this one problem is separated into two parts but are not related to each other. please help me fill out everything in order. zoom in if need be. if ALL correct, will give thumbs up. thanks!!!

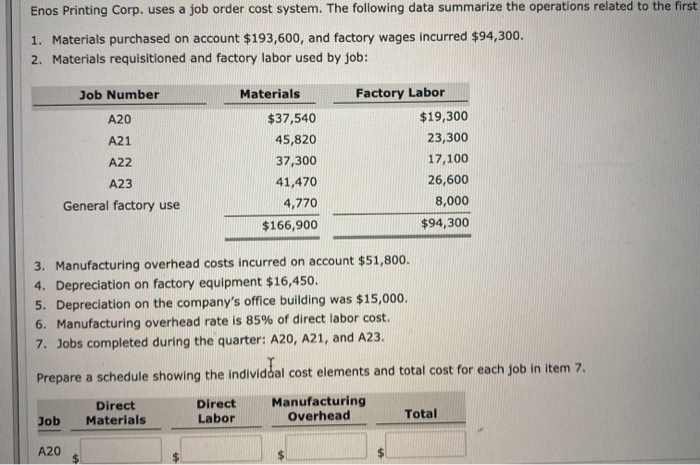

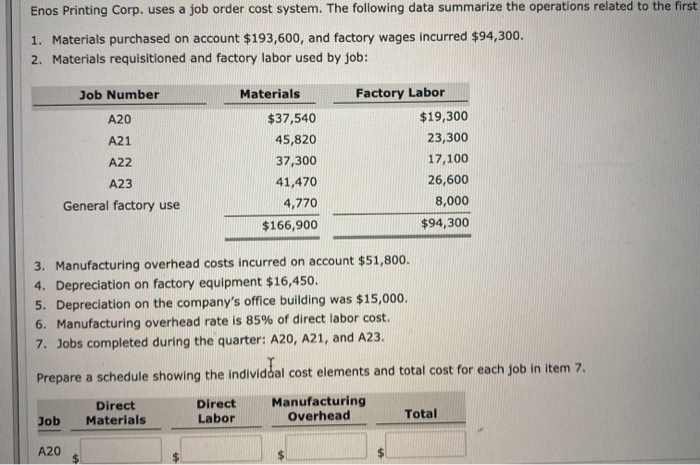

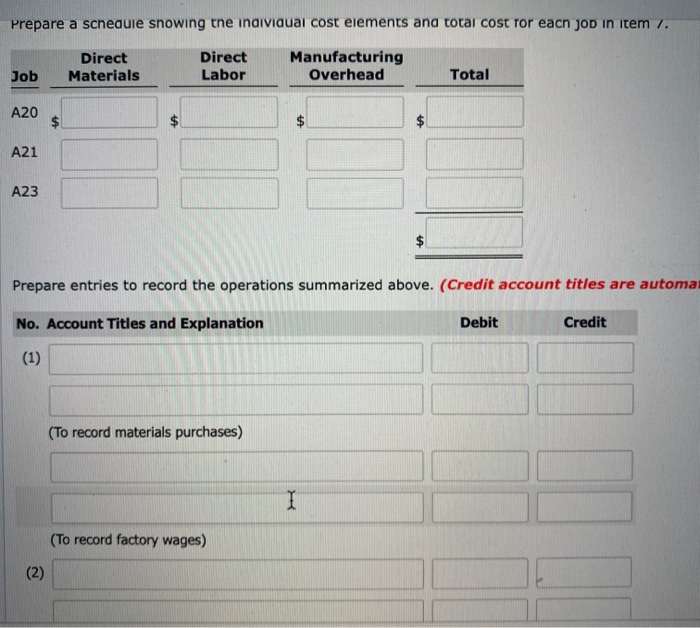

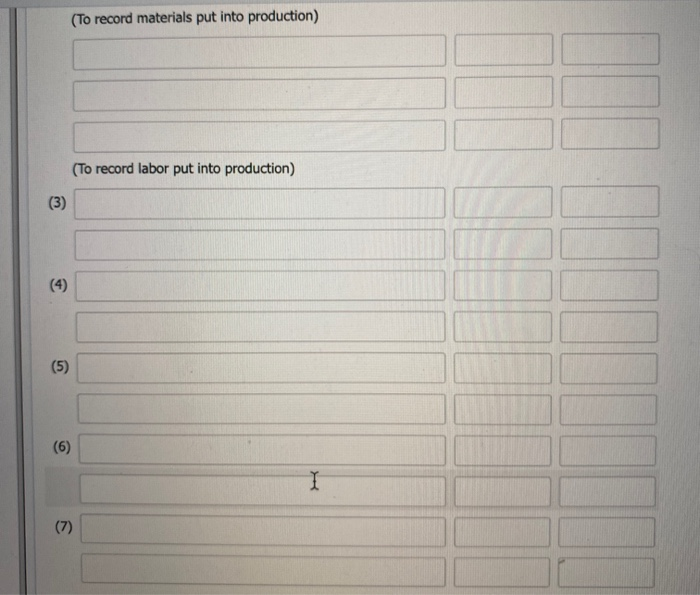

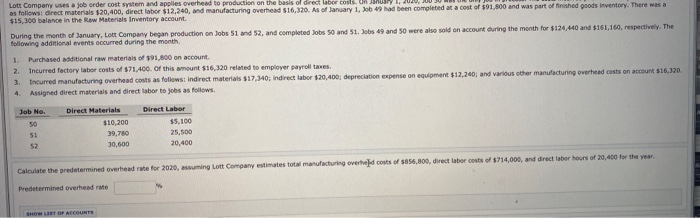

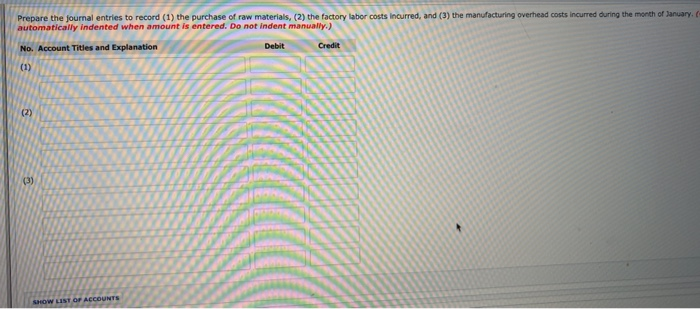

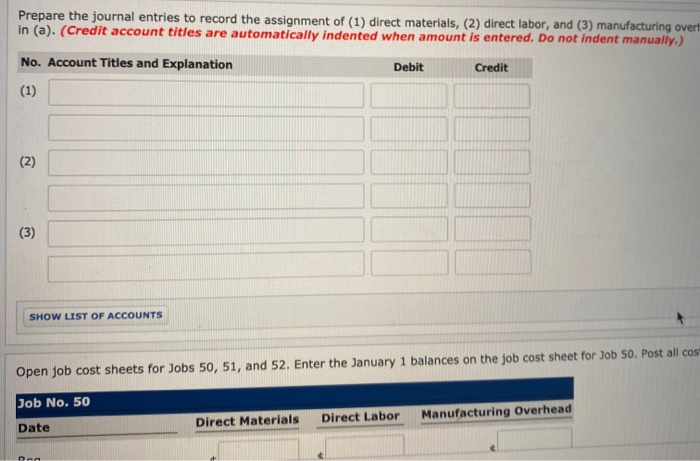

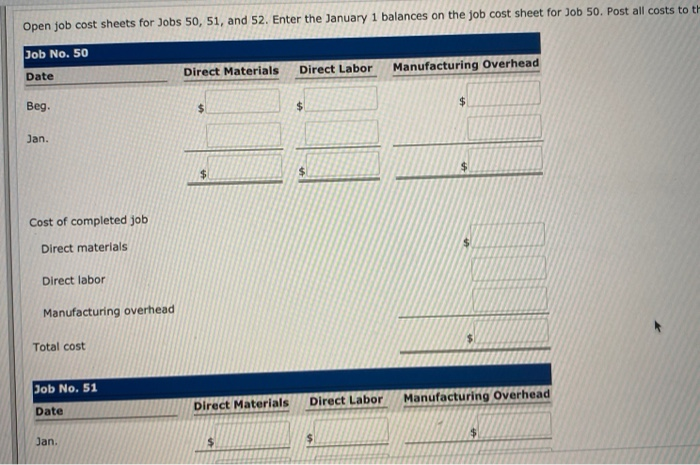

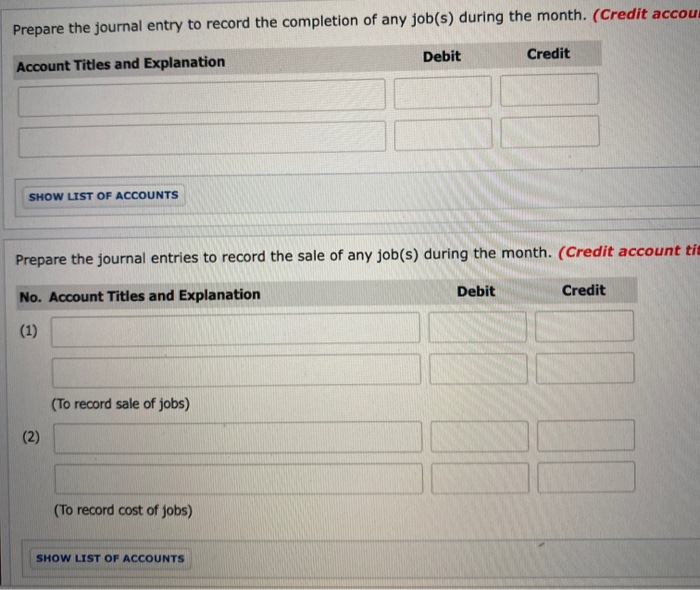

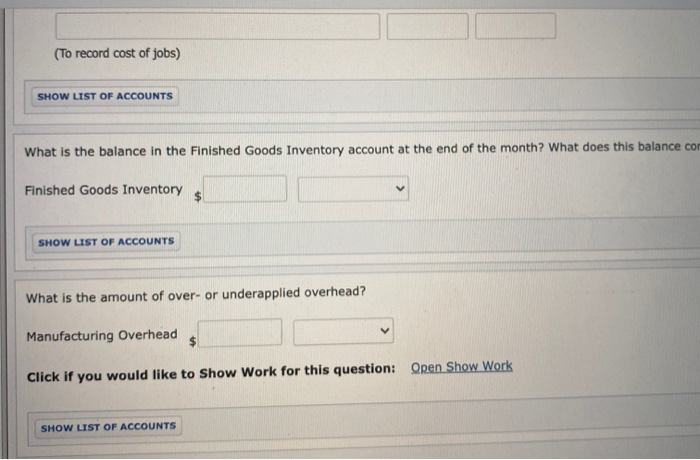

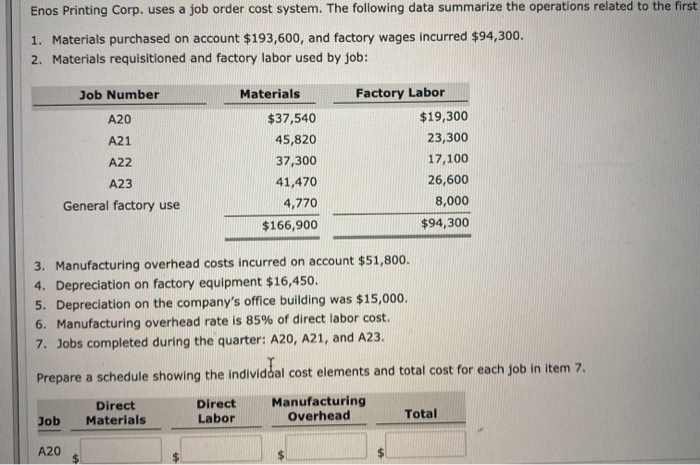

Enos Printing Corp. uses a job order cost system. The following data summarize the operations related to the first 1. Materials purchased on account $193,600, and factory wages incurred $94,300. 2. Materials requisitioned and factory labor used by job: Job Number A20 A21 A22 Materials $37,540 45,820 37,300 41,470 4,770 $166,900 Factory Labor $19,300 23,300 17,100 26,600 8,000 $94,300 A23 General factory use 3. Manufacturing overhead costs incurred on account $51,800. 4. Depreciation on factory equipment $16,450. 5. Depreciation on the company's office building was $15,000. 