This is urgent!!! Please calculate the profit as of the end of Jan 2022?

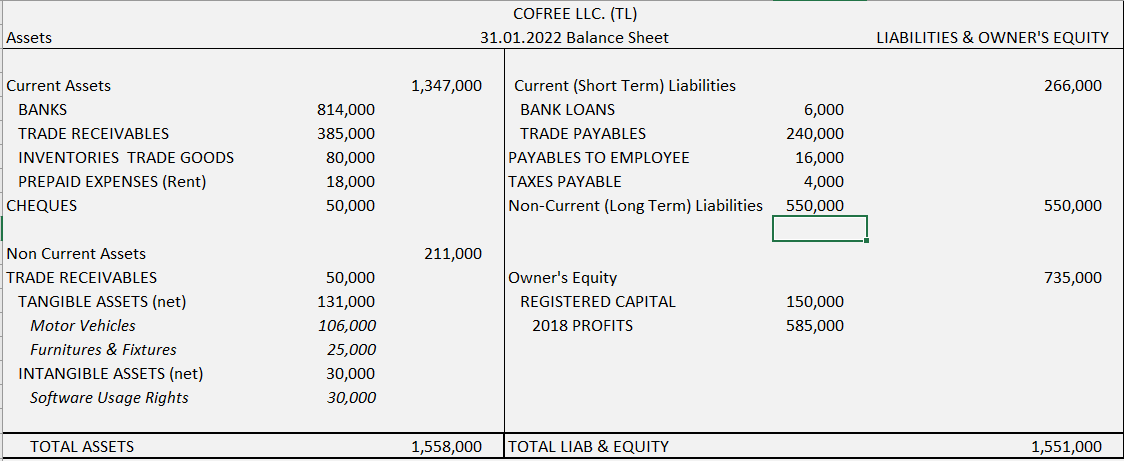

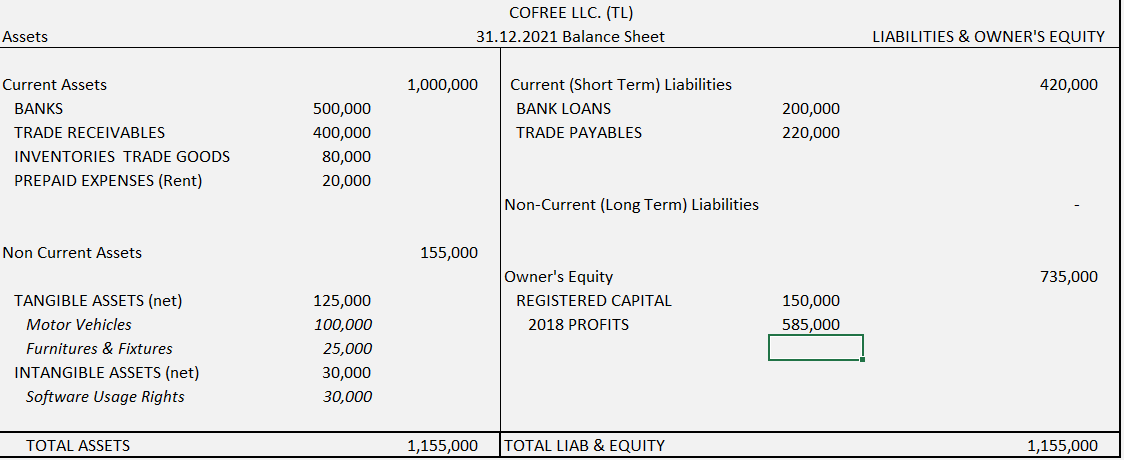

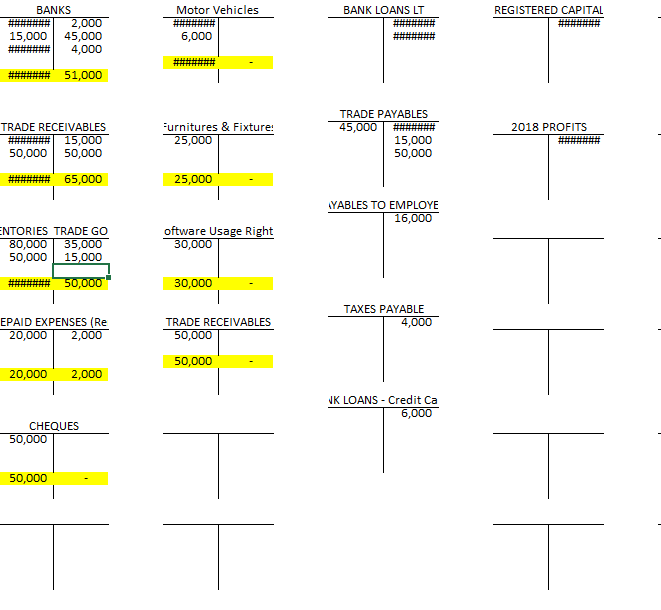

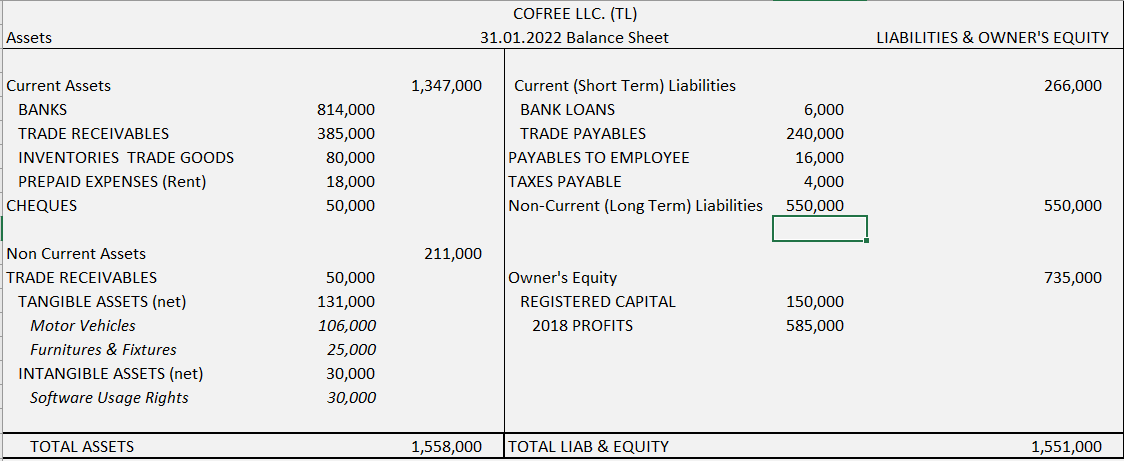

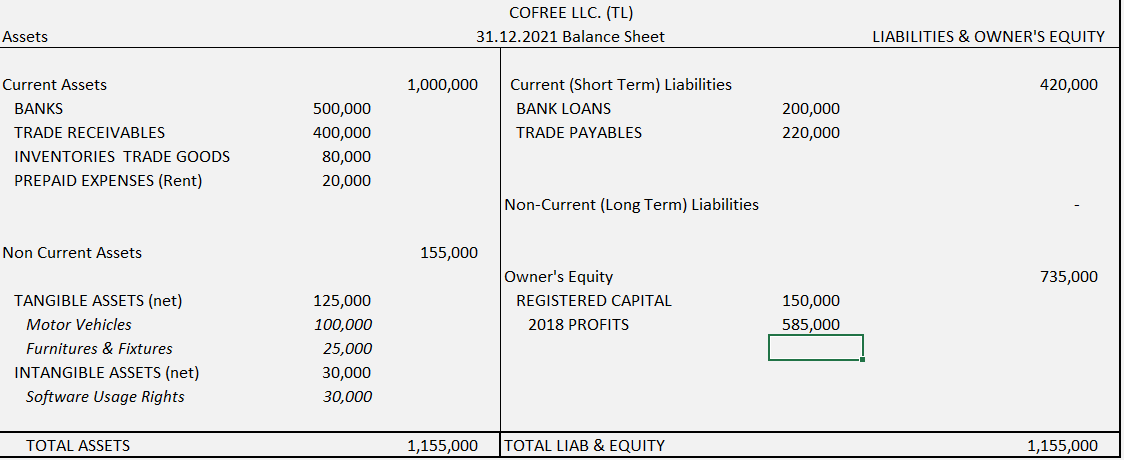

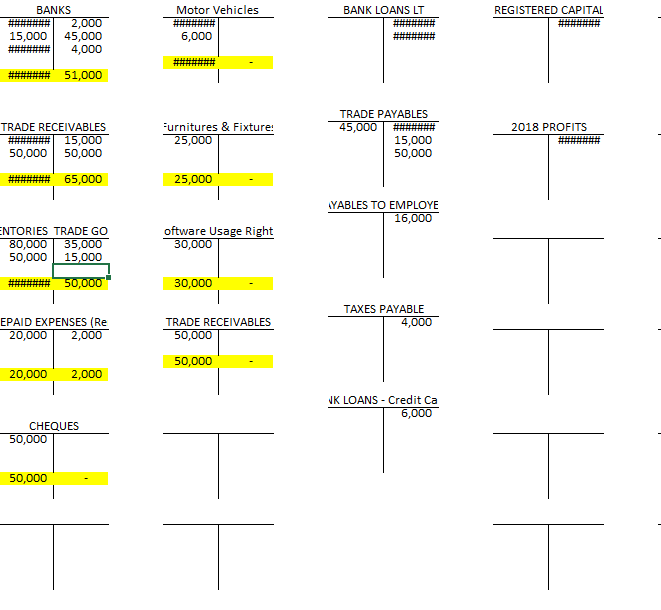

COFREE LLC. (TL) Assets 31.01.2022 Balance Sheet LIABILITIES \& OWNER'S EQUITY Current Assets COFREE LLC. (TL) Assets 31.12.2021 Balance Sheet LIABILITIES \& OWNER'S EQUITY Current Assets BANKS TRADE RECEIVABLES INVENTORIES TRADE GOODS PREPAID EXPENSES (Rent) Non-Current (Long Term) Liabilities Non Current Assets Owner's Equity TANGIBLE ASSETS (net) Motor Vehicles REGISTERED CAPITAL Furnitures \& Fixtures INTANGIBLE ASSETS (net) Software Usage Rights 2018 PROFITS 735,000 TOTAL ASSETS \begin{tabular}{l|l} 1,155,000 & TOTAL LIAB \& EQUITY \end{tabular} Jan 9 ADMIN Expenses BANKS 2,000.00 2,000.00 Jan11 BANKS TRADE RECEIVABLES 15,000.00 15,000.00 Jan13 TRADE PAYABLES BANKS 45,000.00 45,000.00 Jan 14 GIVEN CHEQUES TRADE RECEIVABLES 50,000.00 50,000.00 Jan19 MACHINERY AND EQUIPMENTS 6,000.00 BANK LOANS - Credit Cards 6,000.00 tan21 TRADE RECEIVABLES LT SALES 50,000.00 50,000.00 Jan21 COGS INVENTORIES 35,000.00 35,000.00 Jan 29 