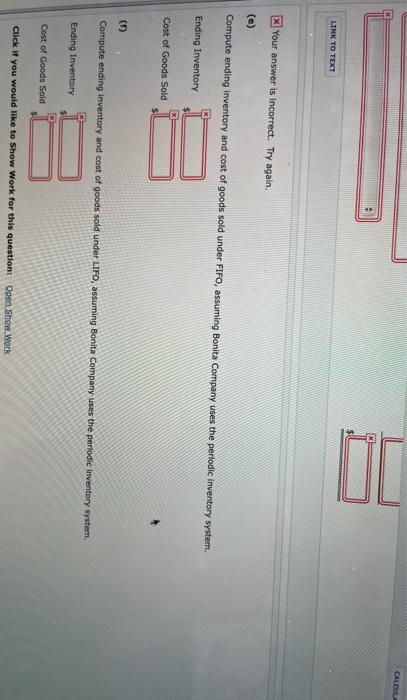

This is the third time i'm posting the SAME question, please make sure you answer all the questions that I haven't solved clearley!!!

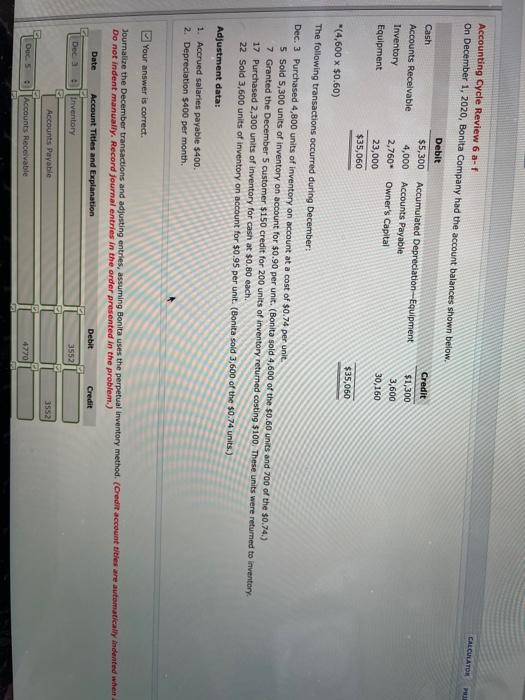

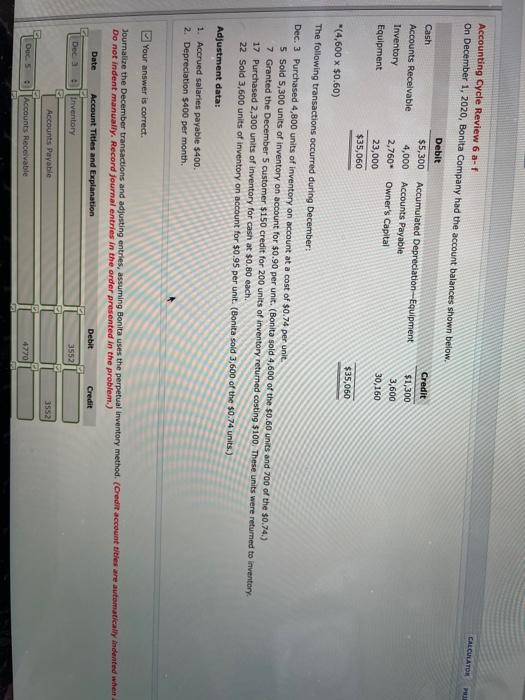

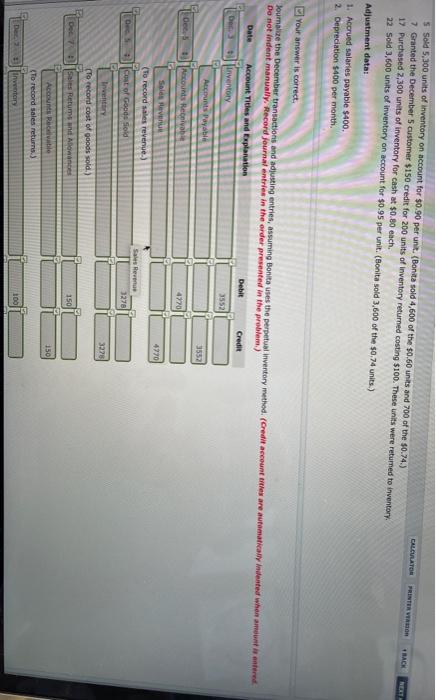

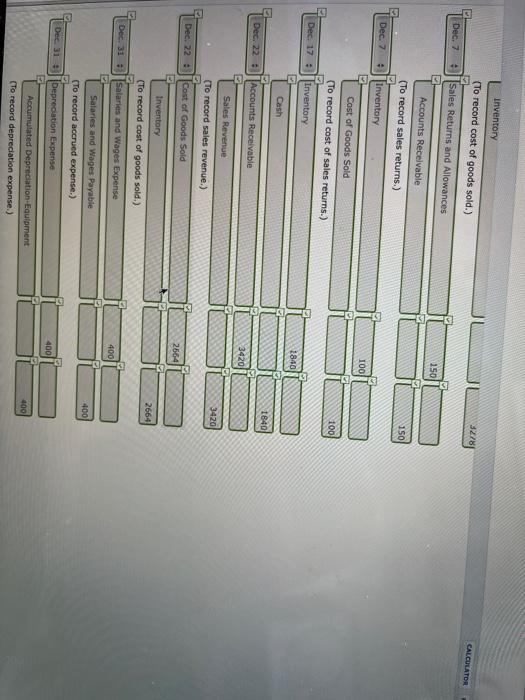

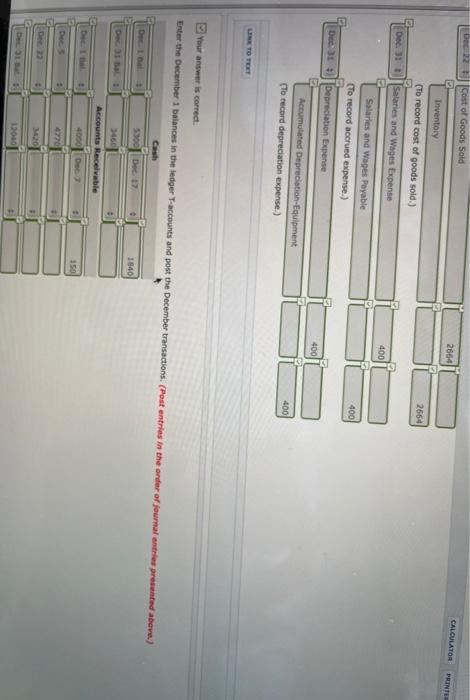

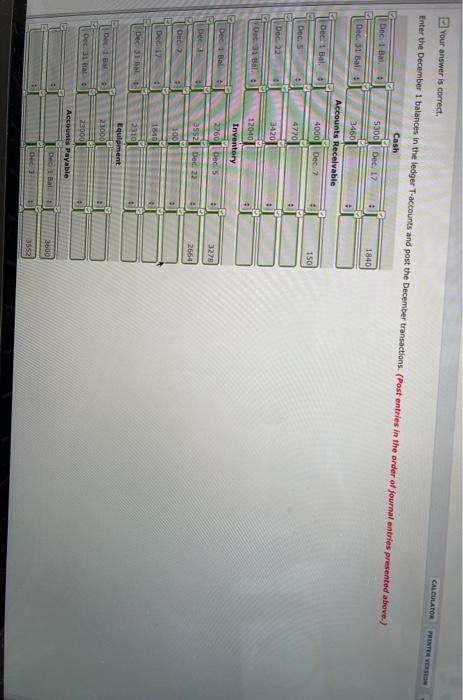

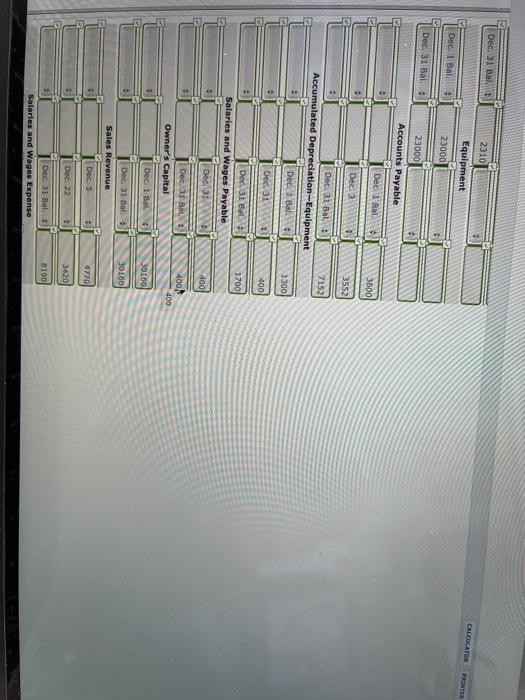

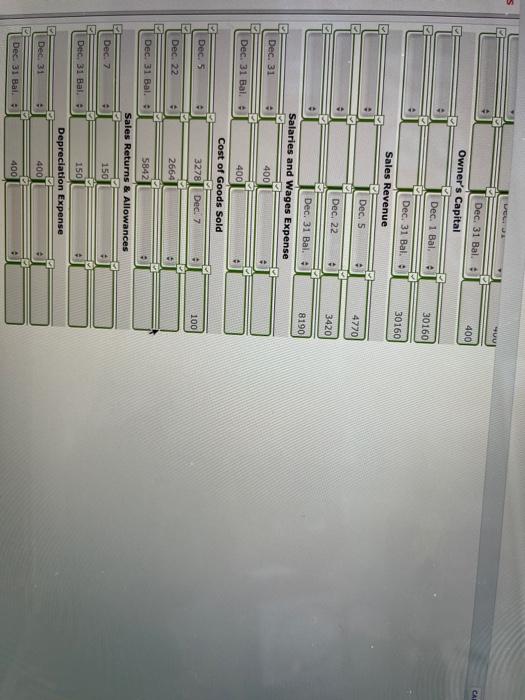

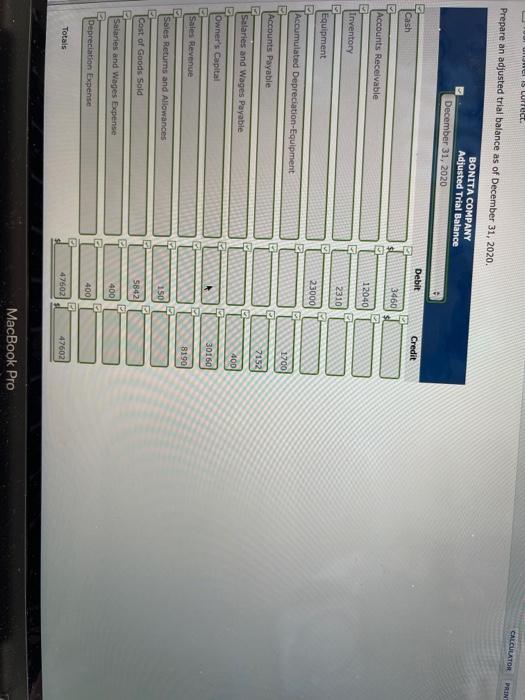

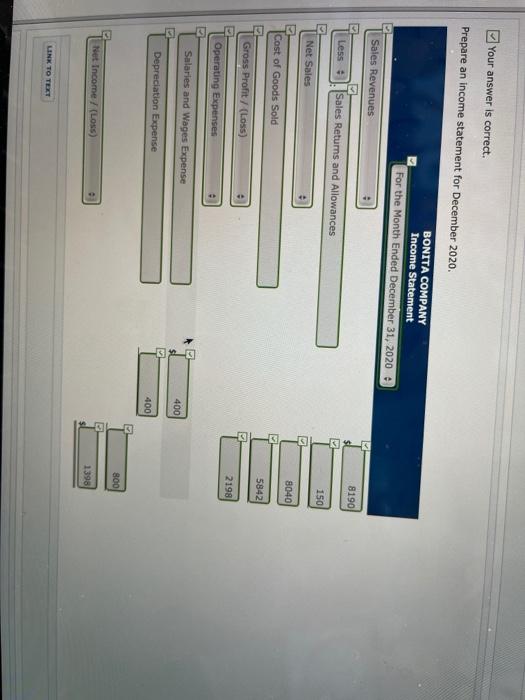

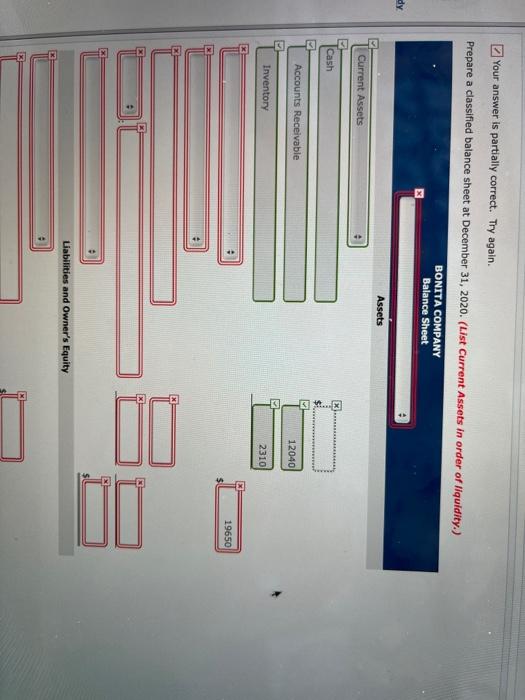

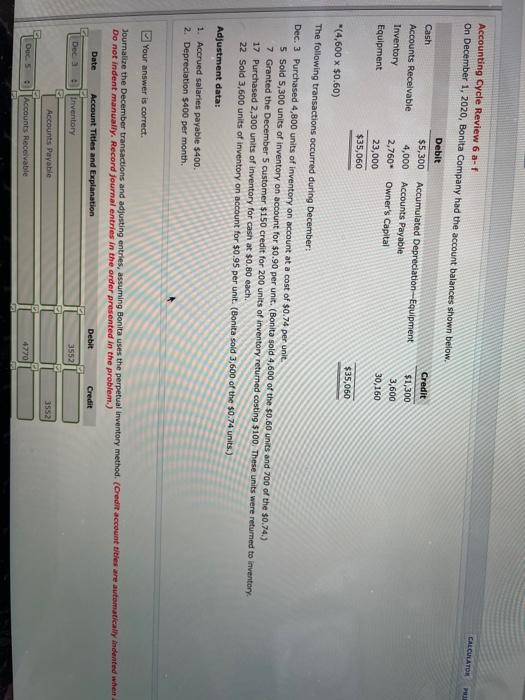

CALCULATOR Accounting Cycle Review 6 af On December 1, 2020, Bonita Company had the account balances shown below. Debit Cash $5,300 Accumulated Depreciation-Equipment Accounts Receivable 4,000 Accounts Payable Inventory 2,760* Owner's Capital Equipment 23,000 $35,060 Credit $1,300 3,600 30,160 $35,060 *(4,600 x $0.60) The following transactions occurred during December: Dec. 3 Purchased 4,800 units of inventory on account at a cost of $0.74 per unit. 5 Sold 5,300 units of inventory on account for $0.90 per unit. (Bonita sold 4,600 of the $0.50 units and 700 of the $0.74.) 7 Granted the December 5 customer $150 credit for 200 units of inventory returned costing $100. These units were returned to inventory. 