Question: this looks like a lot but its for one hw project! Personal Budget Assignment Businesses use budgets to plan for the future. That's what you

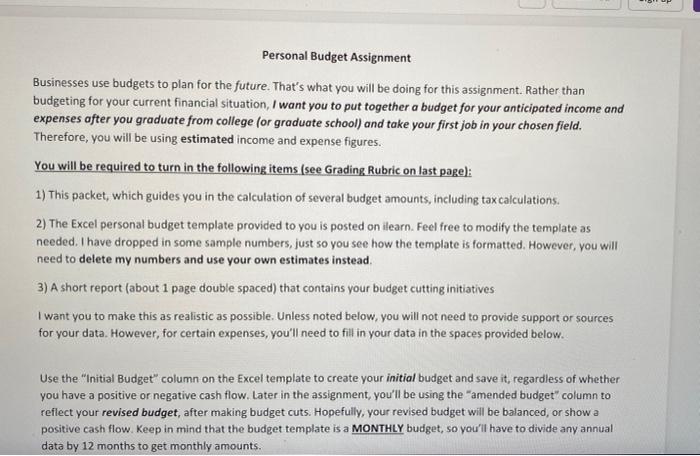

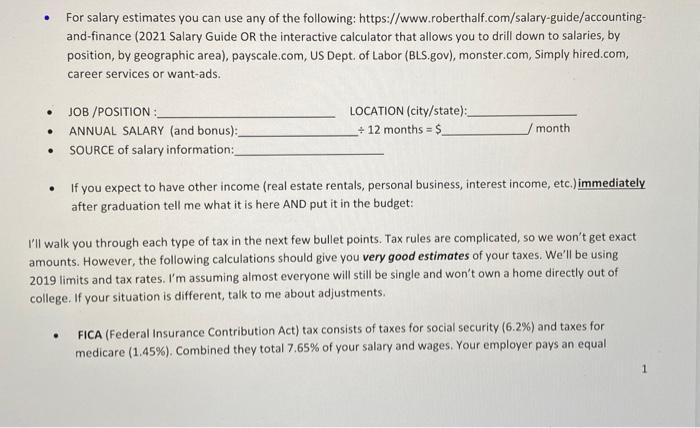

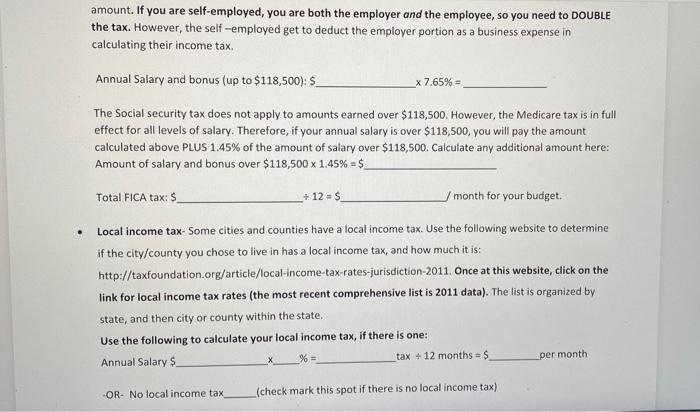

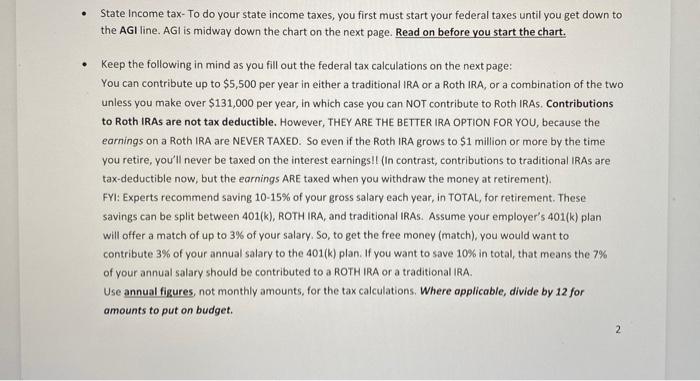

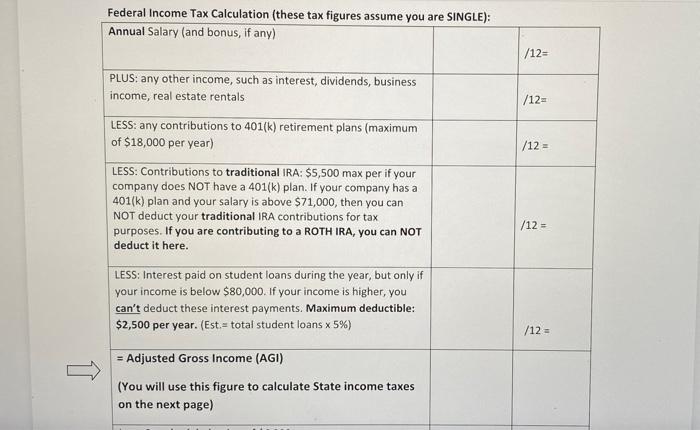

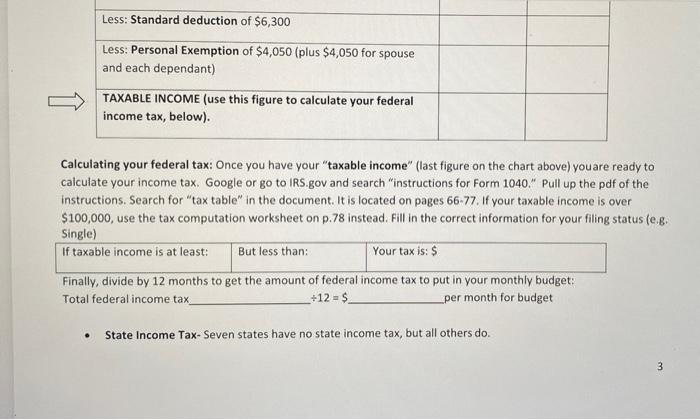

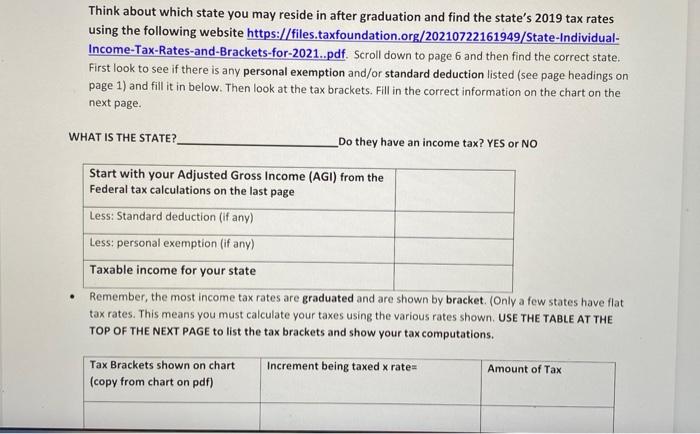

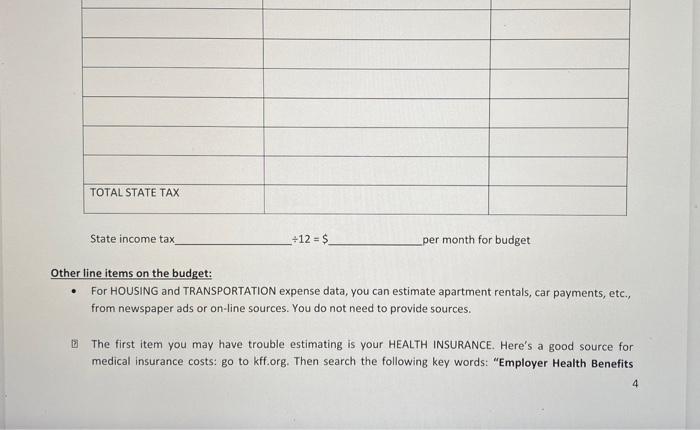

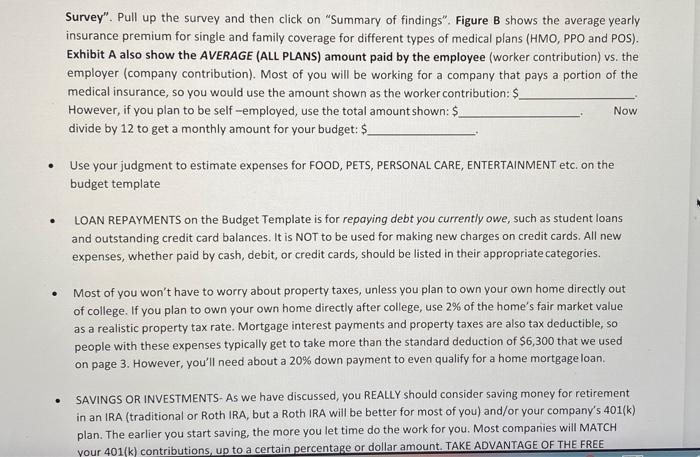

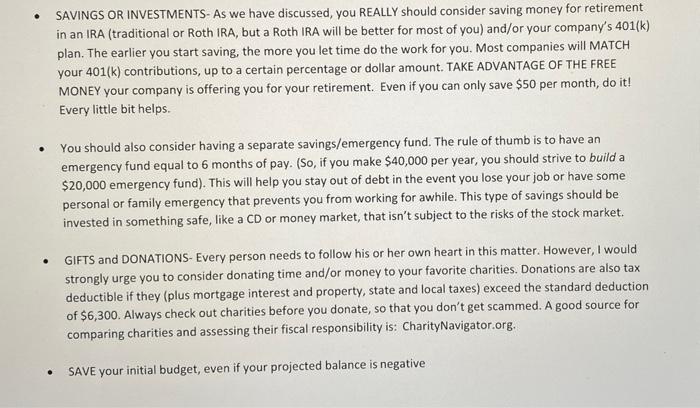

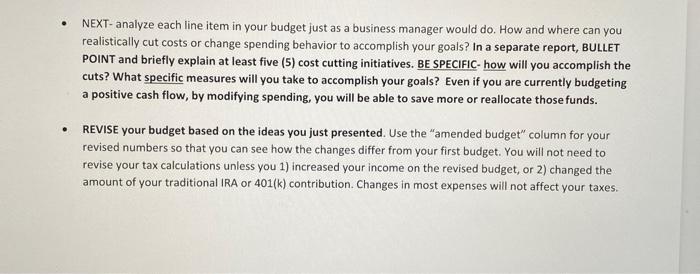

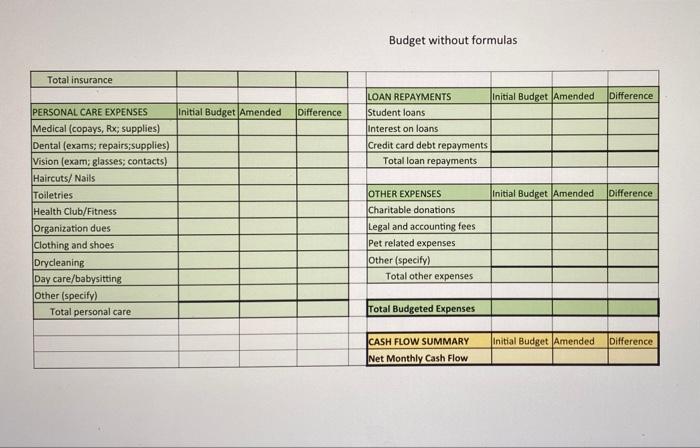

Personal Budget Assignment Businesses use budgets to plan for the future. That's what you will be doing for this assignment. Rather than budgeting for your current financial situation, I want you to put together a budget for your anticipated income and expenses after you graduate from college (or graduate school) and take your first job in your chosen field. Therefore, you will be using estimated income and expense figures. You will be required to turn in the following items (see Grading Rubric on last page): 1) This packet, which guides you in the calculation of several budget amounts, including tax calculations. 2) The Excel personal budget template provided to you is posted on ilearn. Feel free to modify the template as needed. I have dropped in some sample numbers, just so you see how the template is formatted. However, you will need to delete my numbers and use your own estimates instead. 3) A short report (about 1 page double spaced) that contains your budget cutting initiatives I want you to make this as realistic as possible. Unless noted below, you will not need to provide support or sources for your data. However, for certain expenses, you'll need to fill in your data in the spaces provided below. Use the "Initial Budget" column on the Excel template to create your initial budget and save it, regardless of whether you have a positive or negative cash flow. Later in the assignment, you'll be using the "amended budget" column to reflect your revised budget, after making budget cuts. Hopefully, your revised budget will be balanced, or show a positive cash flow. Keep in mind that the budget template is a MONTHLY budget, so you'll have to divide any annual data by 12 months to get monthly amounts. For salary estimates you can use any of the following: https://www.roberthalf.com/salary-guide/accounting- and-finance (2021 Salary Guide OR the interactive calculator that allows you to drill down to salaries, by position, by geographic area), payscale.com, US Dept. of Labor (BLS.gov), monster.com, Simply hired.com, career services or want-ads. JOB /POSITION: LOCATION (city/state):_ +12 months = $ ANNUAL SALARY (and bonus): month SOURCE of salary information: If you expect to have other income (real estate rentals, personal business, interest income, etc.) immediately after graduation tell me what it is here AND put it in the budget: I'll walk you through each type of tax in the next few bullet points. Tax rules are complicated, so we won't get exact amounts. However, the following calculations should give you very good estimates of your taxes. We'll be using 2019 limits and tax rates. I'm assuming almost everyone will still be single and won't own a home directly out of college. If your situation is different, talk to me about adjustments. . FICA (Federal Insurance Contribution Act) tax consists of taxes for social security (6.2%) and taxes for medicare (1.45 %). Combined they total 7.65% of your salary and wages. Your employer pays an equal 1 . . amount. If you are self-employed, you are both the employer and the employee, so you need to DOUBLE the tax. However, the