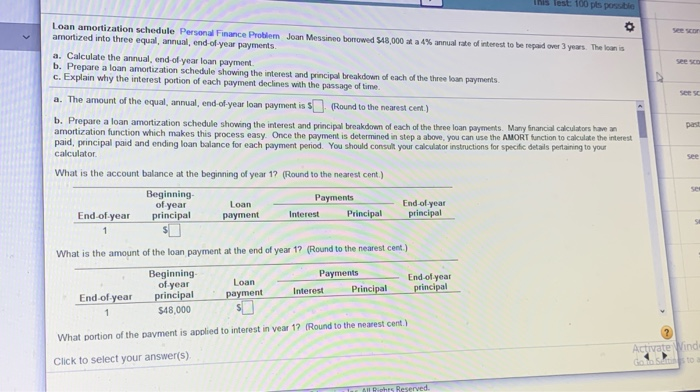

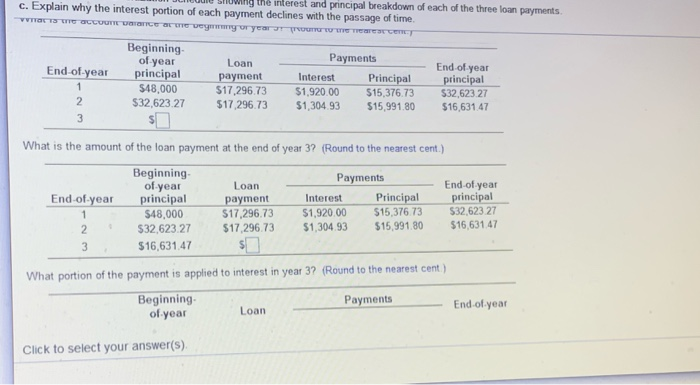

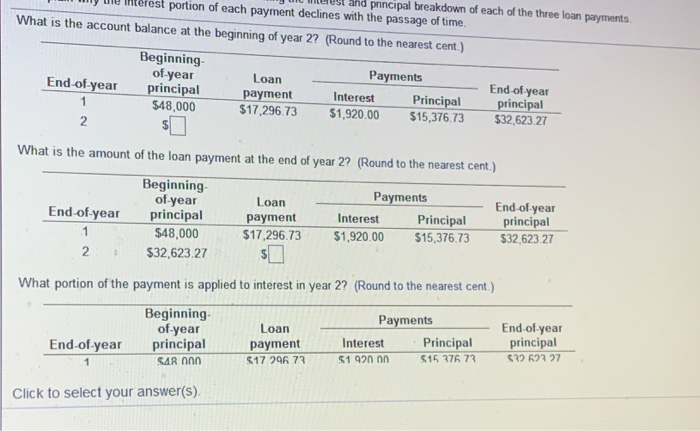

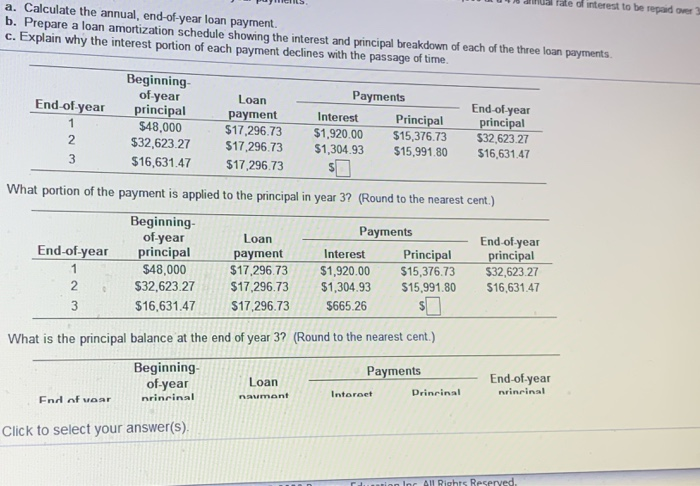

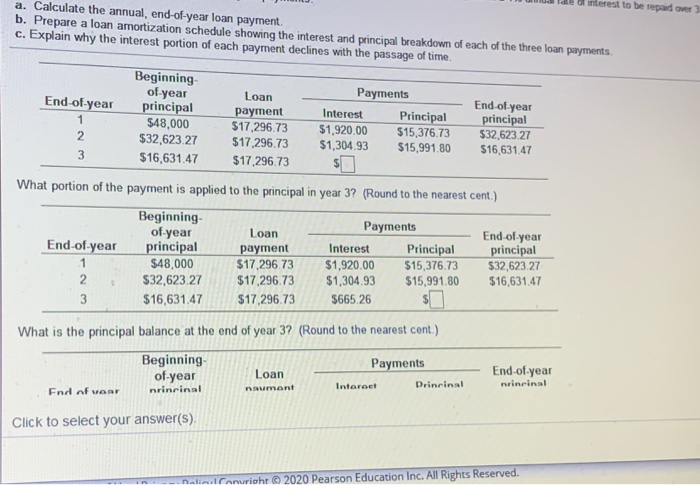

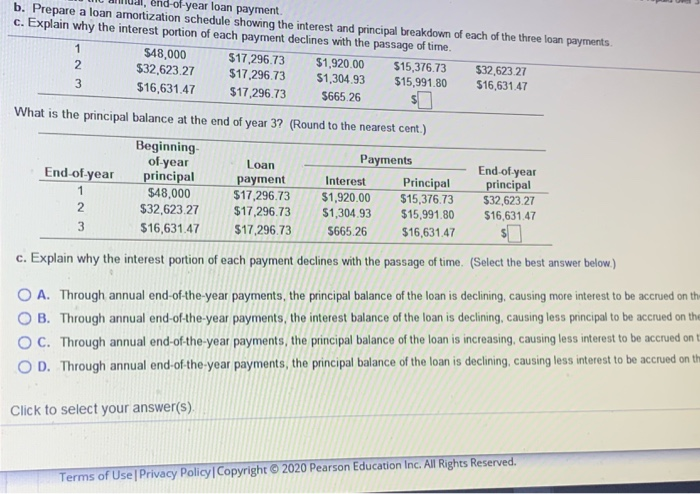

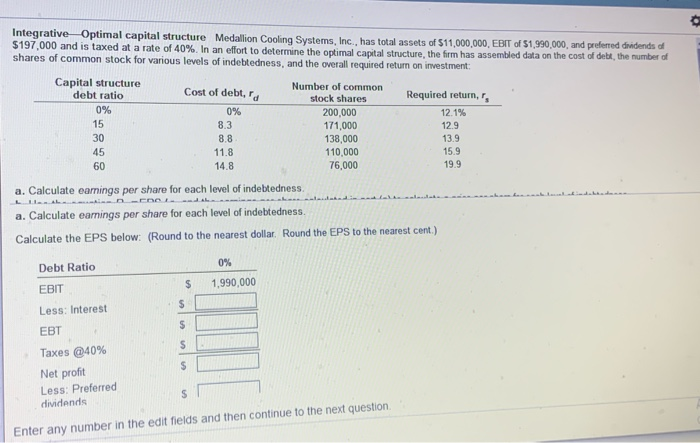

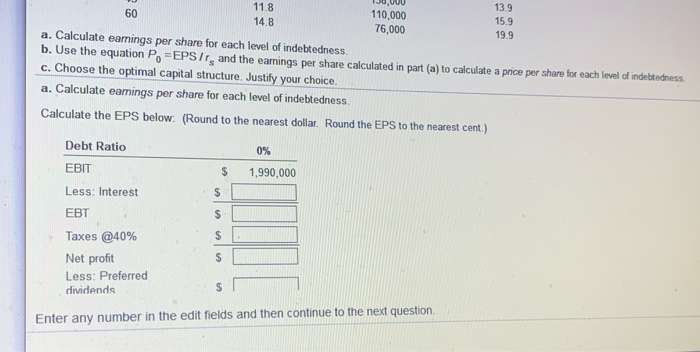

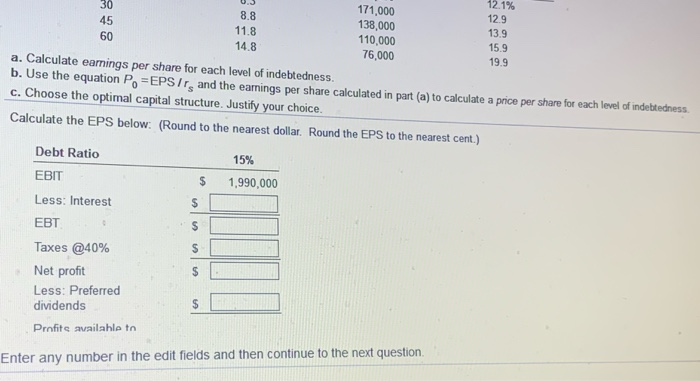

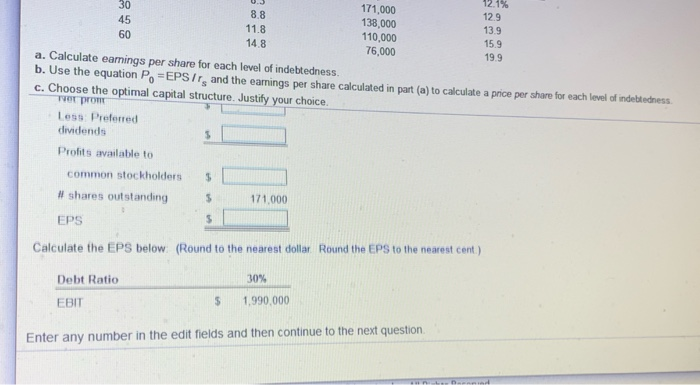

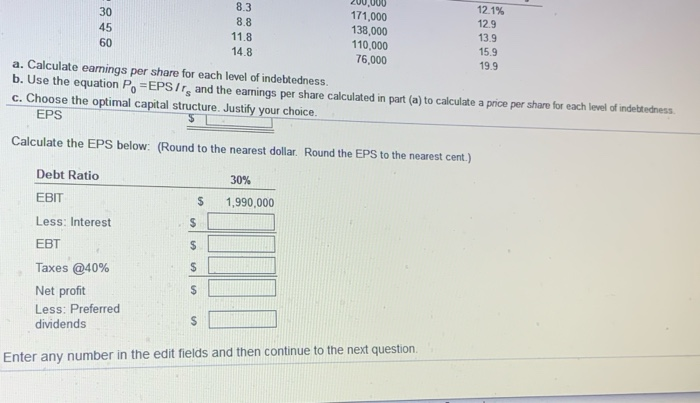

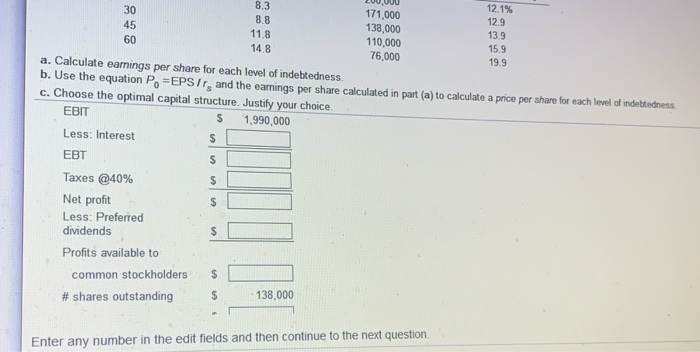

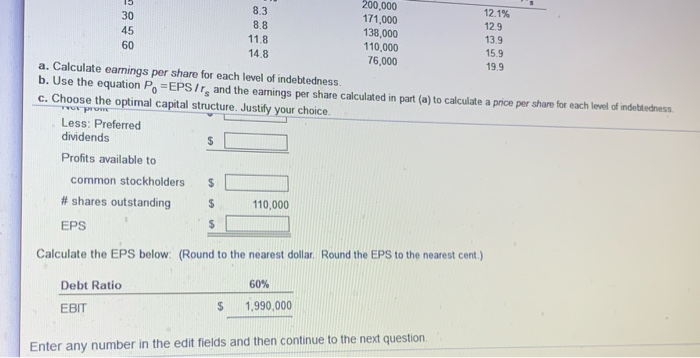

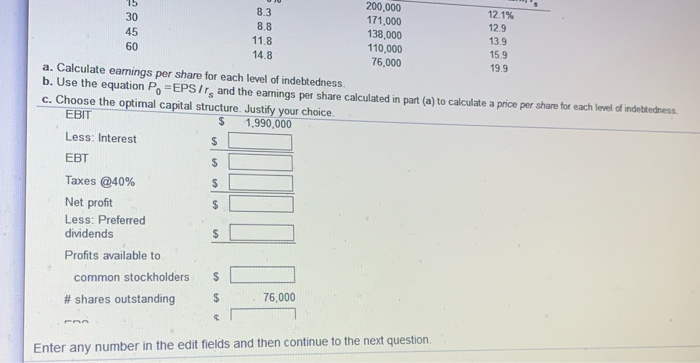

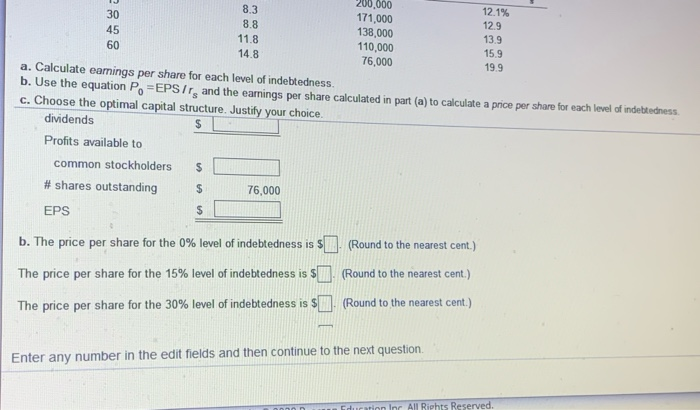

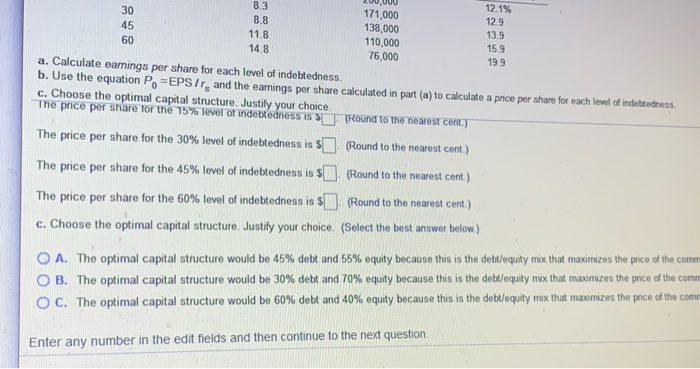

This lest 100 pls poble Loan amortization schedule Personal Finance Problem Joan Messino bonowed 548,000 a 4% annual rate of interest to be read over 3 years. The loan is amortized into three equal, annual, end-of-year payments a. Calculate the annual, end-of-year loan payment. b. Prepare a loan amortization schedule showing the interest and principal breakdown of each of the three loan payments c. Explain why the interest portion of each payment declines with the passage of time See a. The amount of the equal, annual, end-of-year loan payment is (Round to the nearest cent) b. Prepare a loan amortization schedule showing the interest and principal breakdown of each of the three loan payments. Many financial calculators have an amortization function which makes this process easy Once the payment is determined in step a above, you can use the AMORT function to calculate the interest paid, principal paid and ending loan balance for each payment period. You should consult your calculator instructions for specific details pertaining to your calculator What is the account balance at the beginning of year 12 (Round to the nearest cent) - Beginning of year principal $ Payments Interest Principal Loan payment End-of-year End-of-year principal What is the amount of the loan payment at the end of year 1? (Round to the nearest cent.) Payments End of year principal Loan payment Beginning- of year principal $48,000 Interest Principal End of year What portion of the payment is applied to interest