This is part 1-4 of the same problem, not separate problems.

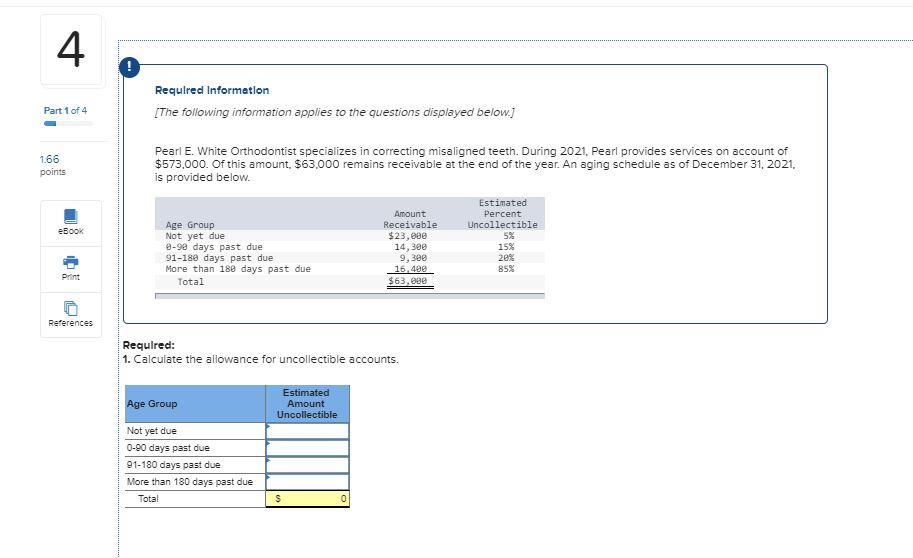

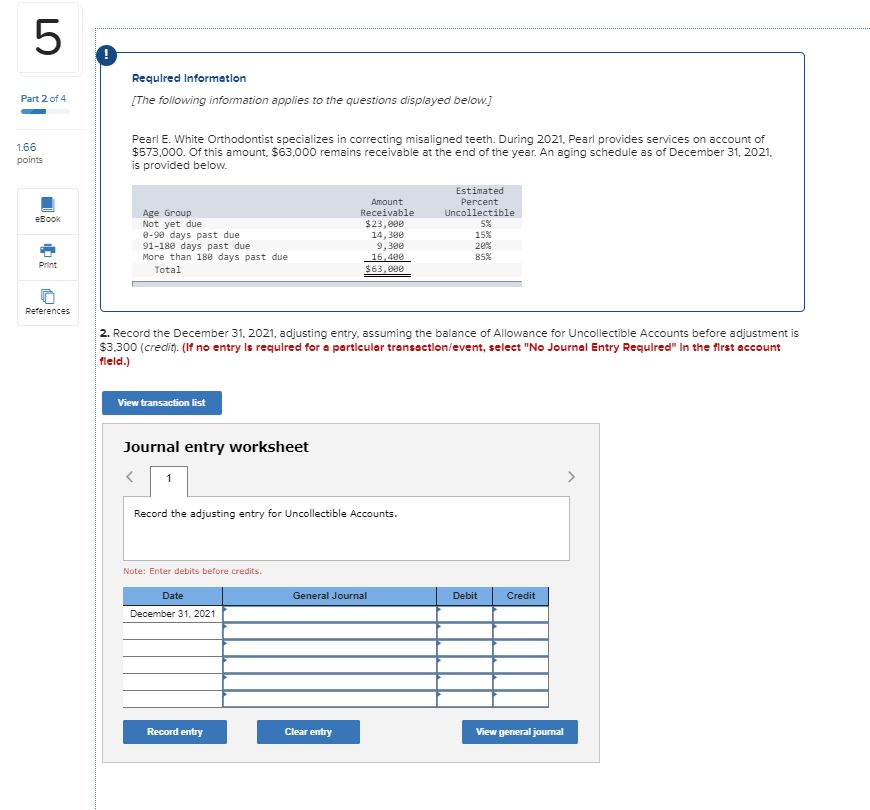

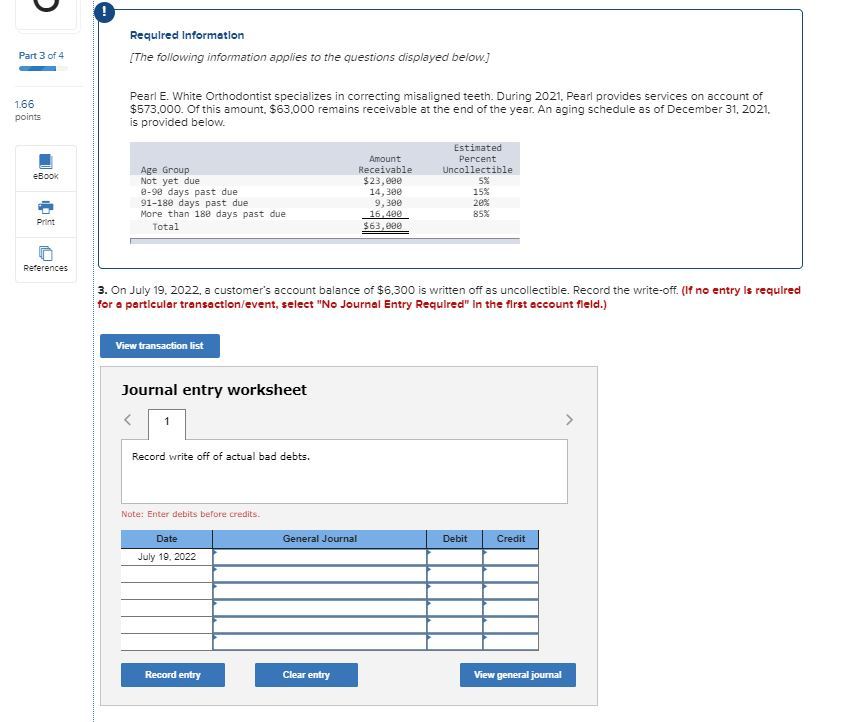

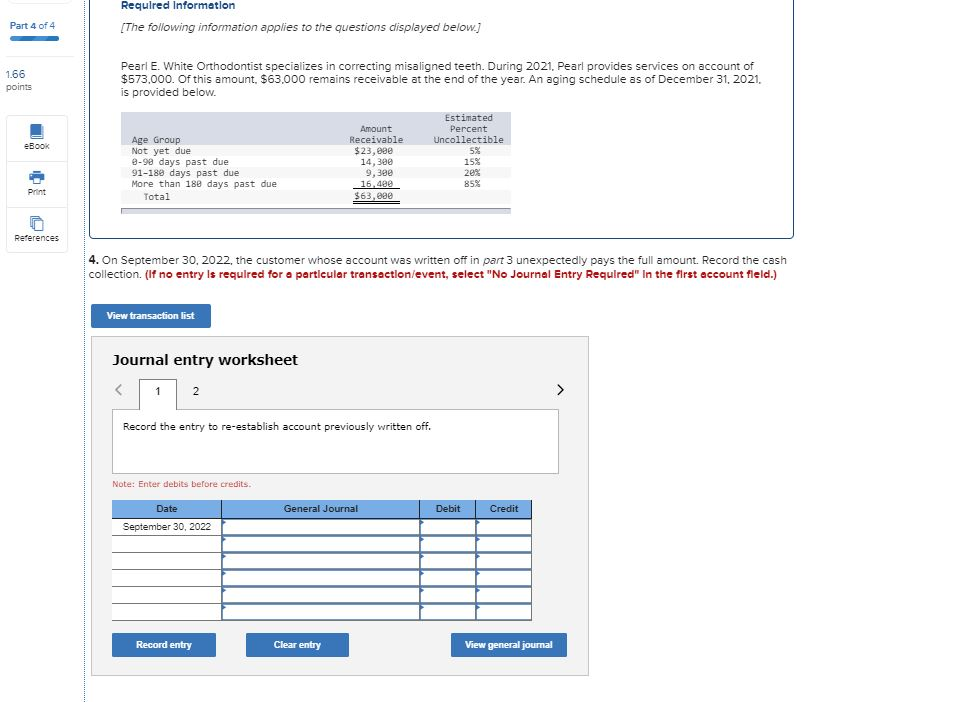

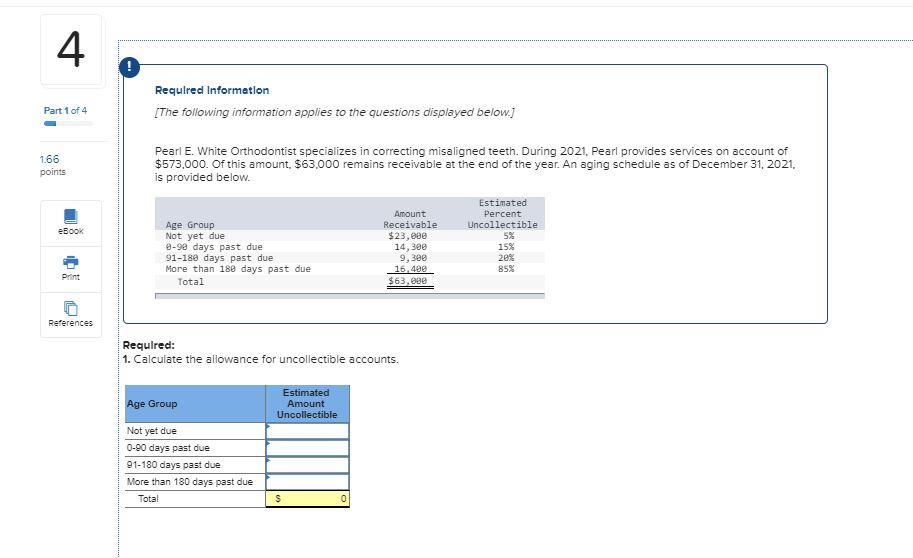

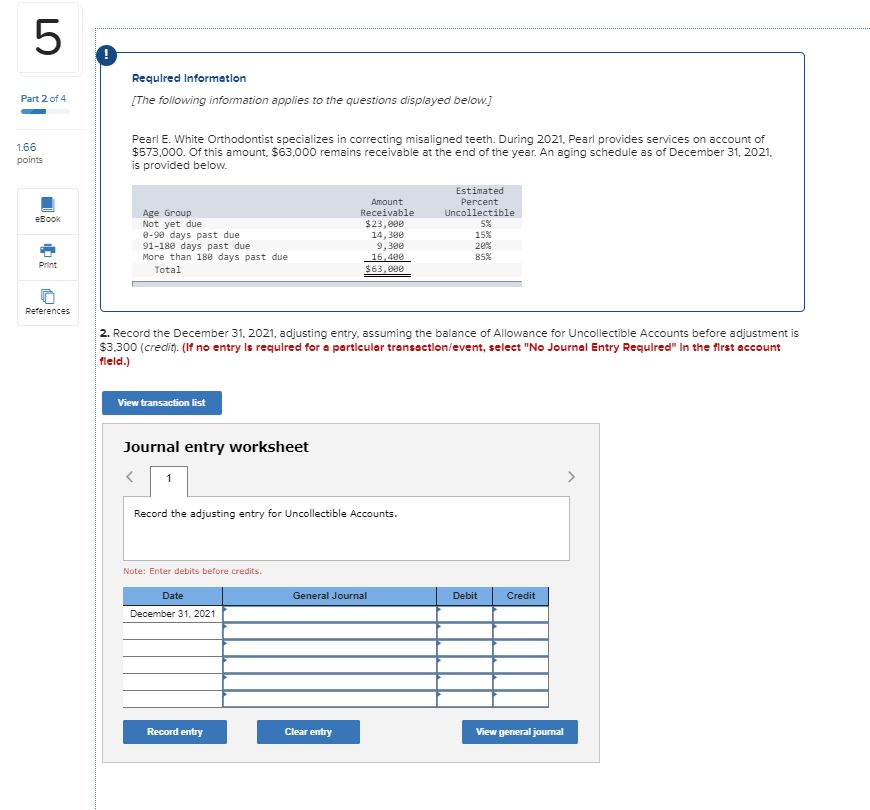

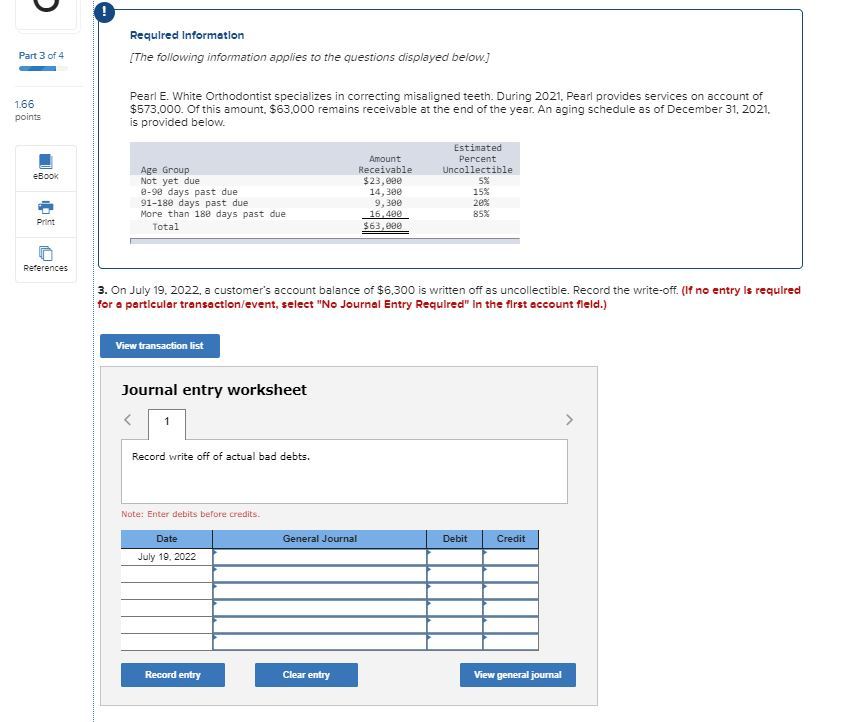

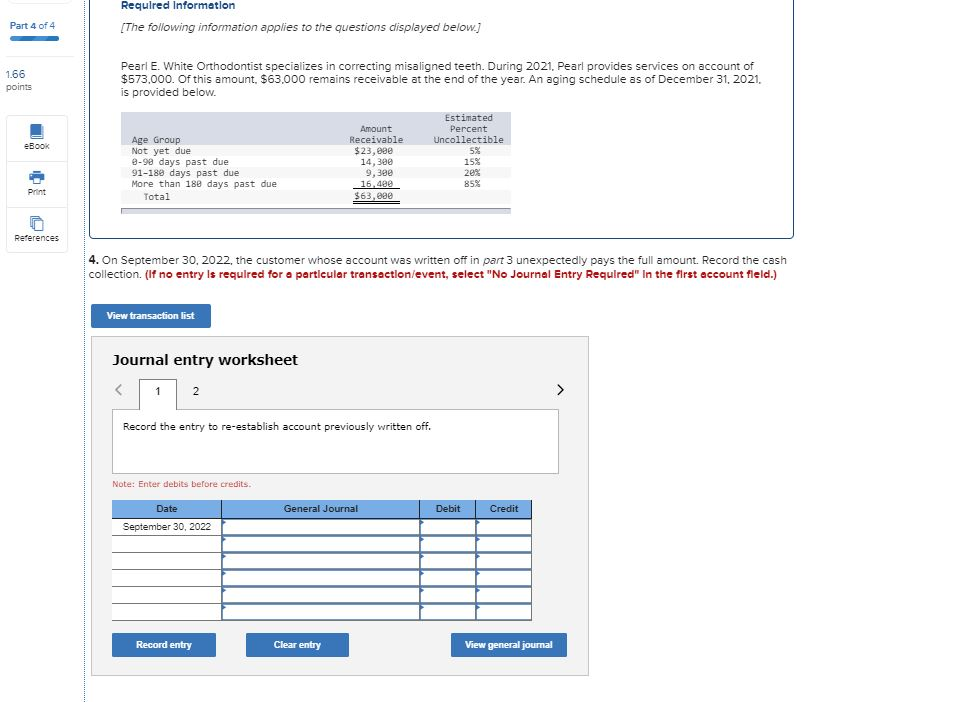

Required Information [The following information applies to the questions displayed below.) Part 1 of 4 1.66 points Pearl E. White Orthodontist specializes in correcting misaligned teeth. During 2021. Pearl provides services on account of $573,000. Of this amount, $63,000 remains receivable at the end of the year. An aging schedule as of December 31, 2021, is provided below. Estimated Percent Uncollectible 5% Amount Receivable $23,000 14,309 9,300 16,400 $63,080 Age