Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this one assignment. federal income tax. if you use tax wise please show the information you have use from the assignment. there is also 10

this one assignment. federal income tax. if you use tax wise please show the information you have use from the assignment. there is also 10 questions. you dont necessarily have to do them. however if you do i greatly appreciate it. thanks in advance!!

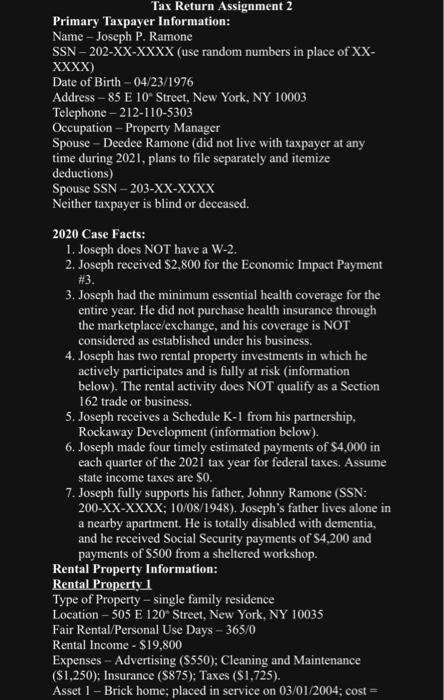

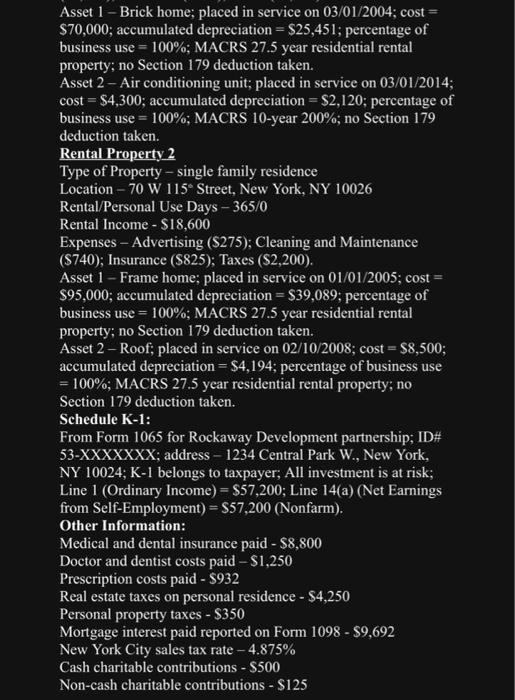

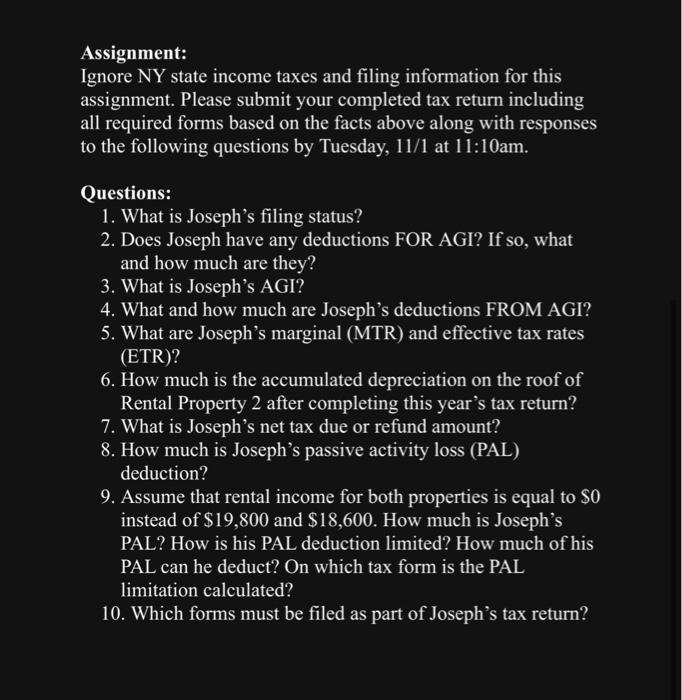

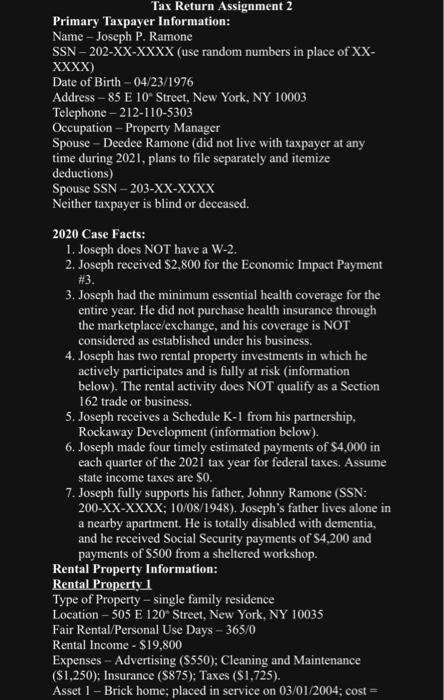

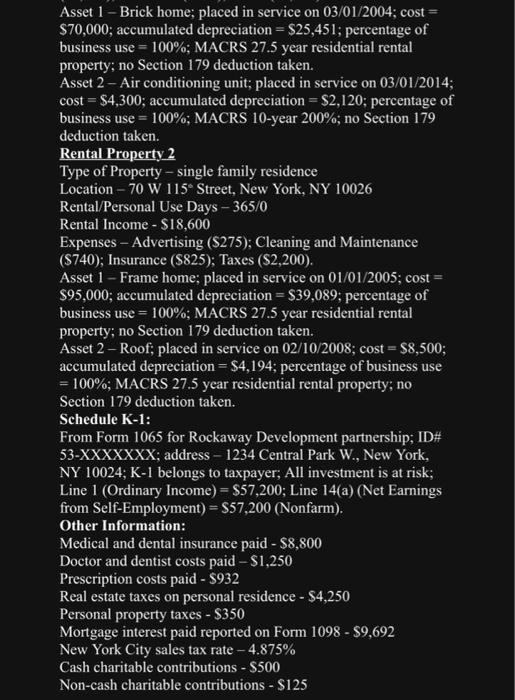

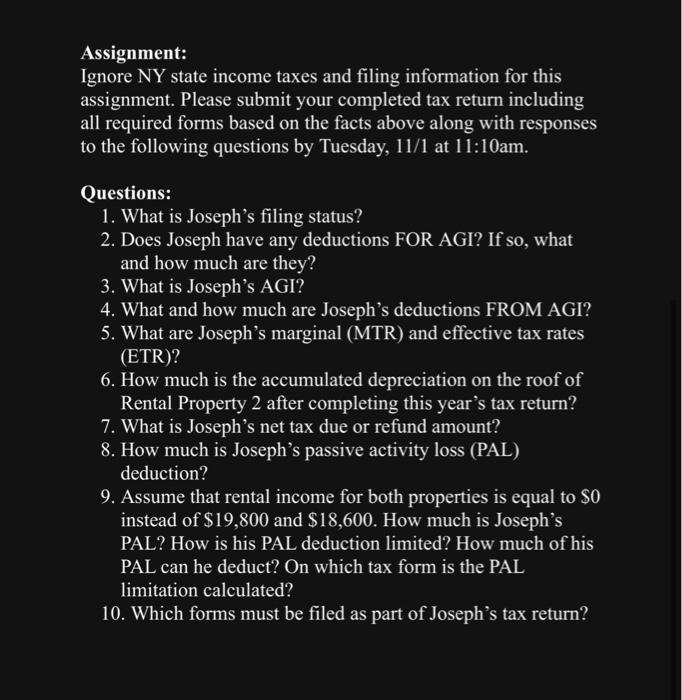

Tax Return Assignment 2 Primary Taxpayer Information: Name - Joseph P. Ramone SSN - 202-XX-XXXX (use random numbers in place of XX - XXXX) Date of Birth 04/23/1976 Address - 85 E 10 Street, New York, NY 10003 Telephone-212-110-5303 Occupation - Property Manager Spouse - Deedee Ramone (did not live with taxpayer at any time during 2021, plans to file separately and itemize deductions) Spouse SSN - 203-XX-XXXX Neither taxpayer is blind or deceased. 2020 Case Facts: 1. Joseph does NOT have a W-2. 2. Joseph received $2,800 for the Economic Impact Payment #3. 3. Joseph had the minimum essential health coverage for the entire year. He did not purchase health insurance through the marketplace/exchange, and his coverage is NOT considered as established under his business. 4. Joseph has two rental property investments in which he actively participates and is fully at risk (information below). The rental activity does NOT qualify as a Section 162 trade or business. 5. Joseph receives a Schedule K1 from his partnership, Rockaway Development (information below). 