Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is the problem above^ and below is the template you must use. Please provide any formula you used/ and explaniing on how you got

This is the problem above^ and below is the template you must use. Please provide any formula you used/ and explaniing on how you got the information

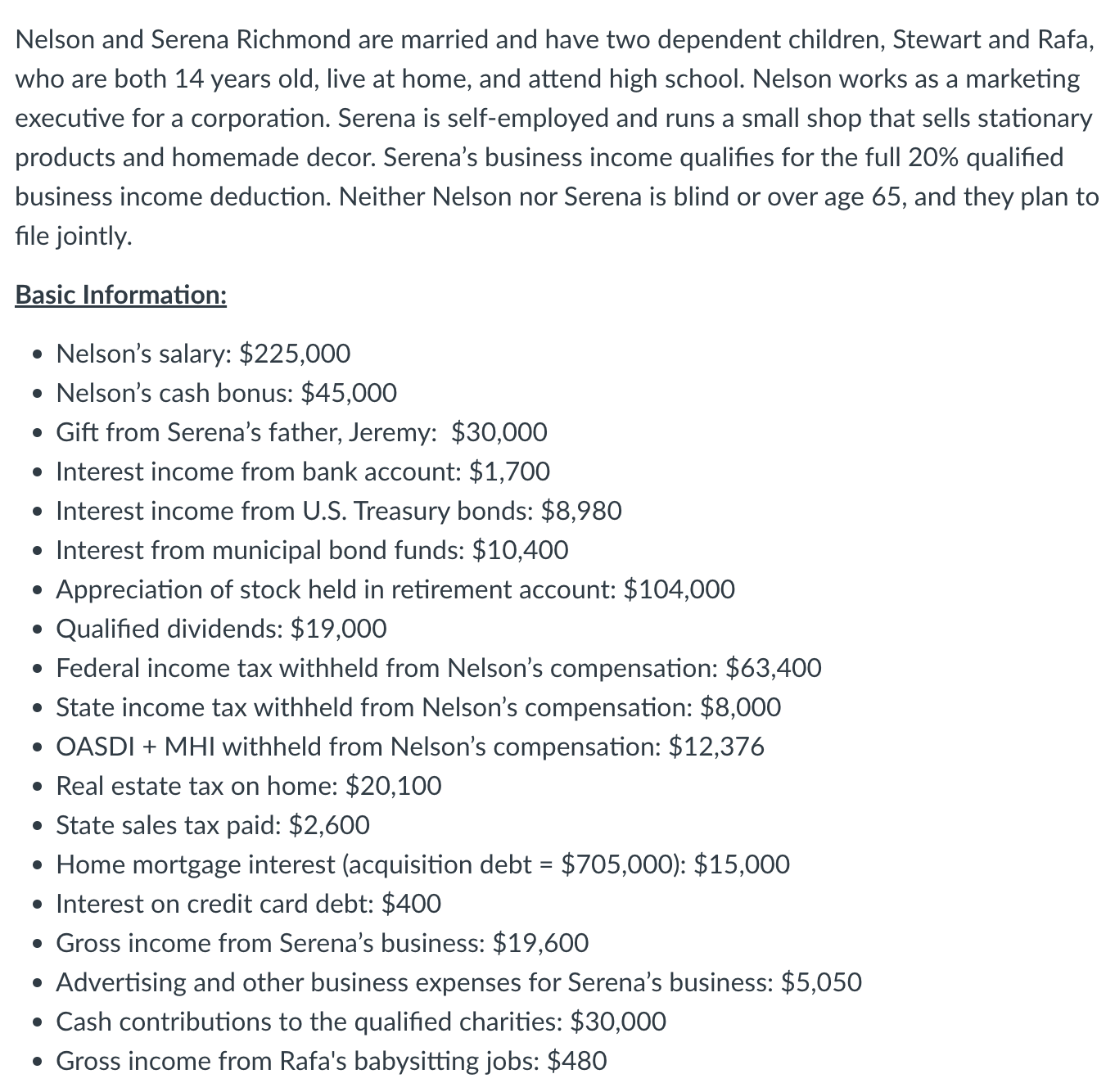

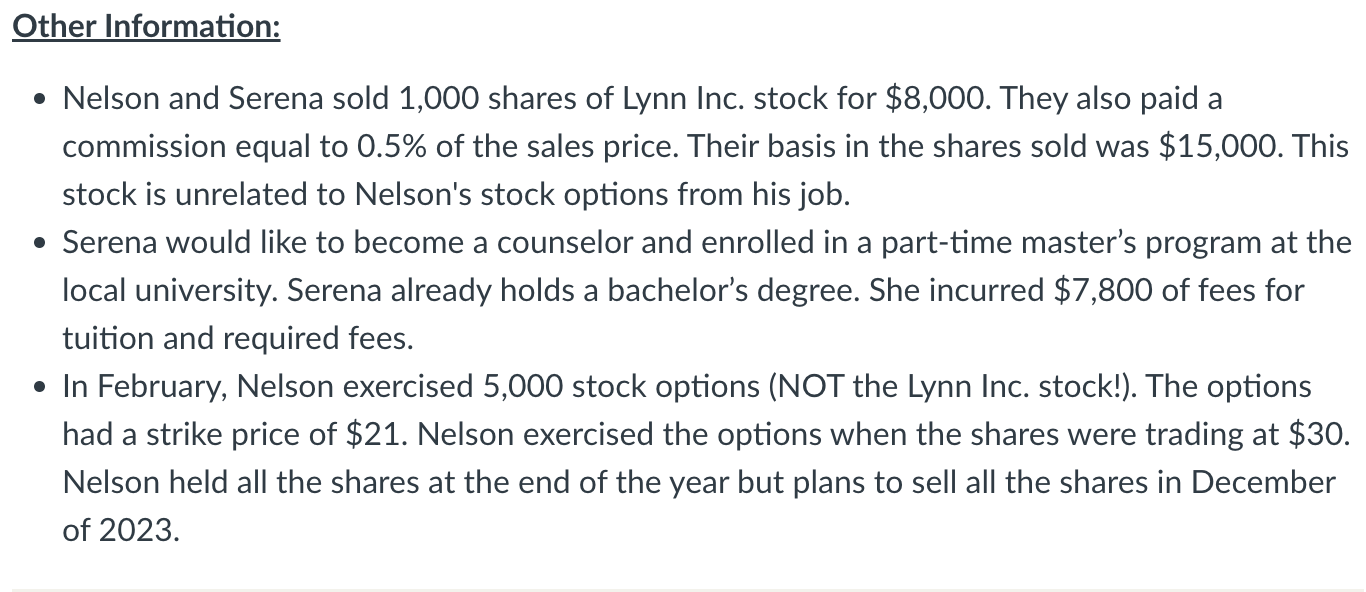

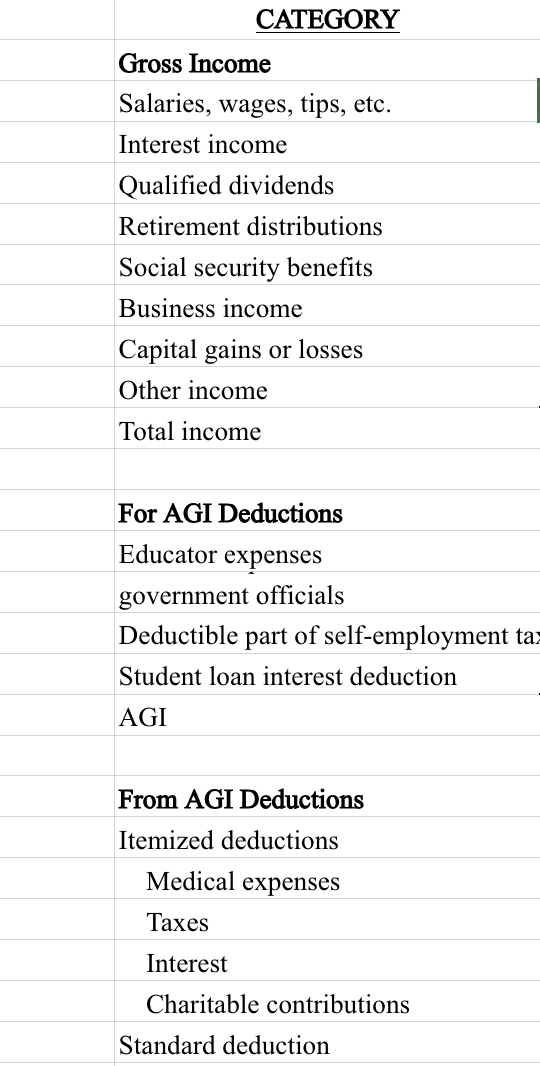

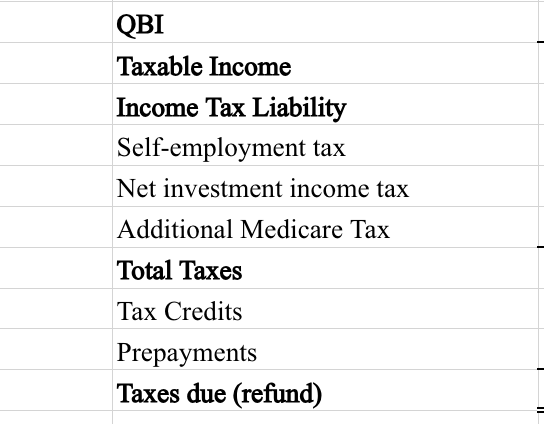

- Nelson and Serena sold 1,000 shares of Lynn Inc. stock for \$8,000. They also paid a commission equal to 0.5% of the sales price. Their basis in the shares sold was $15,000. This stock is unrelated to Nelson's stock options from his job. - Serena would like to become a counselor and enrolled in a part-time master's program at the local university. Serena already holds a bachelor's degree. She incurred $7,800 of fees for tuition and required fees. - In February, Nelson exercised 5,000 stock options (NOT the Lynn Inc. stock!). The options had a strike price of $21. Nelson exercised the options when the shares were trading at $30. Nelson held all the shares at the end of the year but plans to sell all the shares in December of 2023. CATEGORY Gross Income Salaries, wages, tips, etc. Interest income Qualified dividends Retirement distributions Social security benefits Business income Capital gains or losses Other income Total income For AGI Deductions Educator expenses government officials Deductible part of self-employment ta Student loan interest deduction AGI From AGI Deductions Itemized deductions Medical expenses Taxes Interest Charitable contributions Standard deduction Nelson and Serena Richmond are married and have two dependent children, Stewart and Rafa, who are both 14 years old, live at home, and attend high school. Nelson works as a marketing executive for a corporation. Serena is self-employed and runs a small shop that sells stationary products and homemade decor. Serena's business income qualifies