Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is financial statement analysis subject.. Plz help me on this.. its 8 marks.. plz CASE 1 Swiss Sdn Bhd (SSB) produces dairy products and

This is financial statement analysis subject.. Plz help me on this.. its 8 marks.. plz

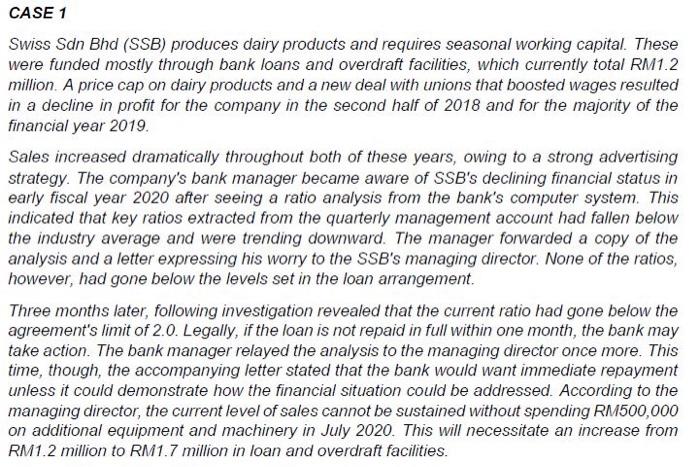

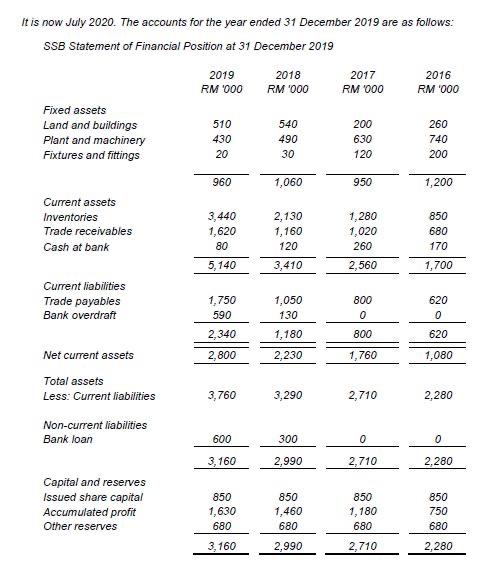

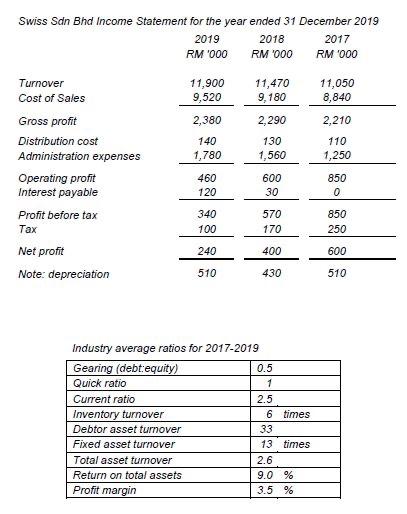

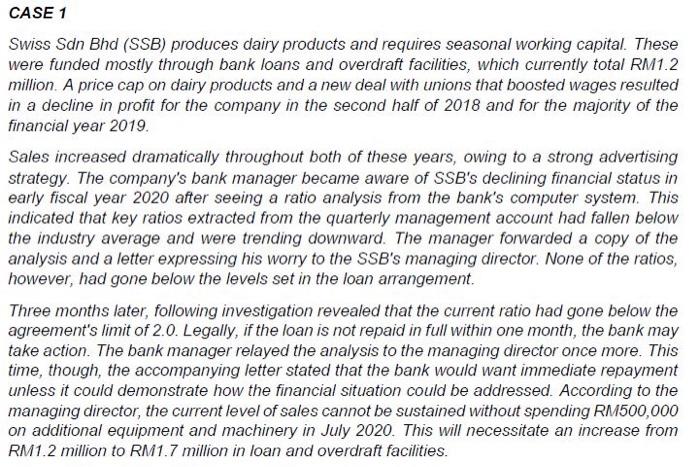

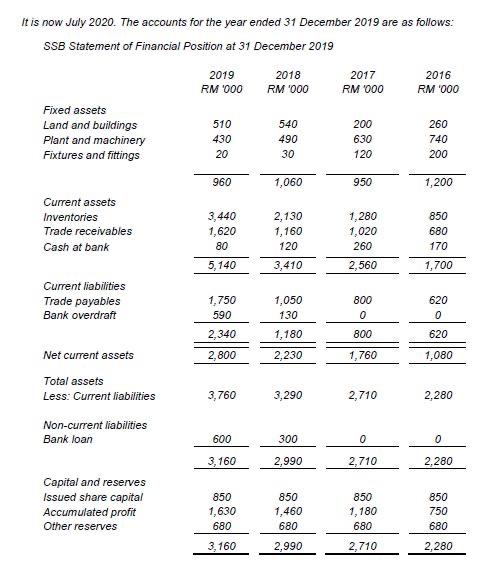

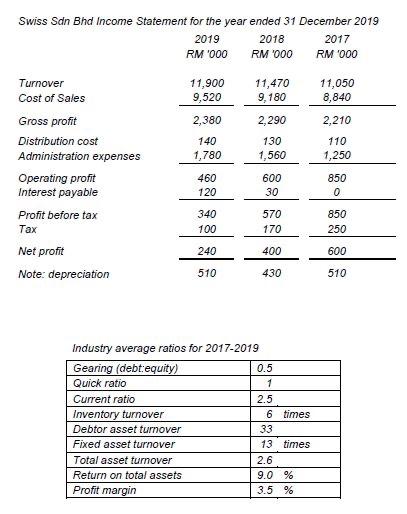

CASE 1 Swiss Sdn Bhd (SSB) produces dairy products and requires seasonal working capital. These were funded mostly through bank loans and overdraft facilities, which currently total RM1.2 million. A price cap on dairy products and a new deal with unions that boosted wages resulted in a decline in profit for the company in the second half of 2018 and for the majority of the financial year 2019. Sales increased dramatically throughout both of these years, owing to a strong advertising strategy. The company's bank manager became aware of SSB's declining financial status in early fiscal year 2020 after seeing a ratio analysis from the bank's computer system. This indicated that key ratios extracted from the quarterly management account had fallen below the industry average and were trending downward. The manager forwarded a copy of the analysis and a letter expressing his worry to the SSB's managing director. None of the ratios, however, had gone below the levels set in the loan arrangement Three months later, following investigation revealed that the current ratio had gone below the agreement's limit of 2.0. Legally, if the loan is not repaid in full within one month, the bank may take action. The bank manager relayed the analysis to the managing director once more. This time, though, the accompanying letter stated that the bank would want immediate repayment unless it could demonstrate how the financial situation could be addressed. According to the