6. Joseph made four timely estimated payments of $4,000 in each quarter of the 2021 tax year for federal taxes. Assume state income taxes are S0. 7. Joseph fully supports his father, Johnny Ramone (SSN: 200-XX-XXXX; 10/08/1948). Joseph's father lives alone in a nearby apartment. He is totally disabled with dementia, and he received Social Security payments of $4,200 and payments of $500 from a sheltered workshop. Rental Property Information: Rental Property 1 Type of Property - single family residence Location - 505 E 120 Street, New York, NY 10035 Fair Rental/Personal Use Days - 365/0 Rental Income - $19,800 Expenses - Advertising (\$550); Cleaning and Maintenance Asset 1 - Brick home; placed in service on 03/01/2004; cost = Asset 1 - Brick home; placed in service on 03/01/2004; cost = $70,000; accumulated depreciation =$25,451; percentage of business use =100%; MACRS 27.5 year residential rental property; no Section 179 deduction taken. Asset 2 - Air conditioning unit; placed in service on 03/01/2014; cost =$4,300; accumulated depreciation =$2,120; percentage of business use =100%; MACRS 10-year 200\%; no Section 179 deduction taken. Rental Property 2 Type of Property - single family residence Location - 70W115 Street, New York, NY 10026 Rental/Personal Use Days - 365/0 Rental Income - $18,600 Expenses - Advertising (\$275); Cleaning and Maintenance ($740); Insurance ($825); Taxes ($2,200). Asset 1 - Frame home; placed in service on 01/01/2005; cost = $95,000; accumulated depreciation =$39,089; percentage of business use =100%; MACRS 27.5 year residential rental property; no Section 179 deduction taken. Asset 2 - Roof; placed in service on 02/10/2008; cost =$8,500; accumulated depreciation =$4,194; percentage of business use =100%; MACRS 27.5 year residential rental property; no Section 179 deduction