This is Tax memo, please solve this with an attached guideline

This is Tax memo, please solve this with an attached guideline

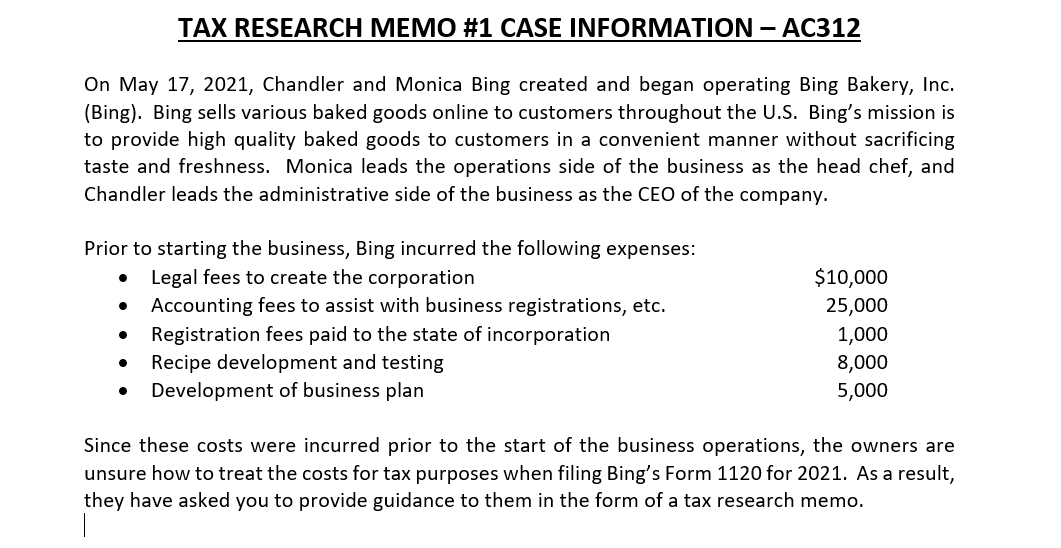

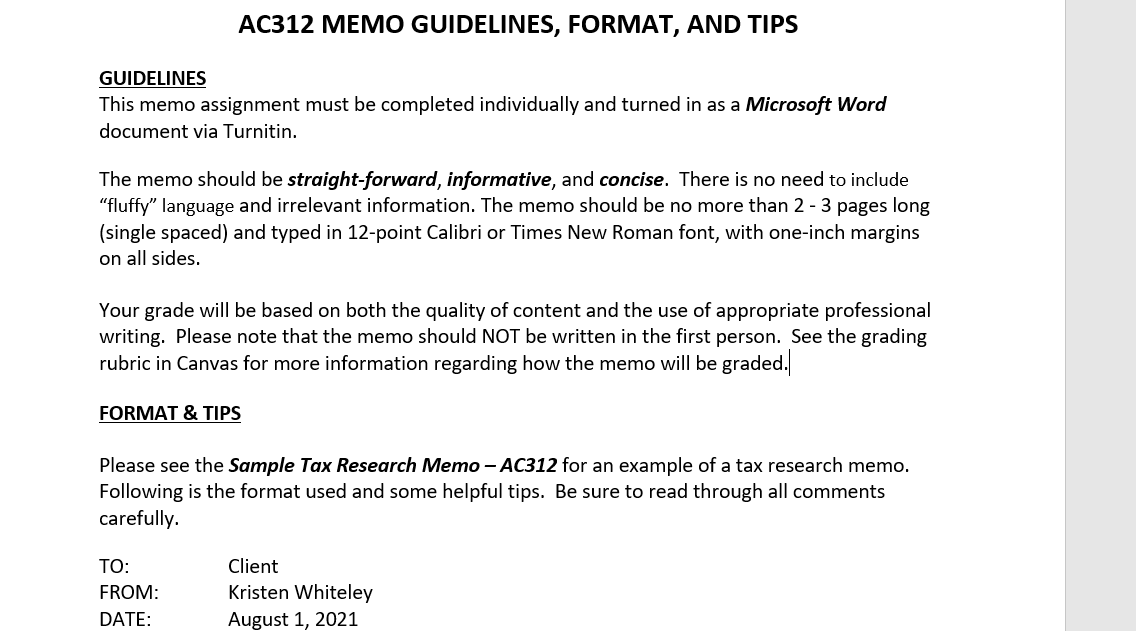

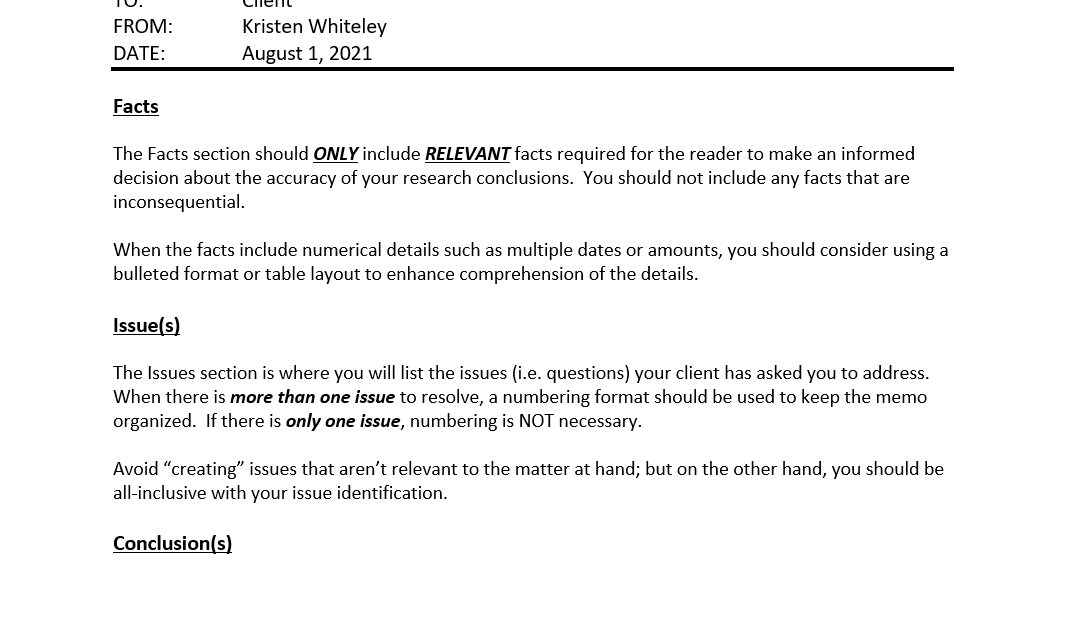

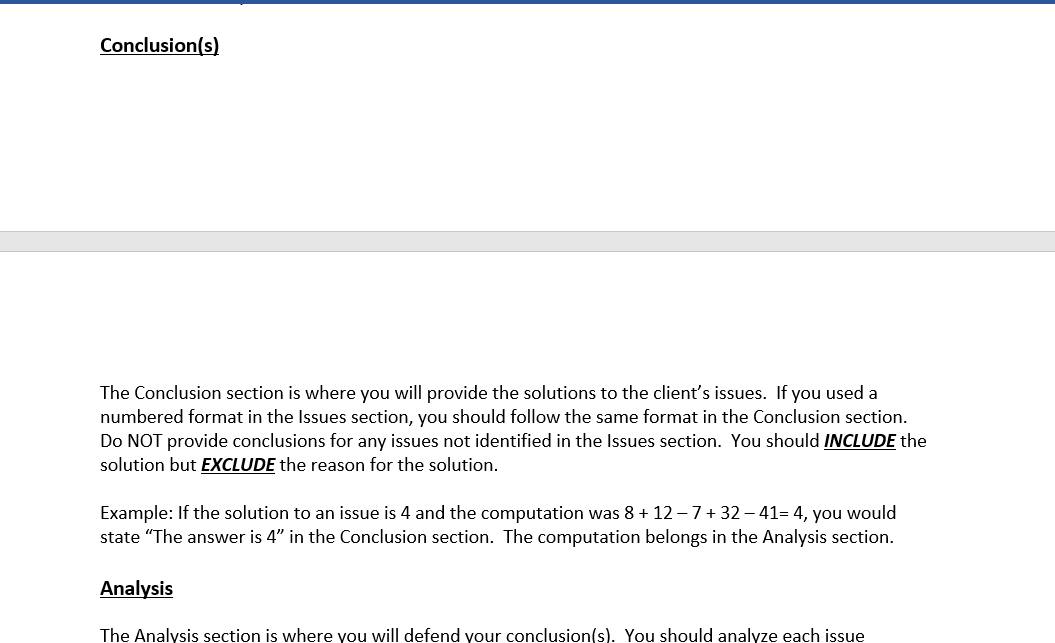

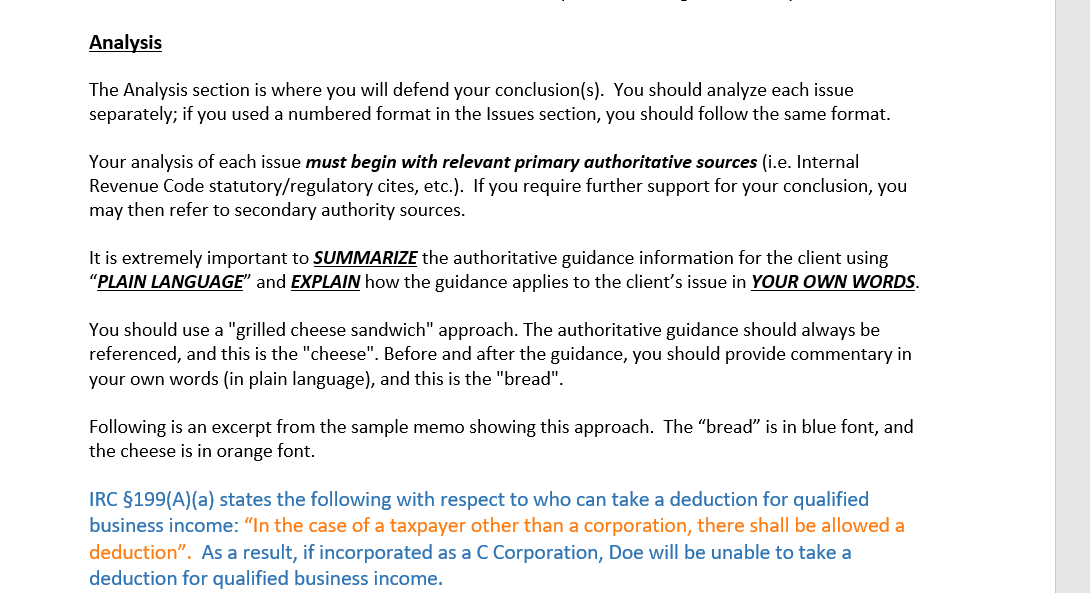

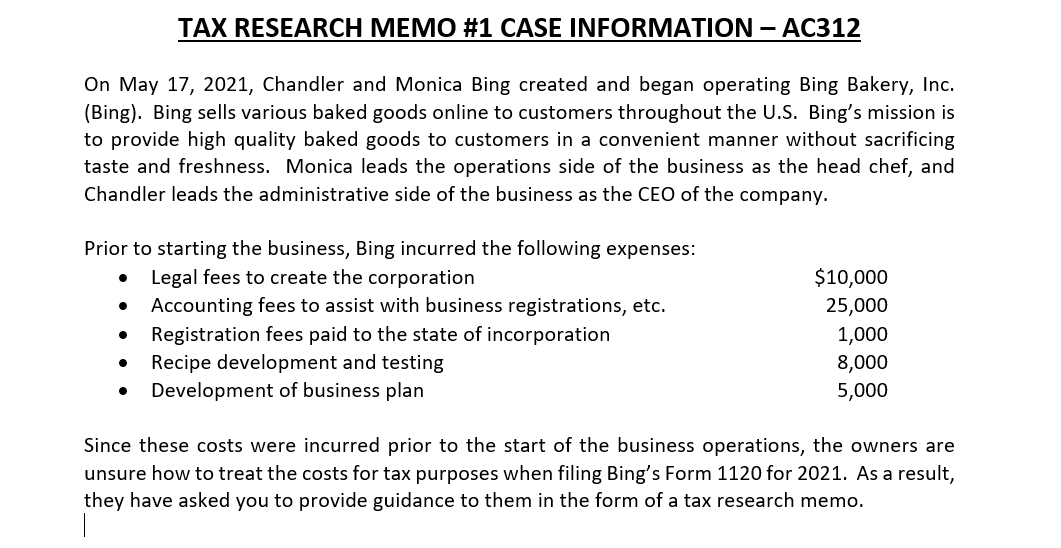

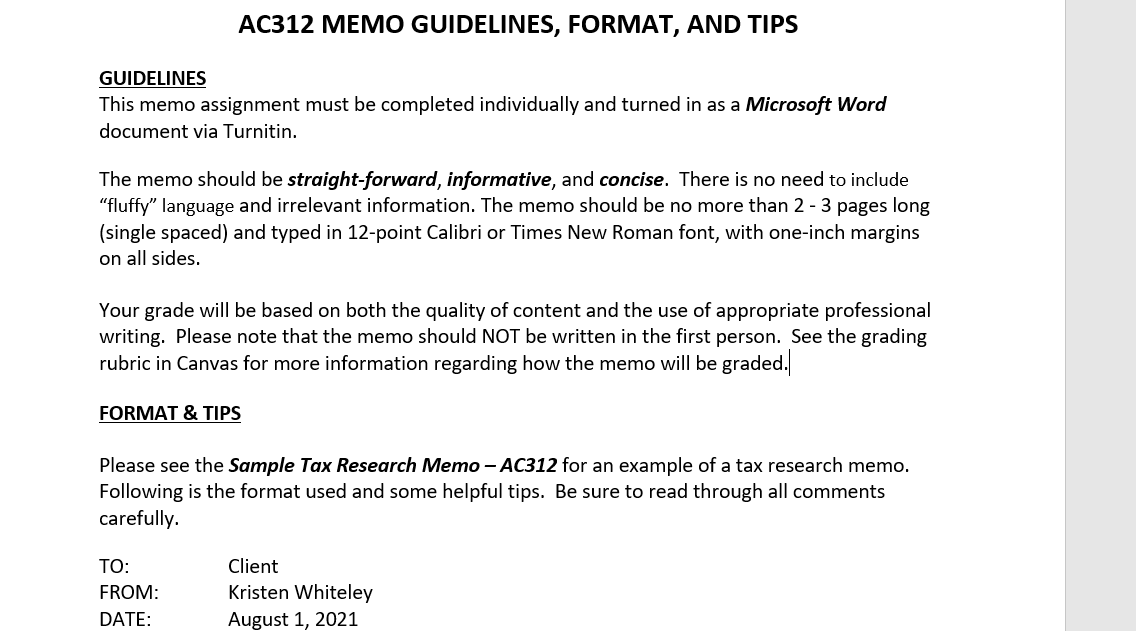

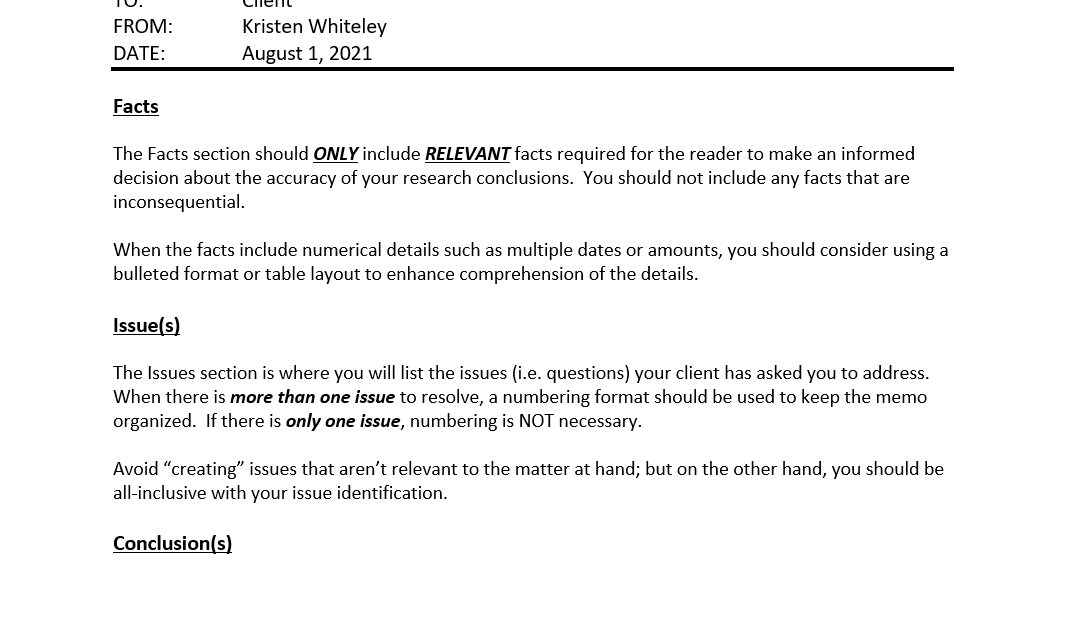

On May 17, 2021, Chandler and Monica Bing created and began operating Bing Bakery, Inc. (Bing). Bing sells various baked goods online to customers throughout the U.S. Bing's mission is to provide high quality baked goods to customers in a convenient manner without sacrificing taste and freshness. Monica leads the operations side of the business as the head chef, and Chandler leads the administrative side of the business as the CEO of the company. Prior to starting the business, Bing incurred the following expenses: Legal fees to create the corporation Accounting fees to assist with business registrations, etc. TAX RESEARCH MEMO #1 CASE