Answered step by step

Verified Expert Solution

Question

1 Approved Answer

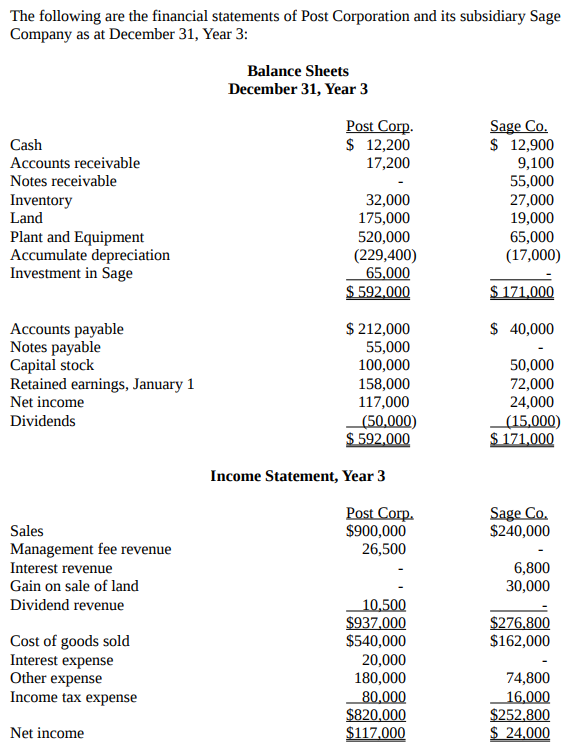

this is the full question no missing information The following are the financial statements of Post Corporation and its subsidiary Sage Company as at December

this is the full question no missing information

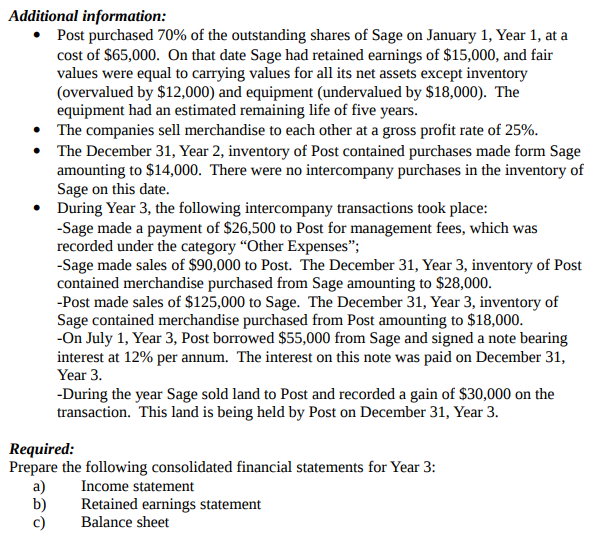

The following are the financial statements of Post Corporation and its subsidiary Sage Company as at December 31, Year 3: Balance Sheets December 31, Year 3 Post Corp. $ 12,200 17,200 Cash Accounts receivable Notes receivable Inventory Land Plant and Equipment Accumulate depreciation Investment in Sage Sage Co. $ 12,900 9,100 55,000 27,000 19,000 65,000 (17,000) 32,000 175,000 520,000 (229,400) 65,000 $ 592.000 $ 171.000 $ 40,000 Accounts payable Notes payable Capital stock Retained earnings, January 1 Net income Dividends $ 212,000 55,000 100,000 158,000 117,000 (50,000) $ 592.000 50,000 72,000 24,000 (15,000) $ 171.000 Income Statement, Year 3 Post Corp $900,000 26,500 Sage Co. $240,000 Sales Management fee revenue Interest revenue Gain on sale of land Dividend revenue 6,800 30,000 $276,800 $162,000 Cost of goods sold Interest expense Other expense Income tax expense 10,500 $937,000 $540,000 20,000 180,000 80,000 $820,000 $117.000 74,800 16,000 $252,800 $ 24,000 Net income Additional information: Post purchased 70% of the outstanding shares of Sage on January 1, Year 1, at a cost of $65,000. On that date Sage had retained earnings of $15,000, and fair values were equal to carrying values for all its net assets except inventory (overvalued by $12,000) and equipment (undervalued by $18,000). The equipment had an estimated remaining life of five years. The companies sell merchandise to each other at a gross profit rate of 25%. The December 31, Year 2, inventory of Post contained purchases made form Sage amounting to $14,000. There were no intercompany purchases in the inventory of Sage on this date. During Year 3, the following intercompany transactions took place: -Sage made a payment of $26,500 to Post for management fees, which was recorded under the category "Other Expenses; -Sage made sales of $90,000 to Post. The December 31, Year 3, inventory of Post contained merchandise purchased from Sage amounting to $28,000. -Post made sales of $125,000 to Sage. The December 31, Year 3, inventory of Sage contained merchandise purchased from Post amounting to $18,000. -On July 1, Year 3, Post borrowed $55,000 from Sage and signed a note bearing interest at 12% per annum. The interest on this note was paid on December 31, Year 3. -During the year Sage sold land to Post and recorded a gain of $30,000 on the transaction. This land is being held by Post on December 31, Year 3. Required: Prepare the following consolidated financial statements for Year 3: a) Income statement b) Retained earnings statement C) Balance sheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started