Answered step by step

Verified Expert Solution

Question

1 Approved Answer

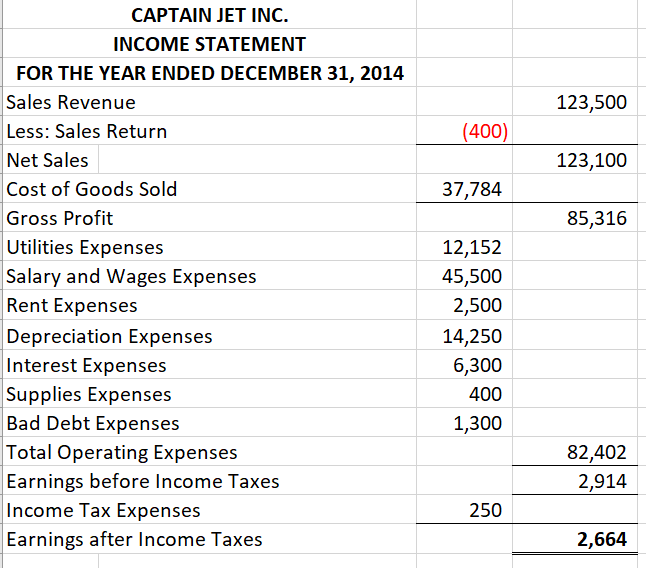

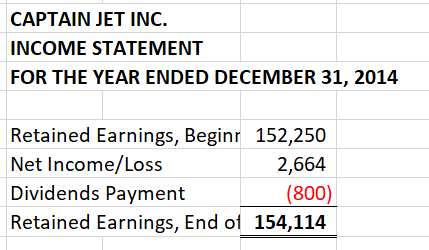

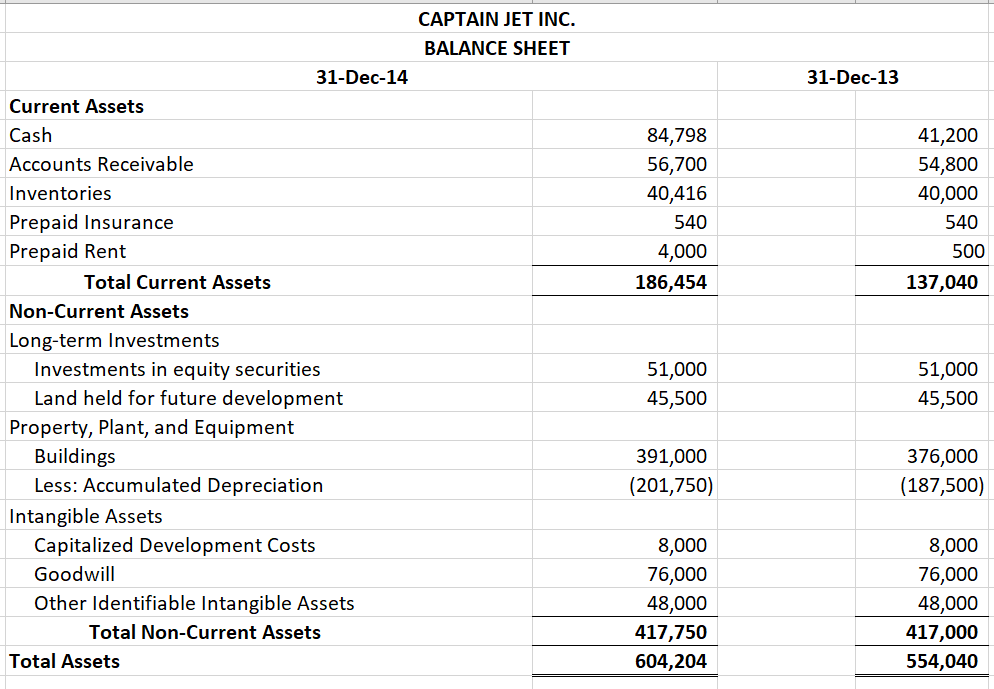

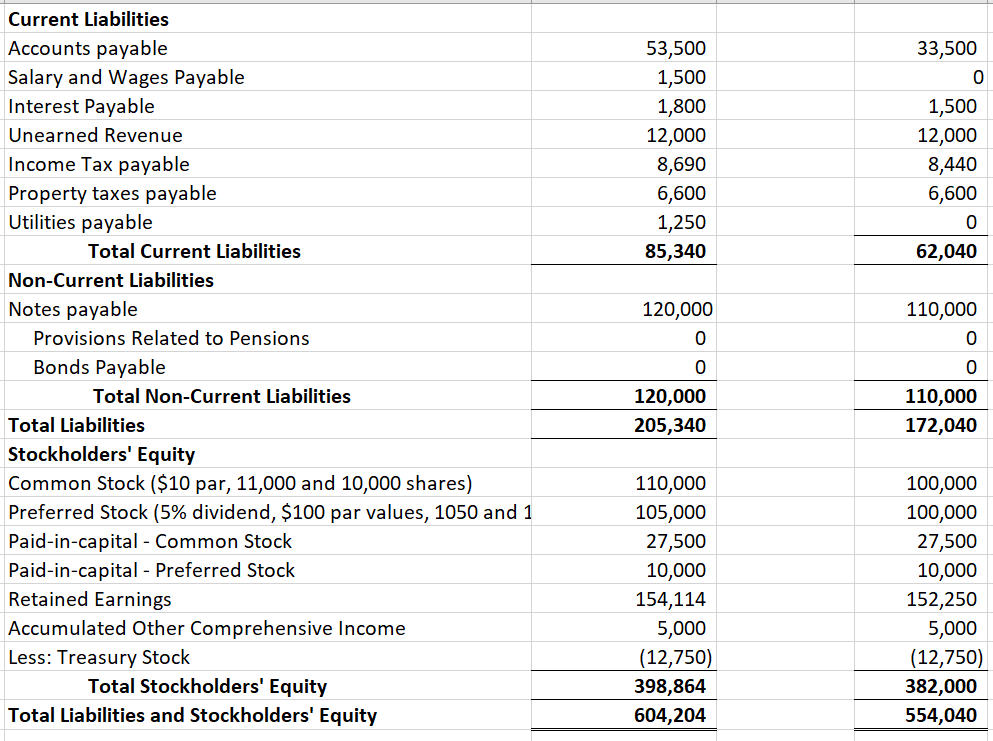

This is one question. Please complete each part. Thanks! Calculate the following ratios for year 2014 (round all ratios to two places behind the decimal):

This is one question. Please complete each part. Thanks!

Calculate the following ratios for year 2014 (round all ratios to two places behind the decimal):

Working Capital =

Current ratio =

Acid test ratio =

Accounts receivable turnover (use net sales as numerator) =

Collection period of receivables (use 360 days in each year) =

Accounts payable turnover ratio =

Inventory turnover ratio =

Days to sell inventory =

Debt-to-Equity ratio =

Times interest earned =

RNOA (assume 12% tax rate) =

ROCE =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started