in vear 17 (Round to the nearest cent) Activate Mind Click to select your answer(s) This served UIT I E Showing the interest and principal breakdown of each of the three loan payments c. Explain why the interest portion of each payment declines with the passage of time. End-of-year Beginning of-year principal $48.000 $32,623.27 $ Loan payment $17.296.73 $17.296.73 Payments Interest Principal $1,920.00 $15,376.73 $1,304.93 $15.991.80 End of year principal $32,623 27 $16,631.47 What is the amount of the loan payment at the end of year 3? (Round to the nearest cent.) - End-of-year Beginning of year principal $48,000 $32,623.27 $16,631.47 Loan payment $17,296.73 $17.296.73 $ Payments Interest Principal $1,920.00 $15,376.73 $1,304.93 515,991.80 End of year principal $32,623 27 $16,63147 2 3 What portion of the payment is applied to interest in year 3? (Round to the nearest cent) Payments Beginning of year End of year Loan Click to select your answer(s) WC Merust and principal breakdown of each of the three loan payments Il y lle interest portion of each payment declines with the passage of time. What is the account balance at the beginning of year 2? (Round to the nearest cent.) End-of-year Beginning- of-year principal $48,000 $ Loan payment $17.296.73 Payments Interest Principal $1,920.00 $15,376.73 End-of-year principal $32,623.27 What is the amount of the loan payment at the end of year 2? (Round to the nearest cent.) End-of-year Beginning- of-year principal $48,000 $32,623.27 Loan payment $17.296.73 $ Payments Interest Principal $1,920.00 $15,376.73 End-of-year principal $32,623 27 2 What portion of the payment is applied to interest in year 2? (Round to the nearest cent.) Beginning. of-year principal 548 000 End-of-year Loan payment Payments Interest Principal $1920 on 15 376 77 End-of-year principal 72 622 27 Click to select your answer(s). U S ale d'interest to be read over 3 a. Calculate the annual, end-of-year loan payment. b. Prepare a loan amortization schedule showing the interest and principal breakdown of each of the three loan payments c. Explain why the interest portion of each payment declines with the passage of time. Payments