Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is the pronunciation of the exercise and the data that are given. The information you want with what is related to? N plc is

This is the pronunciation of the exercise and the data that are given. The information you want with what is related to?

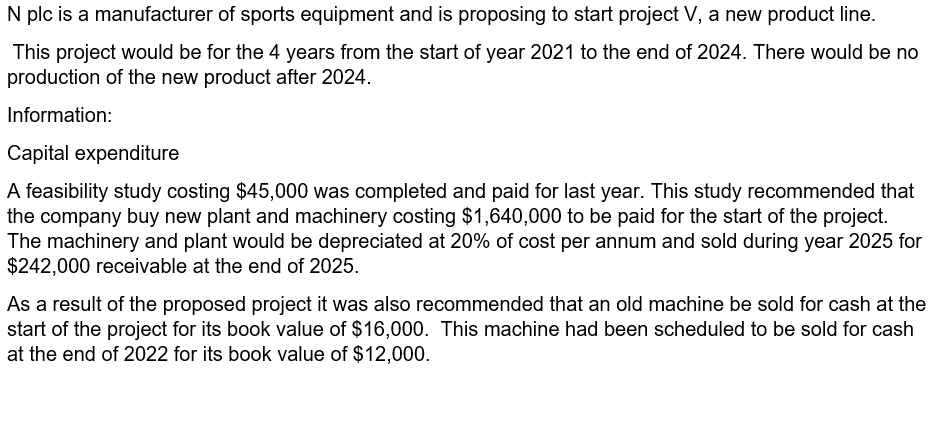

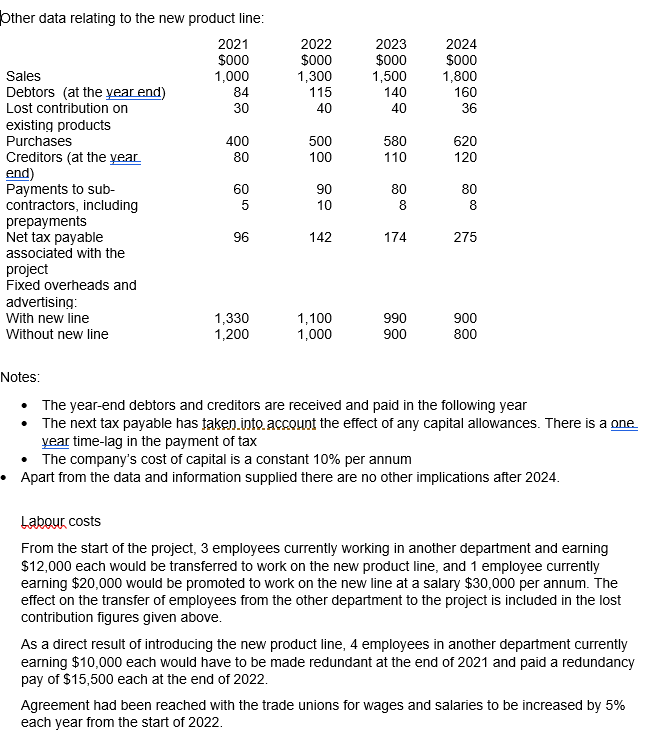

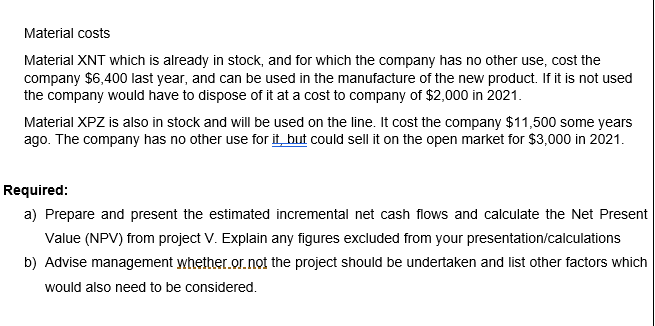

N plc is a manufacturer of sports equipment and is proposing to start project V, a new product line. This project would be for the 4 years from the start of year 2021 to the end of 2024. There would be no production of the new product after 2024. Information: Capital expenditure A feasibility study costing $45,000 was completed and paid for last year. This study recommended that the company buy new plant and machinery costing $1,640,000 to be paid for the start of the project. The machinery and plant would be depreciated at 20% of cost per annum and sold during year 2025 for $242,000 receivable at the end of 2025. As a result of the proposed project it was also recommended that an old machine be sold for cash at the start of the project for its book value of $ 16,000. This machine had been scheduled to be sold for cash at the end of 2022 for its book value of $12,000. 2022 $000 1,300 115 40 2023 $000 1,500 140 40 2024 $000 1,800 160 36 84 500 100 580 110 620 120 Other data relating to the new product line: 2021 $000 Sales 1,000 Debtors (at the year end) Lost contribution on 30 existing products Purchases 400 Creditors (at the year 80 end) Payments to sub- 60 contractors, including 5 prepayments Net tax payable 96 associated with the project Fixed overheads and advertising: With new line 1,330 Without new line 1,200 90 10 80 8 80 8 142 174 275 1,100 1,000 990 900 900 800 Notes: The year-end debtors and creditors are received and paid in the following year The next tax payable has taken into account the effect of any capital allowances. There is a one year time-lag in the payment of tax The company's cost of capital is a constant 10% per annum Apart from the data and information supplied there are no other implications after 2024. Labour costs From the start of the project, 3 employees currently working in another department and earning $12,000 each would be transferred to work on the new product line, and 1 employee currently earning $20,000 would be promoted to work on the new line at a salary $30,000 per annum. The effect on the transfer of employees from the other department to the project is included in the lost contribution figures given above. As a direct result of introducing the new product line, 4 employees in another department currently earning $10,000 each would have to be made redundant at the end of 2021 and paid a redundancy pay of $15,500 each at the end of 2022. Agreement had been reached with the trade unions for wages and salaries to be increased by 5% each year from the start of 2022. Material costs Material XNT which is already in stock, and for which the company has no other use, cost the company $6,400 last year, and can be used in the manufacture of the new product. If it is not used the company would have to dispose of it at a cost to company of $2,000 in 2021. Material XPZ is also in stock and will be used on the line. It cost the company $11,500 some years ago. The company has no other use for it but could sell it on the open market for $3,000 in 2021. Required: a) Prepare and present the estimated incremental net cash flows and calculate the Net Present Value (NPV) from project V. Explain any