Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is management accounting Sweet Threads Ltd. operates as 2 distinct Divisions. The first is the Sweater Division that manufactures unisex knitted sweaters. The second

This is management accounting

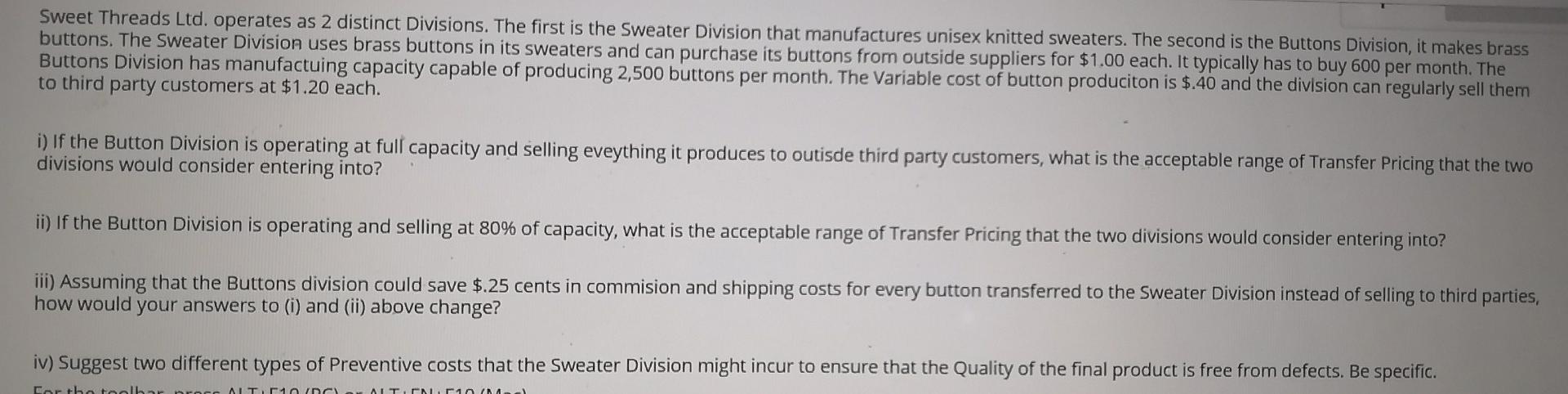

Sweet Threads Ltd. operates as 2 distinct Divisions. The first is the Sweater Division that manufactures unisex knitted sweaters. The second is the Buttons Division, it makes brass buttons. The Sweater Division uses brass buttons in its sweaters and can purchase its buttons from outside suppliers for $1.00 each. It typically has to buy 600 per month. The Buttons Division has manufactuing capacity capable of producing 2,500 buttons per month. The Variable cost of button produciton is $.40 and the division can regularly sell them to third party customers at $1.20 each. i) If the Button Division is operating at full capacity and selling eveything it produces to outisde third party customers, what is the acceptable range of Transfer Pricing that the two divisions would consider entering into? ii) If the Button Division is operating and selling at 80% of capacity, what is the acceptable range of Transfer Pricing that the two divisions would consider entering into? iii) Assuming that the Buttons division could save $.25 cents in commision and shipping costs for every button transferred to the Sweater Division instead of selling to third parties, how would your answers to (i) and (ii) above change? iv) Suggest two different types of Preventive costs that the Sweater Division might incur to ensure that the Quality of the final product is free from defects. Be specific. Cor the toolb- ALTIC TONINA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started