End of year Beginning- of year principal $48.000 $32,623.27 $16,631.47 Loan payment $17.296.73 $17.296.73 $17.296.73 Interest $1,920.00 $1,304.93 S Principal $15,376.73 $15,991,80 End-of-year principal $32,623.27 $16,631.47 What portion of the payment is applied to the principal in year 3? (Round to the nearest cent.) End-of-year 1 2 Beginning- of-year principal $48,000 $32,623.27 $16,631.47 Loan payment $17.296.73 $17.296.73 $17.296.73 Payments Interest Principal $1,920.00 $15,376.73 $1,304.93 $15.991.80 $665.26 $ End-of-year principal $32,623.27 $16,631.47 What is the principal balance at the end of year 3? (Round to the nearest cent.) Payments Beginning- of-year End of waarnrinrinal of year Loann. Loan Interest incinal End-of-year nrinrinal End of year Internet Prinrinal Click to select your answer(s). en loc All Rights Reserved. de interest to be read over 3 a. Calculate the annual, end-of-year loan payment. b. Prepare a loan amortization schedule showing the interest and principal breakdown of each of the three loan payments c. Explain why the interest portion of each payment declines with the passage of time. End-of-year Beginning- of-year principal $48,000 $32,623 27 $16,631.47 Loan Payments payment Interest Principal $17.296.73 $1,920.00 $15,376.73 $17.296.73 $1,304.93 $15.991.80 $17.296.735 End-of-year principal $32.623.27 516,631.47 What portion of the payment is applied to the principal in year 3? (Round to the nearest cent.) End-of-year Beginning- of-year principal $48,000 $32,623.27 $16,631.47 Loan payment $17.296.73 $17.296.73 $17,296.73 Payments - Interest Principal $1,920.00 $15,376.73 $1,304.93 $15,991.80 $665.26 $ End of year principal $32,623.27 $16,631.47 What is the principal balance at the end of year 3? (Round to the nearest cent.) Beginning of-year nrinrinal Loan Payments Internet Prinrinal End-of-year nurinrinal End of voar Rumont Click to select your answer(s). na ranuricht 2020 Pearson Education Inc. All Rights Reserved. UIC I, end-of-year loan payment. b. Prepare a loan amortization schedule showing the interest and principal breakdown of each of the three loan payments c. Explain why the interest portion of each