this is examples please do th need ful......

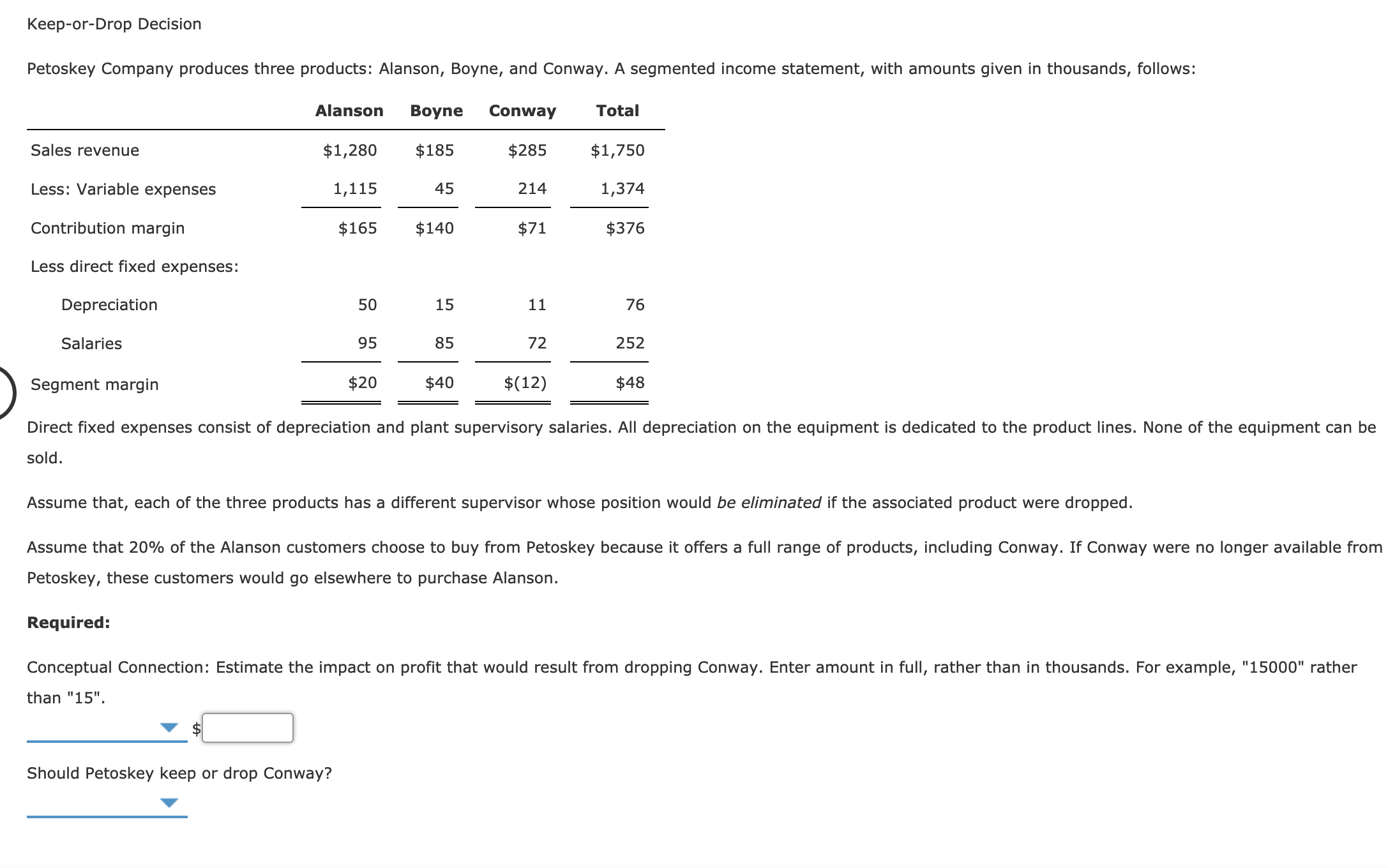

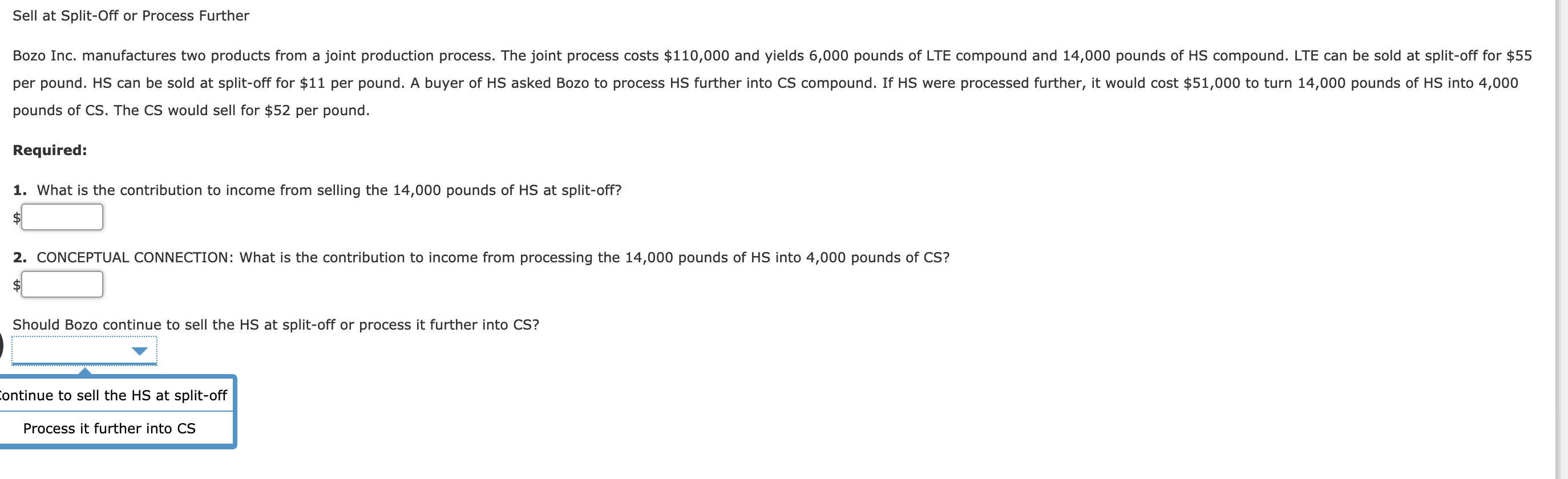

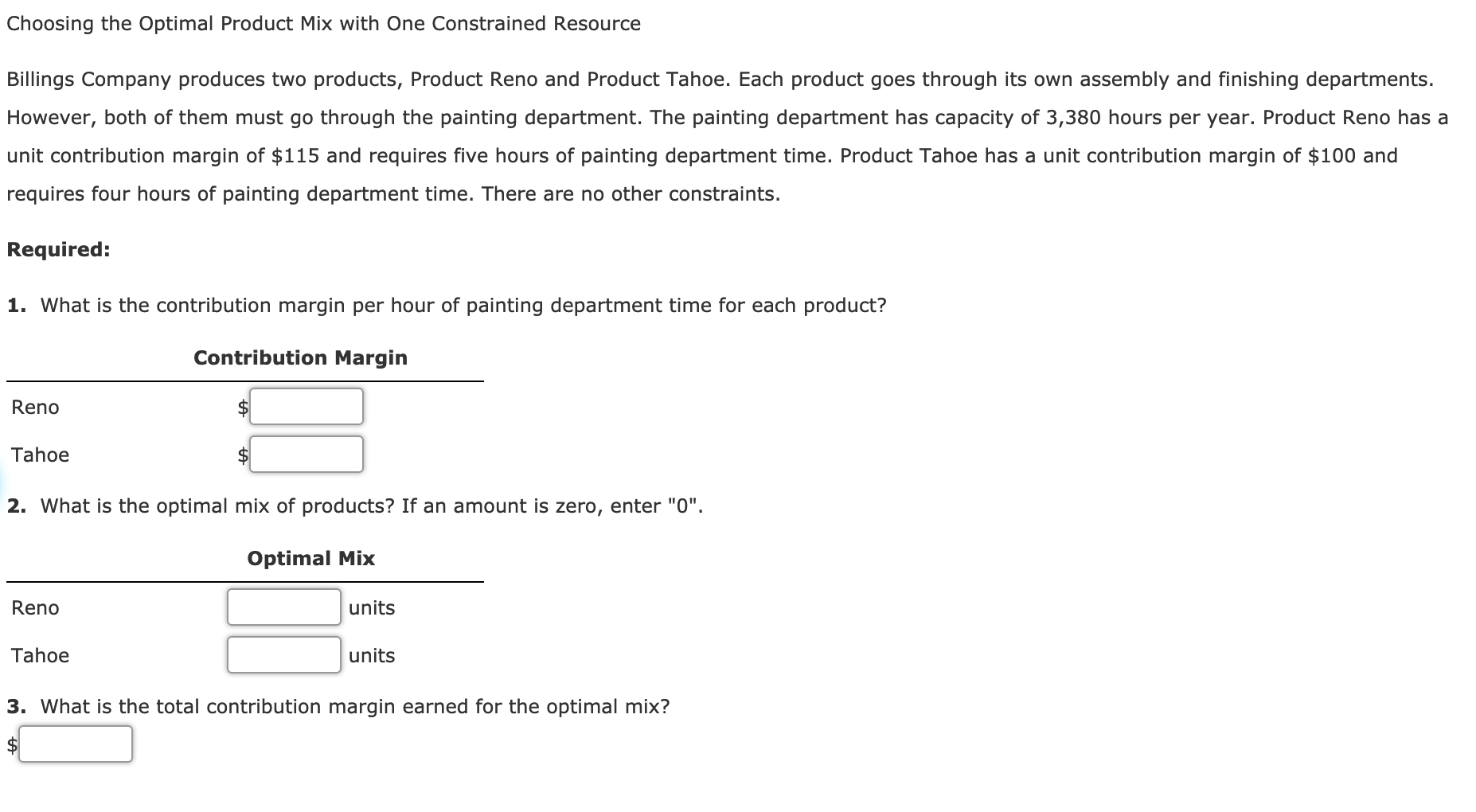

Keepor-Drop Decision Petoskey Company produces three products: Alanson, Boyne, and Conway. A segmented income statement, with amounts given in thousands, follows: Alanson Boyne Conway Total Sales revenue $1,280 $185 $285 $1,750 Less: Variable expenses 1,115 45 214 1,374 Contribution margin $165 $140 $71 $376 Less direct fixed expenses: Depreciation 50 15 11 76 Salaries 95 85 72 252 Segment margin $20 $40 $(12) $48 Direct xed expenses consist of depreciation and plant supervisory salaries. All depreciation on the equipment is dedicated to the product lines. None of the equipment can be sold. Assume that, each of the three products has a different supervisor whose position would be eliminated if the associated product were dropped. Assume that 20% of the Alanson customers choose to buy from Petoskey because it offers a full range of products, including Conway. If Conway