Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is the template given and we are supposed to assume a discount rate of 7% Please help! I am very confused Prepare the financial

This is the template given and we are supposed to assume a discount rate of 7%

Please help! I am very confused

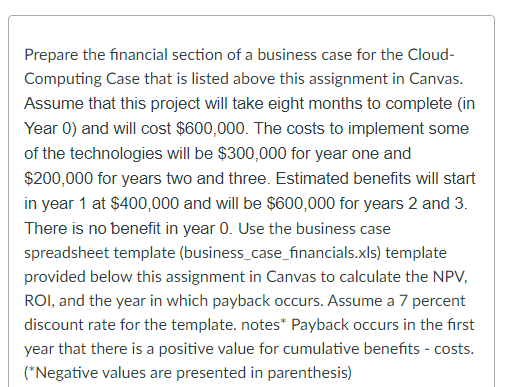

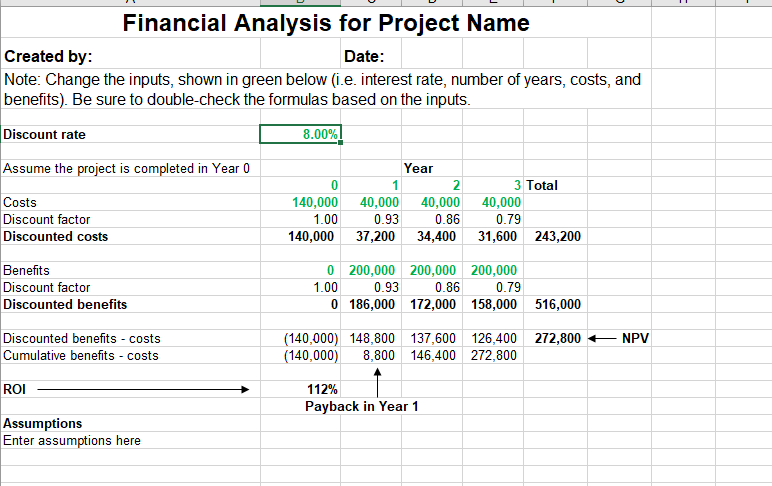

Prepare the financial section of a business case for the Cloud- Computing Case that is listed above this assignment in Canvas. Assume that this project will take eight months to complete (in Year 0) and will cost $600,000. The costs to implement some of the technologies will be $300,000 for year one and $200,000 for years two and three. Estimated benefits will start in year 1 at $400,000 and will be $600,000 for years 2 and 3. There is no benefit in year 0. Use the business case spreadsheet template (business_case_financials.xls) template provided below this assignment in Canvas to calculate the NPV, ROI, and the year in which payback occurs. Assume a 7 percent discount rate for the template. notes* Payback occurs in the first year that there is a positive value for cumulative benefits - costs. (*Negative values are presented in parenthesis) Financial Analysis for Project Name Created by: Date: Note: Change the inputs, shown in green below (1.e. interest rate, number of years, costs, and benefits). Be sure to double-check the formulas based on the inputs. Discount rate 8.00%! Assume the project is completed in Year 0 Costs Discount factor Discounted costs 0 140,000 1.00 140,000 Year 1 2 40,000 40,000 0.93 0.86 37,200 34,400 3 Total 40,000 0.79 31,600 243,200 Benefits Discount factor Discounted benefits 0 200,000 200,000 200,000 1.00 0.93 0.86 0.79 O 186,000 172,000 158,000 516,000 NPV Discounted benefits - costs Cumulative benefits - costs (140,000) 148,800 137,600 126,400 272,800 (140,000) 8,800 146,400 272,800 ROI 112% Payback in Year 1 Assumptions Enter assumptions hereStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started