self-employed get to deduct the employer portion as a business expense in calculating their income tax. Annual Salary and bonus (up to $118,500): $_ x 7.65% = The Social security tax does not apply to amounts earned over $118,500. However, the Medicare tax is in full effect for all levels of salary. Therefore, if your annual salary is over $118,500, you will pay the amount calculated above PLUS 1.45% of the amount of salary over $118,500. Calculate any additional amount here: Amount of salary and bonus over $118,500 x 1.45% = $_ Total FICA tax: $ +12= $ month for your budget. Local income tax- Some cities and counties have a local income tax. Use the following website to determine if the city/county you chose to live in has a local income tax, and how much it is: http://taxfoundation.org/article/local-income-tax-rates-jurisdiction-2011. Once at this website, click on the link for local income tax rates (the most recent comprehensive list is 2011 data). The list is organized by state, and then city or county within the state. Use the following to calculate your local income tax, if there is one: Annual Salary S % = tax+ 12 months = $ per month -OR- No local income tax (check mark this spot if there is no local income tax). State Income tax- To do your state income taxes, you first must start your federal taxes until you get down to the AGI line. AGI is midway down the chart on the next page. Read on before you start the chart. Keep the following in mind as you fill out the federal tax calculations on the next page: You can contribute up to $5,500 per year in either a traditional IRA or a Roth IRA, or a combination of the two unless you make over $131,000 per year, in which case you can NOT contribute to Roth IRAs. Contributions to Roth IRAs are not tax deductible. However, THEY ARE THE BETTER IRA OPTION FOR YOU, because the earnings on a Roth IRA are NEVER TAXED. So even if the Roth IRA grows to $1 million or more by the time you retire, you'll never be taxed on the interest earnings!! (In contrast, contributions to traditional IRAs are tax-deductible now, but the earnings ARE taxed when you withdraw the money at retirement). FYI: Experts recommend saving 10-15% of your gross salary each year, in TOTAL, for retirement. These savings can be split between 401(k), ROTH IRA, and traditional IRAS. Assume your employer's 401(k) plan will offer a match of up to 3% of your salary. So, to get the free money (match), you would want to contribute 3% of your annual salary to the 401(k) plan. If you want to save 10% in total, that means the 7% of your annual salary should be contributed to a ROTH IRA or a traditional IRA. Use annual figures, not monthly amounts, for the tax calculations. Where applicable, divide by 12 for amounts to put on budget. 2 Federal Income Tax Calculation (these tax figures assume you are SINGLE): Annual Salary (and bonus, if any) PLUS: any other income, such as interest, dividends, business income, real estate rentals LESS: any contributions to 401(k) retirement plans (maximum of $18,000 per year) LESS: Contributions to traditional IRA: $5,500 max per if your company does NOT have a 401(k) plan. If your company has a 401(k) plan and your salary is above $71,000, then you can NOT deduct your traditional IRA contributions for tax purposes. If you are contributing to a ROTH IRA, you can NOT deduct it here. LESS: Interest paid on student loans during the year, but only if your income is below $80,000. If your income is higher, you can't deduct these interest payments. Maximum deductible: $2,500 per year. (Est.