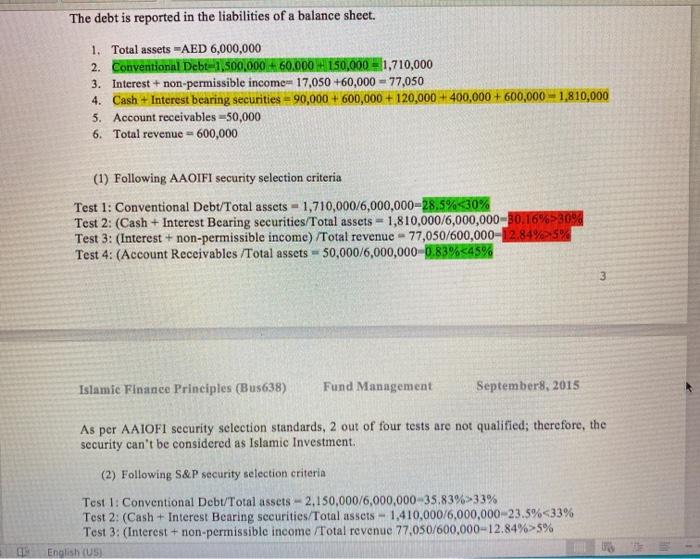

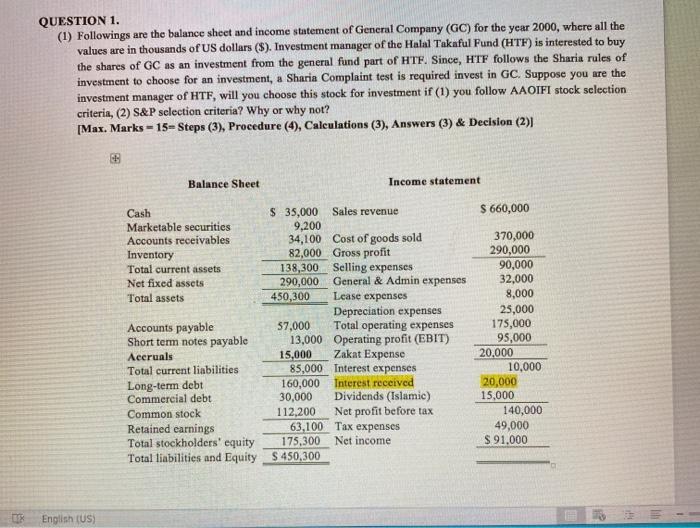

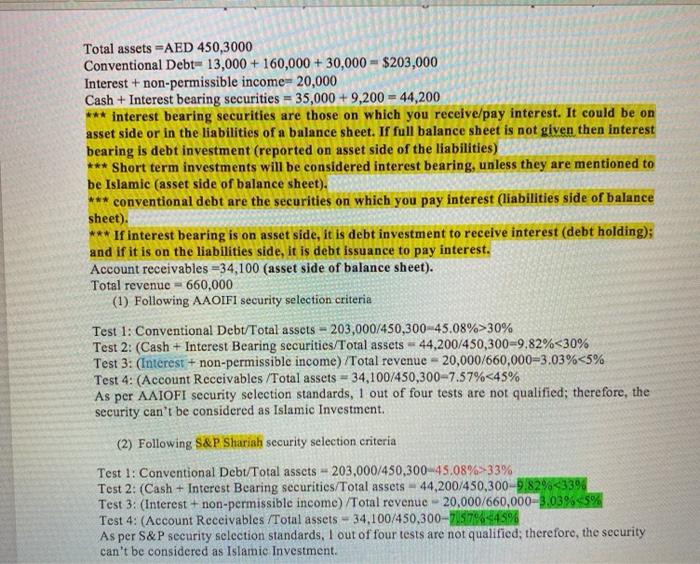

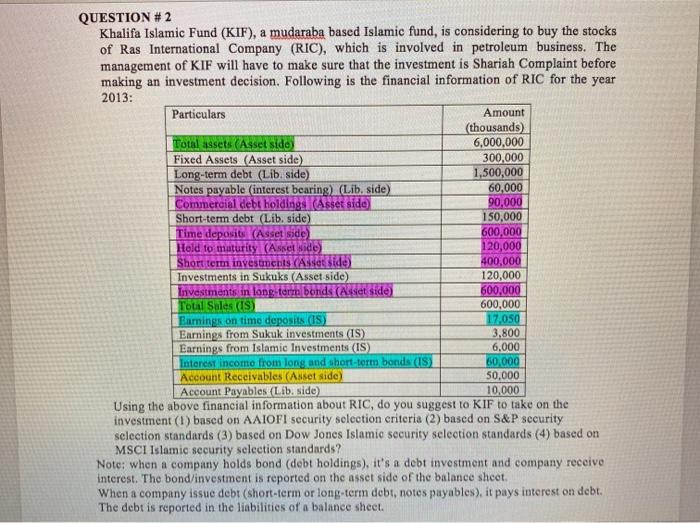

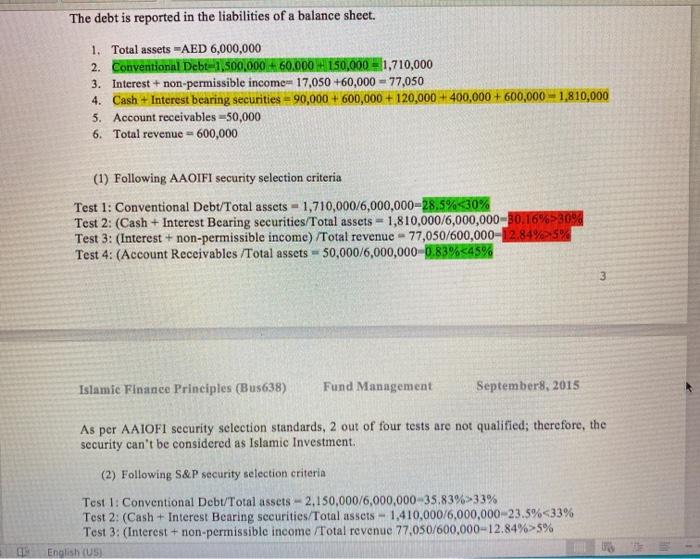

QUESTION 1. (1) Followings are the balance sheet and income statement of FAB for the year 2019 and 2018. The investment manager of the Halal Takaful Fund (HTF) is interested to buy the shares of GC as an investment from the general fund part of HTF. Since, HTF follows the Sharia rules of investment to choose for an investment, Sharia Complaint tests are required to invest in FAB. Suppose you are the investment manager of HTF, will you choose this stock for investment if(1) you follow AAOIFI stock selection criteria, (2) S&P selection criteria, (3) Dow Jones selection criteria, and (4) MSCI selection criteria? Why or why not? [Max. Marks = 100-25 x each selection criteria. 25=Each step x 5+5 marks for decision All four selection criteria are as followings: Following AAOIFI security selection criteria Test 1: Conventional Debt/Total assets C V B N M Tools Window Help % 4467 A Tue 8:53 PM go New Assignment Code of 4) Profit before taxation 12,907,086 12,391,393 Overseas income tax expense (314463) (325,004) 12,592,623 12,066,389 Profit for the year Profit attributable to Shareholders of the Bank Non controlling interests 12,520,203 72,420 12,010,820 55,569 12,592,623 12,066,389 42 110 1.06 Basic earnings per share (AED) Diluted earnings per share (AED) 1.10 106 The notes 1 to 46 are an integral part of these consolidated financial statements The Independent on report out of conscidated francal statements set out on page to Au MacBook Air 2 4 $ 4 % 5 & 7 OD * 9 0 6 0 U E R Y T H D L F QUESTION 1. (1) Followings are the balance sheet and income statement of General Company (GC) for the year 2000, where all the values are in thousands of US dollars ($). Investment manager of the Halal Takaful Fund (HTF) is interested to buy the shares of GC as an investment from the general fund part of HTF. Since, HTF follows the Sharia rules of investment to choose for an investment, a Sharia Complaint test is required invest in GC. Suppose you are the investment manager of HTF, will you choose this stock for investment if (1) you follow AAOIFI stock selection criteria, (2) S&P selection criteria? Why or why not? [Max. Marks -15-Steps (3), Procedure (4), Calculations (3), Answers (3) & Decision (2) Balance Sheet Income statement $ 660,000 Cash $ 35,000 Sales revenue Marketable securities 9,200 Accounts receivables 34,100 Cost of goods sold Inventory 82,000 Gross profit Total current assets 138,300 Selling expenses Net fixed assets 290,000 General & Admin expenses Total assets 450,300 Lease expenses Depreciation expenses Accounts payable 57,000 Total operating expenses Short term notes payable 13,000 Operating profit (EBIT) Accruals 15,000 Zakat Expense Total current liabilities 85,000 Interest