This is one question.

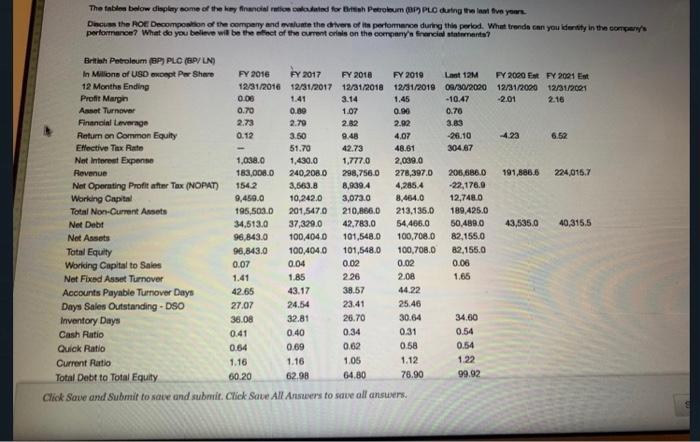

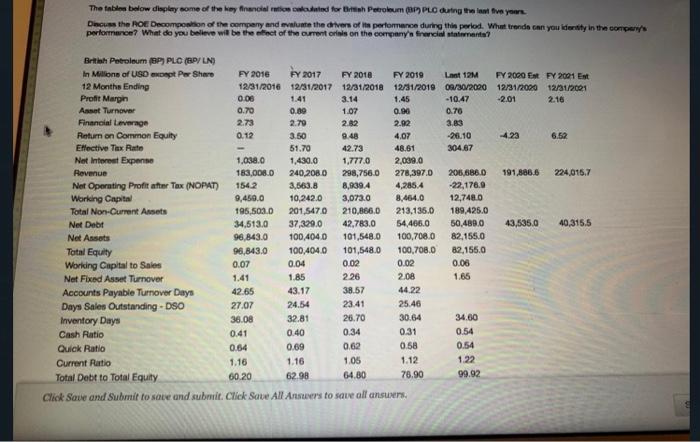

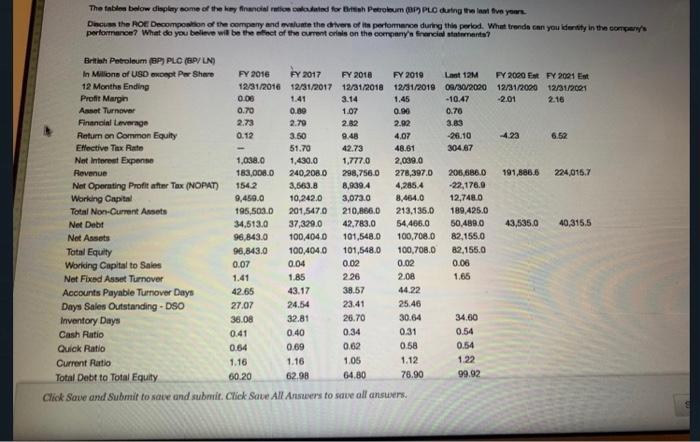

The table below display some of the key financial related for a Petroleum PLC uing the last five your Discuss the ROE Decomposion of the company and evaluate the drivers of the performance during the period. What trends can you dersity in the company's performance? What do you believe will be the act of the currentorns on the company's new talent British Petroleum (BP) PLC (PLN) In Millions of USD pt Per Share FY 2016 FY 2017 FY 2018 FY 2019 Lant 19M FY 2000 EN FY 2001 Ent 12 Months Ending 12/31/2016 12/31/2017 12/31/2018 12/31/2019 09/30/2020 12/31/2000 12/31/2001 Profit Margin 0.06 1.41 3.14 1.45 -10.47 -2.01 2.16 Asset Turnover 0.70 0.89 1.07 0.96 0.70 Financial leverage 2.73 2.70 2.82 2.02 3.63 Return on Common Equity 0.12 3.50 9.48 4.07 -20.10 423 6.52 Effective Tax Rate 51.70 42.73 48.61 304.67 Net Interest Expense 1.038.0 1.430.0 1,777,0 2,039,0 Revue 183,008.0 240,2080 298,756.0 278,397.0 206,686.0 191,886.6 224.015.7 Net Operating Profit after Tax (NOPAT) 1542 3,663.8 8,8394 4.285.4 -22,176.9 Working Capital 9,450.0 10,242.0 3,073.0 8.464.0 12,748.0 Total Non-Current Assets 195.503.0 201.547.0 210,866.0 213,135.0 189.425.0 Net Debt 34.513.0 37,329.0 42,783.0 54,466.0 50,4800 43,535.0 40,315,5 Net Assets 96,843.0 100,4040 101,548.0 100,708.0 82,155.0 Total Equity 96,843.0 100,404.0 101,548.0 100,708.0 82.155.0 Working Capital to Sales 0.07 0.04 0.02 0.02 0.06 Net Fixed Asset Turnover 1.41 1.85 226 208 1.65 Accounts Payable Turnover Days 42.65 43.17 38.57 44.22 Daya Sales Outstanding - DSO 27.07 24.54 23.41 25.46 Inventory Days 36.08 32.81 28.70 30.64 34.60 Cash Ratio 0.41 0.40 0.34 0.31 0.54 Quick Ratio 0.64 0.69 0.62 0.58 0.54 Current Ratio 1.16 1.16 1.05 1.12 1.22 Total Debt to Total Equity 60.20 62.98 64.80 76.90 Click Save and Submit to save and