= total student loans x 5%) = Adjusted Gross Income (AGI) (You will use this figure to calculate State income taxes on the next page) /12= /12= /12 = /12 = /12 = Less: Standard deduction of $6,300 Less: Personal Exemption of $4,050 (plus $4,050 for spouse and each dependant) TAXABLE INCOME (use this figure to calculate your federal income tax, below). Calculating your federal tax: Once you have your "taxable income" (last figure on the chart above) you are ready to calculate your income tax. Google or go to IRS.gov and search "instructions for Form 1040." Pull up the pdf of the instructions. Search for "tax table" in the document. It is located on pages 66-77. If your taxable income is over $100,000, use the tax computation worksheet on p.78 instead. Fill in the correct information for your filing status (e.g. Single) If taxable income is at least: But less than: Your tax is: $ Finally, divide by 12 months to get the amount of federal income tax to put in your monthly budget: Total federal income tax_ +12=$ per month for budget . State Income Tax- Seven states have no state income tax, but all others do. 3 Think about which state you may reside in after graduation and find the state's 2019 tax rates using the following website https://files.taxfoundation.org/20210722161949/State-Individual- Income-Tax-Rates-and-Brackets-for-2021..pdf. Scroll down to page 6 and then find the correct state. First look to see if there is any personal exemption and/or standard deduction listed (see page headings on page 1) and fill it in below. Then look at the tax brackets. Fill in the correct information on the chart on the next page. WHAT IS THE STATE? Do they have an income tax? YES or NO Start with your Adjusted Gross Income (AGI) from the Federal tax calculations on the last page Less: Standard deduction (if any) Less: personal exemption (if any) Taxable income for your state Remember, the most income tax rates are graduated and are shown by bracket. (Only a few states have flat tax rates. This means you must calculate your taxes using the various rates shown. USE THE TABLE AT THE TOP OF THE NEXT PAGE to list the tax brackets and show your tax computations. Increment being taxed x rate= Amount of Tax Tax Brackets shown on chart (copy from chart on pdf) TOTAL STATE TAX State income tax +12= $_ per month for budget Other line items on the budget: For HOUSING and TRANSPORTATION expense data, you can estimate apartment rentals, car payments, etc., from newspaper ads or on-line sources. You do not need to provide sources. The first item you may have trouble estimating is your HEALTH INSURANCE. Here's a good source for medical insurance costs: go to kff.org. Then search the following key words: "Employer Health Benefits 4 Survey". Pull up the survey and then click on "Summary of findings". Figure B shows the average yearly insurance premium for single and family coverage for different types of medical plans (HMO, PPO and POS). Exhibit A also show the AVERAGE (ALL PLANS) amount paid by the employee (worker contribution) vs. the employer (company contribution). Most of you will be working for a company that pays a portion of the medical insurance, so you would use the amount shown as the worker contribution: $ Now However, if you plan to be self-employed, use the total amount shown: $ divide by 12 to get a monthly amount for your budget: $_ Use your judgment to estimate expenses for FOOD, PETS, PERSONAL CARE, ENTERTAINMENT etc. on the budget template LOAN REPAYMENTS on the Budget Template is for repaying debt you currently owe, such as student loans and outstanding credit card balances. It is NOT to be used for making new charges on credit cards. All new. expenses, whether paid by cash, debit, or credit cards, should be listed in their appropriate categories. . Most of you won't have to worry about property taxes, unless you plan to own your own home directly out of college. If you plan to own your own home directly after college, use 2% of the