figures excluded from your presentation/calculations b) Advise management whether or not the project should be undertaken and list other factors which would also need to be considered. N plc is a manufacturer of sports equipment and is proposing to start project V, a new product line. This project would be for the 4 years from the start of year 2021 to the end of 2024. There would be no production of the new product after 2024. Information: Capital expenditure A feasibility study costing $45,000 was completed and paid for last year. This study recommended that the company buy new plant and machinery costing $1,640,000 to be paid for the start of the project. The machinery and plant would be depreciated at 20% of cost per annum and sold during year 2025 for $242,000 receivable at the end of 2025. As a result of the proposed project it was also recommended that an old machine be sold for cash at the start of the project for its book value of $ 16,000. This machine had been scheduled to be sold for cash at the end of 2022 for its book value of $12,000. 2022 $000 1,300 115 40 2023 $000 1,500 140 40 2024 $000 1,800 160 36 84 500 100 580 110 620 120 Other data relating to the new product line: 2021 $000 Sales 1,000 Debtors (at the year end) Lost contribution on 30 existing products Purchases 400 Creditors (at the year 80 end) Payments to sub- 60 contractors, including 5 prepayments Net tax payable 96 associated with the project Fixed overheads and advertising: With new line 1,330 Without new line 1,200 90 10 80 8 80 8 142 174 275 1,100 1,000 990 900 900 800 Notes: The year-end debtors and creditors are received and paid in the following year The next tax payable has taken into account the effect of any capital allowances. There is a one year time-lag in the payment of tax The company's cost of capital is a constant 10% per annum Apart from the data and information supplied there are no other implications after 2024. Labour costs From the start of the project, 3 employees currently working in another department and earning $12,000 each would be transferred to work on the new product line, and 1 employee currently earning $20,000 would be promoted to work on the new line at a salary $30,000 per annum. The effect on the transfer of employees from the other department to the project is included in the lost contribution figures given above. As a direct result of introducing the new product line, 4 employees in another department currently earning $10,000 each would have to be made redundant at the end of 2021 and paid a redundancy pay of $15,500 each at the end of 2022. Agreement had been reached with the trade unions for wages and salaries to be increased by 5% each year from the start of 2022. Material costs Material XNT which is already in stock, and for which the company has no other use, cost the company $6,400 last year, and can be used in the manufacture of the new product. If it is not used the company would have to dispose of it at a cost to company of $2,000 in 2021. Material XPZ is also in stock and will be used on the line. It cost the company $11,500 some years ago. The company has no other use for it but could sell it on the open market for $3,000 in 2021. Required: a) Prepare and present the estimated incremental net cash flows and calculate the Net Present Value (NPV) from project V. Explain any figures excluded from your presentation/calculations b) Advise management whether or not the project should be undertaken and list other factors which would also need to be consideredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started