Question

This is the final assessment for the Accounting module. It contains three parts (Parts 1, 2, and 3). Please follow the instructions carefully. Requirements Part

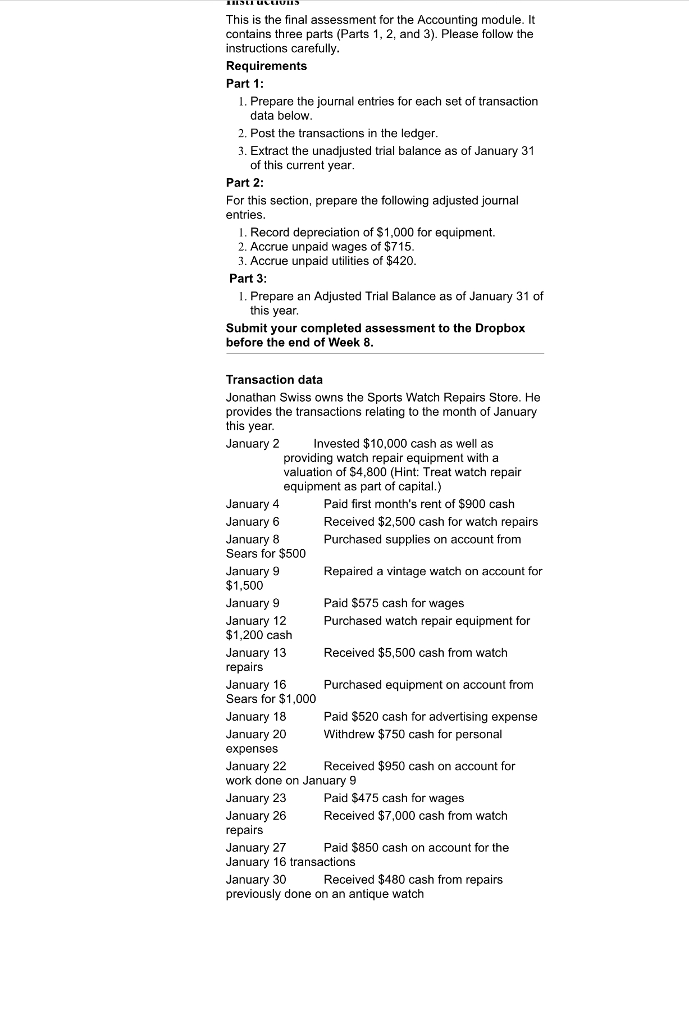

This is the final assessment for the Accounting module. It contains three parts (Parts 1, 2, and 3). Please follow the instructions carefully. Requirements Part 1: 1. Prepare the journal entries for each set of transaction data below. 2. Post the transactions in the ledger. 3. Extract the unadjusted trial balance as of January 31 of this current year. Part 2: For this section, prepare the following adjusted journal entries. 1. Record depreciation of $1,000 for equipment. 2. Accrue unpaid wages of $715. 3. Accrue unpaid utilities of $420. Part 3: 1. Prepare an Adjusted Trial Balance as of January 31 of this year. Submit your completed assessment to the Dropbox before the end of Week 8. Transaction data Jonathan Swiss owns the Sports Watch Repairs Store. He provides the transactions relating to the month of January this year. January 2 Invested $10,000 cash as well as providing watch repair equipment with a valuation of $4,800 (Hint: Treat watch repair equipment as part of capital.) January 4 Paid first month's rent of $900 cash January 6 Received $2,500 cash for watch repairs January 8 Purchased supplies on account from Sears for $500 January 9 Repaired a vintage watch on account for $1,500 January 9 Paid $575 cash for wages January 12 Purchased watch repair equipment for $1,200 cash January 13 Received $5,500 cash from watch repairs January 16 Purchased equipment on account from Sears for $1,000 January 18 Paid $520 cash for advertising expense January 20 Withdrew $750 cash for personal expenses January 22 Received $950 cash on account for work done on January 9 January 23 Paid $475 cash for wages January 26 Received $7,000 cash from watch repairs January 27 Paid $850 cash on account for the January 16 transactions January 30 Received $480 cash from repairs previously done on an antique watch

This is the final assessment for the Accounting module. It contains three parts (Parts 1, 2, and 3). Please follow the instructions carefully. Requirements Part 1: 1. Prepare the journal entries for each set of transaction data below. 2. Post the transactions in the ledger. 3. Extract the unadjusted trial balance as of January 31 of this current year. Part 2: For this section, prepare the following adjusted journal entries. 1. Record depreciation of $1,000 for equipment. 2. Accrue unpaid wages of $715. 3. Accrue unpaid utilities of $420. Part 3: 1. Prepare an Adjusted Trial Balance as of January 31 of this year. Submit your completed assessment to the Dropbox before the end of Week 8. Transaction data Jonathan Swiss owns the Sports Watch Repairs Store. He provides the transactions relating to the month of January this year. January 2 Invested $10,000 cash as well as providing watch repair equipment with a valuation of $4,800 (Hint: Treat watch repair equipment as part of capital.) January 4 Paid first month's rent of $900 cash January 6 Received $2,500 cash for watch repairs January 8 Purchased supplies on account from Sears for $500 January 9 Repaired a vintage watch on account for $1,500 January 9 Paid $575 cash for wages January 12 Purchased watch repair equipment for $1,200 cash January 13 Received $5,500 cash from watch repairs January 16 Purchased equipment on account from Sears for $1,000 January 18 Paid $520 cash for advertising expense January 20 Withdrew $750 cash for personal expenses January 22 Received $950 cash on account for work done on January 9 January 23 Paid $475 cash for wages January 26 Received $7,000 cash from watch repairs January 27 Paid $850 cash on account for the January 16 transactions January 30 Received $480 cash from repairs previously done on an antique watch

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started