home's fair market value as a realistic property tax rate. Mortgage interest payments and property taxes are also tax deductible, so people with these expenses typically get to take more than the standard deduction of $6,300 that we used on page 3. However, you'll need about a 20% down payment to even qualify for a home mortgage loan. . SAVINGS OR INVESTMENTS- As we have discussed, you REALLY should consider saving money for retirement in an IRA (traditional or Roth IRA, but a Roth IRA will be better for most of you) and/or your company's 401(k) plan. The earlier you start saving, the more you let time do the work for you. Most companies will MATCH your 401(k) contributions, up to a certain percentage or dollar amount. TAKE ADVANTAGE OF THE FREE SAVINGS OR INVESTMENTS- As we have discussed, you REALLY should consider saving money for retirement in an IRA (traditional or Roth IRA, but a Roth IRA will be better for most of you) and/or your company's 401(k) plan. The earlier you start saving, the more you let time do the work for you. Most companies will MATCH your 401(k) contributions, up to a certain percentage or dollar amount. TAKE ADVANTAGE OF THE FREE MONEY your company is offering you for your retirement. Even if you can only save $50 per month, do it! Every little bit helps. You should also consider having a separate savings/emergency fund. The rule of thumb is to have an emergency fund equal to 6 months of pay. (So, if you make $40,000 per year, you should strive to build a $20,000 emergency fund). This will help you stay out of debt in the event you lose your job or have some personal or family emergency that prevents you from working for awhile. This type of savings should be invested in something safe, like a CD or money market, that isn't subject to the risks of the stock market. . GIFTS and DONATIONS- Every person needs to follow his or her own heart in this matter. However, I would strongly urge you to consider donating time and/or money to your favorite charities. Donations are also tax deductible if they (plus mortgage interest and property, state and local taxes) exceed the standard deduction of $6,300. Always check out charities before you donate, so that you don't get scammed. A good source for comparing charities and assessing their fiscal responsibility is: CharityNavigator.org. SAVE your initial budget, even if your projected balance is negative NEXT-analyze each line item in your budget just as a business manager would do. How and where can you realistically cut costs or change spending behavior to accomplish your goals? In a separate report, BULLET POINT and briefly explain at least five (5) cost cutting initiatives. BE SPECIFIC- how will you accomplish the cuts? What specific measures will you take to accomplish your goals? Even if you are currently budgeting a positive cash flow, by modifying spending, you will be able to save more or reallocate those funds. REVISE your budget based on the ideas you just presented. Use the "amended budget" column for your revised numbers so that you can see how the changes differ from your first budget. You will not need to revise your tax calculations unless you 1) increased your income on the revised budget, or 2) changed the amount of your traditional IRA or 401(k) contribution. Changes in most expenses will not affect your taxes. Total insurance PERSONAL CARE EXPENSES Medical (copays, Rx; supplies) Dental (exams; repairs;supplies) Vision (exam; glasses; contacts) Haircuts/ Nails Toiletries Health Club/Fitness Organization dues Clothing and shoes Drycleaning Day care/babysitting Other (specify) Total personal care Initial Budget Amended Difference Budget without formulas. LOAN REPAYMENTS Student loans Interest on loans Credit card debt repayments Total