Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is the rest of the question, but i just need help with question 11. Selected company is IOOF Holding Limited is there anything else

this is the rest of the question, but i just need help with question 11.

this is the rest of the question, but i just need help with question 11.

Selected company is IOOF Holding Limited

Selected company is IOOF Holding Limited

is there anything else i can provide to you? can anybody plz help me! thank you so much!!!!!!!!!!!!

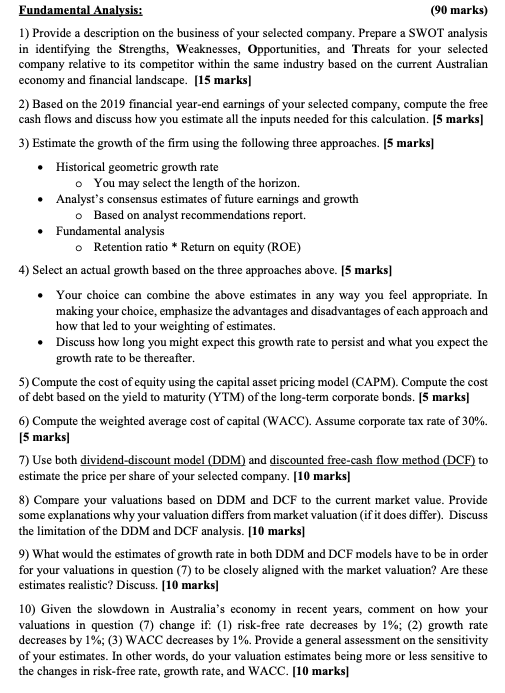

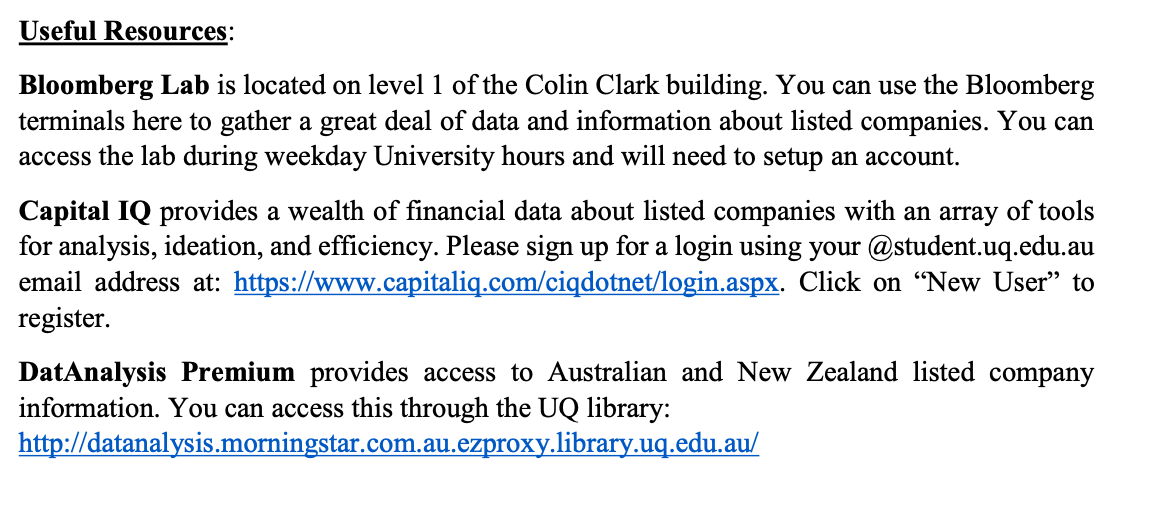

Fundamental Analysis: (90 marks) 1) Provide a description on the business of your selected company. Prepare a SWOT analysis in identifying the Strengths, Weaknesses, Opportunities, and Threats for your selected company relative to its competitor within the same industry based on the current Australian economy and financial landscape. [15 marks] 2) Based on the 2019 financial year-end earnings of your selected company, compute the free cash flows and discuss how you estimate all the inputs needed for this calculation. (5 marks] 3) Estimate the growth of the firm using the following three approaches. 15 marks] Historical geometric growth rate o You may select the length of the horizon. Analyst's consensus estimates of future earnings and growth o Based on analyst recommendations report. Fundamental analysis o Retention ratio * Return on equity (ROE) 4) Select an actual growth based on the three approaches above. [5 marks] Your choice can combine the above estimates in any way you feel appropriate. In making your choice, emphasize the advantages and disadvantages of each approach and how that led to your weighting of estimates. Discuss how long you might expect this growth rate to persist and what you expect the growth rate to be thereafter. 5) Compute the cost of equity using the capital asset pricing model (CAPM). Compute the cost of debt based on the yield to maturity (YTM) of the long-term corporate bonds. (5 marks] 6) Compute the weighted average cost of capital (WACC). Assume corporate tax rate of 30%. (5 marks) 7) Use both dividend-discount model (DDM) and discounted free-cash flow method (DCF) to estimate the price per share of your selected company. [10 marks] 8) Compare your valuations based on DDM and DCF to the current market value. Provide some explanations why your valuation differs from market valuation (if it does differ). Discuss the limitation of the DDM and DCF analysis. [10 marks) 9) What would the estimates of growth rate in both DDM and DCF models have to be in order for your valuations in question (7) to be closely aligned with the market valuation? Are these estimates realistic? Discuss. [10 marks] 10) Given the slowdown in Australia's economy in recent years, comment on how your valuations in question (7) change if: (1) risk-free rate decreases by 1%; (2) growth rate decreases by 1%; (3) WACC decreases by 1%. Provide a general assessment on the sensitivity of your estimates. In other words, do your valuation estimates being more or less sensitive to the changes in risk-free rate, growth rate, and WACC. [10 marks] Useful Resources: Bloomberg Lab is located on level 1 of the Colin Clark building. You can use the Bloomberg terminals here to gather a great deal of data and information about listed companies. You can access the lab during weekday University hours and will need to setup an account. Capital IQ provides a wealth of financial data about listed companies with an array of tools for analysis, ideation, and efficiency. Please sign up for a login using your @student.uq.edu.au email address at: https://www.capitaliq.com/ciqdotnet/login.aspx. Click on New User to register. DatAnalysis Premium provides access to Australian and New Zealand listed company information. You can access this through the UQ library: http://datanalysis.morningstar.com.au.ezproxy.library.uq.edu.au/ 11) Provide an assessment on your selected company in terms of its valuation relative