Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is the cynical, total campaign spending buys the election model from class. The election is between party A and party B. The players

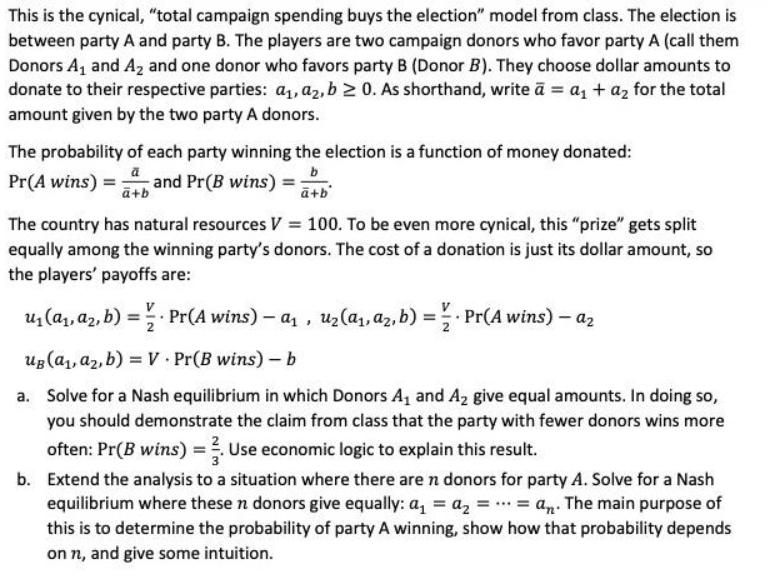

This is the cynical, "total campaign spending buys the election" model from class. The election is between party A and party B. The players are two campaign donors who favor party A (call them Donors A and A and one donor who favors party B (Donor B). They choose dollar amounts to donate to their respective parties: a, a, b 0. As shorthand, write a = a + a for the total amount given by the two party A donors. The probability of each party winning the election is a function of money donated: Pr(A wins) =and Pr(B wins) = a+b The country has natural resources V = 100. To be even more cynical, this "prize" gets split equally among the winning party's donors. The cost of a donation is just its dollar amount, so the players' payoffs are: (a, a, b) = Pr(A wins) - , (a, a, b) = . Pr(A wins) - a ug (a, a, b) = V Pr(B wins) - b a. Solve for a Nash equilibrium in which Donors A and A give equal amounts. In doing so, you should demonstrate the claim from class that the party with fewer donors wins more often: Pr(B wins) = 3. Use economic logic to explain this result. b. Extend the analysis to a situation where there are n donors for party A. Solve for a Nash equilibrium where these n donors give equally: a = a = = a. The main purpose of this is to determine the probability of party A winning, show how that probability depends on n, and give some intuition.

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

This ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started