loan repayments OTHER EXPENSES Charitable donations Legal and accounting fees Pet related expenses Other (specify) Total other expenses Total Budgeted Expenses CASH FLOW SUMMARY Net Monthly Cash Flow Initial Budget Amended Difference Initial Budget Amended Difference Initial Budget Amended Difference Personal Budget Assignment Businesses use budgets to plan for the future. That's what you will be doing for this assignment. Rather than budgeting for your current financial situation, I want you to put together a budget for your anticipated income and expenses after you graduate from college (or graduate school) and take your first job in your chosen field. Therefore, you will be using estimated income and expense figures. You will be required to turn in the following items (see Grading Rubric on last page): 1) This packet, which guides you in the calculation of several budget amounts, including tax calculations. 2) The Excel personal budget template provided to you is posted on ilearn. Feel free to modify the template as needed. I have dropped in some sample numbers, just so you see how the template is formatted. However, you will need to delete my numbers and use your own estimates instead. 3) A short report (about 1 page double spaced) that contains your budget cutting initiatives I want you to make this as realistic as possible. Unless noted below, you will not need to provide support or sources for your data. However, for certain expenses, you'll need to fill in your data in the spaces provided below. Use the "Initial Budget" column on the Excel template to create your initial budget and save it, regardless of whether you have a positive or negative cash flow. Later in the assignment, you'll be using the "amended budget" column to reflect your revised budget, after making budget cuts. Hopefully, your revised budget will be balanced, or show a positive cash flow. Keep in mind that the budget template is a MONTHLY budget, so you'll have to divide any annual data by 12 months to get monthly amounts. For salary estimates you can use any of the following: https://www.roberthalf.com/salary-guide/accounting- and-finance (2021 Salary Guide OR the interactive calculator that allows you to drill down to salaries, by position, by geographic area), payscale.com, US Dept. of Labor (BLS.gov), monster.com, Simply hired.com, career services or want-ads. JOB /POSITION: LOCATION (city/state):_ +12 months = $ ANNUAL SALARY (and bonus): month SOURCE of salary information: If you expect to have other income (real estate rentals, personal business, interest income, etc.) immediately after graduation tell me what it is here AND put it in the budget: I'll walk you through each type of tax in the next few bullet points. Tax rules are complicated, so we won't get exact amounts. However, the following calculations should give you very good estimates of your taxes. We'll be using 2019 limits and tax rates. I'm assuming almost everyone will still be single and won't own a home directly out of college. If your situation is different, talk to me about adjustments. . FICA (Federal Insurance Contribution Act) tax consists of taxes for social security (6.2%) and taxes for medicare (1.45 %). Combined they total 7.65% of your salary and wages. Your employer pays an equal 1 . . amount. If you are self-employed, you are both the employer and the employee, so you need to DOUBLE the tax. However, the self-employed get to deduct the employer portion as a business expense in calculating their income tax. Annual Salary and bonus (up to $118,500): $_ x 7.65% = The Social security tax does not apply to amounts earned over $118,500. However, the Medicare tax is in full effect for all levels of salary. Therefore, if your annual salary is over $118,500, you will