payment declines with the passage of time. $48,000 $17.296.73 $1,920.00 $15,376.73 $32,623 27 $32,623.27 $17.296.73 $1,304.93 $15,991.80 $16,631.47 $16,631.47 $17,296.73 $665 26 5 What is the principal balance at the end of year 3? (Round to the nearest cent.) End-of-year Beginning- of-year principal $48,000 $32,623 27 $16,631.47 Loan payment $17.296.73 $17,296.73 $17.296.73 Payments - Interest Principal $1,920.00 $15,376.73 $1,304.93 $15,991.80 5665.26 $16,631.47 End-of-year principal $32,623.27 $16,631.47 5 c. Explain why the interest portion of each payment declines with the passage of time. (Select the best answer below.) O O A. Through annual end-of-the-year payments, the principal balance of the loan is declining, causing more interest to be accrued on the B. Through annual end-of-the-year payments, the interest balance of the loan is declining, causing less principal to be accrued on the C. Through annual end-of-the-year payments, the principal balance of the loan is increasing, causing less interest to be accrued on D. Through annual end-of-the-year payments, the principal balance of the loan is declining, causing less interest to be accrued on the O O Click to select your answer(s) Terms of Use Privacy Policy Copyright 2020 Pearson Education Inc. All Rights Reserved. Integrative Optimal capital structure Medallion Cooling Systems, Inc., has total assets of $11,000,000, EBIT of $1,990,000, and preferred dividends of 5197,000 and is taxed at a rate of 40% In an effort to determine the optimal capital structure, the firm has assembled data on the cost of debt, the number of shares of common stock for various levels of indebtedness, and the overall required return on investment Capital structure debt ratio Cost of debt.ro 0% 0% Number of common stock shares 200,000 171,000 138,000 110,000 76,000 Required return, 12.1% 12.9 13.9 15.9 8.3 30 45 8.8 11.8 14.8 19.9 a. Calculate earnings per share for each level of indebtedness a. Calculate earnings per share for each level of indebtedness Calculate the EPS below. (Round to the nearest dollar. Round the EPS to the nearest cent) Debt Ratio 1,990,000 EBIT Less: Interest EBT Taxes @40% Net profit