Answered step by step

Verified Expert Solution

Question

1 Approved Answer

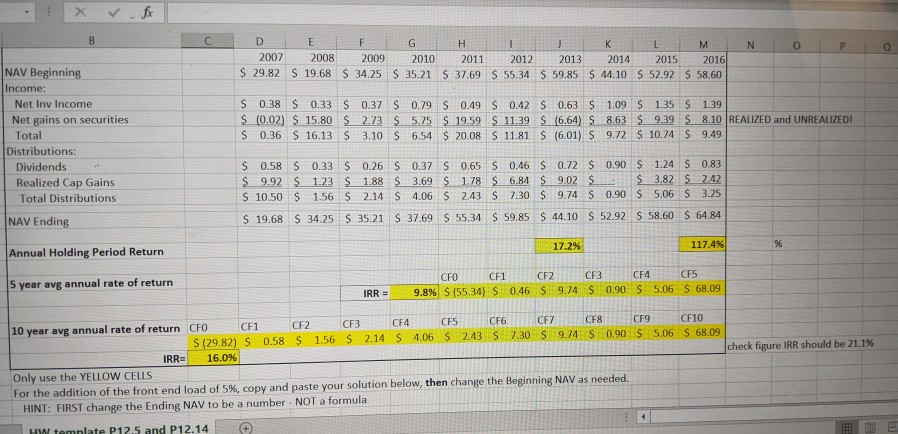

this is the question from the textbook and below is the Excel format we are given to fill in the yellow spaces. (please ignore the

this is the question from the textbook and below is the Excel format we are given to fill in the yellow spaces. (please ignore the numbers already in it)

