Answered step by step

Verified Expert Solution

Question

1 Approved Answer

THis is the complete question please show the complete working .its urgent QUESIIN 1 Scenario In 1995, Colten James, founder of the successful Cape Town

THis is the complete question please show the complete working .its urgent

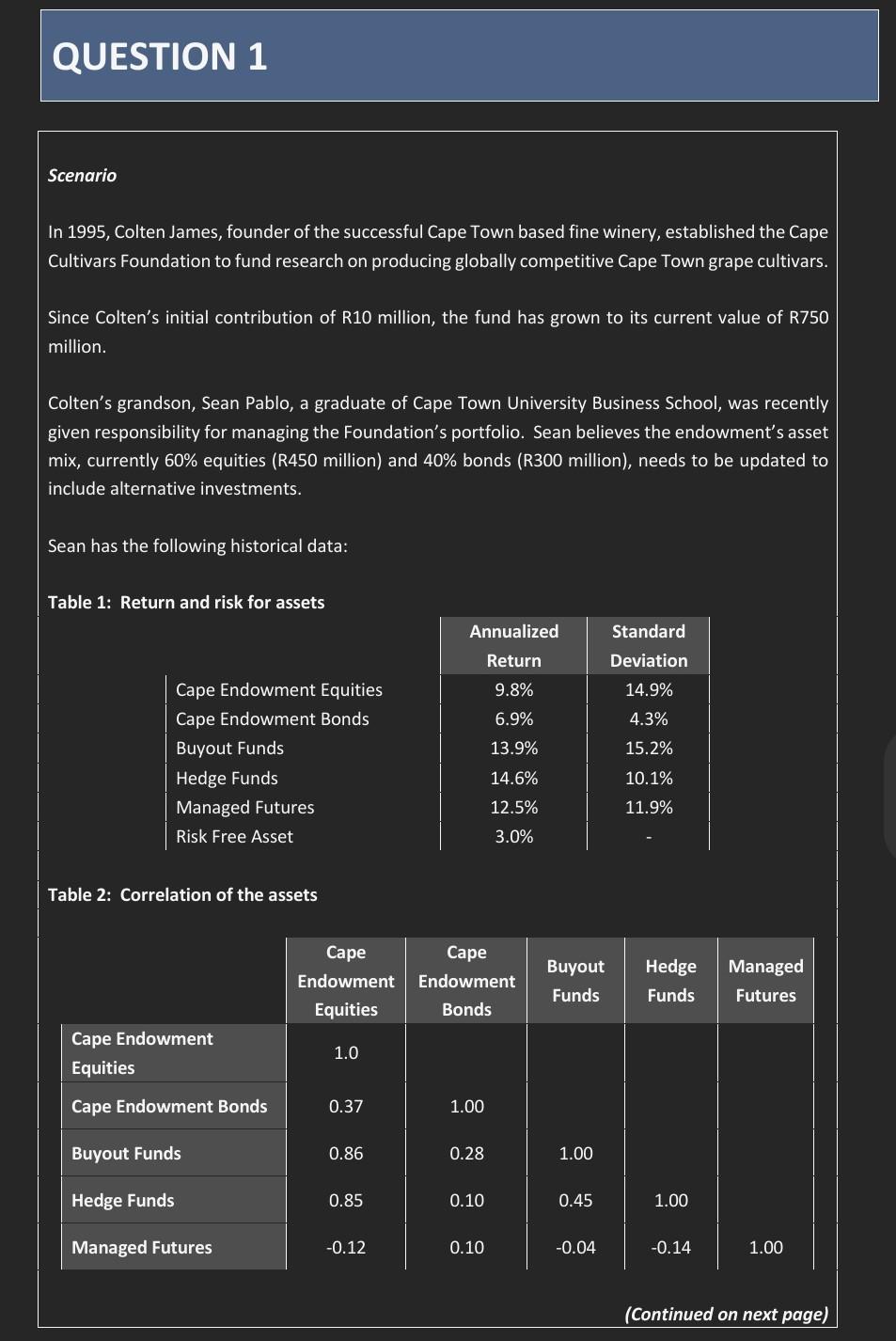

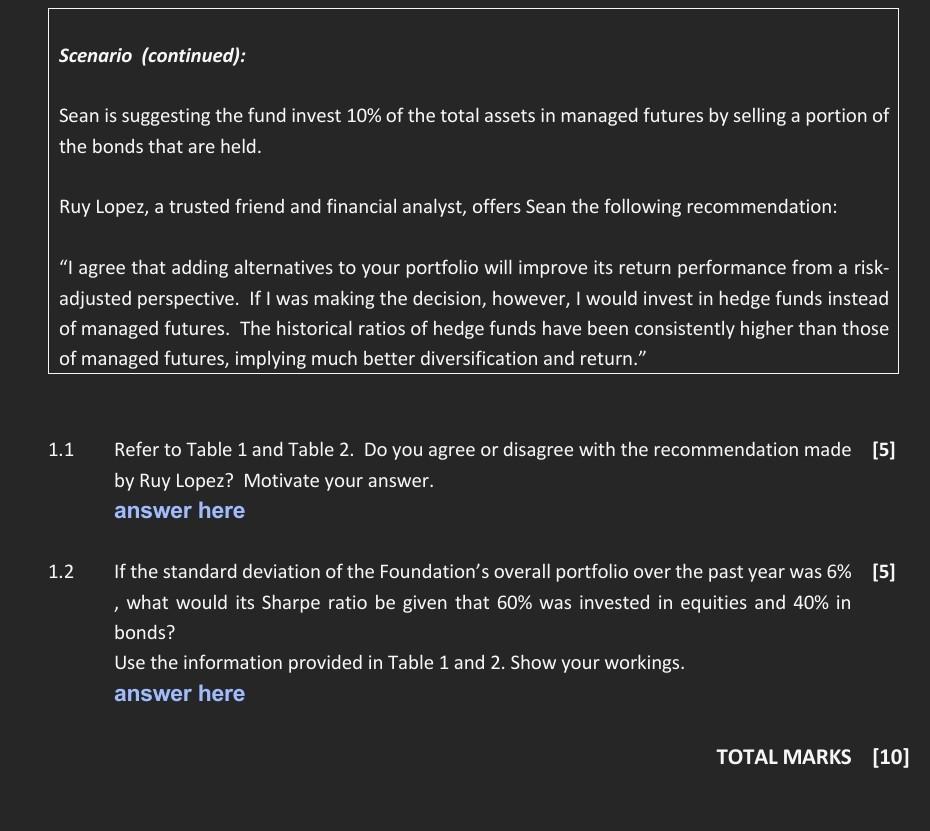

QUESIIN 1 Scenario In 1995, Colten James, founder of the successful Cape Town based fine winery, established the Cape Cultivars Foundation to fund research on producing globally competitive Cape Town grape cultivars. Since Colten's initial contribution of R10 million, the fund has grown to its current value of R750 million. Colten's grandson, Sean Pablo, a graduate of Cape Town University Business School, was recently given responsibility for managing the Foundation's portfolio. Sean believes the endowment's asset mix, currently 60% equities (R450 million) and 40% bonds (R300 million), needs to be updated to include alternative investments. Sean has the following historical data: Table 1: Return and risk for assets Table 2: Correlation of the assets Scenario (continued): Sean is suggesting the fund invest 10% of the total assets in managed futures by selling a portion of the bonds that are held. Ruy Lopez, a trusted friend and financial analyst, offers Sean the following recommendation: "I agree that adding alternatives to your portfolio will improve its return performance from a riskadjusted perspective. If I was making the decision, however, I would invest in hedge funds instead of managed futures. The historical ratios of hedge funds have been consistently higher than those of managed futures, implying much better diversification and return." 