INFORMATION - AC312 Registration fees paid to the state of incorporation Recipe development and testing Development of business plan $10,000 25,000 1,000 8,000 5,000 Since these costs were incurred prior to the start of the business operations, the owners are unsure how to treat the costs for tax purposes when filing Bing's Form 1120 for 2021. As a result, they have asked you to provide guidance to them in the form of a tax research memo. AC312 MEMO GUIDELINES, FORMAT, AND TIPS GUIDELINES This memo assignment must be completed individually and turned in as a Microsoft Word document via Turnitin. The memo should be straight-forward, informative, and concise. There is no need to include "fluffy" language and irrelevant information. The memo should be no more than 2 - 3 pages long (single spaced) and typed in 12-point Calibri or Times New Roman font, with one-inch margins on all sides. Your grade will be based on both the quality of content and the use of appropriate professional writing. Please note that the memo should NOT be written in the first person. See the grading rubric in Canvas for more information regarding how the memo will be graded. FORMAT & TIPS Please see the Sample Tax Research Memo - AC312 for an example of a tax research memo. Following is the format used and some helpful tips. Be sure to read through all comments carefully. TO: FROM: DATE: Client Kristen Whiteley August 1, 2021 FROM: DATE: Facts Kristen Whiteley August 1, 2021 The Facts section should ONLY include RELEVANT facts required for the reader to make an informed decision about the accuracy of your research conclusions. You should not include any facts that are inconsequential. When the facts include numerical details such as multiple dates or amounts, you should consider using a bulleted format or table layout to enhance comprehension of the details. Issue(s) The Issues section is where you will list the issues (i.e. questions) your client has asked you to address. When there is more than one issue to resolve, a numbering format should be used to keep the memo organized. If there is only one issue, numbering is NOT necessary. Avoid "creating" issues that aren't relevant to the matter at hand; but on the other