Marketing Expenses BANKS 4,000.00 4,000.00 Jan31 ADMIN Expenses PREPAID EXPENSES 2,000.00 2,000.00 Jan31 ADMIN Expenses 20,000.00 Payables to employees 16,000.00 Taxes Payable 4,000.00 \begin{tabular}{l|r} \multicolumn{2}{c}{ BANKS } \\ \hline \#\#\#\#\#\#\# & 2,000 \\ 15,000 & 45,000 \\ \#\#\#\#\#\# & 4,000 \\ \#\#\#\#\# & 51,000 \end{tabular} BANK LOANS LT REGISTERED CAPITAL \begin{tabular}{l} \hline \#\#\#\#\#\# \\ \#\#\#\#\#\#\# \end{tabular} \#\#\#\#\#\# \begin{tabular}{c|r} EPAID EXPENSES (Re \\ \hline 20,000 & 2,000 \\ \hline 20,000 & 2,000 \\ \hline \end{tabular} \begin{tabular}{c|c} \multicolumn{2}{c}{ TRADE RECEIVABLES } \\ \hline 50,000 & \\ 50,000 & \end{tabular} \begin{tabular}{l|r|r} \multicolumn{3}{c}{ TAXES PAYABLE } \\ \hline & 4,000 & \\ \cline { 3 - 4 } & & \end{tabular} COFREE LLC. (TL) Assets 31.01.2022 Balance Sheet LIABILITIES \& OWNER'S EQUITY Current Assets COFREE LLC. (TL) Assets 31.12.2021 Balance Sheet LIABILITIES \& OWNER'S EQUITY Current Assets BANKS TRADE RECEIVABLES INVENTORIES TRADE GOODS PREPAID EXPENSES (Rent) Non-Current (Long Term) Liabilities Non Current Assets Owner's Equity TANGIBLE ASSETS (net) Motor Vehicles REGISTERED CAPITAL Furnitures \& Fixtures INTANGIBLE ASSETS (net) Software Usage Rights 2018 PROFITS 