Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is for 2018 tax prep for 2017 tax year 25. In October of the current year, Mike sold a share of Berkshire-Hathaway for $73,000.

This is for 2018 tax prep for 2017 tax year

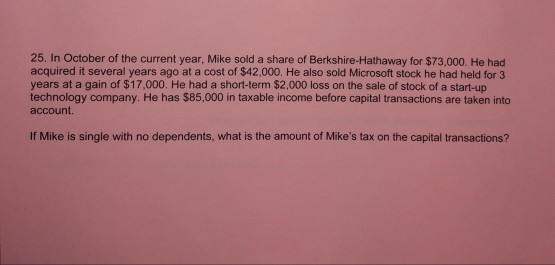

25. In October of the current year, Mike sold a share of Berkshire-Hathaway for $73,000. He had acquired it several years ago at a cost of $42,000. He also sold Microsoft stock he had held for 3 years at a gain of $17,000. He had a short-term $2,000 loss on the sale of stock of a start-up technology company. He has $85,000 in taxable income before capital transactions are taken into account If Mike is single with no dependents, what is the amount of Mike's tax on the capital transactionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started