expenses Long-term debt 160,000 Interest received Commercial debt 30,000 Dividends (Islamic) Common stock 112,200 Net profit before tax Retained earnings 63,100 Tax expenses Total stockholders' equity 175,300 Net income Total liabilities and Equity S 450.300 370,000 290,000 90,000 32,000 8,000 25,000 175,000 95,000 20.000 10,000 20,000 15,000 140,000 49,000 S 91.000 English (US) Total assets AED 450,3000 Conventional Debt- 13,000 + 160,000 + 30,000 = $200,000 Interest + non-permissible income-20,000 Cash + Interest bearing securities - 35,000+ 9,200 - 44,200 *** interest bearing securities are those on which you receive/pay interest. It could be on asset side or in the liabilities of a balance sheet. If full balance sheet is not given then interest bearing is debt investment (reported on asset side of the liabilities) *** Short term investments will be considered interest bearing, unless they are mentioned to be Islamic (asset side of balance sheet). *** conventional debt are the securities on which you pay interest (liabilities side of balance sheet). *** If interest bearing is on asset side, it is debt investment to receive interest (debt holding); and if it is on the liabilities side, it is debt issuance to pay interest. Account receivables -34,100 (asset side of balance sheet). Total revenue - 660,000 (1) Following AAOIFI security selection criteria Test 1: Conventional Debt/Total assets - 203,000/450,300 45.08%>30% Test 2: (Cash + Interest Bearing securities/Total assets - 44,200/450,300-9.82%5% English (US) QUESTION 1. (1) Followings are the balance sheet and income statement of FAB for the year 2019 and 2018. The investment manager of the Halal Takaful Fund (HTF) is interested to buy the shares of GC as an investment from the general fund part of HTF. Since, HTF follows the Sharia rules of investment to choose for an investment, Sharia Complaint tests are required to invest in FAB. Suppose you are the investment manager of HTF, will you choose this stock for investment if(1) you follow AAOIFI stock selection criteria, (2) S&P selection criteria, (3) Dow Jones selection criteria, and (4) MSCI selection criteria? Why or why not? [Max. Marks = 100-25 x each selection criteria. 25=Each step x 5+5 marks for decision All four selection criteria are as followings: Following AAOIFI security selection criteria Test 1: Conventional Debt/Total assets C V B N M Tools Window Help % 4467 A Tue 8:53 PM go New Assignment Code of 4) Profit before taxation 12,907,086 12,391,393 Overseas income tax expense (314463) (325,004) 12,592,623 12,066,389 Profit for the year Profit attributable to Shareholders of the Bank Non controlling interests 12,520,203 72,420 12,010,820 55,569 12,592,623 12,066,389 42 110 1.06 Basic earnings per share (AED) Diluted earnings per share (AED) 1.10 106 The notes 1 to 46 are an integral part of these consolidated financial statements The Independent on report out