17 Purchased 2,300 units of inventory for cash at $0.80 each. 22 Sold 3,600 units of inventory on account for $0.95 per unit (Bonita sold 3,600 of the $0.74 units.) Adjustment data: 1. Accrued salaries payable $400. 2. Depreciation $400 per month. Your answer is correct. Journalize the December transactions and adjusting entries, assuming Bonita uses the perpetual inventory method. (Credit account titles are automatically indeed when Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit Dec a Inventory 3552 Accounts Payable 3552 Duc 5 Accounts Receivable 4770 5 Sold 5.300 units of inventory on account for $0.90 per unit. (Bonita Sold 4,600 of the $0,60 units and 700 of the $0.74.) 7 Granted the December 5 customer $150 credit for 200 units of inventory returned costing $100. These units were retumed to inventory 17 Purchased 2,300 units of inventory for cash at $0.80 each 22 Sold 3.600 units of inventory on account for $0.95 per unit (Bonita sold 3,600 of the 50.74 units.) CALCULATOR BACK Adjustment data: 1. Accrued salaries payable $400. 2. Depreciation $400 per month Your answer is correct. Journalize the December transactions and adjusting entries, assuming Bonita uses the perpetual inventory method. (Credit accountries are automatically Indented when amount is entered Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit Dan Inventory 3552 Accounts Payable Dettecounts Receivable 4770 Sales Revenue (To record sales revenue.) 4770 Coat of Goods Sold Sales Revenue 3276 3278 In (To record cost of goods sold.) Dosis Retums and Awan 150 Accounts Receivable 150 To record sales returns. Der ulinary 100 inventory (To record cost of goods sold.) 3210 CALCULATOR Dec. 7 + Sales Returns and Allowances 250 Accounts Receivable (To record sales returns.) 150 Dec. 7 Inventory 100 Cost of Goods Sold (To record cost of sales returns.) 100 Dec. 17 Inventory 2840 1840 Dec. 22 Accounts Receivable 3420 Sales Revenue (To record sales revenue.) 3420 Dec. 22 Cost of Goods Sold 2564 Inventory (To record cost of goods sold.) 2664 Dec 31 Salaries and Wages Expense 400 Salaries and Wages Payable (To record accrued expense.) 400 400 Dec. 31 Depreciation Expense E Accumulated Depreciation Equipment (To record depreciation expense.) 400 DOC22 Cost of Goods Sold 2664 CALCULATOR Inventory (To record cost of goods sold.) 2664 Dec 31 Salaries and Wages Expense 400 Salaries and Wages Payable (To record accrued expense.) 400 Dec 31 Depreciation Expense 400 Accumulated Depreciation Equipment (To record depreciation expense) 400 UN TO THE Your answer is correct Enter the December 1 balances in the edger T-accounts and post the December transactions. (Post entries in the order of journal entre presented above) 1 530 Dec 17 1940 Accounts Receivable 4000 Doc 159 3 4770 3420 12040 Your answer is correct. CALCULATOR Enter the December 1 balances in the ledger T-accounts and post the December transactions. (Post entries in the order of journal entries presented above.) Cash Dec. 1 Bal. + 5300] Dec 17 1840 Dec. 31 Bal : 3460 Accounts Receivable Deci Bal 4000 | Dec. 7 150 Doc. 5 4770 Dec 22 3420 FO31 Ball 12040 Inventory Det 1 Bal 2760 Dec. 5 3278 3552 Bed 22 2664 Die 100 Dec 17 1830 Dec 31 bal 2310 Equipment Di Bal 2.3000 Det al 21000 Accounts Payable Dec 1 bal 3600 3552 Dec 31 Bal 2310 Equipment CALCULATOR PRINTER Dec. 1 Bal 23000 Dec. 31 Bal 23000 Accounts Payable Dec 1 3600 Dec 3 3552 7152 Dec 31 Bal! Accumulated Depreciation--Equipment Dec. 1 Bald : 1300 Dec 31 400 Dec 31 Bal Salaries and Wages Payable 1700 Dec 31 400 Dec 31 B. Owner's Capital 400 400 Dec. 1 Bal 301601 Dec 31 Bali Sales Revenue 30160 Dec. 5 4770 Dec 22 . 3420 8190 Dec 31 Bal Salaries and Wages Expense UU Dec. 31 Bal. CAL 400 Owner's Capital Dec. 1 Bal 30160 Dec. 31 Bal. Sales Revenue 30160 Dec. 5 4720 Dec, 22 3420 Dec. 31 Bal. 8190 Salaries and Wages Expense Dec. 31 400 Dec. 31 Bal 400 Cost of Goods Sold Dec. 5 3278 Decu 7 100 Dec. 22 2664 Dec. 31 Bal. 5842 Sales Returns & Allowances Dec. 7 150 Dec. 31 Bal. 150 Depreciation Expense Dec. 31 400 Dec. 31 Bal. 400 15 LUFTUCE CALCULATOR Prepare an adjusted trial balance as of December 31, 2020. BONITA COMPANY Adjusted Trial Balance December 31, 2020 Debit Credit Cash 3460 Accounts Receivable 12040 Inventory 2310 Equipment 23000 Accumulated Depreciation-Equipment 1700 Accounts Payable 7152 Salaries and Wages Payable 400 Owner's Capital 30160 Sales Revenue 8190 Sales Returns and Allowances 150 Cost of Goods Sold 5842 Salaries and Wages Expense 400 Depreciation Expense 400 Totals 47602 47602 MacBook Pro Your answer is correct. Prepare an income statement for December 2020. BONITA COMPANY Income Statement For the Month Ended December 31, 2020 Sales Revenues SI 8190 Less : Sales Returns and Allowances 150 Net Sales 8040 Cost of Goods Sold 5842 Gross Profit/ (Loss) 2198 Operating Expenses Salaries and Wages Expense si 400 Depreciation Expense 400 800 Net Income (Loss) 1398 LINK TO TEXT Your answer is partially correct. Try again. Prepare a classified balance sheet at December 31, 2020. (List Current Assets in order of liquidity.) BONITA COMPANY Balance Sheet dy Assets Current Assets Cash Accounts Receivable HTU 12040 Inventory 2310 19650 2 Od DO Liabilities and Owner's Equity Liabilities and Owner's Equity CALCOLA LINK TO TEXT x Your answer is incorrect. Try again. Compute ending Inventory and cost of goods sold under FIFO, assuming Bonita Company uses the periodic inventory system. Ending Inventory Cost of Goods Sold (6) Compute ending Inventory and cost of goods sold under LIFO, assuming Bonita Company uses the periodic inventory system Ending Inventory Cost of Goods Sold Click if you would like to Show Work for this question Open Show Work