Answered step by step

Verified Expert Solution

Question

1 Approved Answer

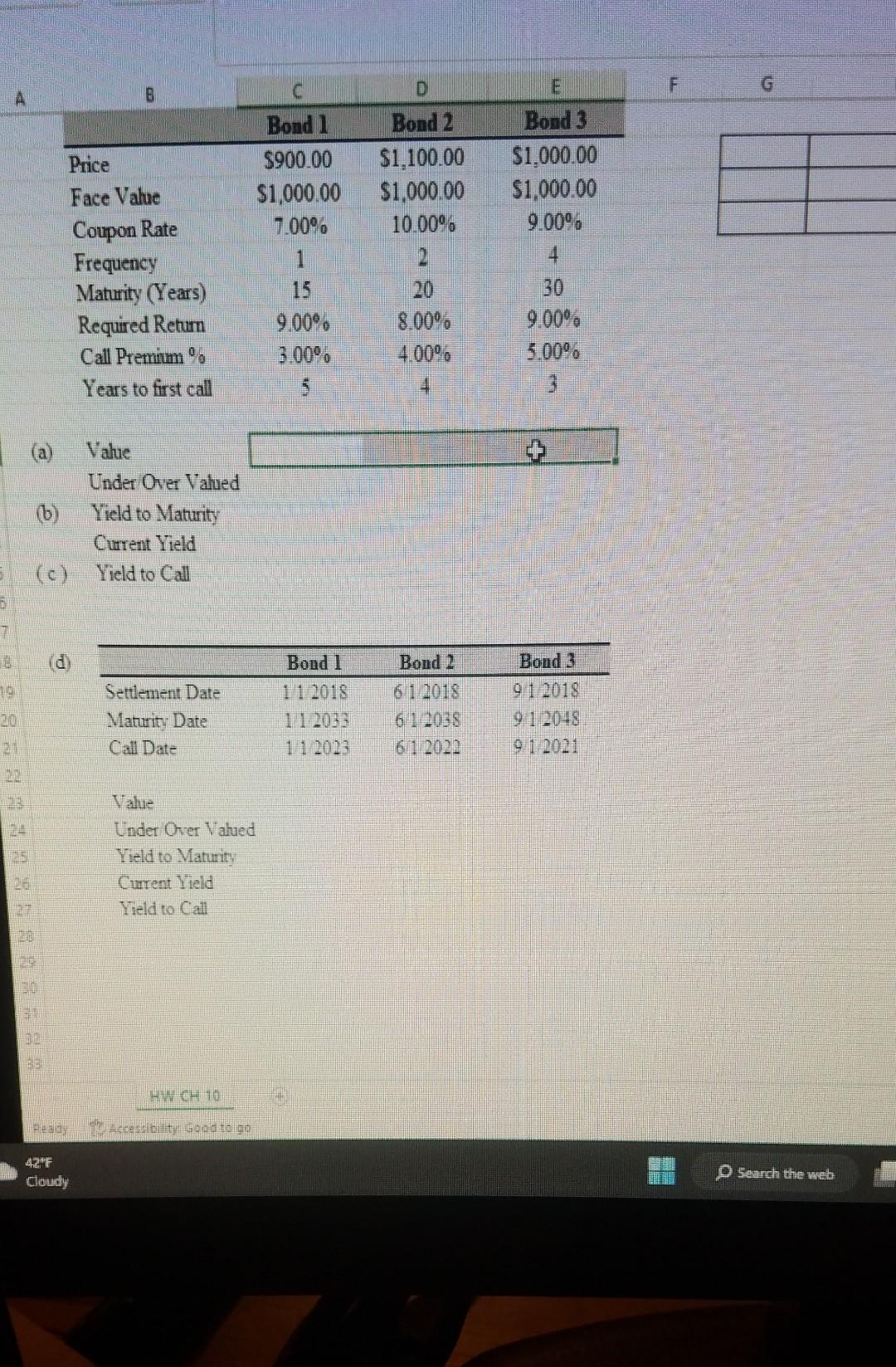

this is the spreadsheet . this is data. can somebody guide me through this. problem. Value Under Over Valued Yield to Maturity Current Yield Yield

this is the spreadsheet .

this is data.

can somebody guide me through this. problem.