for the full 20% qualified business income deduction. Neither Nelson nor Serena is blind or over age 65, and they plan to file jointly. Basic Information: - Nelson's salary: $225,000 - Nelson's cash bonus: $45,000 - Gift from Serena's father, Jeremy: $30,000 - Interest income from bank account: $1,700 - Interest income from U.S. Treasury bonds: $8,980 - Interest from municipal bond funds: $10,400 - Appreciation of stock held in retirement account: $104,000 - Qualified dividends: \$19,000 - Federal income tax withheld from Nelson's compensation: $63,400 - State income tax withheld from Nelson's compensation: $8,000 - OASDI + MHI withheld from Nelson's compensation: $12,376 - Real estate tax on home: $20,100 - State sales tax paid: $2,600 - Home mortgage interest (acquisition debt =$705,000 ): $15,000 - Interest on credit card debt: $400 - Gross income from Serena's business: $19,600 - Advertising and other business expenses for Serena's business: \$5,050 - Cash contributions to the qualified charities: $30,000 - Gross income from Rafa's babysitting jobs: $480 QBI Taxable Income Income Tax Liability Self-employment tax Net investment income tax Additional Medicare Tax Total Taxes Tax Credits Prepayments Taxes due (refund)

- Nelson and Serena sold 1,000 shares of Lynn Inc. stock for \$8,000. They also paid a commission equal to 0.5% of the sales price. Their basis in the shares sold was $15,000. This stock is unrelated to Nelson's stock options from his job. - Serena would like to become a counselor and enrolled in a part-time master's program at the local university. Serena already holds a bachelor's degree. She incurred $7,800 of fees for tuition and required fees. - In February, Nelson exercised 5,000 stock options (NOT the Lynn Inc. stock!). The options had a strike price of $21. Nelson exercised the options when the shares were trading at $30. Nelson held all the shares at the end of the year but plans to sell all the shares in December of 2023. CATEGORY Gross Income Salaries, wages, tips, etc. Interest