1.1 Refer to Table 1 and Table 2. Do you agree or disagree with the recommendation made [5] by Ruy Lopez? Motivate your answer. answer here 1.2 If the standard deviation of the Foundation's overall portfolio over the past year was 6% [5] , what would its Sharpe ratio be given that 60% was invested in equities and 40% in bonds? Use the information provided in Table 1 and 2 . Show vour workings. QUESIIN 1 Scenario In 1995, Colten James, founder of the successful Cape Town based fine winery, established the Cape Cultivars Foundation to fund research on producing globally competitive Cape Town grape cultivars. Since Colten's initial contribution of R10 million, the fund has grown to its current value of R750 million. Colten's grandson, Sean Pablo, a graduate of Cape Town University Business School, was recently given responsibility for managing the Foundation's portfolio. Sean believes the endowment's asset mix, currently 60% equities (R450 million) and 40% bonds (R300 million), needs to be updated to include alternative investments. Sean has the following historical data: Table 1: Return and risk for assets Table 2: Correlation of the assets Scenario (continued): Sean is suggesting the fund invest 10% of the total assets in managed futures by selling a portion of the bonds that are held. Ruy Lopez, a trusted friend and financial analyst, offers Sean the following recommendation: "I agree that adding alternatives to your portfolio will improve its return performance from a riskadjusted perspective. If I was making the decision, however, I would invest in hedge funds instead of managed futures. The historical ratios of hedge funds have been consistently higher than those of managed futures, implying much better diversification and return." 1.1 Refer to Table 1 and Table 2. Do you agree or disagree with the recommendation made [5] by Ruy Lopez? Motivate your answer. answer here 1.2 If the standard deviation of the Foundation's overall portfolio over the past year was 6% [5] , what would its Sharpe ratio be given that 60% was invested in equities and 40% in bonds? Use the information provided in Table 1 and 2 . Show vour workingsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started