Group Not yet due 8-98 days past due 91-180 days past due More than 180 days past due Total 15% 20% 85% print References Required: 1. Calculate the allowance for uncollectible accounts. Age Group Estimated Amount Uncollectible Not yet due 0-90 days past due 91-180 days past due More than 180 days past due Total 0 Required Information Part 2 of 4 [The following information applies to the questions displayed below.] 1.66 points Pearl E. White Orthodontist specializes in correcting misaligned teeth. During 2021, Pearl provides services on account of $573,000. Of this amount. $63,000 remains receivable at the end of the year. An aging schedule as of December 31, 2021. is provided below. Estimated Percent Uncollectible eBook 5% Amount Receivable $23.099 14,388 9.389 16,489 $63.000 Age Group Not yet due 8-90 days past due 91-180 days past due More than 180 days past due Total 15 20% 85% Print References 2. Record the December 31, 2021, adjusting entry, assuming the balance of Allowance for Uncollectible Accounts before adjustment is $3.300 (credit). (If no entry is required for a particular transaction/event, select "No Journal Entry Required" In the first account field.) View transaction list Journal entry worksheet Record the adjusting entry for Uncollectible Accounts. Note: Enter debits before credits General Journal Debit Credit Date December 31, 2021 Record entry Clear entry View general journal Required Information [The following information applies to the questions displayed below.) Part 3 of 4 1.66 points Pearl E. White Orthodontist specializes in correcting misaligned teeth. During 2021. Pearl provides services on account of $573.000. Of this amount. $63,000 remains receivable at the end of the year. An aging