this is have four question.(a b c d)

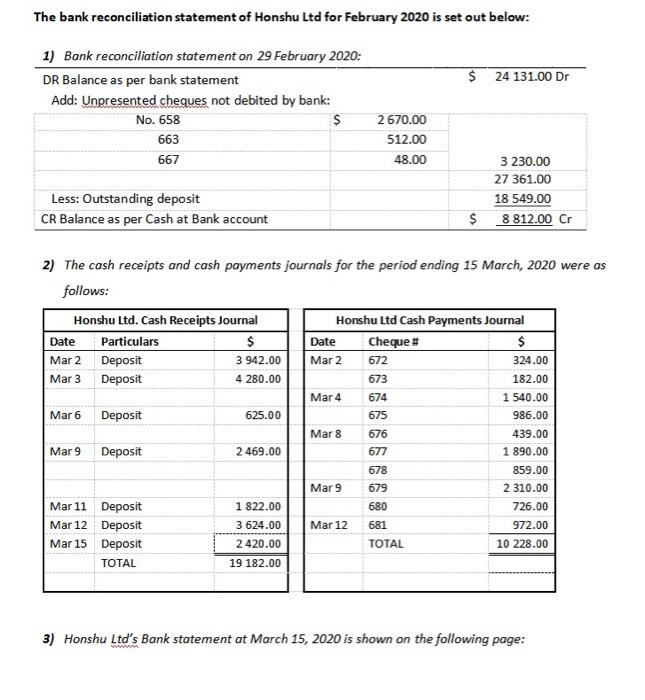

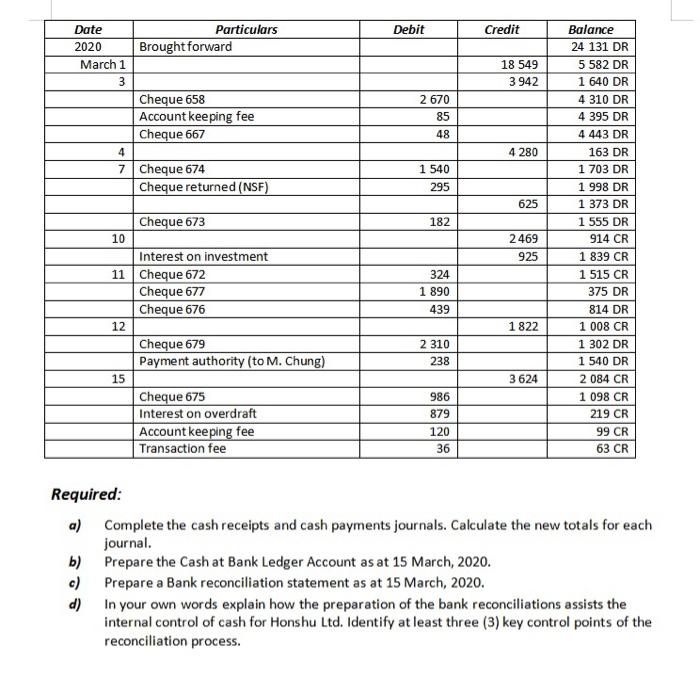

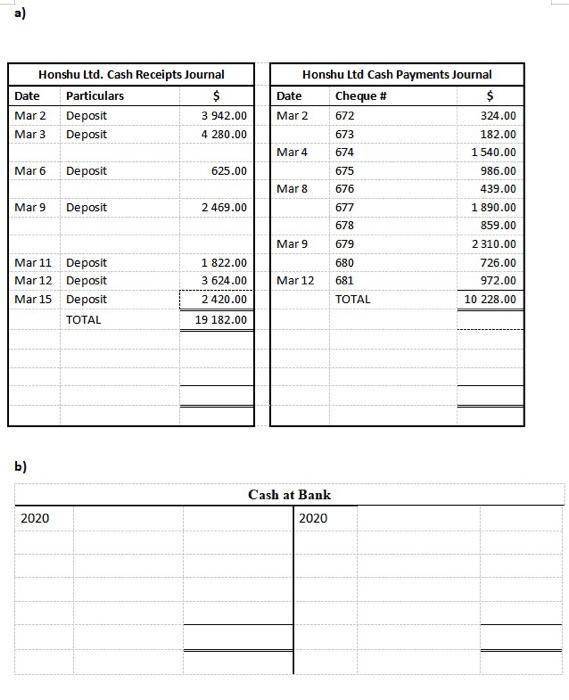

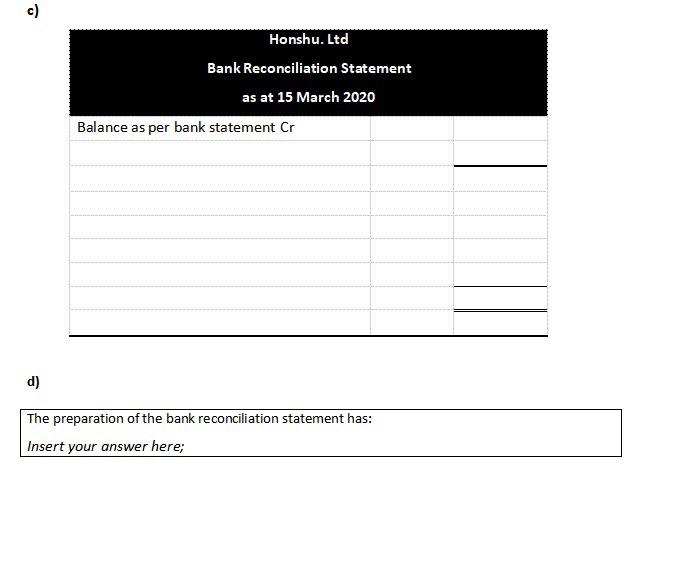

The bank reconciliation statement of Honshu Ltd for February 2020 is set out below: $ 24 131.00 Dr 1) Bank reconciliation statement on 29 February 2020: DR Balance as per bank statement Add: Unpresented cheques not debited by bank: No. 658 $ 663 2670.00 512.00 48.00 667 Less: Outstanding deposit CR Balance as per Cash at Bank account 3 230.00 27 361.00 18 549.00 8 812.00 Cr $ 2) The cash receipts and cash payments journals for the period ending 15 March, 2020 were as follows: Honshu Ltd. Cash Receipts Journal Honshu Ltd Cash Payments Journal Date Particulars $ Date Cheque # $ Mar 2 Deposit 3 942.00 Mar 2 672 324.00 Mar 3 Deposit 4 280.00 673 182.00 Mar 4 674 1 540.00 Mar 6 Deposit 625.00 675 986.00 Mar 8 676 439.00 Mar 9 Deposit 2 469.00 677 1 890.00 678 859.00 Mar 9 679 2 310.00 Mar 11 Deposit 1 822.00 680 726.00 Mar 12 Deposit 3 624.00 Mar 12 681 972.00 Mar 15 Deposit 2 420.00 TOTAL 10 228.00 TOTAL 19 182.00 3) Honshu Ltd's Bank statement at March 15, 2020 is shown on the following page: Debit Credit 18 549 3942 Date Particulars 2020 Brought forward March 1 3 Cheque 658 Account keeping fee Cheque 667 4 7 Cheque 674 Cheque returned (NSF) 2 670 85 48 4 280 1 540 295 625 Cheque 673 182 10 2469 925 Balance 24 131 DR 5 582 DR 1 640 DR 4 310 DR 4 395 DR 4 