pay the amount calculated above PLUS 1.45% of the amount of salary over $118,500. Calculate any additional amount here: Amount of salary and bonus over $118,500 x 1.45% = $_ Total FICA tax: $ +12= $ month for your budget. Local income tax- Some cities and counties have a local income tax. Use the following website to determine if the city/county you chose to live in has a local income tax, and how much it is: http://taxfoundation.org/article/local-income-tax-rates-jurisdiction-2011. Once at this website, click on the link for local income tax rates (the most recent comprehensive list is 2011 data). The list is organized by state, and then city or county within the state. Use the following to calculate your local income tax, if there is one: Annual Salary S % = tax+ 12 months = $ per month -OR- No local income tax (check mark this spot if there is no local income tax). State Income tax- To do your state income taxes, you first must start your federal taxes until you get down to the AGI line. AGI is midway down the chart on the next page. Read on before you start the chart. Keep the following in mind as you fill out the federal tax calculations on the next page: You can contribute up to $5,500 per year in either a traditional IRA or a Roth IRA, or a combination of the two unless you make over $131,000 per year, in which case you can NOT contribute to Roth IRAs. Contributions to Roth IRAs are not tax deductible. However, THEY ARE THE BETTER IRA OPTION FOR YOU, because the earnings on a Roth IRA are NEVER TAXED. So even if the Roth IRA grows to $1 million or more by the time you retire, you'll never be taxed on the interest earnings!! (In contrast, contributions to traditional IRAs are tax-deductible now, but the earnings ARE taxed when you withdraw the money at retirement). FYI: Experts recommend saving 10-15% of your gross salary each year, in TOTAL, for retirement. These savings can be split between 401(k), ROTH IRA, and traditional IRAS. Assume your employer's 401(k) plan will offer a match of up to 3% of your salary. So, to get the free money (match), you would want to contribute 3% of your annual salary to the 401(k) plan. If you want to save 10% in total, that means the 7% of your annual salary should be contributed to a ROTH IRA or a traditional IRA. Use annual figures, not monthly amounts, for the tax calculations. Where applicable, divide by 12 for amounts to put on budget. 2 Federal Income Tax Calculation (these tax figures assume you are SINGLE): Annual Salary (and bonus, if any) PLUS: any other income, such as interest, dividends, business income, real estate rentals LESS: any contributions to 401(k) retirement plans (maximum of $18,000 per year) LESS: Contributions to traditional IRA: $5,500 max per if your company does NOT have a 401(k) plan. If your company has a 401(k) plan and your salary is above $71,000, then you can NOT deduct your traditional IRA contributions for tax purposes. If you are contributing to a ROTH IRA, you can NOT deduct it here. LESS: Interest paid on student loans during the year, but only if your income is below $80,000. If your income is higher, you can't deduct these interest payments. Maximum deductible: $2,500 per year. (Est.