735,000 TOTAL ASSETS \begin{tabular}{l|l} 1,155,000 & TOTAL LIAB \& EQUITY \end{tabular} Jan 9 ADMIN Expenses BANKS 2,000.00 2,000.00 Jan11 BANKS TRADE RECEIVABLES 15,000.00 15,000.00 Jan13 TRADE PAYABLES BANKS 45,000.00 45,000.00 Jan 14 GIVEN CHEQUES TRADE RECEIVABLES 50,000.00 50,000.00 Jan19 MACHINERY AND EQUIPMENTS 6,000.00 BANK LOANS - Credit Cards 6,000.00 tan21 TRADE RECEIVABLES LT SALES 50,000.00 50,000.00 Jan21 COGS INVENTORIES 35,000.00 35,000.00 Jan 29 Marketing Expenses BANKS 4,000.00 4,000.00 Jan31 ADMIN Expenses PREPAID EXPENSES 2,000.00 2,000.00 Jan31 ADMIN Expenses 20,000.00 Payables to employees 16,000.00 Taxes Payable 4,000.00 \begin{tabular}{l|r} \multicolumn{2}{c}{ BANKS } \\ \hline \#\#\#\#\#\#\# & 2,000 \\ 15,000 & 45,000 \\ \#\#\#\#\#\# & 4,000 \\ \#\#\#\#\# & 51,000 \end{tabular} BANK LOANS LT REGISTERED CAPITAL \begin{tabular}{l} \hline \#\#\#\#\#\# \\ \#\#\#\#\#\#\# \end{tabular} \#\#\#\#\#\# \begin{tabular}{c|r} EPAID EXPENSES (Re \\ \hline 20,000 & 2,000 \\ \hline 20,000 & 2,000 \\ \hline \end{tabular} \begin{tabular}{c|c} \multicolumn{2}{c}{ TRADE RECEIVABLES } \\ \hline 50,000 & \\ 50,000 & \end{tabular} \begin{tabular}{l|r|r} \multicolumn{3}{c}{ TAXES PAYABLE } \\ \hline & 4,000 & \\ \cline { 3 - 4 } & & \end{tabular}