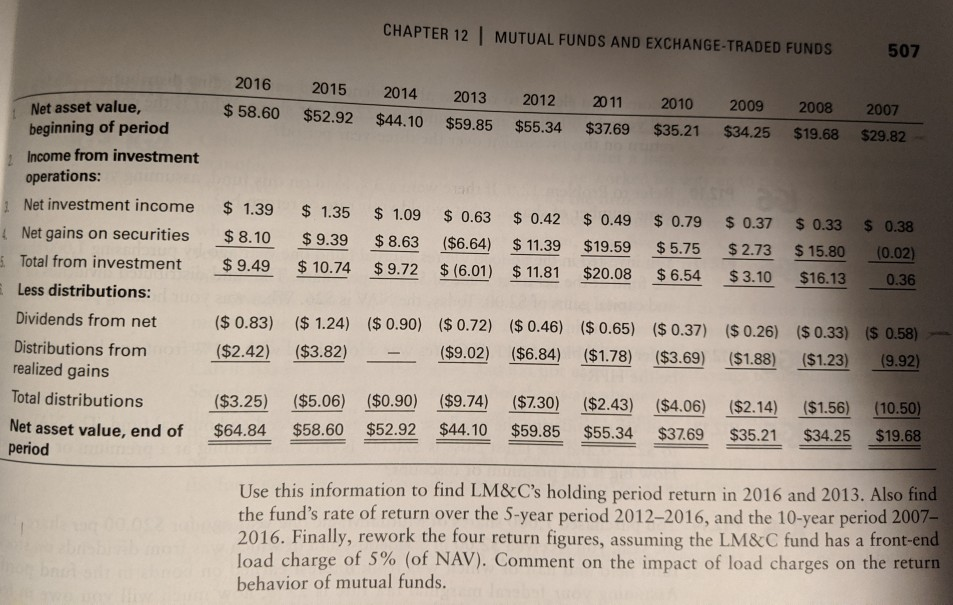

IG IG6 P125 Listed below is the 10-year per share performance record of Larry, Moe, & c. Growth Fund, as obtained from the fund's May 30, 2016, prospectus. CHAPTER 12 | MUTUAL FUNDS AND EXCHANGE-TRADED FUNDS 507 2016 $ 58.60 2015 $52.92 2014 $44.10 2013 $59.85 2012 $55.34 2011 $37.69 2010 $35.21 2009 $34.25 2008 $19.68 2007 $29.82 $ 1.39 $8.10 $9.49 $ 1.35 $ 9.39 $ 10.74 $ 1.09 $8.63 $9.72 $ 0.63 $ 0.42 ($6.64) $ 11.39 $(6.01) $11.81 $ 0.49 $19.59 $20.08 $ 0.79 $5.75 $ 6.54 $ 0.37 $2.73 $ 3.10 S 0.33 $15.80 $16.13 $ 0.38 (0.02) 0.36 Net asset value, beginning of period Income from investment operations: Net investment income Net gains on securities Total from investment Less distributions: Dividends from net Distributions from realized gains Total distributions Net asset value, end of period ($ 0.83) ($2.42) ($ 1.24) ($ 0.90) ($ 0.72) ($ 0.46) ($ 0.65) ($ 0.37) ($ 0.26) ($ 0.33) ($ 0.58) ($3.82) - ($9.02) ($6.84) ($1.78) ($3.69) ($1.88) ($1.23) 19.92) ($3.25) $64.84 ($5.06) ($0.90) ($9.74) $58.60 $52.92 $44.10 ($7.30) $59.85 ($2.43) $55.34 ($4.06) $37.69 ($2.14) $35.21 ($1.56) $34.25 (10.50) $19.68 Use this information to find LM&C's holding period return in 2016 and 2013. Also find the fund's rate of return over the 5-year period 2012-2016, and the 10-year period 2007- 2016. Finally, rework the four return figures, assuming the LM&C fund has a front-end load charge of 5% (of NAV). Comment on the impact of load charges on the return behavior of mutual funds. N O P o. D 2007 $ 29.82 E 2008 $ 19.68 F G H I J K L M 2009 2010 2011 2012 2013 2014 2015 2016 $ 34.25 $ 35.21 $ 37.69 S 55.34 $ 59.85 $ 44.10 $ 52.92 $ 58.60 $ NAV Beginning Income: Net Inv Income Net gains on securities Total Distributions: Dividends Realized Cap Gains Total Distributions 0.38 $ 0.33 10.02 $ 15.80 0.36 $ 16.13 $ S $ 0.37 $ 0.79 $ 0.49 S 0.42 $ 0.63 $ 2.73 $ 5.75 S 19.59 S 11.39 $ (6.64) S 3.10 $ 6.54 $ 20.08 S 11.81 $ (6.01) S 1.09 $ 1.35 $ 1.39 8.63 $_9.39 $ 8.10 REALIZED and UNREALED 9.72 $ 10.74 $ 9.49 $ $ 0.58 S 0.33 $ 0.26 $ 0.37 $ 0.65 $ 0.46 $ 0.72 $ 0.90 S 1.24 S 0.83 $ 9.92 $ 1.23 $ 1.88 $ 3.69 $ 1.78 $ 6.84 $ 9.02 $ $ 3.82 $ 2.42 $ 10.50 $ 1.56 $ 2.14 $ 4.06 S 2.43 $ 7.30 $ 9.74 $ 0.90 S 5.06 $ 3.25 $ 19,68 S 34.25 $ 35.21 $ 37.69 $ 55.34 $ 59.85 $ 44.10 $ 52.92 $ 58.60 $ 64.84 NAV Ending 17.2% 117.496 Annual Holding Period Return CES 5 year avg annual rate of return CFO CH1 $ (55.34) S 0.46 CH2 $ 9.74 CF3 S C 0.90 F4 $ IRR = 9.8% 5.06 $ 68.09 check figure IRR should be 21.1% 10 year avg annual rate of return CFO CF1 CF2 CF3CF4CFSCF6CFZ CF8CF9CF10 $ (29.82) S 0.58 $ 1.56 $ 2.14 S 4.06 $ 2.43 S 7.30 S 9.74 S 0.90 $ 5.06 $ 68.09 IRRE 16.0% Only use the YELLOW CELLS For the addition of the front end load of 5%, copy and paste your solution below, then change the Beginning NAV as needed. HINT: FIRST change the Ending NAV to be a number - NOT a formula HW template P12.5 and P12.14

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started