Answered step by step

Verified Expert Solution

Question

1 Approved Answer

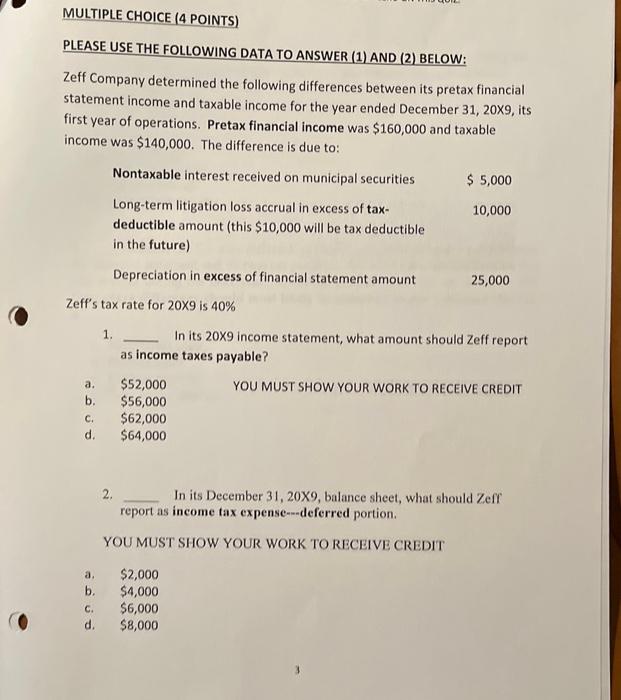

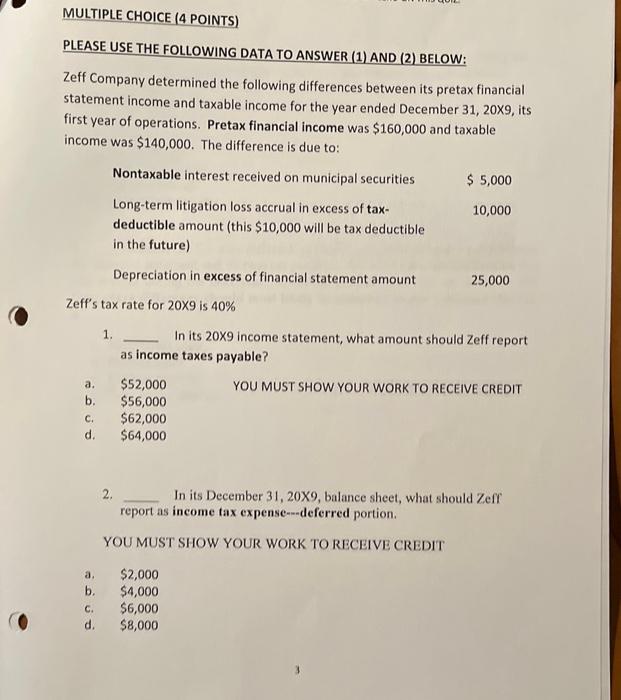

this is one question Zeff's tax rate for 209 is 40% 1. In its 209 income statement, what amount should Zeff report as income taxes

this is one question

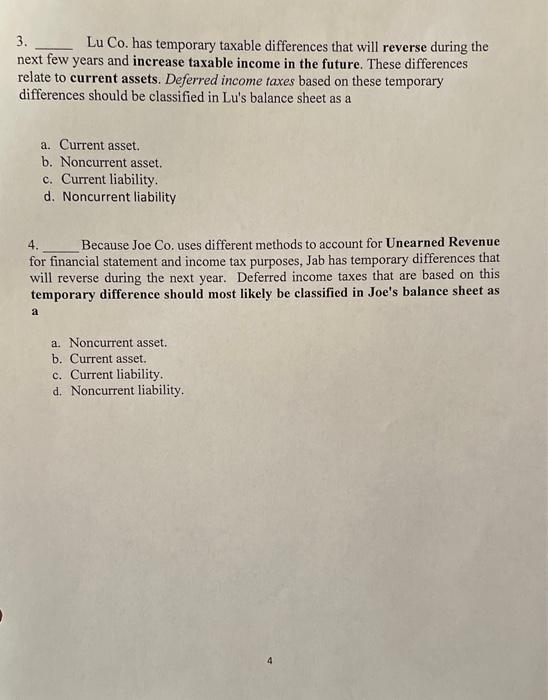

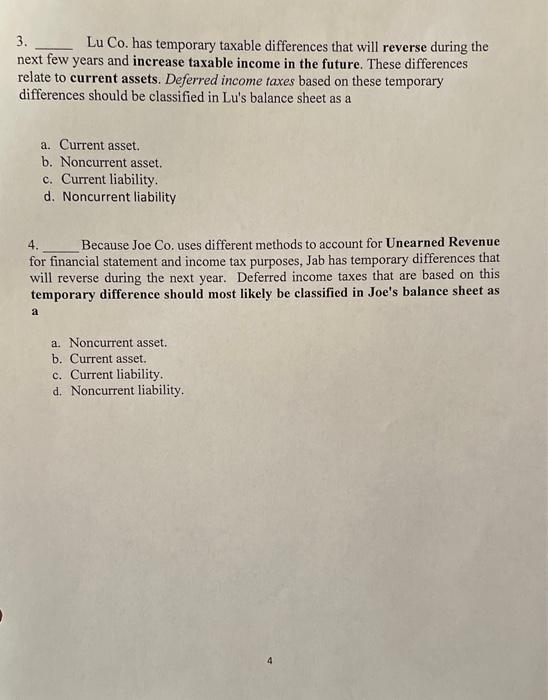

Zeff's tax rate for 209 is 40% 1. In its 209 income statement, what amount should Zeff report as income taxes payable? a. Y52,000 YOU MUST SHOW YOUR WORK TO RECEIVE CREDIT b. $56,000 2. In its December 31,209, balance sheet, what should Zeff report as income tax expense-weferred portion. YOU MUST SHOW YOUR WORK TO RECEIVE CREDIT a. $2,000 b. $4,000 c. $6,000 d. $8,000 3. Lu Co. has temporary taxable differences that will reverse during the next few years and increase taxable income in the future. These differences relate to current assets. Deferred income taxes based on these temporary differences should be classified in Lu's balance sheet as a a. Current asset. b. Noncurrent asset. c. Current liability. d. Noncurrent liability 4. Because Joe Co, uses different methods to account for Unearned Revenue for financial statement and income tax purposes, Jab has temporary differences that will reverse during the next year. Deferred income taxes that are based on this temporary difference should most likely be classified in Joe's balance sheet as a a. Noncurrent asset. b. Current asset. c. Current liability. d. Noncurrent liability

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started