Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is the only data provided thats why we took photo of the question Beta Laboratories reported the following footnote related to its convertible debentures.

this is the only data provided thats why we took photo of the question

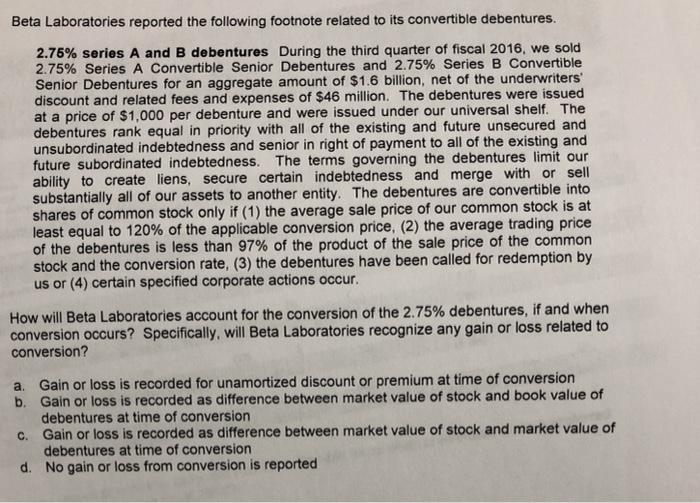

Beta Laboratories reported the following footnote related to its convertible debentures. 2.75% series A and debentures During the third quarter of fiscal 2016, we sold 2.75% Series A Convertible Senior Debentures and 2.75% Series B Convertible Senior Debentures for an aggregate amount of $1.6 billion, net of the underwriters' discount and related fees and expenses of $46 million. The debentures were issued at a price of $1,000 per debenture and were issued under our universal shelf. The debentures rank equal in priority with all of the existing and future unsecured and unsubordinated indebtedness and senior in right of payment to all of the existing and future subordinated indebtedness. The terms governing the debentures limit our ability to create liens, secure certain indebtedness and merge with or sell substantially all of our assets to another entity. The debentures are convertible into shares of common stock only if (1) the average sale price of our common stock is at least equal to 120% of the applicable conversion price, (2) the average trading price of the debentures is less than 97% of the product of the sale price of the common stock and the conversion rate, (3) the debentures have been called for redemption by us or (4) certain specified corporate actions occur. How will Beta Laboratories account for the conversion of the 2.75% debentures, if and when conversion occurs? Specifically, will Beta Laboratories recognize any gain or loss related to conversion? a. Gain or loss is recorded for unamortized discount or premium at time of conversion b. Gain or loss is recorded as difference between market value of stock and book value of debentures at time of conversion c. Gain or loss is recorded as difference between market value of stock and market value of debentures at time of conversion d. No gain or loss from conversion is reported Beta Laboratories reported the following footnote related to its convertible debentures. 2.75% series A and debentures During the third quarter of fiscal 2016, we sold 2.75% Series A Convertible Senior Debentures and 2.75% Series B Convertible Senior Debentures for an aggregate amount of $1.6 billion, net of the underwriters' discount and related fees and expenses of $46 million. The debentures were issued at a price of $1,000 per debenture and were issued under our universal shelf. The debentures rank equal in priority with all of the existing and future unsecured and unsubordinated indebtedness and senior in right of payment to all of the existing and future subordinated indebtedness. The terms governing the debentures limit our ability to create liens, secure certain indebtedness and merge with or sell substantially all of our assets to another entity. The debentures are convertible into shares of common stock only if (1) the average sale price of our common stock is at least equal to 120% of the applicable conversion price, (2) the average trading price of the debentures is less than 97% of the product of the sale price of the common stock and the conversion rate, (3) the debentures have been called for redemption by us or (4) certain specified corporate actions occur. How will Beta Laboratories account for the conversion of the 2.75% debentures, if and when conversion occurs? Specifically, will Beta Laboratories recognize any gain or loss related to conversion? a. Gain or loss is recorded for unamortized discount or premium at time of conversion b. Gain or loss is recorded as difference between market value of stock and book value of debentures at time of conversion c. Gain or loss is recorded as difference between market value of stock and market value of debentures at time of conversion d. No gain or loss from conversion is reported Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started