to its competitor (at least two companies) within the same industry. Comparison can be done using valuation multiples as discussed in the lecture. In your capacity as an analyst, would you recommend investors buying/selling your selected company and explain why? [10 marks] Fundamental Analysis: (90 marks) 1) Provide a description on the business of your selected company. Prepare a SWOT analysis in identifying the Strengths, Weaknesses, Opportunities, and Threats for your selected company relative to its competitor within the same industry based on the current Australian economy and financial landscape. [15 marks] 2) Based on the 2019 financial year-end earnings of your selected company, compute the free cash flows and discuss how you estimate all the inputs needed for this calculation. (5 marks] 3) Estimate the growth of the firm using the following three approaches. 15 marks] Historical geometric growth rate o You may select the length of the horizon. Analyst's consensus estimates of future earnings and growth o Based on analyst recommendations report. Fundamental analysis o Retention ratio * Return on equity (ROE) 4) Select an actual growth based on the three approaches above. [5 marks] Your choice can combine the above estimates in any way you feel appropriate. In making your choice, emphasize the advantages and disadvantages of each approach and how that led to your weighting of estimates. Discuss how long you might expect this growth rate to persist and what you expect the growth rate to be thereafter. 5) Compute the cost of equity using the capital asset pricing model (CAPM). Compute the cost of debt based on the yield to maturity (YTM) of the long-term corporate bonds. (5 marks] 6) Compute the weighted average cost of capital (WACC). Assume corporate tax rate of 30%. (5 marks) 7) Use both dividend-discount model (DDM) and discounted free-cash flow method (DCF) to estimate the price per share of your selected company. [10 marks] 8) Compare your valuations based on DDM and DCF to the current market value. Provide some explanations why your valuation differs from market valuation (if it does differ). Discuss the limitation of the DDM and DCF analysis. [10 marks) 9) What would the estimates of growth rate in both DDM and DCF models have to be in order for your valuations in question (7) to be closely aligned with the market valuation? Are these estimates realistic? Discuss. [10 marks] 10) Given the slowdown in Australia's economy in recent years, comment on how your valuations in question (7) change if: (1) risk-free rate decreases by 1%; (2) growth rate decreases by 1%; (3) WACC decreases by 1%. Provide a general assessment on the sensitivity of your estimates. In other words, do your valuation estimates being more or less sensitive to the changes in risk-free rate, growth rate, and WACC. [10 marks] Useful Resources: Bloomberg Lab is located on level 1 of the Colin Clark building. You can use the Bloomberg terminals here to gather a great deal of data and information about listed companies. You can access the lab during weekday University hours and will need to setup an account. Capital IQ provides a wealth of financial data about listed companies with an array of tools for analysis, ideation, and efficiency. Please sign up for a login using your @student.uq.edu.au email address at: https://www.capitaliq.com/ciqdotnet/login.aspx. Click on New User to register. DatAnalysis Premium provides access to Australian and New Zealand listed company information. You can access this through the UQ library: http://datanalysis.morningstar.com.au.ezproxy.library.uq.edu.au/ 11) Provide an assessment on your selected company in terms of its valuation relative to its competitor (at least two companies) within the same industry. Comparison can be done using valuation multiples as discussed in the lecture. In your capacity as an analyst, would you recommend investors buying/selling your selected company and explain why? [10 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started