schedule as of December 31, 2021, is provided below. Estimated Percent Uncollectible 5% eBook Age Group Not yet due -98 days past due 91-180 days past due More than 180 days past due Total Amount Receivable $ 23,00 14,380 9.382 16 489 $63,000 15% 2e print References 3. On July 19, 2022, a customer's account balance of $6,300 is written off as uncollectible. Record the write-off. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" In the first account field.) View transaction list Journal entry worksheet Record write off of actual bad debts. Note: Enter debits before credits Date General Journal Debit Credit July 19, 2022 Record entry Clear entry View general journal Required Information [The following information applies to the questions displayed below.] Part 4 of 4 1.66 points Pearl E. White Orthodontist specializes in correcting misaligned teeth. During 2021, Pearl provides services on account of $573.000. Of this amount. $63.000 remains receivable at the end of the year. An aging schedule as of December 31, 2021. is provided below. Estimated Percent Uncollectible eBook Age Group Not yet due 8-90 days past due 91-180 days past due More than 180 days past due Total Amount Receivable $ 23,888 14,388 9,300 16.489 $63,290 15% 2ex 85% Print References 4. On September 30, 2022, the customer whose account was written off in part 3 unexpectedly pays the full amount. Record the cash collection. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" In the first account field.) View transaction list Journal entry worksheet Record the entry to re-establish account previously written off. Note: Enter debits before credits. Date General Journal Debit Credit September 30, 2022 Record entry Clear entry View general journal