managing director, the current level of sales cannot be sustained without spending RM500,000 on additional equipment and machinery in July 2020. This will necessitate an increase from RM1.2 million to RM1.7 million in loan and overdraft facilities. it is now July 2020. The accounts for the year ended 31 December 2019 are as follows: SSB Statement of Financial Position at 31 December 2019 2019 RM 000 2018 RM 1000 2017 RM 1000 2016 RM '000 Fixed assets Land and buildings Plant and machinery Fixtures and fittings 510 430 20 540 490 30 200 630 120 260 740 200 960 1,060 950 1,200 Current assets Inventories Trade receivables Cash at bank 850 680 3,440 1,620 80 5.140 2,130 1,160 120 3,410 1,280 1,020 260 2,560 170 1,700 Current liabilities Trade payables Bank overdraft 1,750 590 2,340 1,050 130 1,180 800 0 620 0 800 620 2,800 2,230 1,760 1,080 Net current assets Total assets Less: Current liabilities 3,760 3,290 2,710 2,280 Non-current liabilities Bank loan 600 300 0 0 3,160 2,990 2,710 2,280 Capital and reserves Issued share capital Accumulated profit Other reserves 850 1,630 680 850 1,460 680 850 1,180 680 850 750 680 3,160 2.990 2,710 2,280 Swiss Sdn Bhd Income Statement for the year ended 31 December 2019 2019 2018 2017 RM '000 RM 000 RM 000 11,900 9,520 11,470 9.180 11,050 8,840 2,380 2,290 2,210 140 1,780 130 1,560 110 1,250 Turnover Cost of Sales Gross profit Distribution cost Administration expenses Operating profit Interest payable Profit before tax Tax Net profit Note: depreciation 460 120 600 30 850 0 340 100 570 170 850 250 240 400 600 510 430 510 Industry average ratios for 2017-2019 Gearing (debt:equity) 0.5 Quick ratio 1 Current ratio 2.5 Inventory turnover 6 times Debtor asset turnover 33 Fixed asset turnover 13 times Total asset turnover 2.6 Return on total assets 9.0 % Profit margin 3.5 % d. If the bank granted the additional loan, could the company pay off the loan by 31 December 2020? Explain (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started