submit. Click Save All Answers to save all answers, 99.92 The table below display some of the key financial related for B Petroleum PLC during the love your Discuss the HOE Decomposion of the company and value the drivers of the performance during the period. What trends can you dersity in the company's performance? What do you believe will be the act of the current or is on the company's statements -10.47 3.50 British Petroleum (BP) PLO (BP/UN) In Millions of USD wept Per Share FY 2016 FY 2017 FY 2018 FY 2019 Lant 12M FY 2000 EN FY 2001 Ent 12 Months Ending 12/31/2016 12/31/2017 12/31/2018 12/31/2019 08/30/2020 12/31/2000 12/31/2001 Profit Margin 0.08 1.41 3.14 1.45 -2.01 2.15 Asset Turnov 0.70 0.89 1.07 0.96 0.70 Financial Leverage 2.73 2.70 2.82 2.02 3.83 Return on Common Equity 0.12 9.48 4.07 26.10 4.23 6.52 Elective Tax Rate 51.70 42.73 48.61 304.67 Net Interest Expense 1.038.0 1.430.0 1,777,0 2,039.0 Revenue 163,008.0 240,208.0 298,756.0 278,397.0 206,686 0 191,886.6 224.015.7 Net Operating Profit after Tax (NOPAT) 1542 3,663.8 8,8394 4.285.4 -22,176.9 Working Capital 9,459.0 10,242.0 3,073.0 8,454.0 12,748.0 Total Non-Current Assets 195,503.0 201.547.0 210,886,0 213,135.0 189.425.0 Net Debt 34,513.0 37,329.0 42,783.0 54 465.0 50.489.0 43,535.0 40,315,5 Net Assets 96,843.0 1004040 101,548.0 100,708.0 82,155.0 Total Equity 96,843.0 100,404.0 101,548.0 100,708.0 82.155.0 Working Capital to Sales 0.07 0.04 0.02 0.02 0.06 Net Fixed Asset Turnover 1.41 1.85 226 2.08 1.66 Accounts Payable Turnover Days 42.65 43.17 38.57 44.22 Days Salen Outstanding - DSO 27.07 24.54 23.41 25.46 Inventory Days 36.08 32.81 26.70 30.64 34.60 Cash Ratio 0.41 0.40 0.34 0.31 0.54 Quick Ratio 0.64 0.69 0.62 0.58 0.54 Current Ratio 1.16 1.16 1.05 1.12 1.22 Total Debt to Total Equity 60.20 62.98 64.80 76.90 99.92 Click Save and Submit to save and submit. Click Save All Ansers to save all answers

This is one question.

This is one question.