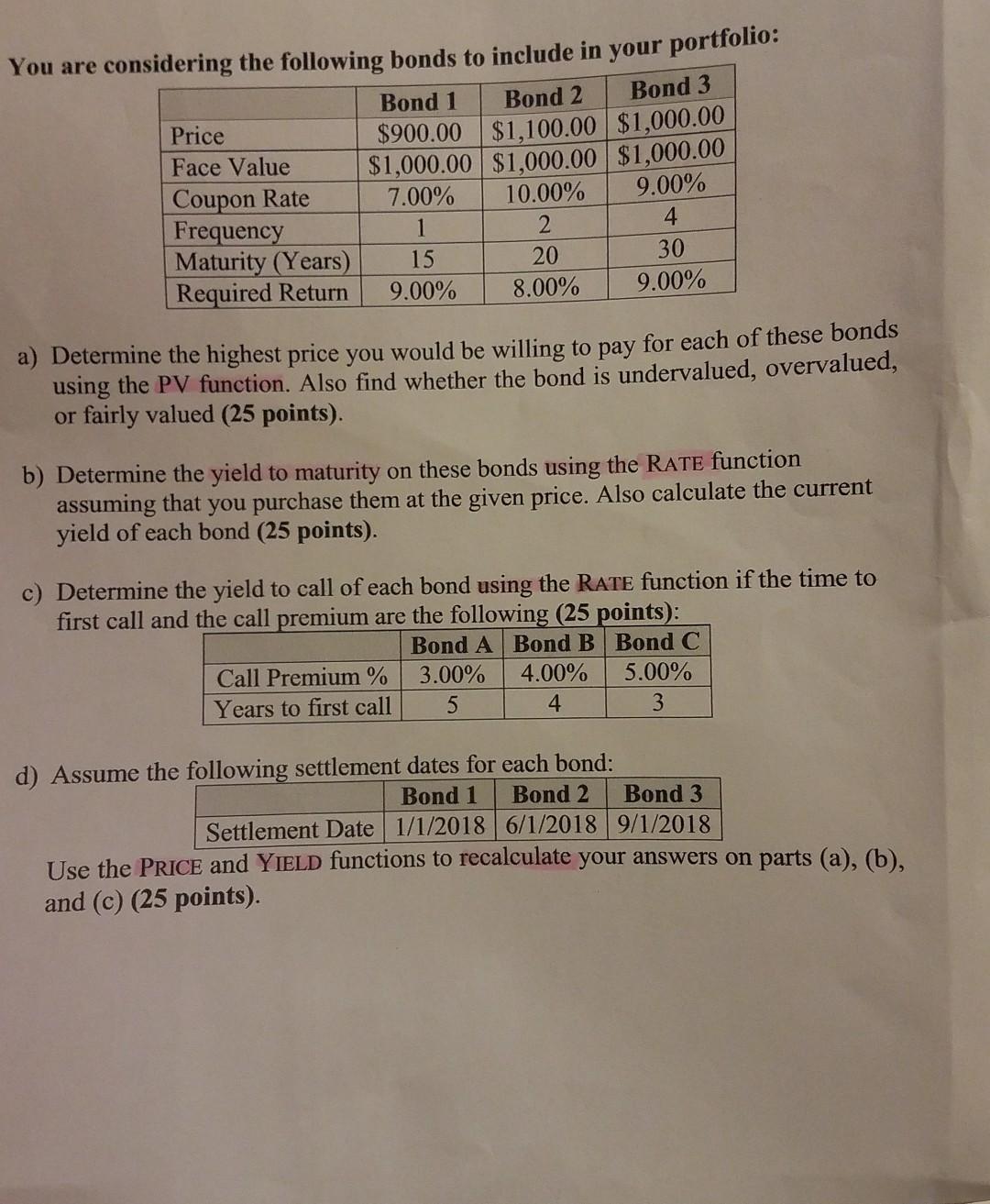

Value Under Over Valued Yield to Maturity Current Yield Yield to Call You are considering the following bonds to include in your portfolio: a) Determine the highest price you would be willing to pay for each of these bonds using the PV function. Also find whether the bond is undervalued, overvalued, or fairly valued ( 25 points). b) Determine the yield to maturity on these bonds using the RATE function assuming that you purchase them at the given price. Also calculate the current yield of each bond ( 25 points). c) Determine the yield to call of each bond using the RATE function if the time to first call and the call premium are the following ( 25 points): d) Assume the following settlement dates for each bond: Use the PRICE and YIELD functions to recalculate your answers on parts (a), (b), and (c) (25 points). Value Under Over Valued Yield to Maturity Current Yield Yield to Call You are considering the following bonds to include in your portfolio: a) Determine the highest price you would be willing to pay for each of these bonds using the PV function. Also find whether the bond is undervalued, overvalued, or fairly valued ( 25 points). b) Determine the yield to maturity on these bonds using the RATE function assuming that you purchase them at the given price. Also calculate the current yield of each bond ( 25 points). c) Determine the yield to call of each bond using the RATE function if the time to first call and the call premium are the following ( 25 points): d) Assume the following settlement dates for each bond: Use the PRICE and YIELD functions to recalculate your answers on parts (a), (b), and (c) (25 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started