Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is the part of question no. 3 All three need to be soloved. 1) The following information was available for Anderson Company for the

This is the part of question no. 3

All three need to be soloved.

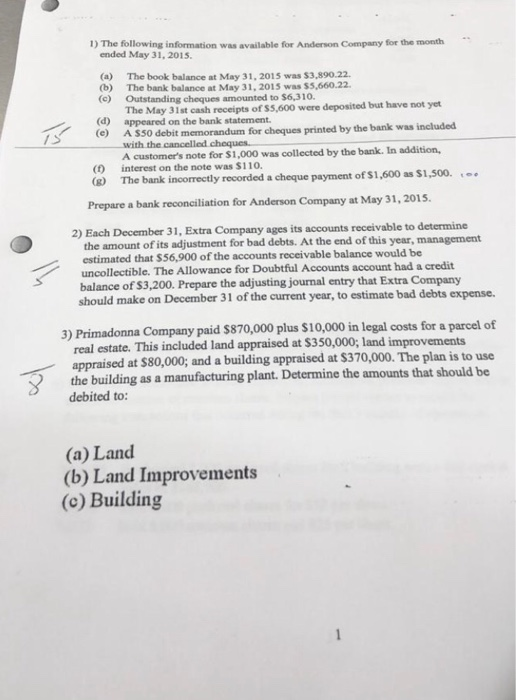

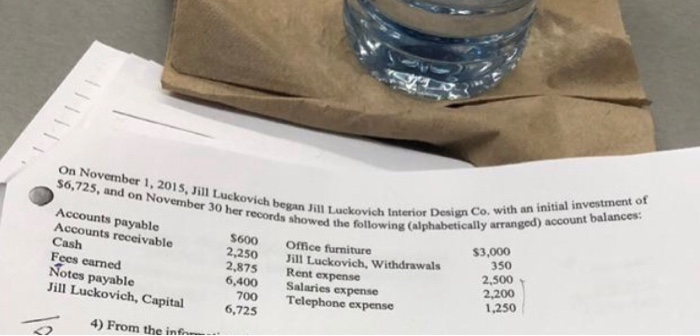

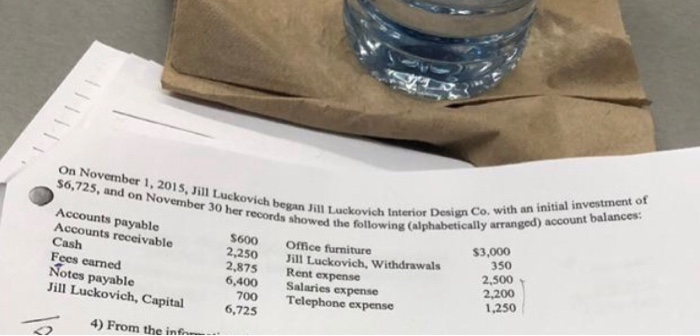

1) The following information was available for Anderson Company for the month ended May 31, 2015. () (d) The book balance at May 31, 2015 was $3,890.22 The bank balance at May 31, 2015 was $5.660.22 Outstanding cheques amounted to $6,310. The May 31st cash receipts of 55,600 were deposited but have not yet appeared on the bank statement. A $50 debit memorandum for cheques printed by the bank was included with the cancelled cheques A customer's note for $1,000 was collected by the bank. In addition, interest on the note was $110. The bank incorrectly recorded a cheque payment of $1,600 a $1,500. (1) (8) Prepare a bank reconciliation for Anderson Company at May 31, 2015. 2) Each December 31, Extra Company ages its accounts receivable to determine the amount of its adjustment for bad debts. At the end of this year, management estimated that $56.900 of the accounts receivable balance would be uncollectible. The Allowance for Doubtful Accounts account had a credit balance of $3,200. Prepare the adjusting journal entry that Extra Company should make on December 31 of the current year, to estimate bad debts expense. 3) Primadonna Company paid $870,000 plus $10,000 in legal costs for a parcel of real estate. This included land appraised at $350,000; land improvements appraised at $80,000; and a building appraised at $370,000. The plan is to use the building as a manufacturing plant. Determine the amounts that should be debited to: (a) Land (b) Land Improvements (c) Building On November 1, 2015, Jill Luckovich began in Lucko S6,725, and on November 30 her records showed the fol Luckovich Interior Design Co, with an initial investment of following (alphabetically arranged) account balances: Accounts payable Accounts receivable Cash Fees eamed Notes payable Jill Luckovich, Capital S600 2,250 2.875 6,400 700 6,725 Office furniture Jill Luckovich, Withdrawals Rent expense Salaries expense Telephone expense $3,000 350 2.500 2,200 1.250 4) From the info Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started