Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is the details of this question... whole balance sheet 7. Please describe the Du pont analysis approach. And according to financial statements of Corporation

this is the details of this question... whole balance sheet

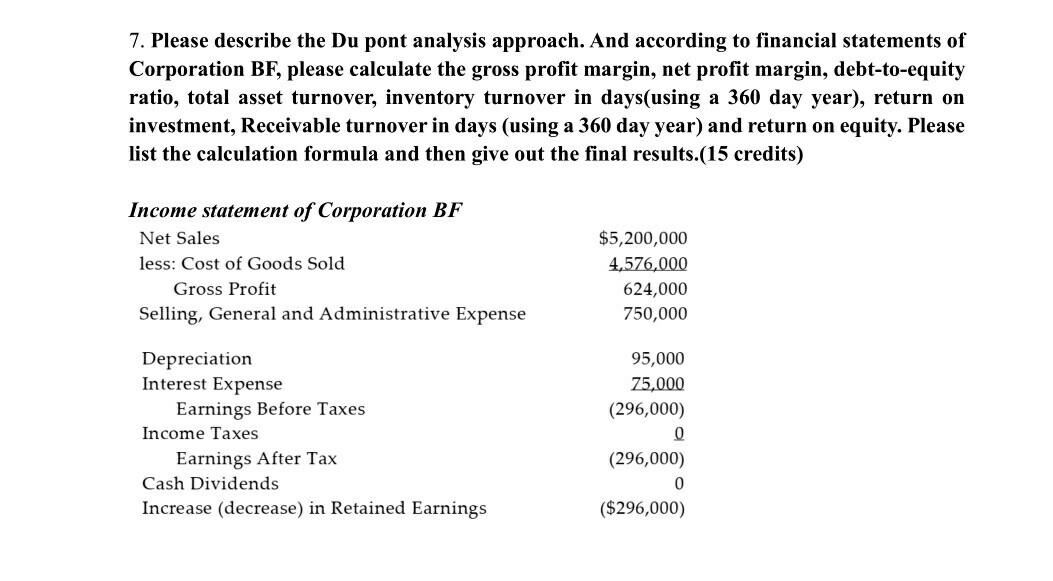

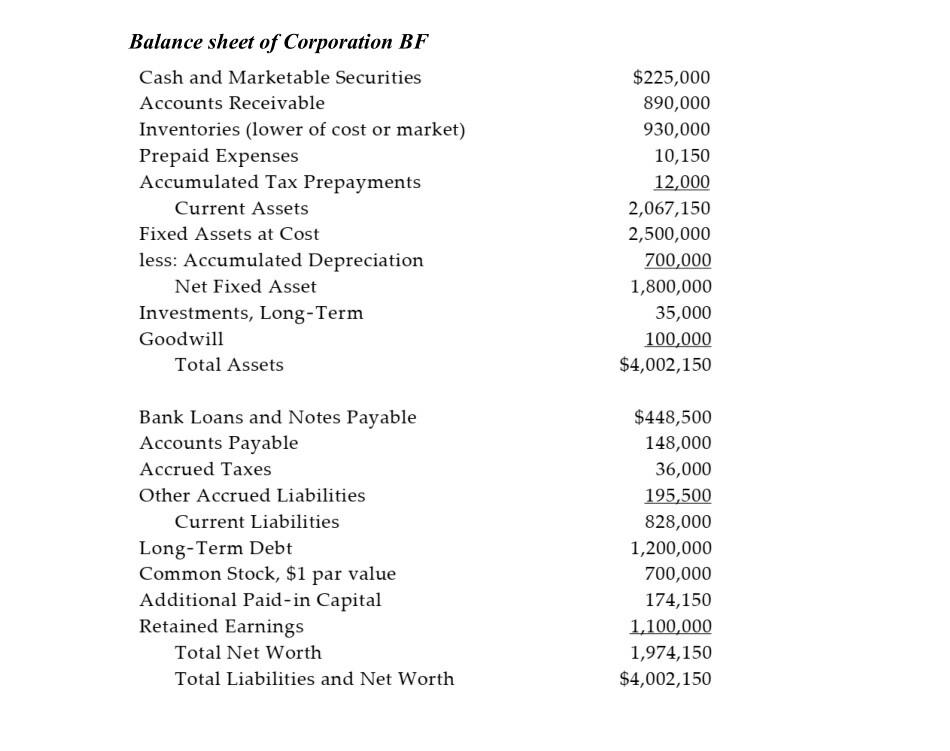

7. Please describe the Du pont analysis approach. And according to financial statements of Corporation BF, please calculate the gross profit margin, net profit margin, debt-to-equity ratio, total asset turnover, inventory turnover in days(using a 360 day year), return on investment, Receivable turnover in days (using a 360 day year) and return on equity. Please list the calculation formula and then give out the final results.(15 credits) Income statement of Corporation BF Net Sales less: Cost of Goods Sold Gross Profit Selling, General and Administrative Expense $5,200,000 4,576,000 624,000 750,000 Depreciation Interest Expense Earnings Before Taxes Income Taxes Earnings After Tax Cash Dividends Increase (decrease) in Retained Earnings 95,000 75,000 (296,000) 0 (296,000) 0 ($296,000) Balance sheet of Corporation BF Cash and Marketable Securities Accounts Receivable Inventories (lower of cost or market) Prepaid Expenses Accumulated Tax Prepayments Current Assets Fixed Assets at Cost less: Accumulated Depreciation Net Fixed Asset Investments, Long-Term Goodwill Total Assets $225,000 890,000 930,000 10,150 12,000 2,067,150 2,500,000 700,000 1,800,000 35,000 100,000 $4,002,150 Bank Loans and Notes Payable Accounts Payable Accrued Taxes Other Accrued Liabilities Current Liabilities Long-Term Debt Common Stock, $1 par value Additional Paid-in Capital Retained Earnings Total Net Worth Total Liabilities and Net Worth $448,500 148,000 36,000 195,500 828,000 1,200,000 700,000 174,150 1,100,000 1,974,150 $4,002,150Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started