443 DR 163 DR 1 703 DR 1 998 DR 1 373 DR 1 555 DR 914 CR 1 839 CR 1 515 CR 375 DR 814 DR 1 008 CR 1 302 DR 1 540 DR 2 084 CR 1 098 CR 219 CR 99 CR 63 CR Interest on investment 11 Cheque 672 Cheque 677 Cheque 676 12 Cheque 679 Payment authority (to M. Chung) 324 1 890 439 1 822 2 310 238 15 3 624 Cheque 675 Interest on overdraft Account keeping fee Transaction fee 986 879 120 36 Required: a) Complete the cash receipts and cash payments journals. Calculate the new totals for each journal. b) Prepare the Cash at Bank Ledger Account as at 15 March, 2020. c) Prepare a Bank reconciliation statement as at 15 March, 2020. d) in your own words explain how the preparation of the bank reconciliations assists the internal control of cash for Honshu Ltd. Identify at least three (3) key control points of the reconciliation process. a) Honshu Ltd. Cash Receipts Journal Date Particulars $ Mar 2 Deposit 3 942.00 Mar 3 Deposit 4 280.00 Mar 6 Deposit 625.00 Honshu Ltd Cash Payments Journal Date Cheque # $ Mar 2 672 324.00 673 182.00 Mar 4 674 1 540.00 675 986.00 Mar 8 676 439.00 677 1 890.00 678 859.00 Mar 9 679 2 310.00 680 726.00 Mar 12 681 972.00 TOTAL 10 228.00 Mar 9 Deposit 2 469.00 Mar 11 Deposit Mar 12 Deposit Mar 15 Deposit TOTAL 1 822.00 3 624.00 2420.00 19 182.00 b) Cash at Bank 2020 2020 Honshu. Ltd Bank Reconciliation Statement as at 15 March 2020 Balance as per bank statement Cr d) The preparation of the bank reconciliation statement has: Insert your answer here