= total student loans x 5%) = Adjusted Gross Income (AGI) (You will use this figure to calculate State income taxes on the next page) /12= /12= /12 = /12 = /12 = Less: Standard deduction of $6,300 Less: Personal Exemption of $4,050 (plus $4,050 for spouse and each dependant) TAXABLE INCOME (use this figure to calculate your federal income tax, below). Calculating your federal tax: Once you have your "taxable income" (last figure on the chart above) you are ready to calculate your income tax. Google or go to IRS.gov and search "instructions for Form 1040." Pull up the pdf of the instructions. Search for "tax table" in the document. It is located on pages 66-77. If your taxable income is over $100,000, use the tax computation worksheet on p.78 instead. Fill in the correct information for your filing status (e.g. Single) If taxable income is at least: But less than: Your tax is: $ Finally, divide by 12 months to get the amount of federal income tax to put in your monthly budget: Total federal income tax_ +12=$ per month for budget . State Income Tax- Seven states have no state income tax, but all others do. 3 Think about which state you may reside in after graduation and find the state's 2019 tax rates using the following website https://files.taxfoundation.org/20210722161949/State-Individual- Income-Tax-Rates-and-Brackets-for-2021..pdf. Scroll down to page 6 and then find the correct state. First look to see if there is any personal exemption and/or standard deduction listed (see page headings on page 1) and fill it in below. Then look at the tax brackets. Fill in the correct information on the chart on the next page. WHAT IS THE STATE? Do they have an income tax? YES or NO Start with your Adjusted Gross Income (AGI) from the Federal tax calculations on the last page Less: Standard deduction (if any) Less: personal exemption (if any) Taxable income for your state Remember, the most income tax rates are graduated and are shown by bracket. (Only a few states have flat tax rates. This means you must calculate your taxes using the various rates shown. USE THE TABLE AT THE TOP OF THE NEXT PAGE to list the tax brackets and show your tax computations. Increment being taxed x rate= Amount of Tax Tax Brackets shown on chart (copy from chart on pdf) TOTAL STATE TAX State income tax +12= $_ per month for budget Other line items on the budget: For HOUSING and TRANSPORTATION expense data, you can estimate apartment rentals, car payments, etc., from newspaper ads or on-line sources. You do not need to provide sources. The first item you may have trouble estimating is your HEALTH INSURANCE. Here's a good source for medical insurance costs: go to kff.org. Then search the following key words: "Employer Health Benefits 4 Survey". Pull up the survey and then click on "Summary of findings". Figure B shows the average yearly insurance premium for single and family coverage for different types of medical plans (HMO, PPO and POS). Exhibit A also show the AVERAGE (ALL PLANS) amount paid by the employee (worker contribution) vs. the employer (company contribution). Most of you will be working for a company that pays a portion of the medical insurance, so you would use the amount shown as the worker contribution: $ Now However, if you plan to be self-employed, use the total amount shown: $ divide by 12 to get a monthly amount for your budget: $_ Use your judgment to estimate expenses for FOOD, PETS, PERSONAL CARE, ENTERTAINMENT etc. on the budget template LOAN REPAYMENTS on the Budget Template is for repaying debt you currently owe, such as student loans and outstanding credit card balances. It is NOT to be used for making new charges on credit cards. All new. expenses, whether paid by cash, debit, or credit cards, should be listed in their appropriate categories. . Most of you won't have to worry about property taxes, unless you plan to own your own home directly out of college. If you plan to own your own home directly after college, use 2% of the home's fair market value as a realistic property tax rate. Mortgage interest payments and property taxes are also tax deductible, so people with these expenses typically get to take more than the standard deduction of $6,300 that we used on page 3. However, you'll need about a 20% down payment to even qualify for a home mortgage loan. . SAVINGS OR