taken. Schedule K-1: From Form 1065 for Rockaway Development partnership; ID# 53-XXXXXXX; address - 1234 Central Park W., New York, NY 10024; K-1 belongs to taxpayer; All investment is at risk; Line 1( Ordinary Income )=$57,200; Line 14(a) (Net Earnings from Self-Employment )=$57,200( Nonfarm ). Other Information: Medical and dental insurance paid - $8,800 Doctor and dentist costs paid $1,250 Prescription costs paid - \$932 Real estate taxes on personal residence $4,250 Personal property taxes $350 Mortgage interest paid reported on Form 1098 - \$9,692 New York City sales tax rate 4.875% Cash charitable contributions - $500 Non-cash charitable contributions - $125 Assignment: Ignore NY state income taxes and filing information for this assignment. Please submit your completed tax return including all required forms based on the facts above along with responses to the following questions by Tuesday, 11/1 at 11:10am. Questions: 1. What is Joseph's filing status? 2. Does Joseph have any deductions FOR AGI? If so, what and how much are they? 3. What is Joseph's AGI? 4. What and how much are Joseph's deductions FROM AGI? 5. What are Joseph's marginal (MTR) and effective tax rates (ETR)? 6. How much is the accumulated depreciation on the roof of Rental Property 2 after completing this year's tax return? 7. What is Joseph's net tax due or refund amount? 8. How much is Joseph's passive activity loss (PAL) deduction? 9. Assume that rental income for both properties is equal to $0 instead of $19,800 and $18,600. How much is Joseph's PAL? How is his PAL deduction limited? How much of his PAL can he deduct? On which tax form is the PAL limitation calculated? 10. Which forms must be filed as part of Joseph's tax return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started