this is illustration 2-6

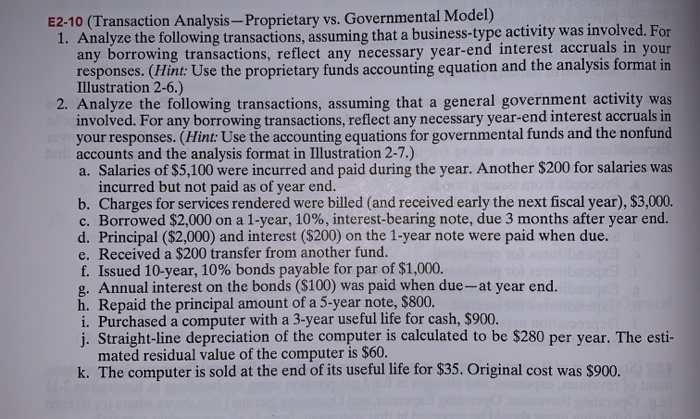

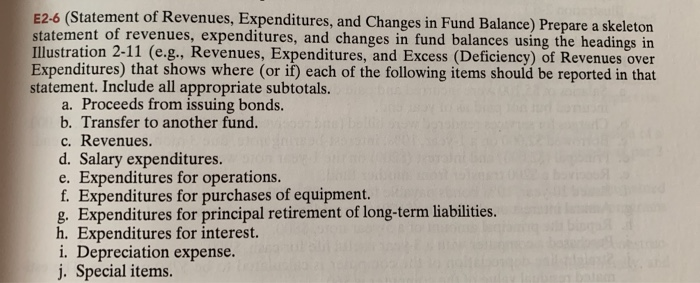

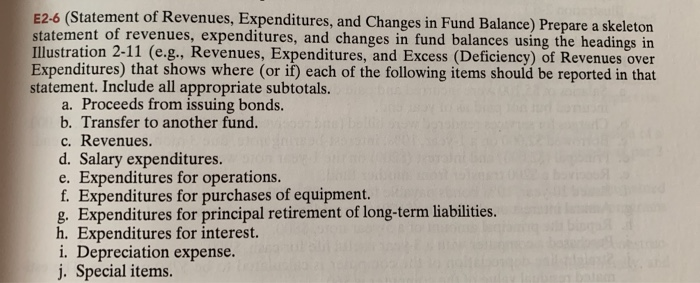

E2-10 (Transaction Analysis - Proprietary vs. Governmental Model) 1. Analyze the following transactions, assuming that a business-type activity was involved. For any borrowing transactions, reflect any necessary year-end interest accruals in your responses. (Hint: Use the proprietary funds accounting equation and the analysis format in Illustration 2-6.) 2. Analyze the following transactions, assuming that a general government activity was involved. For any borrowing transactions, reflect any necessary year-end interest accruals in your responses. (Hint: Use the accounting equations for governmental funds and the nonfund accounts and the analysis format in Illustration 2-7.) a. Salaries of $5,100 were incurred and paid during the year. Another $200 for salaries was incurred but not paid as of year end. b. Charges for services rendered were billed and received early the next fiscal year), $3,000. c. Borrowed $2,000 on a 1-year, 10%, interest-bearing note, due 3 months after year end. d. Principal ($2,000) and interest ($200) on the 1-year note were paid when due. e. Received a $200 transfer from another fund. f. Issued 10-year, 10% bonds payable for par of $1,000. g. Annual interest on the bonds ($100) was paid when due-at year end. h. Repaid the principal amount of a 5-year note, $800. i. Purchased a computer with a 3-year useful life for cash, $900. j. Straight-line depreciation of the computer is calculated to be $280 per year. The esti- mated residual value of the computer is $60. k. The computer is sold at the end of its useful life for $35. Original cost was $900. E2-6 (Statement of Revenues, Expenditures, and Changes in Fund Balance) Prepare a skeleton statement of revenues, expenditures, and changes in fund balances using the headings in Illustration 2-11 (e.g., Revenues, Expenditures, and Excess (Deficiency) of Revenues over Expenditures) that shows where (or if) each of the following items should be reported in that statement. Include all appropriate subtotals. a. Proceeds from issuing bonds. b. Transfer to another fund. c. Revenues. d. Salary expenditures. e. Expenditures for operations. f. Expenditures for purchases of equipment. g. Expenditures for principal retirement of long-term liabilities. h. Expenditures for interest. i. Depreciation expense. j. Special items