hand, you should be all-inclusive with your issue identification. Conclusion(s) Conclusion(s) The Conclusion section is where you will provide the solutions to the client's issues. If you used a numbered format in the Issues section, you should follow the same format in the Conclusion section. Do NOT provide conclusions for any issues not identified in the Issues section. You should INCLUDE the solution but EXCLUDE the reason for the solution. Example: If the solution to an issue is 4 and the computation was 8 + 12-7 +32-41= 4, you would state "The answer is 4" in the Conclusion section. The computation belongs in the Analysis section. Analysis The Analysis section is where you will defend your conclusion(s). You should analyze each issue Analysis The Analysis section is where you will defend your conclusion(s). You should analyze each issue separately; if you used a numbered format in the Issues section, you should follow the same format. Your analysis of each issue must begin with relevant primary authoritative sources (i.e. Internal Revenue Code statutory/regulatory cites, etc.). If you require further support for your conclusion, you may then refer to secondary authority sources. It is extremely important to SUMMARIZE the authoritative guidance information for the client using "PLAIN LANGUAGE" and EXPLAIN how the guidance applies to the client's issue in YOUR OWN WORDS. You should use a "grilled cheese sandwich" approach. The authoritative guidance should always be referenced, and this is the "cheese". Before and after the guidance, you should provide commentary in your own words (in plain language), and this is the "bread". Following is an excerpt from the sample memo showing this approach. The "bread" is in blue font, and the cheese is in orange font. IRC 199(A)(a) states the following with respect to who can take a deduction for qualified business income: "In the case of a taxpayer other than a corporation, there shall be allowed a deduction". As a result, if incorporated as a C Corporation, Doe will be unable to take a deduction for qualified business income

This is Tax memo, please solve this with an attached guideline

This is Tax memo, please solve this with an attached guideline