of conscidated francal statements set out on page to Au MacBook Air 2 4 $ 4 % 5 & 7 OD * 9 0 6 0 U E R Y T H D L F QUESTION 1. (1) Followings are the balance sheet and income statement of General Company (GC) for the year 2000, where all the values are in thousands of US dollars ($). Investment manager of the Halal Takaful Fund (HTF) is interested to buy the shares of GC as an investment from the general fund part of HTF. Since, HTF follows the Sharia rules of investment to choose for an investment, a Sharia Complaint test is required invest in GC. Suppose you are the investment manager of HTF, will you choose this stock for investment if (1) you follow AAOIFI stock selection criteria, (2) S&P selection criteria? Why or why not? [Max. Marks -15-Steps (3), Procedure (4), Calculations (3), Answers (3) & Decision (2) Balance Sheet Income statement $ 660,000 Cash $ 35,000 Sales revenue Marketable securities 9,200 Accounts receivables 34,100 Cost of goods sold Inventory 82,000 Gross profit Total current assets 138,300 Selling expenses Net fixed assets 290,000 General & Admin expenses Total assets 450,300 Lease expenses Depreciation expenses Accounts payable 57,000 Total operating expenses Short term notes payable 13,000 Operating profit (EBIT) Accruals 15,000 Zakat Expense Total current liabilities 85,000 Interest expenses Long-term debt 160,000 Interest received Commercial debt 30,000 Dividends (Islamic) Common stock 112,200 Net profit before tax Retained earnings 63,100 Tax expenses Total stockholders' equity 175,300 Net income Total liabilities and Equity S 450.300 370,000 290,000 90,000 32,000 8,000 25,000 175,000 95,000 20.000 10,000 20,000 15,000 140,000 49,000 S 91.000 English (US) Total assets AED 450,3000 Conventional Debt- 13,000 + 160,000 + 30,000 = $200,000 Interest + non-permissible income-20,000 Cash + Interest bearing securities - 35,000+ 9,200 - 44,200 *** interest bearing securities are those on which you receive/pay interest. It could be on asset side or in the liabilities of a balance sheet. If full balance sheet is not given then interest bearing is debt investment (reported on asset side of the liabilities) *** Short term investments will be considered interest bearing, unless they are mentioned to be Islamic (asset side of balance sheet). *** conventional debt are the securities on which you pay interest (liabilities side of balance sheet). *** If interest bearing is on asset side, it is debt investment to receive interest (debt holding); and if it is on the liabilities side, it is debt issuance to pay interest. Account receivables -34,100 (asset side of balance sheet). Total revenue - 660,000 (1) Following AAOIFI security selection criteria Test 1: Conventional Debt/Total assets - 203,000/450,300 45.08%>30% Test 2: (Cash + Interest Bearing securities/Total assets - 44,200/450,300-9.82%5% English (US)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started