6. Manufacturing overhead rate is 85% of direct labor cost. 7. Jobs completed during the quarter: A20, A21, and A23. Prepare a schedule showing the individdal cost elements and total cost for each job in Item 7. Direct Materials Direct Labor Manufacturing Overhead Total Job A20 Prepare a schedule snowing the individual cost elements and total cost for each jod in item 7. Direct Materials Direct Labor Manufacturing Overhead Job Total A20 $ $ $ A21 A23 $ Prepare entries to record the operations summarized above. (Credit account titles are automa No. Account Titles and Explanation Debit Credit (1) (To record materials purchases) I (To record factory wages) (2) (To record materials put into production) (To record labor put into production) (3) (4) (5) (6) (7) Lott Company uses a job order cost system and applies overhead to production on the basis of direct labor costi. as follows direct materials $20,400, direct labor $12,240, and manufacturing overhead $16.320. As of January 1, Job 49 had been completed at a cost of 191,800 and was part of finished goods Inventory. There was a $15,300 balance in the Raw Materials inventory account During the month of January, Lott Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were also sold on account during the month for $124440 and $161,160, respectively. The following additional events occurred during the month 1 Purchased additional raw materials of $91,800 on account 2. incurred factory labor costs of $71,400. of this amount $16,320 related to employer payroll taxes. 