Less: Preferred dividends Enter any number in the edit fields and then continue to the next question 15.9 110,000 76,000 15.9 19.9 a. Calculate earnings per share for each level of indebtedness. b. Use the equation Po-EPS Ir, and the earnings per share calculated in part (a) to calculate a price per share for each level of indebtedness c. Choose the optimal capital structure. Justify your choice. a. Calculate earnings per share for each level of indebtedness. Calculate the EPS below: (Round to the nearest dollar. Round the EPS to the nearest cent.) Debt Ratio 0% $ 1,990,000 EBIT Less: Interest EBT Taxes @40% Net profit Less: Preferred dividends Enter any number in the edit fields and then continue to the next question 12.1% 12.9 0.3 8.8 11.8 14.8 171,000 138,000 110,000 76,000 13.9 15.9 19.9 a. Calculate earnings per share for each level of indebtedness. b. Use the equation Po=EPSIr, and the earnings per share calculated in part (a) to calculate a price per share for each level of indebtedness c. Choose the optimal capital structure. Justify your choice. Calculate the EPS below. (Round to the nearest dollar. Round the EPS to the nearest cent.) Debt Ratio EBIT 15% $ 1,990,000 Less: Interest EBT Taxes @40% Net profit Less: Preferred dividends Profits available to Enter any number in the edit fields and then continue to the next question. 8.8 45 12.1% 171.000 12.9 138,000 11.8 13.9 110,000 15.9 14.8 76,000 199 a. Calculate earings per share for each level of indebtedness. b. Use the equation Po=EPSIr, and the earnings per share calculated in part (a) to calculate a price per share for each level of indebtedness c. Choose the optimal capital structure. Justify your choice. TOT PONT Less Preferred dividends Profits available to common stockholders # shares outstanding 171 000 EPS Calculate the EPS below. (Round to the nearest dollar. Round the EPS to the nearest cent.) 30% Debt Ratio EBIT $ 1,990,000 Enter any number in the edit fields and then continue to the next question 8.3 8.8 11.8 14 8 200.000 171,000 138,000 110,000 76,000 12.1% 12.9 13.9 15.9 19.9 a. Calculate earnings per share for each level of indebtedness. b. Use the equation