Question

This is the link for complete General Ledger: http://docdro.id/KcC8xY2 *Office Furniture owned by the business: original purchase price was $9,000, estimated useful life was 5

This is the link for complete "General Ledger": http://docdro.id/KcC8xY2

*Office Furniture owned by the business: original purchase price was $9,000, estimated useful life was 5 years, and estimated residual value was $1,000 at the end of the useful life. Depreciation is calculated on a monthly basis using the straight line method. The monthly depreciation charge is calculated as the yearly depreciation expense divided by the number of months in a year.

*Office Equipment owned by the business: original purchase price was $41,000, estimated useful life was 9 years, and estimated residual value was $3,500 at the end of the useful life. Depreciation is calculated on a monthly basis using the straight line method. The monthly depreciation charge is calculated as the yearly depreciation expense divided by the number of months in a year.

*Office supplies totalling $2,414 are still on hand at June 30.

*2 months of rent remained pre-paid at the start of June.

*3 months of advertising remained pre-paid at the start of June.

*5 months of insurance remained pre-paid at the start of June

Account: Accum Depn: Office Furniture

Account No. 151

| Date | Description | Ref. | Debit | Credit | Balance | ||

| May | 31 | Balance | 1,867 CR | ||||

| Jun | 30 | Balance | 1,867 CR | ||||

Account: Accum Depn: Office Equipment Account No. 161

| Date | Description | Ref. | Debit | Credit | Balance | ||

| May | 31 | Balance | 24,653 CR | ||||

| Jun | 30 | Balance | 24,653 CR | ||||

Account: Depn Expense: Office Furniture Account No. 560

| Date | Description | Ref. | Debit | Credit | Balance | ||

| May | 31 | Balance | 0 | ||||

| Jun | 30 | Balance | 0 | ||||

Account: Depn Expense: Office Equipment Account No. 561

| Date | Description | Ref. | Debit | Credit | Balance | ||

| May | 31 | Balance | 0 | ||||

| Jun | 30 | Balance | 0 | ||||

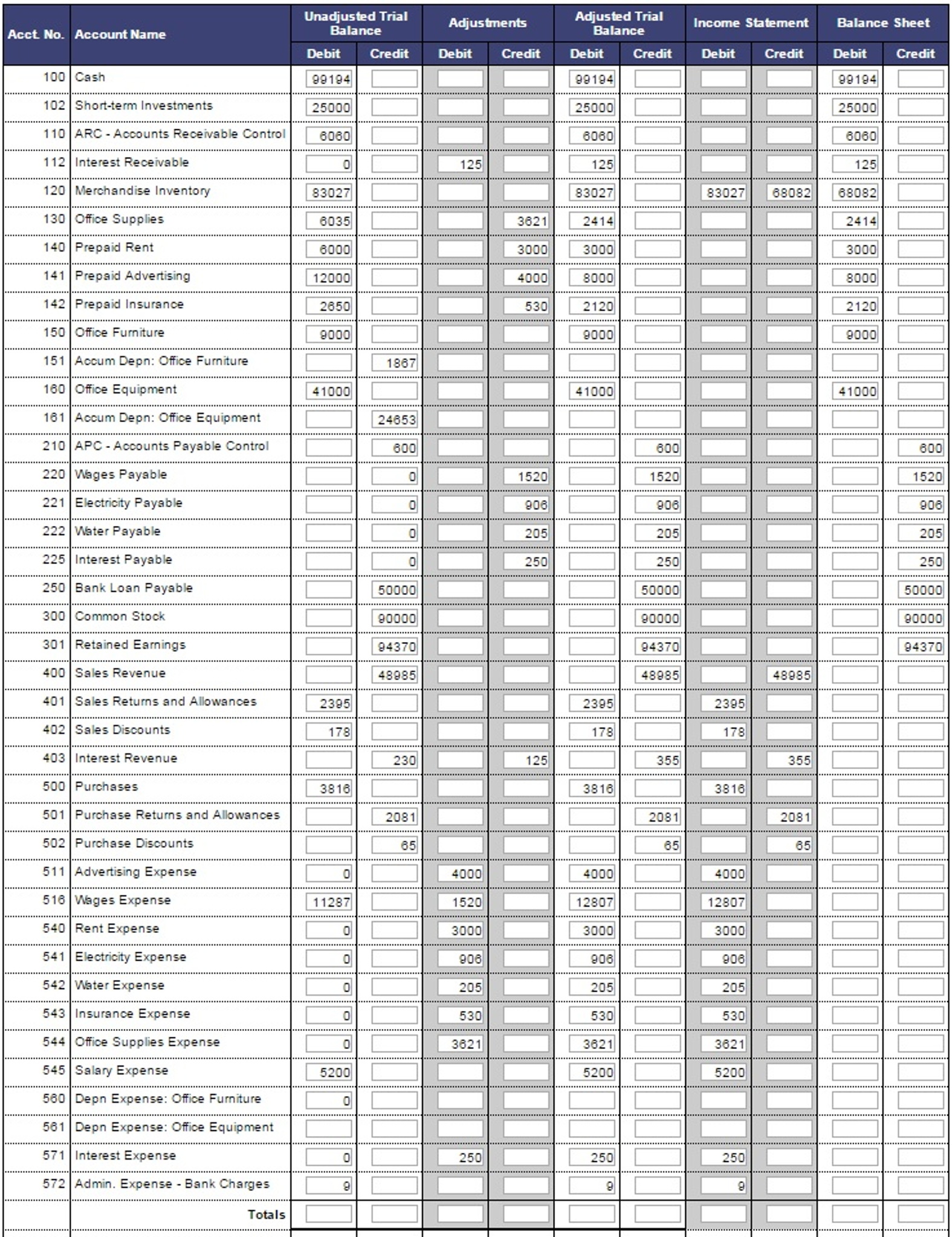

The "Worksheet" so far, I just need help with those up there only.

This is the link for complete "General Ledger": http://docdro.id/KcC8xY2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started