Answered step by step

Verified Expert Solution

Question

1 Approved Answer

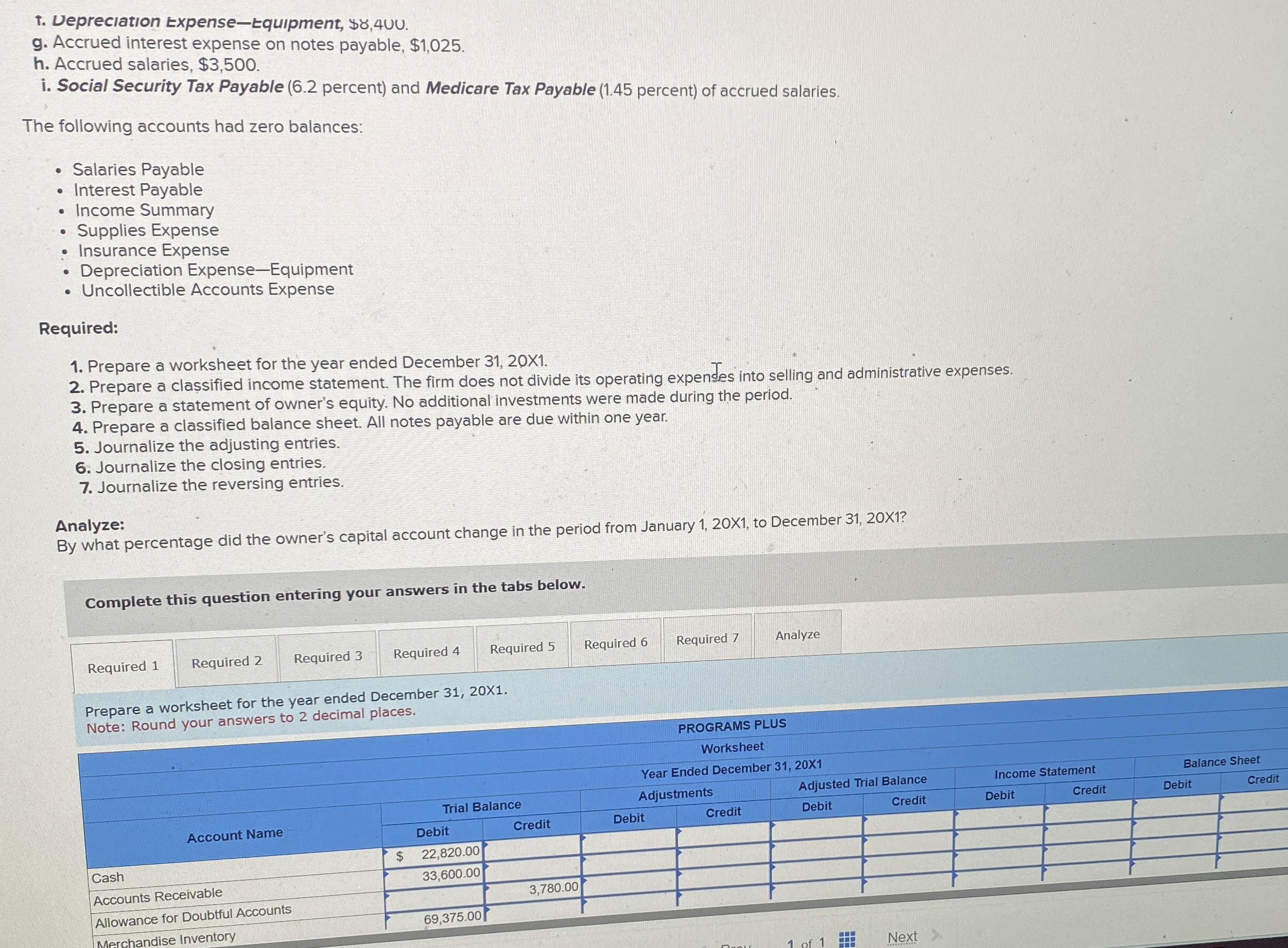

* * THIS IS PICTURE 2 FROM PART ONE :) Vepreciation Expense - Equipment, $ 8 , 4 U . g . Accrued interest expense

THIS IS PICTURE FROM PART ONE :)

Vepreciation ExpenseEquipment, $

g Accrued interest expense on notes payable, $

h Accrued salaries, $

i Social Security Tax Payable percent and Medicare Tax Payable percent of accrued salaries.

The following accounts had zero balances:

Salaries Payable

Interest Payable

Income Summary

Supplies Expense

Insurance Expense

Depreciation ExpenseEquipment

Uncollectible Accounts Expense

Required:

Prepare a worksheet for the year ended December

Prepare a classified income statement. The firm does not divide its operating expenses into selling and administrative expenses.

Prepare a statement of owner's equity. No additional investments were made during the period.

Prepare a classified balance sheet. All notes payable are due within one year.

Journalize the adjusting entries.

Journalize the closing entries.

Journalize the reversing entries.

Analyze:

Complete this question entering your answers in the tabs below.

Required

Required

Required

Required

Required

Required

Analyze

Prepare a worksheet for the year ended December

Note: Round your answers to decimal places.

tableNote: Round your arsvucisWorkshe,,,,,Balance SheetYear Ended December XIncome StatementTrial BiAdjustments,Adjusted Trial Balance,tableDebitCredit,Debit,CreditAccount Name,Debit,Credit,Debit,Credit,Debit,Cash$Accounts Receivable,Allowance for Doubtful Accounts,,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started