3. Incurred manufacturing overhead costs as follows: Indirect materials $17,340, indirect labor $20,400; depreciation expense on equipment $12,240; and various other manufacturing overhead costs on account $16,120 Assigned direct materials and direct labor to jobs as follows. Job No. 50 51 Direct Materials $10,200 39.780 30,600 Direct Labor 55.100 25.500 20,400 Calculate the predetermined overhead rate for 2020, assuming Lott Company estimates total manufacturing overhead cons of $856,800, direct labor costs of $714,000, and direct labor hours of 20,400 for the year. Predetermined overhead rate SHOT OF ACCOUNTS Prepare the journal entries to record (1) the purchase of raw materials, (2) the factory labor costs incurred, and (3) the manufacturing overhead costs incurred during the month of January automatically indented when amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit (1) (2) (3) SHOW LIST OF ACCOUNTS Prepare the journal entries to record the assignment of (1) direct materials, (2) direct labor, and (3) manufacturing over in (a). (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit (1) (2) (3) SHOW LIST OF ACCOUNTS Open job cost sheets for Jobs 50, 51, and 52. Enter the January 1 balances on the job cost sheet for Job 50. Post all cos Job No. 50 Direct Materials Direct Labor Date Manufacturing Overhead Open job cost sheets for Jobs 50, 51, and 52. Enter the January 1 balances on the job cost sheet for Job 50. Post all costs to th Job No. 50 Direct Materials Direct Labor Date Manufacturing Overhead $ Beg. $ $ Jan. $ $ Cost of completed job Direct materials Direct labor Manufacturing overhead Total cost Job No. 51 Direct Materials Direct Labor Date Manufacturing Overhead $ Jan. Prepare the journal entry to record the completion of any job(s) during the month. (Credit accou Debit Credit Account Titles and Explanation SHOW LIST OF ACCOUNTS Prepare the journal entries to record the sale of any job(s) during the month. (Credit account tit No. Account Titles and Explanation Debit Credit (1) (To record sale of jobs) (2) (To record cost of jobs) SHOW LIST OF ACCOUNTS (To record cost of jobs) SHOW LIST OF ACCOUNTS What is the balance in the Finished Goods Inventory account at the end of the month? What does this balance con Finished Goods Inventory SHOW LIST OF ACCOUNTS What is the amount of over- or underapplied overhead? Manufacturing Overhead Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS