Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is the whole thing, i have found the data given in that table, what i need help with is part 5 please mention which

this is the whole thing, i have found the data given in that table, what i need help with is part 5 please mention which data do you need me to provide you or assume any missing data and mention the reason behind the assumption, thank you

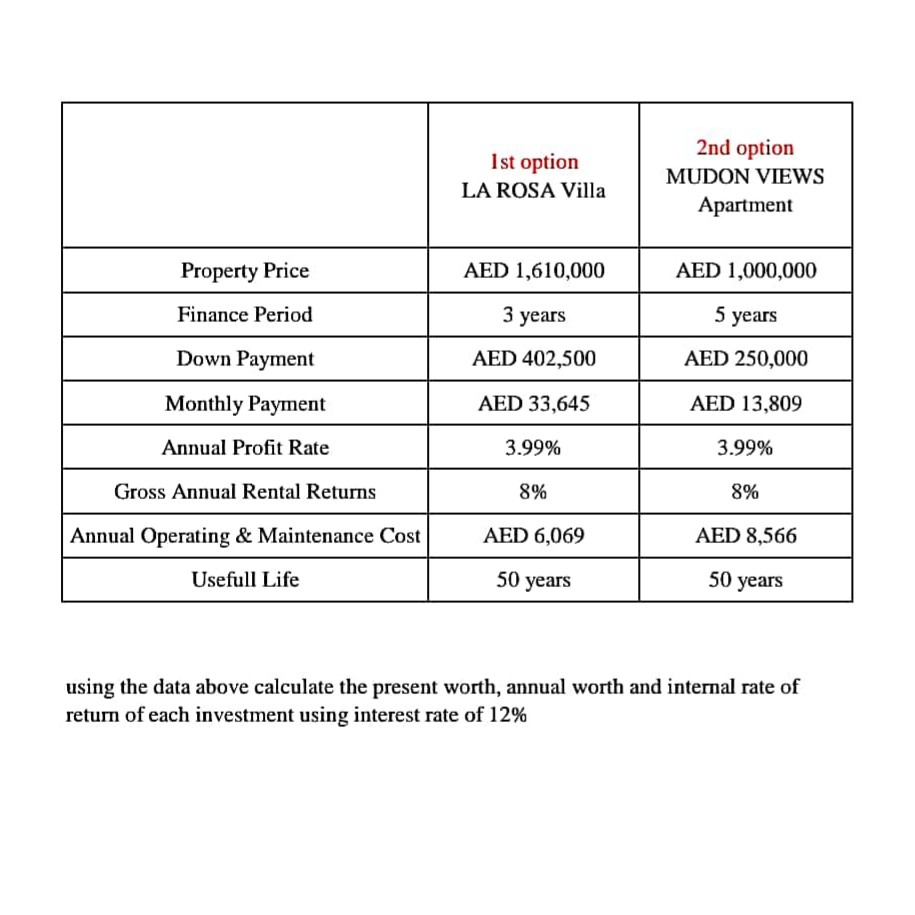

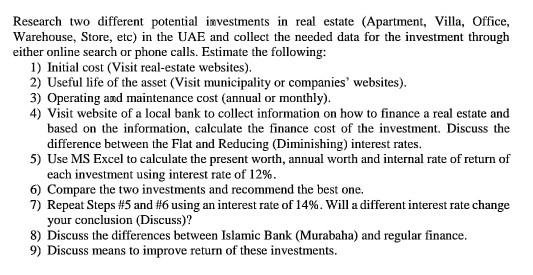

Ist option LA ROSA Villa 2nd option MUDON VIEWS Apartment Property Price AED 1,610,000 AED 1,000,000 Finance Period 3 years 5 years Down Payment AED 402.500 AED 250,000 Monthly Payment AED 33,645 AED 13,809 Annual Profit Rate 3.99% 3.99% Gross Annual Rental Returns 8% 8% AED 6,069 AED 8,566 Annual Operating & Maintenance Cost Usefull Life 50 years 50 years using the data above calculate the present worth, annual worth and internal rate of return of each investment using interest rate of 12% Research two different potential investments in real estate (Apartment, Villa, Office, Warehouse, Store, etc) in the UAE and collect the needed data for the investment through either online search or phone calls. Estimate the following: 1) Initial cost (Visit real-estate websites). 2) Useful life of the asset (Visit municipality or companies' websites). 3) Operating and maintenance cost (annual or monthly). 4) Visit website of a local bank to collect information on how to finance a real estate and based on the information, calculate the finance cost of the investment. Discuss the difference between the Flat and Reducing (Diminishing) interest rates. 5) Use MS Excel to calculate the present worth, annual worth and internal rate of return of each investment using interest rate of 12%. 6) Compare the two investments and recommend the best one. 7) Repeat Steps #5 and #6 using an interest rate of 14%. Will a different interest rate change your conclusion (Discuss)? 8) Discuss the differences between Islamic Bank (Murabaha) and regular finance. 9) Discuss means to improve return of these investmentsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started