income Qualified dividends Retirement distributions Social security benefits Business income Capital gains or losses Other income Total income For AGI Deductions Educator expenses government officials Deductible part of self-employment ta Student loan interest deduction AGI From AGI Deductions Itemized deductions Medical expenses Taxes Interest Charitable contributions Standard deduction Nelson and Serena Richmond are married and have two dependent children, Stewart and Rafa, who are both 14 years old, live at home, and attend high school. Nelson works as a marketing executive for a corporation. Serena is self-employed and runs a small shop that sells stationary products and homemade decor. Serena's business income qualifies for the full 20% qualified business income deduction. Neither Nelson nor Serena is blind or over age 65, and they plan to file jointly. Basic Information: - Nelson's salary: $225,000 - Nelson's cash bonus: $45,000 - Gift from Serena's father, Jeremy: $30,000 - Interest income from bank account: $1,700 - Interest income from U.S. Treasury bonds: $8,980 - Interest from municipal bond funds: $10,400 - Appreciation of stock held in retirement account: $104,000 - Qualified dividends: \$19,000 - Federal income tax withheld from Nelson's compensation: $63,400 - State income tax withheld from Nelson's compensation: $8,000 - OASDI + MHI withheld from Nelson's compensation: $12,376 - Real estate tax on home: $20,100 - State sales tax paid: $2,600 - Home mortgage interest (acquisition debt =$705,000 ): $15,000 - Interest on credit card debt: $400 - Gross income from Serena's business: $19,600 - Advertising and other business expenses for Serena's business: \$5,050 - Cash contributions to the qualified charities: $30,000 - Gross income from Rafa's babysitting jobs: $480 QBI Taxable Income Income Tax Liability Self-employment tax Net investment income tax Additional Medicare Tax Total Taxes Tax Credits Prepayments Taxes due (refund) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started