Question

This is the third time I am posting this question in order to get it answered. Please answer the question in the format shown below.

This is the third time I am posting this question in order to get it answered. Please answer the question in the format shown below.

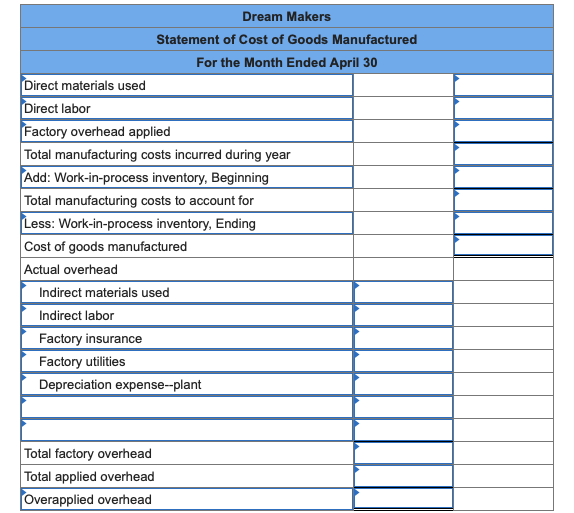

Dream Makers is a small manufacturer of gold and platinum jewelry. It uses a job costing system that applies overhead on the basis of direct labor hours. Budgeted factory overhead for the year was $642,600, and management budgeted 42,000 direct labor-hours. The company had no Materials, Work-in-Process, or Finished Goods Inventory at the beginning of April. These transactions were recorded during April:

- April insurance cost for the manufacturing property and equipment was $2,650. The premium had been paid in January.

- Recorded $1,620 depreciation on an administrative asset.

- Purchased 21 pounds of high-grade polishing materials at $16 per pound (indirect materials).

- Paid factory utility bill, $7,190, in cash.

- Incurred 4,000 hours and paid payroll costs of $160,000. Of this amount, 1,000 hours and $20,000 were indirect labor costs.

- Incurred and paid other factory overhead costs, $6,780.

- Purchased $33,000 of materials. Direct materials included unpolished semiprecious stones and gold. Indirect materials included supplies and polishing materials.

- Requisitioned $27,000 of direct materials and $3,300 of indirect materials from Materials Inventory.

- Incurred miscellaneous selling and administrative expenses, $8,040.

- Incurred $5,290 depreciation on manufacturing equipment for April.

- Paid advertising expenses in cash, $3,925.

- Applied factory overhead to production on the basis of direct labor hours.

- Completed goods costing $72,500 during the month.

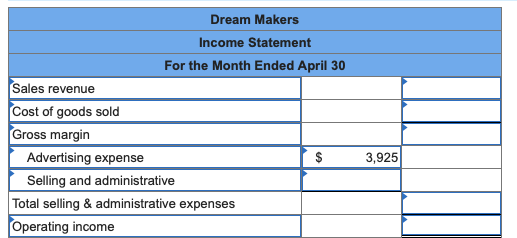

- Made sales on account in April, $77,980. The Cost of Goods Sold was $62,140.

Required:

1. Prepare a schedule of Cost of Goods Manufactured.

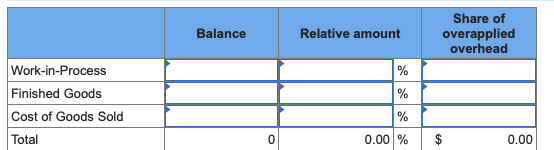

2. Compute the amount of overapplied or underapplied overhead that should be prorated to Work-in-Process, Finished Goods, and Cost of Goods Sold.

3. Prepare the income statement for April.

Dream Makers Statement of Cost of Goods Manufactured For the Month Ended April 30 Direct materials used Direct labor Factory overhead applied Total manufacturing costs incurred during year Add: Work-in-process inventory, Beginning Total manufacturing costs to account for Less: Work-in-process inventory, Ending Cost of goods manufactured Actual overhead Indirect materials used Indirect labor Factory insurance Factory utilities Depreciation expense--plant Total factory overhead Total applied overhead Overapplied overhead Balance Relative amount Share of overapplied overhead Work-in-Process Finished Goods Cost of Goods Sold % % % 0.00 % Total 0 $ 0.00 Dream Makers Income Statement For the Month Ended April 30 Sales revenue Cost of goods sold Gross margin Advertising expense Selling and administrative Total selling & administrative expenses Operating income 3,925

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started