Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is the third time I have posted this question. Exercise 3-21 (Algorithmic) (LO. 2) Compute the 2021 standard deduction for the following taxpayers. If

This is the third time I have posted this question.

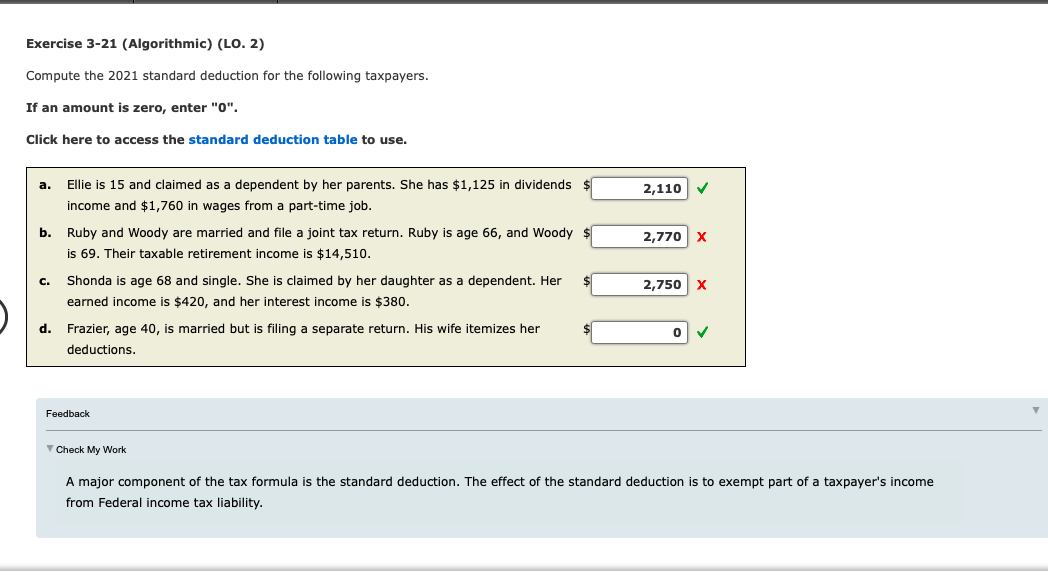

Exercise 3-21 (Algorithmic) (LO. 2) Compute the 2021 standard deduction for the following taxpayers. If an amount is zero, enter "O". Click here to access the standard deduction table to use. a. 2,110 2,770 X Ellie is 15 and claimed as a dependent by her parents. She has $1,125 in dividends income and $1,760 in wages from a part-time job. b. Ruby and Woody are married and file a joint tax return. Ruby is age 66, and Woody $ is 69. Their taxable retirement income is $14,510. c. Shonda is age 68 and single. She is claimed by her daughter as a dependent. Her earned income is $420, and her interest income is $380. d. Frazier, age 40, is married but is filing a separate return. His wife itemizes her deductions. 2,750 X 0 Feedback Check My Work A major component of the tax formula is the standard deduction. The effect of the standard deduction is to exempt part of a taxpayer's income from Federal income tax liabilityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started