were no longer available from Petoskey, these customers would go elsewhere to purchase Alanson. Required: Conceptual Connection: Estimate the impact on profit that would result from dropping Conway. Enter amount in full, rather than in thousands. For example, "15000" rather than "15". '$:l Should Petoskey keep or drop Conway? v Sell at Split-Off or Process Further Bozo Inc. manufactures two products from a joint production process. The joint process costs $110,000 and yields 6,000 pounds of LTE compound and 14,000 pounds of HS compound. LTE can be sold at split-off for $55 per pound. HS can be sold at split-off for $11 per pound. A buyer of HS asked Bozo to process HS further into CS compound. If HS were processed further, it would cost $51,000 to turn 14,000 pounds of HS into 4,000 pounds of CS. The CS would sell for $52 per pound. Required: 1. What is the contribution to income from selling the 14,000 pounds of HS at split-off? 2. CONCEPTUAL CONNECTION: What is the contribution to income from processing the 14,000 pounds of HS into 4,000 pounds of CS? $ Should Bozo continue to sell the HS at split-off or process it further into CS? ontinue to sell the HS at split-off Process it further into CSChoosing the Optimal Product Mix with One Constrained Resource Billings Company produces two products, Product Reno and Product Tahoe. Each product goes through its own assembly and finishing departments. However, both of them must go through the painting department. The painting department has capacity of 3,380 hours per year. Product Reno has a unit contribution margin of $115 and requires five hours of painting department time. Product Tahoe has a unit contribution margin of $100 and requires four hours of painting department time. There are no other constraints. Required: 1. What is the contribution margin per hour of painting department time for each product? Contribution Margin Reno 54:] Tahoe 23:] 2. What is the optimal mix of products? If an amount is zero, enter "0". Optimal Mix 3. what is the total contribution margin earned for the optimal mix? 34:] Reno units Tahoe units