INVESTMENTS- As we have discussed, you REALLY should consider saving money for retirement in an IRA (traditional or Roth IRA, but a Roth IRA will be better for most of you) and/or your company's 401(k) plan. The earlier you start saving, the more you let time do the work for you. Most companies will MATCH your 401(k) contributions, up to a certain percentage or dollar amount. TAKE ADVANTAGE OF THE FREE SAVINGS OR INVESTMENTS- As we have discussed, you REALLY should consider saving money for retirement in an IRA (traditional or Roth IRA, but a Roth IRA will be better for most of you) and/or your company's 401(k) plan. The earlier you start saving, the more you let time do the work for you. Most companies will MATCH your 401(k) contributions, up to a certain percentage or dollar amount. TAKE ADVANTAGE OF THE FREE MONEY your company is offering you for your retirement. Even if you can only save $50 per month, do it! Every little bit helps. You should also consider having a separate savings/emergency fund. The rule of thumb is to have an emergency fund equal to 6 months of pay. (So, if you make $40,000 per year, you should strive to build a $20,000 emergency fund). This will help you stay out of debt in the event you lose your job or have some personal or family emergency that prevents you from working for awhile. This type of savings should be invested in something safe, like a CD or money market, that isn't subject to the risks of the stock market. . GIFTS and DONATIONS- Every person needs to follow his or her own heart in this matter. However, I would strongly urge you to consider donating time and/or money to your favorite charities. Donations are also tax deductible if they (plus mortgage interest and property, state and local taxes) exceed the standard deduction of $6,300. Always check out charities before you donate, so that you don't get scammed. A good source for comparing charities and assessing their fiscal responsibility is: CharityNavigator.org. SAVE your initial budget, even if your projected balance is negative NEXT-analyze each line item in your budget just as a business manager would do. How and where can you realistically cut costs or change spending behavior to accomplish your goals? In a separate report, BULLET POINT and briefly explain at least five (5) cost cutting initiatives. BE SPECIFIC- how will you accomplish the cuts? What specific measures will you take to accomplish your goals? Even if you are currently budgeting a positive cash flow, by modifying spending, you will be able to save more or reallocate those funds. REVISE your budget based on the ideas you just presented. Use the "amended budget" column for your revised numbers so that you can see how the changes differ from your first budget. You will not need to revise your tax calculations unless you 1) increased your income on the revised budget, or 2) changed the amount of your traditional IRA or 401(k) contribution. Changes in most expenses will not affect your taxes. Total insurance PERSONAL CARE EXPENSES Medical (copays, Rx; supplies) Dental (exams; repairs;supplies) Vision (exam; glasses; contacts) Haircuts/ Nails Toiletries Health Club/Fitness Organization dues Clothing and shoes Drycleaning Day care/babysitting Other (specify) Total personal care Initial Budget Amended Difference Budget without formulas. LOAN REPAYMENTS Student loans Interest on loans Credit card debt repayments Total loan repayments OTHER EXPENSES Charitable donations Legal and accounting fees Pet related expenses Other (specify) Total other expenses Total Budgeted Expenses CASH FLOW SUMMARY Net Monthly Cash Flow Initial Budget Amended Difference Initial Budget Amended Difference Initial Budget Amended Difference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts