Answered step by step

Verified Expert Solution

Question

1 Approved Answer

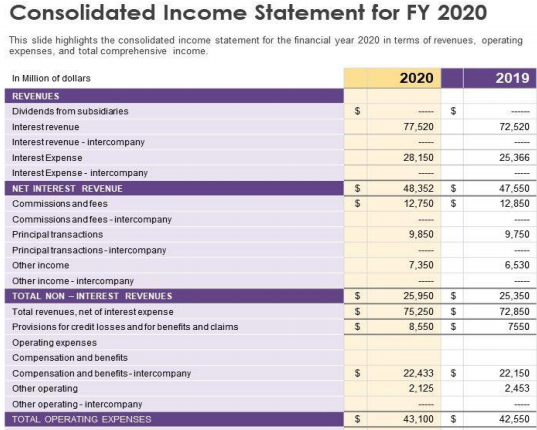

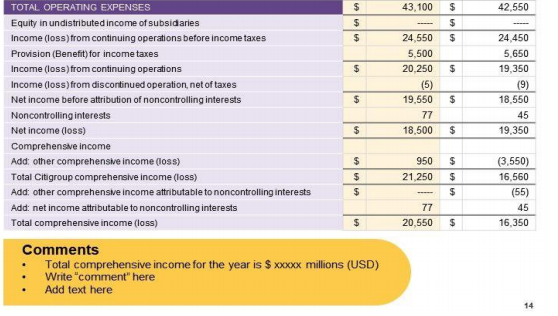

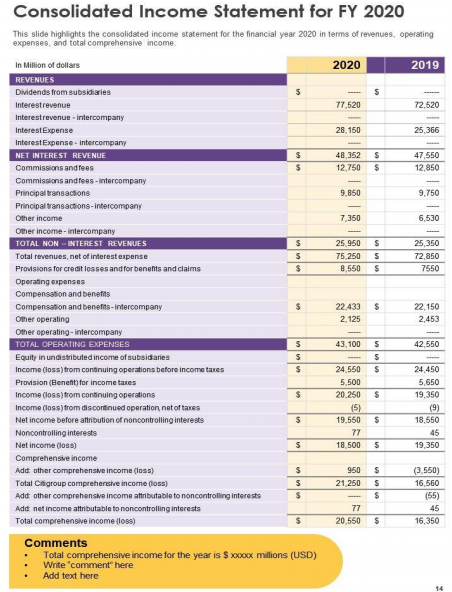

This is financial data of a XYZ Bank. Evaluate this data, what is going on ? In other words do you trust this bank is

This is financial data of a XYZ Bank. Evaluate this data, what is going on ? In other words do you trust this bank is OK ?

Consolidated Income Statement for FY 2020 This slide highlights the consolidated income statement for the financial year 2020 in terms of revenues, operating expenses, and total comprehensive income In Million of dollars 2020 2019 REVENUES Dividends from subsidiaries $ Interest revenue 77.520 72,520 Interest revenue - intercompany 28,150 25,366 Interest Expense Interest Expense - intercompany NET INTEREST REVENUE Commissions and fees Commissions and fees-intercompany Principal transactions $ $ 48,352 12.750 47,550 12,850 9,850 9.750 Principal transactions-intercompany Other income 7,350 6,530 $ 25,950 $ 25,350 Other income-intercompany TOTAL NON-INTEREST REVENUES Total revenues, net of interest expense Provisions for credit losses and for benefits and claims $ 75,250 $ 72.850 $ 8,550 $ 7550 Operating expenses Compensation and benefits $ $ $ Compensation and benefits-intercompany Other operating Other operating-intercompany 22.433 2.125 22.150 2.453 TOTAL OPERATING EXPENSES $ 43,100 $ 42,550 TOTAL OPERATING EXPENSES $ 43,100 $ 42,550 Equity in undistributed income of subsidiaries $ $ $ $ 24,550 $ 24,450 Income (loss) from continuing operations before income taxes Provision (Benefit) for income taxes Income (loss) from continuing operations 5,500 5,650 $ 20,250 $ 19,350 Income (loss) from discontinued operation, net of taxes (5) 19.550 (9) 18.550 Net income before attribution of noncontrolling interests $ $ Noncontrolling interests 77 45 Net income (loss) $ 18,500 $ 19,350 Comprehensive income Add: other comprehensive income (loss) $ 950 (3,550) 16,560 Total Citigroup comprehensive income (loss) $ 21250 Add: other comprehensive Income attributable to noncontrolling interests $ (55) Add net income attributable to noncontrolling interests 77 45 Total comprehensive income (loss) $ 20.550 $ 16,350 Comments Total comprehensive income for the year is $ xxxxx millions (USD) Write "comment" here Add text here 14 Consolidated Income Statement for FY 2020 This slide highlights the consolidated income statement for the financial year 2020 in terms of revenues, operating expenses, and total comprehensive income in Million of dollars 2020 2019 REVENUES Dividends from subsidiaries 5 Interestrevenue 77.520 72.520 Interestrevenue Intercompany 28.150 25,366 Interest Expense Interest Expense. intercompany NET INTEREST REVENUE $ 48,352 $ 47,550 Commissions and fees $ 12.750 $ 12,850 Commissions and fees - Intercompany waar samaan Principal transactions 9.850 9.750 Principal transactions intercompany Other income 7,350 6.530 Other income-intercompany TOTAL NON-INTEREST REVENUES Total revenues, net of interest expense $ 25 950 $ 25 350 $ 75 250 $ 72.850 Provisions for credit losses and for benefits and claims $ 8.550 $ 7550 Operating expenses Compensation and benefits $ 22.433 $ 22,150 Compensation and benefits-intercompany Other operating 2.125 2,453 Other operating-intercompany TOTAL OPERATING EXPENSES $ 43.100 $ 42,550 Equity in undistributed income of subsidiaries $ S Income (loss) from continuing operations before income taxes $ 24.550 $ 24.450 Provision (Benefit) for income taxes 5.500 $ 20.250 $ Income (loss) from continuing operations Income (loss) from discontinued operation net of taxes Net income before attribution of noncontrolling interests (5) 5,650 19,350 (9) 18,550 45 5 $ $ 19.560 $ Noncontrolling interests 77 Net income (loss) 5 18.500 $ 19,350 Comprehensive income Add other comprehensive income (loss) $ 950 s (3.550) Total Citigroup comprehensive income (loss) $ 21 250 S 16,560 Add other comprehensive income attributable to noncontrolling interests $ $ (55) Add net income attributable to noncontrolling interests 77 45 Total comprehensive income foss) $ 20.550 $ 16,350 Comments Total comprehensive income for the year is $ xxxx millions (USD) Write "comment" here Add text here 14

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started