Po-EPSIr, and the earnings per share calculated in part (a) to calculate a price per share for each level of indebtedness c. Choose the optimal capital structure. Justify your choice. EPS Calculate the EPS below (Round to the nearest dollar. Round the EPS to the nearest cent.) 30% Debt Ratio EBIT 1,990,000 Less: Interest EBT Taxes @40% Net profit Less: Preferred dividends Enter any number in the edit fields and then continue to the next question. 200,000 8.3 12.1% 171.000 8.8 12.9 138,000 11.8 13.9 110,000 14.8 15.9 76,000 199 a. Calculate earnings per share for each level of indebtedness. b. Use the equation Po=EPSir, and the earnings per share calculated in part (a) to calculate a price per share for each level of indebtedness c. Choose the optimal capital structure. Justify your choice. EBIT $ 1,990,000 Less: Interest EBT Taxes @40% Net profit Less: Preferred dividends Profits available to common stockholders # shares outstanding $ 138,000 , Enter any number in the edit fields and then continue to the next question 15 8.3 200,000 12.1% 171.000 8.8 12.9 138,000 11.8 13.9 110,000 14.8 15.9 76,000 19.9 a. Calculate earnings per share for each level of indebtedness. b. Use the equation Po=EPS Ir, and the earnings per share calculated in part (a) to calculate a price per share for each level of indebtedness c. Choose the optimal capital structure. Justify your choice. Tu prome Less: Preferred dividends Profits available to common stockholders # shares outstanding 110,000 EPS Calculate the EPS below: (Round to the nearest dollar. Round the EPS to the nearest cent.) 60% Debt Ratio EBIT 1,990,000 Enter any number in the edit fields and then continue to the next question 199 200.000 8.3 12.1% 171,000 8.8 12.9 138,000 11.8 13.9 110,000 15.9 14.8 76,000 a. Calculate earnings per share for each level of indebtedness. b. Use the equation Po=EPS Ir, and the earnings per share calculated in part (a) to calculate a price per share for each level of indebtedness c. Choose the optimal capital structure. Justify your choice. EBIT $ 1,990,000 Less: Interest EBT Taxes @40% Net profit Less: Preferred dividends Profits available to common stockholders # shares outstanding $ 76,000 Enter any number in the edit fields and then continue to the next question J 8.3 200.000 12.1% 171,000 12.9 138,000 13.9 110,000 14.8 15.9 76,000 19.9 a. Calculate earnings per share for each level of indebtedness b. Use the equation Po=EPSIr, and the earnings per share calculated in part (a) to calculate a price per share for each level of indebtedness c. Choose the optimal capital structure. Justify your choice. dividends Profits available to common stockholders $ # shares outstanding 76,000 EPS $ b. The price per share for the 0% level of indebtedness is 5 (Round to the nearest cent.) The price per share for the 15% level of indebtedness is $ (Round to the nearest cent.) The price per share for the 30% level of indebtedness is $ . (Round to the nearest cent.) Enter any number in the edit fields and then continue to the next question. duration Inc. All Rights Reserved. 200,00 8.3 12.1% 171,000 8.8 12.9 138,000 13.9 11.8 110,000 15,9 14.8 76,000 19.9 a. Calculate earnings per share for each level of indebtedness. b. Use the equation Po=EPS Ir, and the earnings per share calculated in part (a) to calculate a price per share for each level of indebtedness c. Choose the optimal capital structure. Justify your choice The price per share for the 15% level of indebtedness is (Round to the nearest cent.) The price per share for the 30% level of indebtedness is 5 (Round to the nearest cent.) The price per share for the 45% level of indebtedness is 5 (Round to the nearest cent.) The price per share for the 60% level of indebtedness is $ (Round to the nearest cent.) c. Choose the optimal capital structure. Justify your choice. (Select the best answer below.) O O A. The optimal capital structure would be 45% debt and 55% equity because this is the debt/equity mix that maximizes the price of the comm B. The optimal capital structure would be 30% debt and 70% equity because this is the debt/equity mix that maximizes the price of the com C. The optimal capital structure would be 60% debt and 40% equity because this is the debt/equity mix that maximizes the price of the come O Enter any number in the edit fields and then continue to the next